Why is ICICI Pru Guaranteed Wealth Protector special?

You can enjoy the opportunity to get potentially better returns and grow your money by investing in mix of equity and debt. This combination helps you beat inflation while protecting your investments.

How does a mix of equity and debt beat inflation?

Inflation is the rate at which the price of goods and services increases over a period of time. For example, the price of a particular item has increased from `100 in 2005 to `243 in 2017.

To gain from your investments, your savings should grow at a rate higher than the inflation rate.

In order to get better returns in the long run, it is advisable to have equity exposure. Equity markets are subject to short-term market volatility. However, the effect of market volatility is negligible in the long term.

Below is an example of how investing in a mix of equity and debt can help in building your savings,

If 60% of your money was invested in the equity market and 40% in debt market## in the last 12 years, your investment would have grown by around 12% on an annualized basis. This growth would have helped you stay ahead of the inflation rate of about 7.7%# in the same period.

*Source: CEIC, CSO, CPI inflation average of 12 years (from March 2006 to March 2017)

##Equity market: BSE 100; Debt market: CRISIL Composite Bond Index (from March 2005 to March 2017)

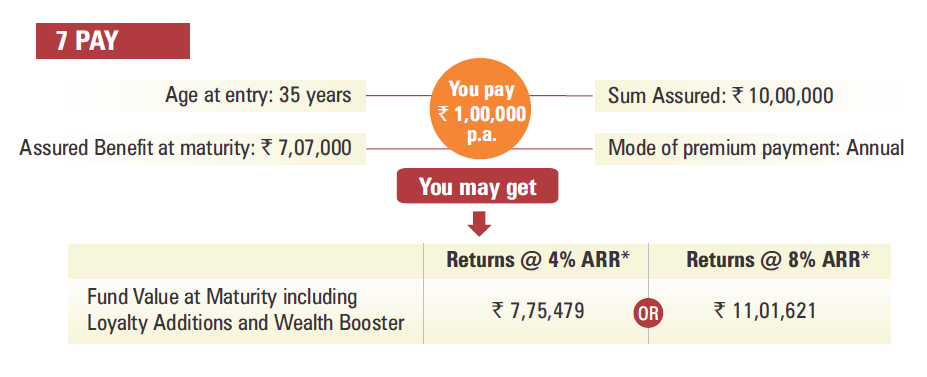

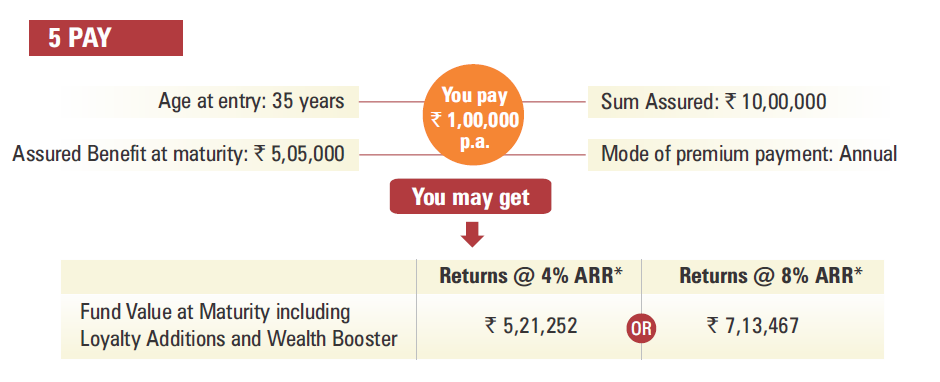

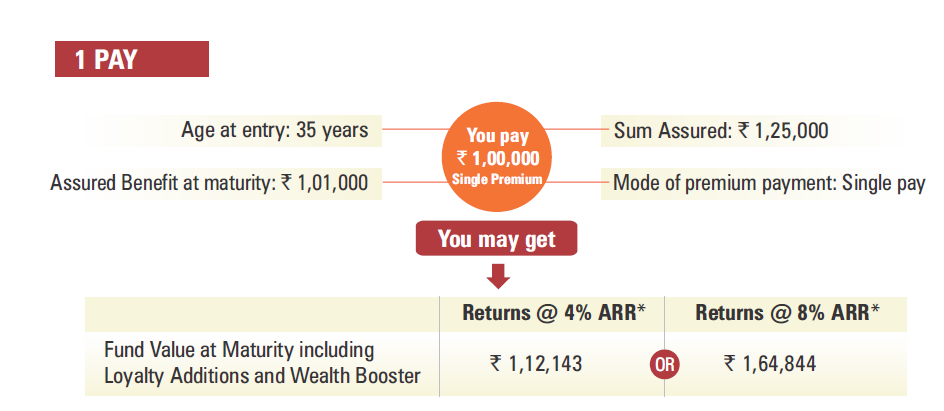

Along with the potential to give you better returns, this plan has been designed to protect your money. It does this by offering you capital guarantee on the money that you invest. The company guarantees that it will return a minimum amount called Assured Benefit.** At the time of maturity, company offers you higher of Assured Benefit or Fund Value amount.

How much Assured Benefit will I get?

In case your Fund Value* at maturity is less than the sum of premiums paid by you, the Assured Benefit** feature ensures that you receive 101% of all the premiums paid at the time of maturity. As a result, your money is protected as the company returns your invested money regardless of market ups and downs.

For example, if you invest `1,00,000 every year for 5 years, the company guarantees to return a minimum sum of `5,05,000.

**The Assured Benefit amount shown assumes all due premiums as per the premium payment term shown above are paid. On maturity, you will receive higher of Assured Benefit or fund value. Assured Benefit will be 101% of total premium paid which is applicable only on maturity of the policy and does not apply on death or surrender.You can utilise this benefit amount only as per the available options. Alternatively, you can choose to postpone your vesting date.

*Fund Value is the total value of the money that is invested in a fund of your choice. This plan offers you Life Growth Fund (SFIN: ULIF 134 19/09/13 LGF 105) and Life Secure Fund (SFIN: ULIF 135 19/09/13 LSF 105) to choose from. For further details on these funds, please refer the product brochure.

To reward you for being a loyal customer, the company further adds to your savings with Loyalty Additions, which helps your wealth grow.

What are Loyalty Additions?

Each Loyalty Addition is equivalent to 0.25% of the average Fund Value*. Loyalty Additions will be added as extra units at the end of every policy year, 6th policy year onwards.

*Average of the Fund Values on the last business day of the last eight policy quarters.

The company also adds a Wealth Booster to your savings. This helps you grow your money without having to make any additional investments.

What is the value of Wealth Boosters that I will get?

At the end of the tenth policy year, Wealth Booster addition will be equal to 3.25% of the Fund Value average* for the Five pay and Seven pay option and 1.5% for the One Pay option.

Is this a guaranteed feature of the product?

Yes, the allocation of Wealth Booster units is guaranteed.

*Fund Value is the total value of the money that is invested in a fund of your choice. This plan offers you Life Growth Fund (SFIN: ULIF 134 19/09/13 LGF 105) and Life Secure Fund (SFIN: ULIF 135 19/09/13 LSF 105) to choose from. For further details on these funds, please refer the product brochure.

ICICI Pru Guaranteed Wealth Protector provides you and your family all-round protection. In case an unfortunate event occurs during the policy term, your family receives a lump sum amount. This amount ensures that even in your absence, your loved ones are able to live the life you have planned for them.

How much money will my loved ones receive in my absence?

Your family will receive an amount that is the higher of:

A fixed amount, also called the Sum Assured

Minimum Life Cover equal to 105% of the total premiums received up to the date of death

Fund Value that is the total value of the money that is invested in a fund of your choice+

+This plan offers you Life Growth Fund (SFIN: ULIF 134 19/09/13 LGF 105) and Life Secure Fund (SFIN: ULIF 135 19/09/13 LSF 105) to choose from. For further details on these funds, please refer the product brochure.

With this plan, you can reduce your taxable income by investing up to `1.5 lakh under Section 80C. This will help you save tax. What’s more, even shifting your money from equity to debt or debt to equity is completely tax-free*. The money you get on maturity is also tax-free*.

*Tax benefits under the policy are subject to conditions u/s 80C, 10(10D) and other provisions of the Income Tax Act, 1961. Applicable taxes will be charged extra as per prevailing rates. Tax laws are subject to amendments from time to time.