Why is ICICI Pru Life Raksha special?

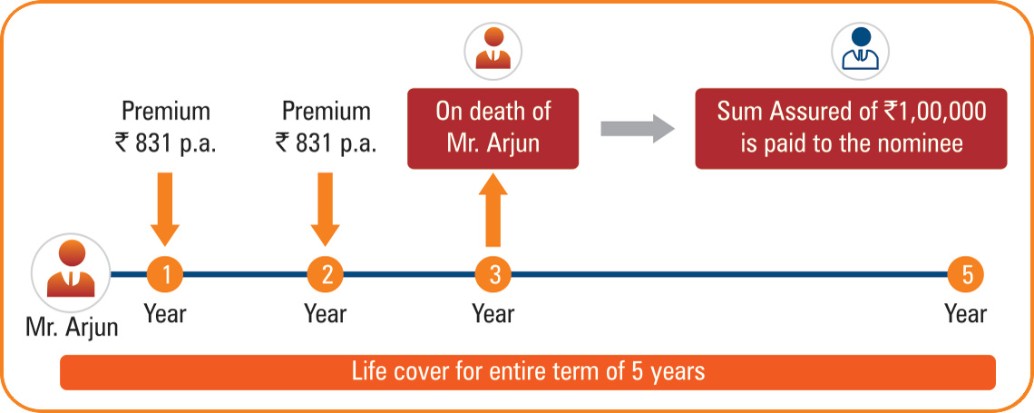

You care for your family and wish to fulfill their needs. But life is uncertain. You would want that the needs of your loved ones are provided for in your absence. Presenting ICICI Pru Life Raksha, a plan that provides you and your family complete protection. Under this plan, in case of any unfortunate event during the policy term, your family receives a lump sum that will take care of their financial needs.

How much money will my loved ones receive in my absence?

In case of an unforeseen event during the policy term, the higher of the following will be paid to your family:

A fixed, minimum amount called Sum Assured

An amount equal to 10 times the annual premium*

105% of the total premiums paid

*Excluding applicable premium payment frequency loading, if any, and taxes. Premium payment frequency loading is an extra charge that is added to your base premium when you choose to pay your premiums on a monthly basis.

With this plan, you can reduce your taxable income by paying up to `1.5 lakh as premium under Section 80C. This will help you save tax. What's more, the amount received on death is also tax free*.

*Tax benefits under the policy are subject to conditions under Section 80C, 10(10D) and other provisions of the Income Tax Act, 1961. Applicable taxes will be charged extra as per prevailing rates. Tax laws are subject to amendments from time to time.