In the prime of your life and at the peak of your career, you enjoy all the comforts of life - a happy family, your own home and a car, holidays in India and abroad. To keep enjoying these comforts for the rest of your life, we bring to you ICICI Pru Lakshya Lifelong Income, a protection and savings oriented conventional participating life product to fulfill your financial needs.

ICICI Pru Lakshya Lifelong Income is specially designed to provide you policy benefits till 99 years of age.

KEY BENEFITS OF ICICI PRU LAKSHYA LIFELONG INCOME

![]()

Regular Income

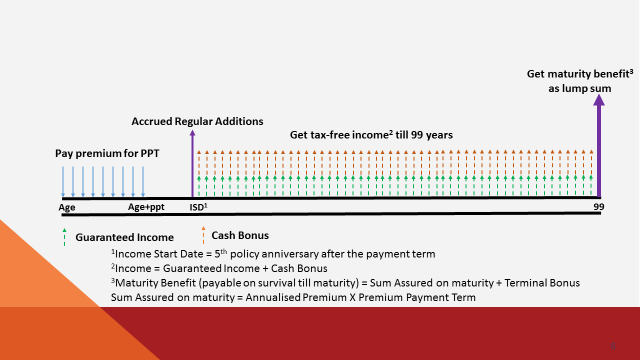

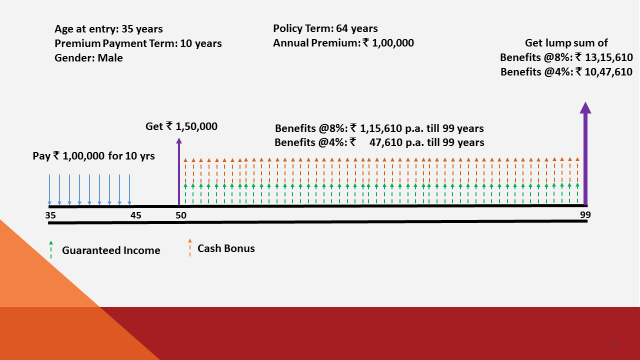

Guaranteed Income and Cash Bonus1 every year after Income Start Date2 till the age of 99 years.

![]()

Guaranteed Capital Protection

Get Guaranteed Capital protection in the form of ‘Sum Assured on Maturity’3

![]()

Regular Additions

Enjoy bonuses in the form of Regular Additions4 every year to grow your wealth till the Income start date.

![]()

Life Cover

Life cover throughout the policy term till the age of 99 years to secure your family’s future.

![]()

Liquidity

Liquidity5 benefits during the policy term to help you in case of financial emergencies.

![]()

Tax Benefits

Get Tax Benefits6 on premiums paid and benefits received as per prevailing tax laws.

Product at a Glance - ICICI Pru Lakshya Lifelong Income

What is Guaranteed Income?

Guaranteed Income (GI) is set at policy inception and is based on your Sum Assured on Maturity (SAM). Higher premiums are eligible for higher Guaranteed Income. This benefit will be payable on every policy anniversary after the Income Start Date till the end of the policy term or death, whichever is earlier.

What is Income Start Date? What is the Regular Income I get?

Income Start Date (ISD) is the fifth policy anniversary after the premium payment term on which the accrued regular additions net of encashment if any, till that date shall be payable as a lump sum, thereafter on every policy anniversary, till the end of the policy term or death whichever is earlier. Guaranteed Income (GI) and Cash Bonus (if declared) is payable during this period.

What is Sum Assured on Maturity?

Sum Assured on maturity is equal to your total contribution throughout the policy term. The premiums you pay during the policy term is protected with this benefit.

What happens in case of Death?

On death of the Life Assured during the policy term, the nominee will receive the higher of:

A) Sum Assured on death including Bonuses*

B) 105% of Total Premiums paid as on the date of death

On payment of Death Benefit, all policy benefits will cease.

Will I get tax benefits?

Tax benefits under the policy are subject to conditions under Section 80C, 10(10D) and other provisions of the Income Tax Act, 1961. Applicable taxes will be charged extra as per prevailing rates. Tax laws are subject to amendments from time to time.

What is Guaranteed Income?

Guaranteed Income (GI) is set at policy inception and is based on your Sum Assured on Maturity (SAM). Higher premiums are eligible for higher Guaranteed Income. This benefit will be payable on every policy anniversary after the Income Start Date till the end of the policy term or death, whichever is earlier.

What is Income Start Date? What is the Regular Income I get?

Income Start Date (ISD) is the fifth policy anniversary after the premium payment term on which the accrued regular additions net of encashment if any, till that date shall be payable as a lump sum, thereafter on every policy anniversary, till the end of the policy term or death whichever is earlier. Guaranteed Income (GI) and Cash Bonus (if declared) is payable during this period.

What is Sum Assured on Maturity?

Sum Assured on maturity is equal to your total contribution throughout the policy term. The premiums you pay during the policy term is protected with this benefit.

What happens in case of Death?

On death of the Life Assured during the policy term, the nominee will receive the higher of:

A) Sum Assured on death including Bonuses*

B) 105% of Total Premiums paid as on the date of death

On payment of Death Benefit, all policy benefits will cease.

Will I get tax benefits?

Tax benefits under the policy are subject to conditions under Section 80C, 10(10D) and other provisions of the Income Tax Act, 1961. Applicable taxes will be charged extra as per prevailing rates. Tax laws are subject to amendments from time to time.

People like you also read ...