1 Life cover is the death benefit payable on death of the Life Assured during the policy term.

For ‘Return of Premium’ plan option, Death Benefit will be the highest of a) Sum Assured on Death b) Basic Sum Assured to be paid on death c) (Applicable only for limited pay and regular pay) 105% of the Total Premiums Paid till the date of death. Where Sum Assured on Death is 7 X Annualised Premium for regular pay and limited pay and 1.25 X Single Premium for single pay;

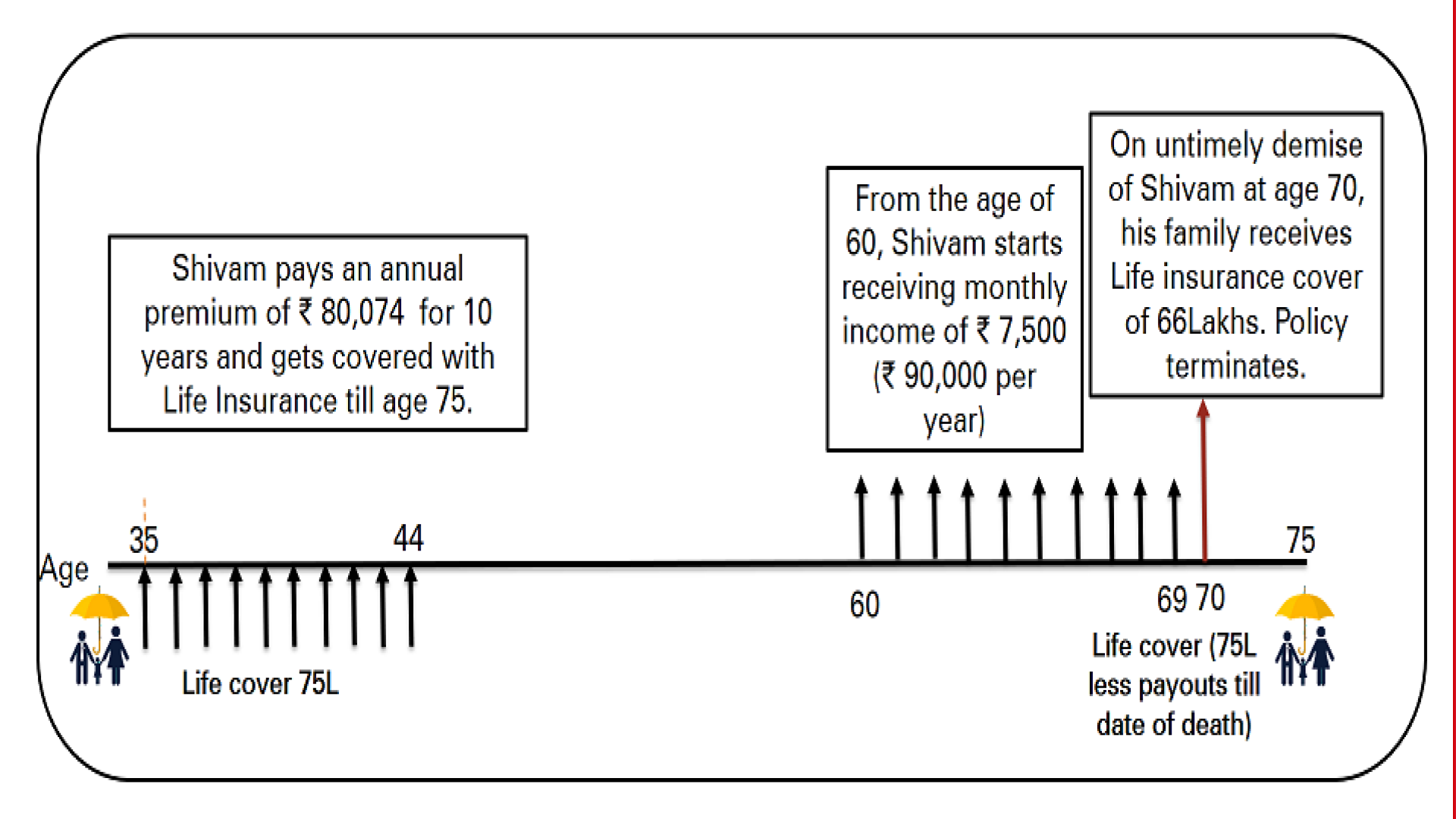

For ‘Income Benefit’ plan option, Death Benefit will be the highest of a) Sum Assured on Death b) 105% of the Total premiums Paid till the date of death c) Basic Sum Assured to be paid on death, less total Survival Benefit paid till date of death. Where, Sum Assured on Death is 10 X Annualised Premium.

For ‘Return of Premium with Life-stage cover’ & ‘Early Return of Premium with Life-stage cover’ plan options, Death Benefit will be the highest of a) Sum Assured on Death b) 105% of the Total premiums paid till the date of death c) Absolute amount assured to be paid on death Where Sum Assured on Death is 7 X Annualised Premium

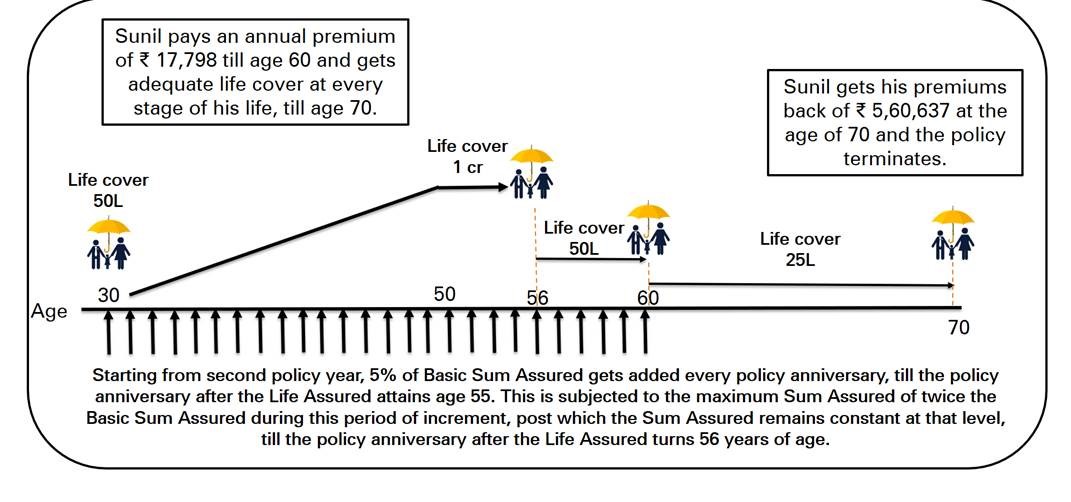

2 In case of Life-stage cover, Absolute amount assured to be paid on death will be based on age of the Life Assured as provided below.

- In the first policy year, Absolute amount assured to be paid on death will be the same as Basic Sum Assured as chosen by You at inception

- From the second policy year till the policy anniversary after the Life Assured attains age 55, 5% of Basic Sum Assured gets added on every policy anniversary to the Basic Sum Assured. This amount cumulatively shall be the Absolute amount assured to be paid on death. The Absolute amount assured to be paid on death remains constant till the next policy anniversary. In case the Absolute amount assured to be paid on death becomes twice the Basic Sum Assured during this period of increment, it stays constant at that level, till the policy anniversary after the Life Assured attains age of 56 years

- On the policy anniversary after the Life Assured attains 56 years of age, the Absolute amount assured to be paid on death shall revert back to Basic SA. This will continue till the policy anniversary after the Life Assured attains 60 years of age

- On the policy anniversary after the Life Assured attains 60 years of age, the absolute amount assured to be paid on death shall be 50% of Basic Sum Assured and continues at the same level till end of the policy term

3 Premium back refers to the total of all premiums received, excluding premiums for optional benefits i.e. Accidental Death Benefit, Critical Illness Benefit, extra premium, any rider premium and taxes, if any, upon the full payment of policy premiums.

4 Critical Illness: CI Benefit is an additional optional benefit chosen at inception and is available with ‘Life and health’ and ‘All in One’ benefit options. The CI Sum Assured is paid as a lump sum upon the Life Assured being diagnosed on first occurrence of any of the covered 60 major Critical Illnesses within CI Benefit term. 25% of the CI Sum Assured or INR 500,000.00 whichever is lower is paid as a lump sum upon the Life Assured being diagnosed on first occurrence of any of the covered 4 minor Critical Illnesses within CI Benefit term. CI Benefit is available for Single Pay and Limited Pay and is lower of (15 years, policy term). For regular pay, the CI benefit term will be lower of (policy term, 40 years) subject to maximum cover ceasing age of 85 years. CI Benefit can be less than or equal to the Basic Sum Assured chosen by You at inception for Return of Premium Plan and Income Benefit Plan. CI Benefit can be less than or equal to the 50% of the Basic Sum Assured chosen at inception for Return of Premium with Life-stage Cover Plan and Early Return of Premium with Life-stage Cover Plan. CI Benefit is a pure risk benefit and does not have Survival or Maturity Benefit. Premiums paid corresponding to CI Benefit shall be excluded from Survival or Maturity Benefit.

5 Accidental Death Benefit: ADB Benefit is an additional optional benefit and is available with ‘Life Plus’ and ‘All in One’ benefit options. In the event of the Life Assured’s death due to an Accident, ADB will be payable as a lump sum. ADB is available for the policy term or till the age of 80 years, whichever is lower. For Return of Premium Plan and Income Benefit Plan, ADB can be less than or equal to the Basic Sum Assured as per plan option. For Return of Premium with Life-stage Cover Plan and Early Return of Premium with Life-stage Cover Plan, ADB can be less than or equal to the 50% of the Basic Sum Assured chosen at inception. ADB is a pure risk benefit and does not have Survival or Maturity Benefit. Premiums paid corresponding to ADB shall be excluded from Survival or Maturity Benefit.

6 Tax benefits may be available as per the prevailing tax laws. Tax benefits under the policy are subject to prevailing conditions and provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per applicable rates. The tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on above.

&The premium of ₹ 700 p.m. has been approximately calculated for protection plans and will vary case to case depending on different payment and policy term chosen. Goods and Services tax and/or applicable cesses (if any) as per applicable rates will be charged extra.

@Life cover, Critical illness cover, Accidental death cover, Return of premiums' features are available across various protection plans available with ICICI Prudential Life Insurance.

Life cover is the benefit payable on death of the Life Assured during the policy term.

ICICI Pru iProtect Return of Premium(UIN: 105N186V01), A Non-Linked, Non-Participating Individual Life insurance Savings product

E/II/4573/2021-22