What is

Signature assure

Choose premium amount

Select your choice of funds

Make a payment

Policy Issued

Choose premium amount

Select your choice of funds

Make a payment

Policy Issued

Policy term 15 – 19 (48,000 p.a.), 20 – 25 (30,000 p.a.)

Get additional coverage in case of death/disability due to accident

2.5% of fund value added once every fifth year from 10th year

minimum: 5 years, maximum: 15 years

Minimum: 15 years, maximum: 25 years

5 years

Unlimited free withdrawals

Unlimited free fund switches

Life cover for the entire policy term

Company pays premiums in your absence

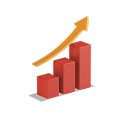

8%

4%

Year 1

(Age 35)

Year 5

Year 10

Akash’s family receives sum assured of - ₹12L

+

Akash’s family receives ₹1.2L p.a till the end of policy term

Company will pay your remaining premiums till payment term

₹27,09,364

fund value will be paid at maturity

**ARR (Assumed Rate of Return) refers to the standard assumption for the rate of return of 8% and 4%, as specified by IRDAI. This is just an illustration and not indicative of the actual returns you may get. Please look at our fund performance below to track the actual returns.

9.17 Cr

Lives covered as on March 31, 2025^^

₹46,182 Cr

Benefits paid till March 31, 2025`

₹3.1 Lakh Cr

Assets under management as on March 31, 2025^^

1 Day<

Death Claim Settlement