Why is ICICI Pru Future Perfect Endowment Plan special?

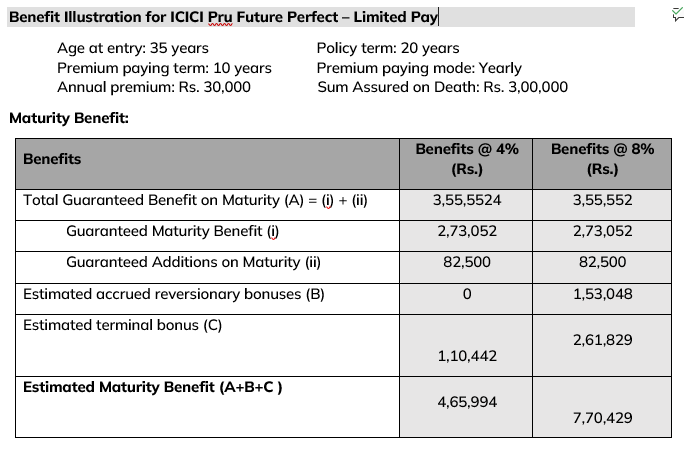

ICICI Pru Future Perfect grows your wealth with the promise of protecting your money. This is done through two guaranteed features in the plan called Guaranteed Additions (GA) and Guaranteed Maturity Benefit (GMB). At the end of the policy term, you receive a sum that includes Guaranteed Maturity Benefit (GMB), Guaranteed additions (GA) and additional bonuses declared by the company, if any. Guaranteed benefits are payable subject to all due premiums being paid and the policy being in force on the date of maturity.

What are Guaranteed Additions?

Guaranteed Additions (GAs) are additional benefit that will be added throughout the policy term, if all premiums due till that year are paid. GAs as a percentage of annualized premium is set out in the following table:

| Policy year/PPT | 5 years or 7 years | 10 years, 15 years or 20 years |

|---|---|---|

| 1 - 5 | 8% | 10% |

| 6 - 10 | 10% | 12% |

| 11 - 15 | 12% | 15% |

| 16 onwards | 15% | 18% |

During Premium Paying Term(PPT) GA will accrue on premium payment* and after PPT, GA will accrue at the beginning of policy year.

* In case of monthly premium frequency, 1/12th; times GA will be accrued every month on premium payment. For half yearly premium frequency, 0.5 times GA will be accrued on premium payment.

What is Guaranteed Maturity Benefit?

Guaranteed Maturity Benefit (GMB) is the guaranteed lump sum payable at the end of the policy term. Your GMB will be set at policy inception and will depend on age, policy term, premium amount, premium payment term and gender. Your GMB may be lower than your Sum Assured on death.

ICICI Pru Future Perfect provides you and your family all-round protection. In case of an unfortunate event during the policy term, your family receives a lump sum amount. This amount ensures that even in your absence, your loved ones are able to live the life you planned for them.

How much money will my family receive in my absence?

Your family will receive the higher of:

A fixed Sum Assured including Guaranteed Additions and Bonuses*

Guaranteed Maturity Benefit including Guaranteed Additions and Bonuses*

Minimum Life Cover that is equal to 105% of sum of premiums paid till date **

*Consists of vested reversionary bonuses, interim bonus and terminal bonus, if any.

.

**Including extra Mortality Premiums and excluding taxes. The cost of providing a Life Cover under the policy is called Mortality Premium.

With this plan, you can reduce your taxable income by investing up to ![]() 1.5 lakh under Section 80C. This will help you save tax. The money you get on maturity or death is also completely tax-free*.

1.5 lakh under Section 80C. This will help you save tax. The money you get on maturity or death is also completely tax-free*.

*Tax benefits under the policy are subject to conditions under Section 80C, 10(10D) and other provisions of the Income Tax Act, 1961. Applicable taxes will be charged extra as per prevailing rates. Tax laws are subject to amendments from time to time.