- What is Term Insurance?

- Why Should You Buy a Term Insurance plan?

- Who Should Buy a Term Plan?

- Features of Term Insurance

- Benefits of buying a term insurance plan

- Types of term insurance plan

- 3 Easy steps to buy term insurance

- How to Choose the Best Term Insurance Plan?

- Why do you need a term insurance policy?

- How much term insurance cover do you need?

- What factors need to be considered while buying a term insurance plan?

- Why choose our top-selling~~ term plan ICICI Pru iProtect Smart?

- What are the payout options in term life insurance?

- When should you buy term life insurance?

- How long should be the term insurance policy period?

- What are the factors that can affect term insurance premiums?

- What is a term insurance rider?

- How can a Term plan secure your family’s future?

- Documents required for term life insurance

- Term Insurance Terminology

- Frequently Asked Questions

Term insurance is one of the most basic forms of life insurance. It offers you financial coverage for a predefined policy term in return for a fixed premium. A term insurance plan safeguards the financial interests of your loved ones in your absence. This single tool can help them cover various expenses like education, housing, groceries and more.

Therefore, it is essential to invest in a good term life insurance policy. This can ensure your family’s financial security after you.

What is Term Insurance?

Term insurance is a type of life insurance that provides coverage for a specific period of time or years, i.e., a term. This type of life insurance provides a financial benefit to the nominee in case of the unfortunate demise of the insured during the policy term. A term insurance policy provides high life cover@ at lower premiums. For e.g.: Premium for ₹ 1 Crore Term Insurance cover could be as low as ₹ 432* p.m. These fixed premiums can be paid at once or at regular intervals for the entire policy term or for a limited period. Premium amount varies basis the type of the premium payment method opted by the buyer.

Why Should You Buy a Term Insurance Plan?

To Safeguard Your Family's Future

As a breadwinner, it is important for you to ensure the well-being of your spouse, parents, and children. Term insurance can help you do this. This financial tool can offer your loved one’s financial security in your absence and help them cover their essential needs.

To Protect Your Assets

You may have taken loans to buy a house or car. The obligation to settle these loans will fall on your family after you. Term insurance offers your family the financial support they need to repay your outstanding debt. Not only does the insurance payout help them pay your dues, but it also ensures that the assets you have worked hard to build and acquire are protected and available for your family.

To Reduce Lifestyle Risks

The mental and financial strain of losing a loved one can be hard on a family. Dealing with loss can make it difficult for loved ones to carry on with their lives. This can impact their work and ability to earn money. Term life insurance can help the surviving family with adequate financial support at a trying time.

To Be Prepared for Uncertainty

Apart from anticipated expenses like education, loan repayments, housing and others, term insurance is also helpful to cover financial emergencies in your absence. As witnessed during the COVID-19 pandemic, life can be uncertain. Term insurance can help you prepare for unexpected financial needs, so you always have a safety net to rely on.

Low Premium and Attractively Large Cover

Term insurance offers an affordable way to safeguard the financial interests of your family. You can get high insurance coverage at a cost-effective premium and leave a substantial sum for your dependents. This helps you ensure financial protection without straining your pocket.

Comprehensive Rider

A term life insurance policy is a multi-faceted tool that can offer coverage against a range of financial uncertainties. Term insurance offers the option to add riders to enhance the plan's coverage. These can be added on top of the base sum assured at an additional cost. You can choose from riders like accidental death benefit, critical illness rider, waiver of premium rider and terminal illness rider and enjoy better financial protection in adverse situations.

Who Should Buy a Term Plan?

Anyone with financial dependents should buy a Term Insurance Policy. This includes married couples, parents, entrepreneurs and self-employed, SIP investors, young professionals with dependent parents, and in some cases, even retirees.

Premiums paid under the policy are allowed as a deduction subject to conditions u/s 80C of the Income Tax Act, 1961. The proceeds received under the policy are exempt subject to conditions prescribed under 10(10D) of the Income Tax Act, 1961. Term Insurance also has among the lowest premiums compared to the different types of insurance policies.

Hence, individuals who derive any of the three significant benefits associated with term insurance should consider buying such policies. The three significant benefits are – life protection, tax-saving and affordable premiums.

Features of Term Insurance

Here are some features of term insurance plans:

Term insurance plans have a minimum entry age of 18 years only, allowing young adults to secure their loved ones early on

The term plan offers long policy tenures of up to 40 years that allow you to protect your family members for a long time

A term insurance plan can be purchased online in minimal steps. You can compare different plans and features with a few clicks and pick a plan that suits your needs the best. The submission of documents, premium payment, and all other customer queries can be submitted online from the comfort of your home or office

Term insurance plans offer flexible premium payment options like monthly, quarterly, or yearly payment

A term insurance plan is flexible and allows you to increase the sum assured if you have opted for the life-stage option at the time of buying the plan

The sum assured of a term insurance plan can be used to ensure your family’s financial security and protect them from debt liabilities like a loan repayment

Benefits of Buying a Term Insurance Plan

Affordable Premiums

Term Insurance plans provide a large amount of life insurance cover at an affordable premium. This cover can compensate for several years of lost earnings

Cover Against Critical Illnesses6

Along with providing life cover@, a new-age term plan like ICICI Pru iProtect Smart also provides protection against critical illnesses. For a small additional premium, Critical Illness rider provides lump sum payments when a critical illness like a heart attack, cancer, kidney failure, or any other critical illness6 is first diagnosed

Support in Case of Disability##

In new-age Term Plans such as ICICI Pru iProtect Smart, the insurance company pays your future premiums in case of total and permanent disability. As a result, your life insurance cover continues even if you are unable to pay premiums

Additional Financial Security

To increase the security of your family, a Term Policy provides additional payout (up to ₹ 2 crore) in case of an accidental death5. For example, if your life cover is ₹ 1 crore, a Term Insurance Plan with Accident Death Benefit rider pays ₹ 2 crore to your family in case of an accidental death5

Tax Benefits

Term Insurance plans offer tax^^ benefits on premiums paid up to ₹ 46,800 under Section 80C. New-age Term Plans with critical illness6 cover also offer additional tax^^ benefits on premiums paid up to ₹ 7,800 under Section 80D. You also get tax^^ benefits subject to conditions prescribed under Section 10(10D) on the money that your family receives in case of an unfortunate event

Death Benefit

In the unfortunate event of death during the policy term, your family receives the death benefit from term insurance. Your nominee can choose to receive a regular income along with a lump sum benefit in your absence

Survival Benefits

Standard term insurance does not offer any benefit if you survive the term. However, there are term insurance plans with the return of premium option. These term plans pay back an amount that is at least equal to the total premiums paid, if you survive the policy term. You receive these assured benefits at the end of the policy tenure

Whole Life Cover

ICICI Pru iProtect Smart offers an option for whole life insurance that ensures uninterrupted financial coverage till the age of 99 years. This can help you safeguard your dependents for a long time

Flexible Payout Options

In case of an unfortunate event during the policy term, a term insurance plan offers a sum assured to the family members of the insured. The plan also offers option to choose the frequency of the payout, keeping in mind the diverse needs of a family. During the time of purchase, you can select the payout option as a lump sum payment or opt for regular instalments, either annually or monthly. The plan also offers the option to receive a combination of lump sum and regular income or an increasing income over time.

Flexible payouts help cover various financial needs, including household expenses, outstanding debts and other expenses

Types of Term Insurance Plan

ICICI Prudential Life offers different term plan options to suit your different needs

When selecting a term life insurance plan, it is important to personalise the plan according to your needs. It is advised to go through the features of a plan and pick one that can be aligned to your needs. ICICI Prudential Life provides a range of tailored solutions that can cater to diverse needs at different stages of your life. Below are the variants you can choose from:

Basic Term Plan

Term Insurance with Critical Illness6 Cover

Term Insurance with Accidental Death Cover5

Term Insurance with Limited Pay

All in One Term Plan

Term Plan with Return of Premium

Group Term Life Insurance Plan

3 Easy Steps to Buy Term Insurance

Step 1 Calculate Your Assured Sum

The first step in buying a term insurance plan is to analyse your financial needs. On our ICICI Pru Life website, choose the term plan of your choice and click on Calculate Premium. Answer a few basic questions about your age, lifestyle habits like smoking and drinking, annual income and contact information

Step 2Select Your Benefits and Request a Quote

The second step involves selecting your preferred benefits. These include payout options, such as monthly or annual income, lump sum, and others. You can also add riders like critical illness6 benefit and accidental death benefit5. The calculator will offer you an estimate of your premium according to the features you select

Step 3 Fill in the Details and Pay the Premium

After selecting all benefits and checking the premium, you can proceed to pay the premium. You will be asked for some additional details and essential documents. You can fill in the details and upload copies of the required documents

How to Choose the Best Term Insurance Plan?

Evaluate your needs

Assess your financial situation, family's needs and future expenses to determine the coverage amount and the term that best suits you

Compare different plans

Research and compare various insurance providers and their term insurance plans. Pay attention to premiums, coverage options and any additional features or benefits

Check the credibility of the insurer

Before buying a term insurance, it is important to assess the credibility of the insurer. Analysing the factors like claim settlement ratio, number of lives covered, volume of claims settled, solvency ratio and longevity of the company can help you choose the right insurance company as per your needs

Know the existing customer experience

Customer experience plays a crucial role in selecting the best term insurance plan. Apart from benefits and affordability, make sure to pay attention to the customer experience. This simplifies the processes involved and offers you peace of mind. Look for an insurance company that has a quick turnaround time and is proactive in solving your queries

Take into account service quality and online accessibility

Service quality and online accessibility ease the process of buying a plan, paying premiums and raising a claim. You can look for online reviews or check with your peers and family to find plans that offer easy accessibility through customer support. This enhances convenience and saves time

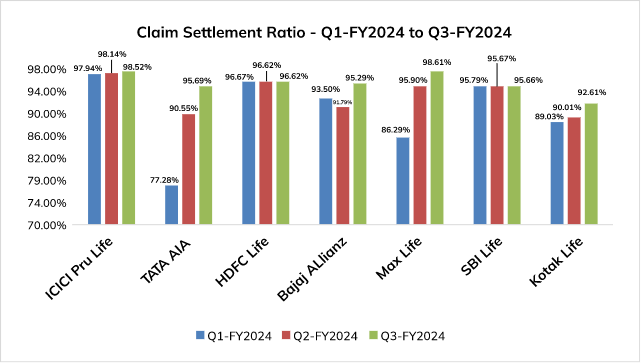

Check the claim settlement ratio

The claim settlement ratio helps you determine the insurer's credibility and ability to settle claims on time. It is important to look for an insurance company with a high ratio to ensure your insurance claim is paid on time without any hassles or delays. This can offer better financial security for your loved ones

Choose a plan that offers term insurance riders

While the primary purpose of term life insurance is to offer your family financial protection in your absence, term insurance also offers additional features. Riders like the critical illness benefit, accidental death benefit and others provide financial support against many adverse situations. Consider your needs and budget and add suitable riders to your plan to enhance your plan's coverage

Look for a term insurance plan with multiple payout options

Traditionally, term insurance policies offer a lump sum payout to your family in case of an untoward incident during the policy term. While this can help your family cover their needs, it can be challenging for them to manage such a large sum. Hence, it is advisable to look for term insurance plans that have the option to choose regular income, increasing income or a combination of lump sum and regular income. You can opt for options that cater to your needs to ensure your family's well-being in the long run

Why Do You Need a Term Insurance Policy?

Your family depends on you

Your assets need protection

Lifestyle risks

How Much Term Insurance Cover Do You Need?

You can get a simple, quick and clear answer to this question by calculating your Human Life Value or HLV. HLV is an easy-to-use numeric method of calculating the amount of life cover that you may need.

What Factors Need to be Considered While Buying a Term Insurance Plan?

While buying a Term Plan, we always have questions like which term policy is best and how to compare the best Term Life Insurance Plan. Here are some parameters which may help you choose the best Term Plan for yourself:

Calculate Your Assured Sum

Claim Settlement Ratio:

This ratio tells you how many claims for life insurance have been paid out as a proportion of claims made. The higher this ratio is, the betterFact: ICICI Pru Life has a claim settlement ratio~ of 98.7%

Solvency Ratio

Solvency Ratio:

Solvency ratio tells you whether the insurer you choose will be financially capable of settling your claim if the need arises. IRDAI mandates that every life insurer should maintain a solvency ratio of at least 1.5Fact: ICICI Pru Life has a solvency ratio$ of 2.09

Option to add Critical Illness Benefit6

Option to add Critical Illness Benefit6:

A critical illness like cancer or brain surgery can cost a lot of money and cripple the family’s finances. Critical illness protects your family from this risk. It pays out immediately on diagnosis, and only medical documents confirming diagnosis are to be submitted3

Option to add Accidental Death Benefit5

Option to add Accidental Death Benefit5:

If you have opted for Accidental Death cover5, your family will get additional payout in case of death due to an accident, subject to a maximum of ₹2 crore

Waiver of Premium on Terminal Illness^

Waiver of Premium on Terminal Illness^:

In case the person covered by the policy gets affected by a terminal illness, his/her future term plan premiums will need not to be paid

Why Choose Our Top-Selling~~ Term Plan

ICICI Pru iProtect Smart?

It fits in your budget:

After paying your monthly rent, phone, and electricity bills, paying a term insurance premium can be difficult. ICICI Pru iProtect Smart’s affordable premiums make sure they fit in your budget

It gives you a longer cover:

The best time to buy life insurance is now. Buying now will ensure that you get life cover@ at low premiums for the desired term. ICICI Pru iProtect Smart can cover you till the age of 85, and you also have the option to get whole life insurance till the age of 99

It gives you the option to cover 34 critical illnesses6:

ICICI Pru iProtect Smart Term Insurance Plan pays on the diagnosis of any one of 34 critical illnesses. No hospital bills are required3

It provides you option of lump sum or periodic payouts:

ICICI Pru iProtect Smart allows your family to get their life insurance payout as a lump sum, income or a combination of both. A lump sum payment is a single payment made to the nominee in case of an unfortunate event of the insured person. A periodic payment is a series of annual or monthly payments, made to the nominee in case of a mishap with the insured person. The latter option can save your family from the hassle of managing and investing a large sum of money

It gives you accelerated pay out in case of terminal illness^:

ICICI Pru iProtect Smart pays out your term insurance cover even before death, if you are affected by a terminal illness

It provides you protection against other claims:

You can buy the term insurance policy under the Married Woman’s Property Act++. This protects the money paid under the policy from other claims. It thus provides an additional layer of protection to your family

What are the Payout Options in Term Life Insurance?

A term insurance plan is a pure protection plan that offers a life cover@ to the policyholder in return for timely premium payments. If you buy a term plan, you will be asked to name a nominee. This could be a child, spouse, parent, sibling, or any other loved one. In case of an unfortunate event, the chosen sum assured will be paid to this nominee, depending on the payout method you opt for. Here’s how this works:

Lump sum

Income

A combination of both

Increasing income

When Should You Buy Term Life Insurance?

When it comes to buying term insurance plan, it is best to begin as early as possible. The premium of your term insurance increases with your age. Hence, to make the most of your term plan, it is advisable to buy a term plan at an early age. The below table will help you understand how your term insurance premium increases as per your age. The examples are in relation to a non-smoker.

| Age | Base policy Premium (Life Cover ₹ 1 crore) | With Critical Illness benefit (₹ 10 lakh) | With Accidental Death Benefit (₹ 50 lakh) | With Critical Illness (₹ 10 lakh) + Accidental Death Benefit (₹ 50 lakh) |

|---|---|---|---|---|

| 25 years | ₹ 597 | ₹ 733 | ₹ 884 | ₹ 1,010 |

| 35 years | ₹ 858 | ₹ 1,186 | ₹ 1,145 | ₹ 1,473 |

| 45 years | ₹ 1,969 | ₹ 2,875 | ₹ 2,256 | ₹ 3,162 |

| 55 years | ₹ 4,446 | ₹ 6,544 | ₹ 4,733 | ₹ 6,831 |

How Long Should Be the Term Insurance Policy Period?

The policy term offered by most life insurers ranges from 5 years to 40 years. One should always opt for a policy term depending on their retirement age. In India, 60 years is the general age of retirement. If you buy a Term Insurance Policy till 60 years, by that age all your financial liabilities and responsibilities will be cleared. Policyholders can opt for life cover@ for up to 99 years age if they have many dependents and would like to cover them for a complete life span.

What are the Factors That Can Affect Term Insurance Premiums?

The premium for a term insurance plan is calculated based on a number of factors. Various aspects of your health and lifestyle, such as your gender, age, habits, past or current medical ailments, hereditary diseases that are likely to affect you, and other aspects are considered before deciding upon a premium amount.

Here are some things that determine the value of your term insurance premium:

What Is a Term Insurance Rider?

A term insurance rider is an add-on cover that can be bought over the base plan. Riders are added at an additional price over and above the premium and can be chosen as per your needs. There are different types of riders, such as a terminal illness rider^, a critical illness6 benefit, an accidental death5 benefit, and a permanent disability rider##.

So, what are the different life insurance riders?

Terminal illness^ rider

Waiver of premium due to permanent disability##

Critical illness rider6

Accidental death benefit5

How Can a Term Plan Secure Your Family's Future?

Term insurance can safeguard your family's future by ensuring an assured payout in the event of your absence. The payout from term insurance plans can serve multiple purposes, such as replacing lost income, settling outstanding debts and supporting your family in achieving their future financial goals.

Documents Required For Term Life Insurance

The documents required to complete the application of a Term policy are:

-

One recent photograph

-

Copy of PAN

-

Official ID Proof

This can be any of the following: Aadhaar - front & back/ Driving License/ Passport - front & back

-

Income proof

Do note, your income proof should match with your declared annual income. Also for salaried applicants: Last 3 months’ salary slip/ Form 16/ Last 3 years ITR/ Last 6 months’ bank statement where salary gets credited. For non-salaried applicants: Last 3 years ITR with computation of income

Term Insurance Terminology

Here are some terms you must know:

Claim Settlement Ratio:

The Claim Settlement Ratio represents the proportion of insurance claims settled by the insurer against the total number of claims filed in a year. A higher ratio indicates a more reliable insurer, as it implies a lower likelihood of claim rejection for your family.

Term Insurance Premium:

The premium for term insurance is the periodic payment made to the insurer for financial protection. These premiums can be paid monthly, semi-annually, or annually, and typically increase with policyholder’s age.

Add-on Benefits (Riders):

You can enhance your plan with additional benefits, known as riders, which cover critical illnesses, accidental deaths, or permanent disabilities. Riders incur an additional, usually nominal, cost on top of the base premium.

Sum Assured:

The sum assured is the amount paid to the nominee in the event of the policyholder's untimely demise. It also influences the premium amount.

Death Benefit:

The death benefit, synonymous with sum assured, is the payment made to the nominee upon the policyholder's death.

Frequently Asked Questions

When is the right time to buy a term insurance plan?

The right time to buy a term insurance plan is as soon as you can. The chances of getting lifestyle diseases increase as you age, and so do insurance costs. When you invest in a term plan at a young age, you get an insurance policy at an affordable premium. Hence, it may be advised to invest in term life insurance when you are young. This will save a lot of money in the long run. Moreover, it will also provide you and your loved ones with extended coverage and financial security from an early age.

Are deaths due to Coronavirus covered by ICICI Pru term plan?

Life insurance plans including Term Life insurance cover death caused due to health issues. This stands true for death caused due to Coronavirus as well. If an unfortunate event occurs with a person who has purchased ICICI Pru iProtect smart policy due to COVID-19, his/her nominee will be paid the sum assured.

Should I buy a term plan or a traditional life insurance plan?

If your main purpose is to financially protect your family like your partner, children or parents in your absence, then you could opt for a Term Insurance Plan. Term Insurance plans give you adequate life insurance cover at a much lower cost. However, if you are looking for insurance as well as savings returns, then you may go for traditional life insurance policies like endowment plans or ULIPs.

How long should be the duration of your term plan insurance?

To ensure the protection of your family, you must pick an optimal policy duration of your term plan. Several aspects need to be looked at while selecting a term. You can start with your age. The younger you are, the longer the period you need protection for and vice versa. Your gender plays a crucial role here, as women generally live longer than men4. Similarly, your lifestyle habits, the ages of your dependents, and other aspects also decide the length of your policy term.

What is the policy term that I should select?

As a thumb rule, you should opt for a policy term depending on your retirement age. By then you would have paid off all your liabilities. However, in case you have some loans or liabilities, which will continue even after your retirement, you may choose your policy term accordingly.

E.g.: If your current age is 30 and you expect to retire at the age of 60, you should opt for a term life cover@ for 30 years policy term.

Ideal Policy Term = Your Expected Retirement Age – Your Current Age1

OR

Your Expected Age to attain Zero Liability – Your Current Age2

Can senior citizens buy term insurance?

Yes, senior citizens below 65*^ years of age can buy term insurance in case they want to financially secure the future of their spouse or dependent family. However, it is always advisable to buy a term insurance at a young age as the premiums tend to increase with age.

Is term insurance considered an asset?

Yes, term insurance is one of the greatest assets you can create to safeguard the future financial interests of your family members. It can help you leave behind a legacy for your loved ones and help them carry on with their lives and fulfil their goals in your absence.

What is the age limit to buy a term plan?

The age limit varies based on the particular plan you choose. The minimum age is 18 years and the maximum age is 60 years to buy ICICI Pru iProtect Smart, our best-selling Term Plan~~.

Do term insurance premiums increase every year?

The premiums for an existing term insurance plan do not increase every year. The plan you purchase today will have the same premiums a few years from now as long as your policy is active and unchanged. The premiums will only alter if you purchase a new plan altogether. Your premium may also rise if you increase your life cover@ or enhance the coverage of your policy with additional add-on benefits.

Do I need a term plan in my 50s or 60s?

A Term Plan's objective is to replace your income and provide financial support to your family in your absence. Therefore, you need a Term Plan as long as you work and earn an income, and your family remains financially dependent on you.

Thus, in your 50s or 60s, if you are responsible for your children's/grandchildren's education and upbringing, spouse who is financially dependent on you, or a differently abled relative's living costs, a Term Plan can be helpful for you. It will cover your loved ones' expenses in case of an eventuality. Hence, you need to assess your family's financial needs to decide until what age you want to keep your term insurance cover active.

Can I have multiple term insurance policies?

Yes, you can buy multiple term insurance plans to enhance your family’s overall financial protection, provided you’re financially eligible for the total sum assured of all the polices.

What are the types of death covered in term insurance?

When it comes to claiming settlement for the sum assured in a term life insurance plan, the following deaths are considered valid by an insurance company:

- Natural death caused by factors, such as age or a medical condition

- Death due to a critical illness6 such as cancer, stroke, and other

- Death due to an accident is also covered. Some plans also offer additional payouts to the nominee in the event of accidental death5

- Death due to a natural calamity like an earthquake, flood, hurricane, tsunami, and others is also covered under the plan

- Death due to suicide is covered in a term insurance plan. If the Life Assured commits suicide within 12 months, the nominee or beneficiary shall be entitled to 80% of the total premiums paid till the death provided the policy is in force

The following death is not included in a term insurance plan:

- Death in a homicide that involves the nominee is not covered under a term insurance plan. In such cases, a proper investigation will be conducted

It is important to know these aspects before purchasing a plan. You can also read the policy document to be sure of which kinds of deaths are not included in your term insurance.

Do term insurance plans offer tax^^ benefits?

Yes, Term Insurance premiums are allowed as a deduction subject to conditions prescribed under Section 80C of the Income Tax Act 1961. You can claim upto ₹ 1.5 lakh deduction for term insurance premiums paid over the year.

How much cover should I take in a term plan?

We suggest, your term insurance cover should be about 10-12 times your annual income. For e.g.: if you are earning ₹ 7.5 lakh per annum, you must secure yourself with a cover of about ₹ 75 lakh.

Additionally, you may also consider the following liabilities if applicable:

I. Loans & Liabilities

II. Children’s Education Cost

A simple rule of thumb for calculating Sum Assured in a Term Insurance policy is -

Minimum Sum Assured = Annual Income x 10 times + Loans/Liabilities$$

How can I get ₹ 1 crore term plan?

Before you buy a Term Plan, you should look into the insurance provider's credibility and claim settlement history. Choose an insurer with a consistent Claim Settlement Ratio (CSR) over 95% and a high Claim Paying Ability Rating. ICICI Prudential Life's FY2023 CSR stands at 98.7%~. We have consistently received iAAA claim settlement capacity ranking from ICRA.

The next step is to find out the premium you have to pay. Decide the premium payment frequency and the duration of the cover. Also decide how you want your family to receive the claim payouts, as a lump sum or a regular income. At the end, pay the premium and get the coverage you want. You can buy the ICICI Pru iProtect Smart Term Plan online in three simple steps:

- Calculate the premium you need to pay for ₹ 1 crore life cover@ using our online Term Insurance Premium Calculator. The calculator will help you determine the premium amount you will have to pay as per your chosen premium payment period and frequency (monthly, half-yearly, or yearly)

- Enter your personal and income details in the application form. Upload scanned copies of the relevant documents in our web portal

- Review the details you have entered, pay the premium online to get an attractive discount, and make your life cover@ active

Should you opt for Limited Pay or Regular Pay Term Insurance Plan?

Limited Pay lets the customer pay off their entire premium in a limited period while enjoying the benefits of the plan for the entire policy term. This lets you free from the burden of paying premiums early on while keeping your family secured for a long period of time. While the premiums to be paid now are higher with Limited Pay, you can end up saving up to 65%`` on total premiums paid over the course of the policy. This is a good option for people who don’t have many financial obligations currently and can manage to pay high premiums. However, if budget is a constraint, then you can go with the Regular Pay option where you pay throughout the policy term. You can choose to pay the premiums monthly, half-yearly or annually.

Can I change my term insurance plans details later on during the policy tenure?

You can change specified personal and policy details at any time during the policy tenure. You can download the relevant form from our website and submit it at our branches to ask for changes in details such as:

- The spelling of your name

- Contact information

- Residential status

- Date of birth

- Nominee

- Premium payment frequency or mode

But the policy tenure cannot be modified after you buy the plan. However, your insurance needs might change as your financial liabilities increase. Therefore, the ICICI Pru iProtect Smart Term Plan allows you to increase your life cover@ amount after your marriage or the addition of your children into your family.

Can I change the duration of life cover@ after the term insurance policy is issued?

No, you cannot change the policy period of Term Insurance after the policy is issued.

What happens to term life insurance at the end of the term?

Once your policy matures or reaches the end of its term, it ceases to exist which means the term life insurance policy expires and your coverage stops.

What kind of deaths are not covered in term insurance?

All kinds of deaths are covered under a term insurance plan, including natural, accidental, murder, illnesses and natural calamities. Only death due to suicide in the first year of policy is not covered.

How many times can I change the nominee in my term plan?

During the policy period, the nominee of your term plan can be changed as many times as you want. This change must be communicated to the insurer in writing, which shall ensure that the person who you think should benefit from your life cover@ receives the pay-out on time.

You can download the Nomination Form to update ICICI Prudential Life of any changes you want in your nomination details here.

What happens if the nominee dies?

After the policyholder is no more, if an unfortunate event occurs with the nominee before the sum assured is paid, then the policy benefits are received by the legal heir(s) or representative(s) or succession certificate holder(s).

Do you get your money back at the end of the policy term on survival?

No, you don’t get your money back on survival till the end of the policy term in a Term Insurance plan.

Can you cash out term insurance?

Term insurance is a pure protection plan that does not pay any maturity amount in case the life assured survives the policy term. This often discourages people from buying term insurance. However, you should remember that it is because of this very feature that insurance firms are able to offer term insurance at such low rates. Term insurance plans are very cost-effective with a ₹ 1 crore plan starting at as low as ₹ 432 p.m.*

Why is the term insurance premium amount for smokers higher than that of a non-smoker?

Term Insurance premium increases if the probability of the policyholder’s death rises. Smokers have a higher death rate than non-smokers. Hence, they are charged a higher premium.

Will my term insurance premium remain constant if, later, I became a heavy drinker/smoker?

Your Term Plan premium is decided when you buy the plan and remains unchanged throughout the policy period. However, the insurance provider may not take into consideration any claim arising as a direct consequence of alcohol consumption. Read your policy document carefully to understand all the exclusions related to alcohol use.

You should also disclose any change in your lifestyle and health condition, including smoking habits, to your insurer. It will ensure a hassle-free claim settlement at a time when your family needs the sum assured the most.

What happens if you stop paying term insurance premiums?

A grace period for payment of premium of 15 days applies for monthly premium payment mode and 30 days for other modes of premium payment. If the premium is not paid even within the grace period, the policy shall lapse, and the cover will cease.

What if I become an NRI after purchasing a term plan?

If you become an NRI after purchasing a Term Plan, your policy remains intact and continues to provide life cover@ anywhere in the world.

Is there any advantage of the limited pay option in Term Insurance?

You can save up to 66%'' on the total premium if you opt to pay off your premiums early with Limited Pay option of 5, 7 or 10 years. This also ensures lesser liabilities but sufficient cover for the later part of your life.

For instance, if you are 30 years old and bought a Term Plan with a policy term of 30 years. You may pay off your premium in the first 10 years itself. By then you would have turned 40 and you will not have to pay any premium anymore, but you will be sufficiently covered till you are 60.

What is Terminal Illness^ in Term Insurance?

Terminal Illness, as defined for ICICI Pru iProtect Smart, is a condition which, in the opinion of two independent medical practitioners specialising in the treatment of such illness, is highly likely to lead to death within six months. The terminal illness^ must be diagnosed and confirmed by medical practitioners registered with the Indian Medical Association and approved by the company. The company reserves the right for an independent assessment.

What will happen if I don't die until my Term Plan is over?

Term Insurance provides pay-out to your nominee only if an unfortunate event occurs while the cover is in force. If you survive your policy period, your life cover@ will end on the policy maturity date. Your policy will terminate, and you will not receive any pay-outs.

Due to the absence of any savings feature in term plans, these products are available at very reasonable premiums. With the ICICI Pru iProtect Smart Term Plan, you can get life cover@ up to ₹ 1 crore for premiums as low as ₹ 432* per month. While the plan is in-force, your family remains secure against any financial challenge arising from life's uncertainties.

People like you also read...