CHILD EDUCATION PLANNER

Are you investing enough for your child's higher education?

Planning for your child's education can be complicated.

Accounting for inflation, the changing lifestyle needs and interests of your child, arriving at an approximate

value of how much money you will need, can be tricky. Mistakes can cost your child their future and result in

lost opportunities... Read More

Smart Planning Tool

What Is a Child Education Planning Calculator

A child education planning calculator is a

digital tool that helps you estimate how much you need to save for your child's future educational needs. It

provides accurate results based on your inputs and helps you plan properly.

The child plan calculator helps you plan better and avoid any

shortfall in funds later due to underestimating the costs.

How Does ICICI Pru Life’s Child Education Planner Works?

Quick Guide

How to use a child plan calculator

Quick Guide

How To Use A Child Plan Calculator

Here are the steps to use a child education planner

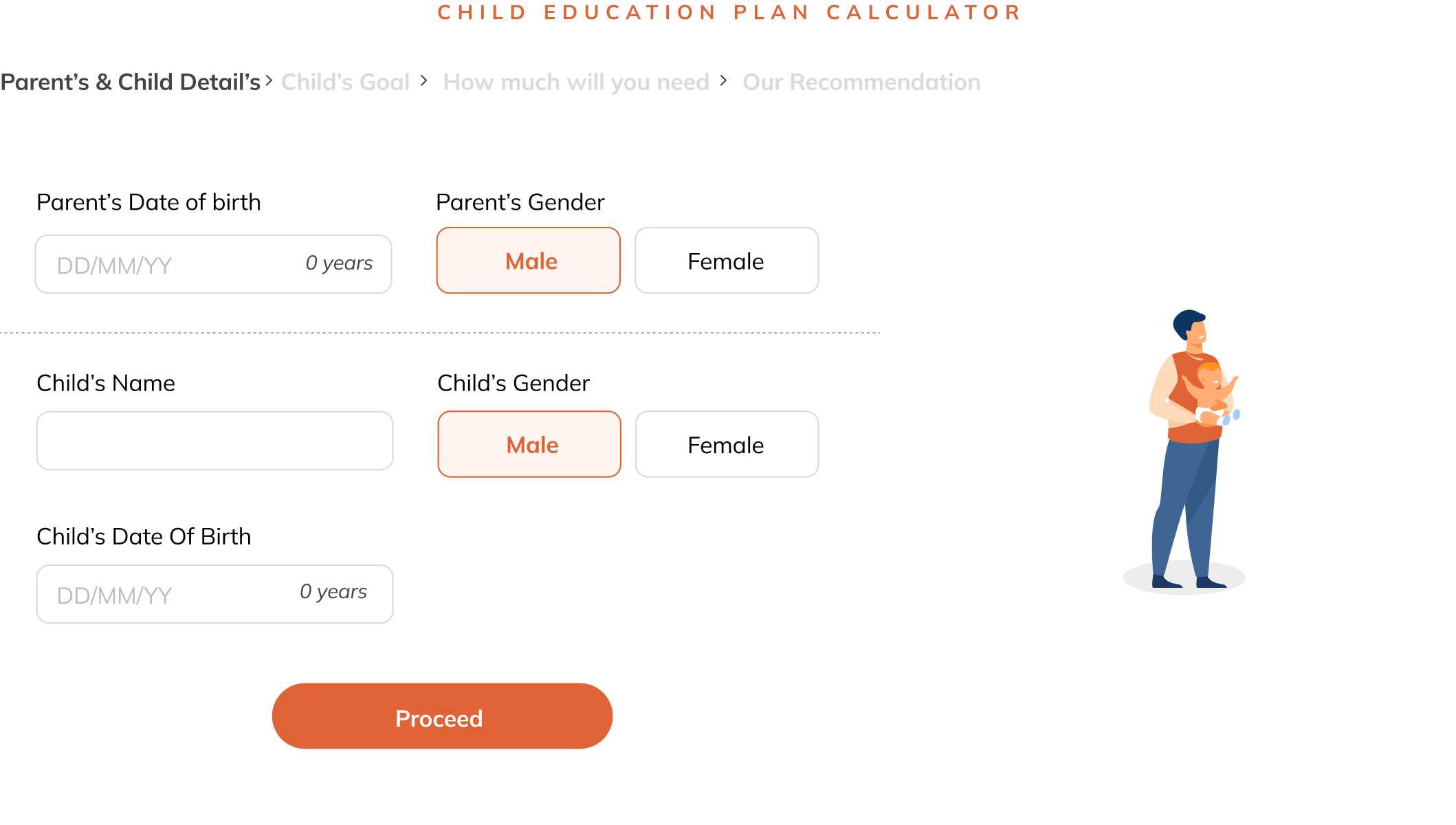

Enter the following details

Parent's Date Of Birth

Parent's Gender

Child's Name

Child's Gender

Child's Age

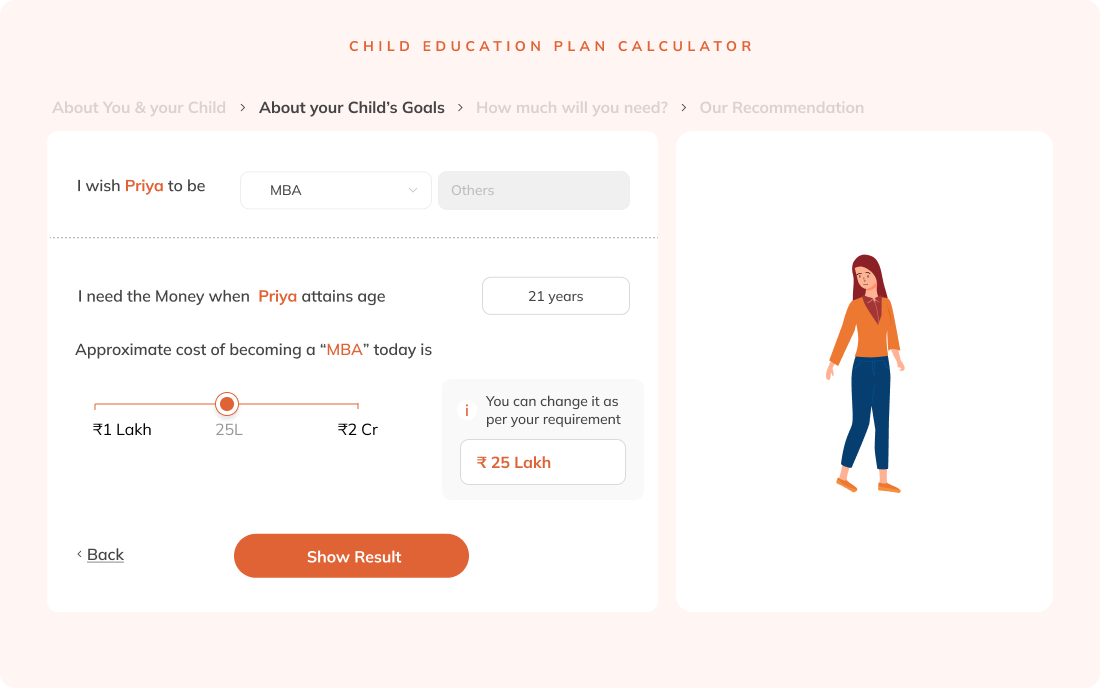

Enter education goals of

your child

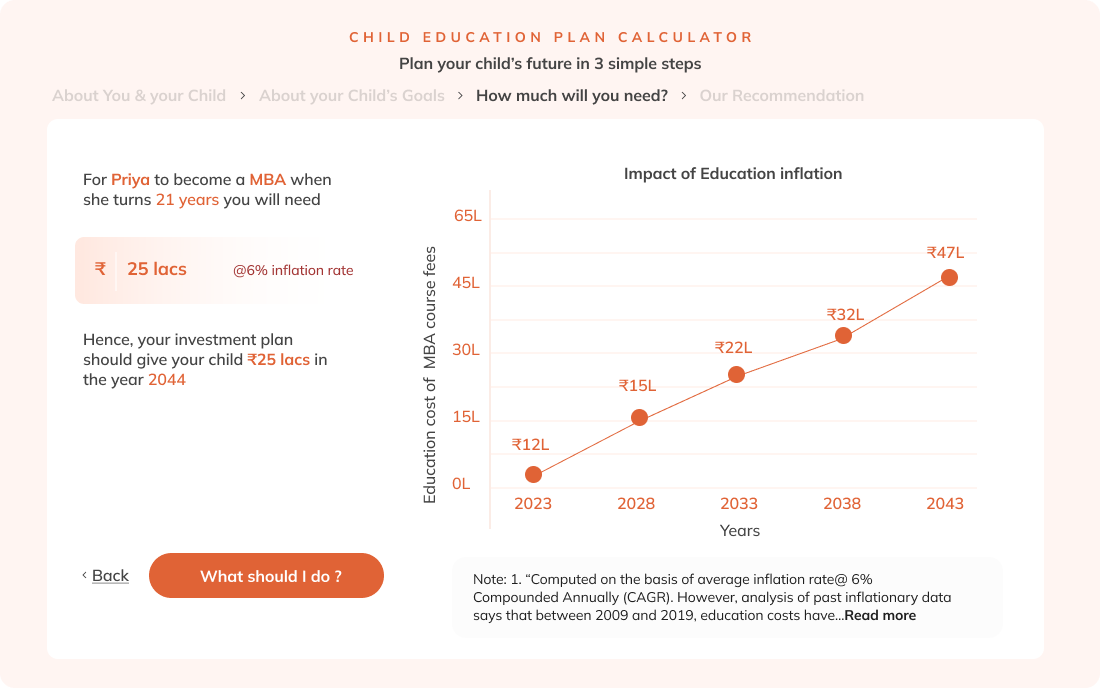

Get information on future

cost

Get to know our

recommendation

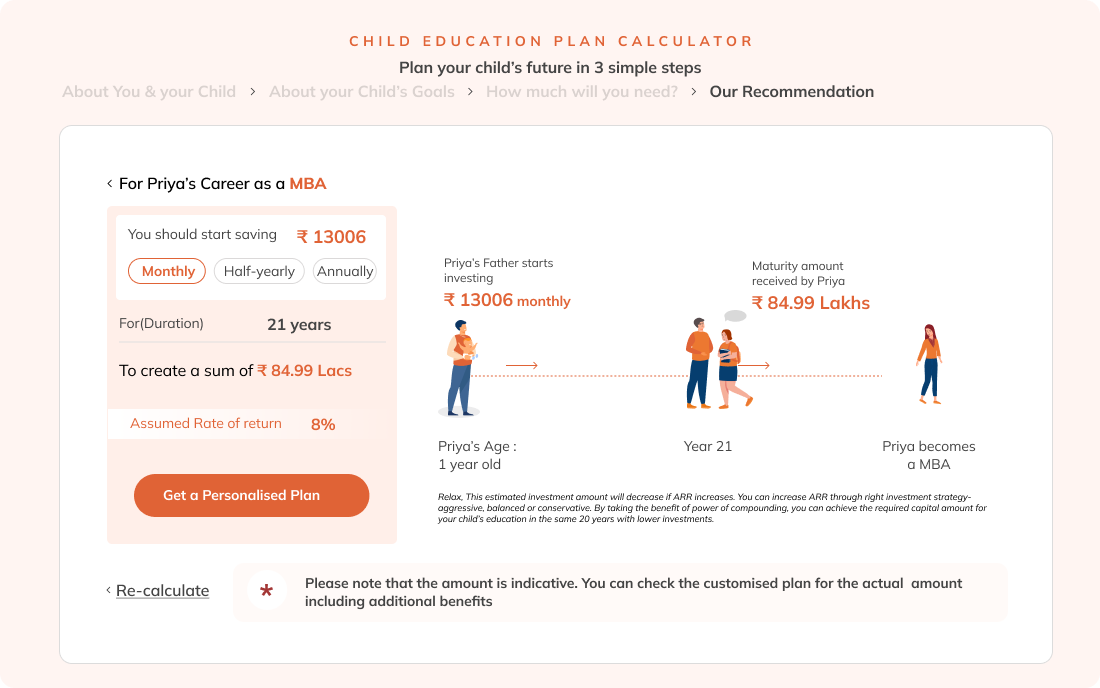

The calculator will show you how much you need to save based on your chosen frequency

(monthly/half-yearly/yearly) to arrive at the money you need at maturity.

Lets talk about benefits

What Are the Advantages of Using a Child Education Planning Calculator?

A child education

calculator can offer you the following advantages:

FAQ on Child Education Plan Calculator

What is Child education planning?

Inflation

typically raises the costs~ of everything in life. This is true for the cost of

education for your children as well. This is where child education planning comes in. As a parent,

you should factor in the rising cost~ of education and account for it when it comes to

your child's growth. This can help in saving funds beforehand, so when the time comes you can have

the funds handy without incurring any sudden financial burden. In effect, this works like a life

insurance plan, which helps in investment as well as providing a safety net for your child’s

future.

Why should I use a Child Education Planner to calculate future education costs?

A child

education planner offers data-driven results that give you clear estimates of what you will need

in the future. It also suggests how you can reach your goals. Using it is not only helpful but

also convenient and easy. That is why it makes sense to use it.

Can the Child Education Planner be used for other financial goals, like planning for a child's marriage?

The child

education planner is specifically designed for education needs and is best suited for estimating

those costs. It may not be ideal for planning other goals like marriage.

How accurate is the Child Education Planner in estimating education expenses?

The child

education planner is fairly accurate. It offers results based on your inputs and the current rate

of education inflation. While actual costs may vary in the future, it provides a close estimate

you can use as a foundation for planning.

*The calculations mentioned above take into

consideration an assumed rate of 8%. This calculation is generated on the basis of the information

provided and is for assistance only. And is not intended to be and must not alone be taken as the basis

for an investment decision. The returns shown above are not guaranteed and they are not the upper or lower

limits of what you might get back, as the maturity value of policy depends on a number of factors

including future investment performance.

Reference for CPI for education:

https://www.statista.com/statistics/655041/consumer-price-index-of-education-india/

Reference for CPI for education:

https://www.statista.com/statistics/655041/consumer-price-index-of-education-india/

~Reference for rising cost of

education:

https://www.thehindubusinessline.com/data-stories/data-focus/after-a-massive-dip-in-2021-education-inflation-rises-with-return-to-normalcy/article65513706.ece

https://www.moneycontrol.com/news/business/personal-finance/how-education-inflation-can-hurt-your-childs-future-8682261.html

`Reference for Average estimated cost of educational courses:

https://www.moneycontrol.com/news/business/personal-finance/childrens-day-how-to-save-for-your-kids-expensive-college-education-7711131.html

https://www.cnbctv18.com/india/how-your-child-can-still-make-it-to-the-dream-college-despite-rising-education-inflation-13816892.htm

https://collegedunia.com/courses/master-of-technology-mtech

https://www.aviationfly.com/how-much-is-the-commercial-pilot-training-cost-in-india/

https://collegedunia.com/courses/bachelor-of-arts-ba-journalism

COMP/DOC/Jul/2023/257/3597

COMP/DOC/Jun/2025/136/0484

COMP/DOC/Jan/2026/61/1784

https://www.thehindubusinessline.com/data-stories/data-focus/after-a-massive-dip-in-2021-education-inflation-rises-with-return-to-normalcy/article65513706.ece

https://www.moneycontrol.com/news/business/personal-finance/how-education-inflation-can-hurt-your-childs-future-8682261.html

`Reference for Average estimated cost of educational courses:

https://www.moneycontrol.com/news/business/personal-finance/childrens-day-how-to-save-for-your-kids-expensive-college-education-7711131.html

https://www.cnbctv18.com/india/how-your-child-can-still-make-it-to-the-dream-college-despite-rising-education-inflation-13816892.htm

https://collegedunia.com/courses/master-of-technology-mtech

https://www.aviationfly.com/how-much-is-the-commercial-pilot-training-cost-in-india/

https://collegedunia.com/courses/bachelor-of-arts-ba-journalism

COMP/DOC/Jul/2023/257/3597

COMP/DOC/Jun/2025/136/0484

COMP/DOC/Jan/2026/61/1784

©ICICI Prudential Life Insurance Co. Ltd. All

rights reserved. Registered with Insurance Regulatory & Development Authority of India (IRDAI) as Life

Insurance Company. Regn. No. 105. CIN: L66010MH2000PLC127837. Reg. Off.: ICICI PruLife Towers, 1089

Appasaheb Marathe Marg, Prabhadevi, Mumbai 400025. Tel.: 40391600. Customer helpline number – 1800-2660.

Timings – 10:00 A.M. to 7:00 P.M., Monday to Saturday (except national holidays). Member of the Life

Insurance Council. Trade Logo displayed above belongs to ICICI Bank Ltd & Prudential IP services Ltd

and used by ICICI Prudential Life Insurance Company Ltd under license.

BEWARE OF SPURIOUS / FRAUD PHONE CALLS!

IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.