`~Source for Popular, Bestseller, Trending, Most Selling, Top Selling, High Demand: Company BuyOnline Data-April 2021 till date

`^Source: Company Buy Online Data-December 2015 till date

ICICI Pru iProtect Return of Premium

1 Life cover is the death benefit payable on death of the Life Assured during the policy term.

For ‘Return of Premium’ plan option, Death Benefit will be the highest of a) Sum Assured on Death b) Basic Sum Assured to be paid on death c) (Applicable only for limited pay and regular pay) 105% of the Total Premiums Paid till the date of death. Where Sum Assured on Death is 7 X Annualised Premium for regular pay and limited pay and 1.25 X Single Premium for single pay;

For ‘Income Benefit’ plan option, Death Benefit will be the highest of a) Sum Assured on Death b) 105% of the Total premiums Paid till the date of death c) Basic Sum Assured to be paid on death, less total Survival Benefit paid till date of death. Where, Sum Assured on Death is 10 X Annualised Premium.

For ‘Return of Premium with Life-stage cover’ & ‘Early Return of Premium with Life-stage cover’ plan options, Death Benefit will be the highest of a) Sum Assured on Death b) 105% of the Total premiums paid till the date of death c) Absolute amount assured to be paid on death Where Sum Assured on Death is 7 X Annualised Premium

2 Life-stage cover: In case of Life-stage cover, Absolute amount assured to be paid on death will be based on age of the Life Assured as provided below. In the first policy year, Absolute amount assured to be paid on death will be the same as Basic Sum Assured as chosen by You at inception. From the second policy year till the policy anniversary after the Life Assured attains age 55, 5% of Basic Sum Assured gets added on every policy anniversary to the Basic Sum Assured. This amount cumulatively shall be the Absolute amount assured to be paid on death. The Absolute amount assured to be paid on death remains constant till the next policy anniversary. In case the Absolute amount assured to be paid on death becomes twice the Basic Sum Assured during this period of increment, it stays constant at that level, till the policy anniversary after the Life Assured attains age of 56 years. On the policy anniversary after the Life Assured attains 56 years of age, the Absolute amount assured to be paid on death shall revert back to Basic SA. This will continue till the policy anniversary after the Life Assured attains 60 years of age. On the policy anniversary after the Life Assured attains 60 years of age, the absolute amount assured to be paid on death shall be 50% of Basic Sum Assured and continues at the same level till end of the policy term

3 Return of Premium / Guranteed Return: Return of premiums is available on survival under three of the Plan Options: ‘Return of Premium’, ‘Return of Premium with Life-stage cover’ and ‘Early Return of Premium with Life-stage cover’ and refers to total of all premiums received, excluding premiums for optional benefits i.e. Accidental Death Cover, Critical Illness Benefit, any extra premium, any rider premium and taxes, if any. The plan options ‘Return of Premium’ and ‘Return of Premium with Life-stage cover’ provide maturity benefit on survival of the Life Assured till the end of the policy term. The plan option ‘Early Return of Premium with Life-stage cover’ provides survival benefit on survival of the Life Assured till the policy anniversary immediately after the Life Assured turns age 60 or 70, depending on the return of premium age chosen by the customer at inception. The fourth plan option ‘Income Benefit’ provides regular monthly income from the policy anniversary after the Life Assured attains age 60 as a survival benefit till the end of the policy term. Please note that the sum of monthly incomes paid under this plan option can be higher or lower than the total premiums paid by the customer, and may not be return of premium

4 Critical Illness Benefit: Critical Illness Benefit is up to ₹1 Crore (Subjected to underwriting guidelines).CI Benefit is an additional optional benefit chosen at inception and is available with ‘Life and health’ and ‘All in One’ benefit options. The CI Sum Assured is paid as a lump sum upon the Life Assured being diagnosed on first occurrence of any of the covered 60 major Critical Illnesses within CI Benefit term. 25% of the CI Sum Assured or ₹500,000.00 whichever is lower is paid as a lump sum upon the Life Assured being diagnosed on occurrence of any of the covered 4 minor Critical Illnesses within CI Benefit term. CI Benefit is available for Single Pay and Limited Pay and is lower of (15 years, policy term). For regular pay, the CI benefit term will be lower of (policy term, 40 years) subject to maximum cover ceasing age of 85 years. CI Benefit can be less than or equal to the Basic Sum Assured chosen by You at inception for Return of Premium Plan and Income Benefit Plan. CI Benefit can be less than or equal to the 50% of the Basic Sum Assured chosen at inception for Return of Premium with Life-stage Cover Plan and Early Return of Premium with Life-stage Cover Plan. CI Benefit is a pure risk benefit and does not have Survival or Maturity Benefit. Premiums paid corresponding to CI Benefit shall be excluded from Survival or Maturity Benefit

5 Accidental Death Cover: Accidental Death Cover is up to ₹2 crore (Subjected to underwriting guidelines). ADB Benefit is an additional optional benefit and is available with ‘Life Plus’ and ‘All in One’ benefit options. In the event of the Life Assured’s death due to an Accident, ADB will be payable as a lump sum. ADB is available for the policy term or till the age of 80 years, whichever is lower. For Return of Premium Plan and Income Benefit Plan, ADB can be less than or equal to the Basic Sum Assured as per plan option. For Return of Premium with Life-stage Cover Plan and Early Return of Premium with Life-stage Cover Plan, ADB5 can be less than or equal to the 50% of the Basic Sum Assured chosen at inception. ADB is a pure risk benefit and does not have Survival or Maturity Benefit. Premiums paid corresponding to ADB shall be excluded from Survival or Maturity Benefit

‘`` The above calculations are for a 25-year-old healthy male who has opted for Regular pay: 40 years premium payment option with a policy term of 40 years under Return of premium option for ICICI Pru iProtect Return of premium with a life cover of ₹ 50 lakh with Lump sum payout option. The above premiums are inclusive of taxes

2a Monthly income is available under “Income Benefit” plan option and starts from the policy anniversary after the Life Assured turns 60 years of age till the end of the policy term. Please note that the monthly income is 0.1%,0.2% or 0.3% of base Sum Assured depending on the monthly income percentage chosen by the customer at inception and the sum of monthly incomes paid under this plan option can be higher or lower than the total premiums paid by the customer, and may not be return of premium

2b Tax benefit of ₹ 54,600 (₹ 46,800 u/s 80C & ₹ 7,800 u/s 80D) is calculated at highest tax slab rate of 31.2% (including Cess excluding surcharge) on life insurance premium u/s 80C of ₹ 1,50,000 and health premium u/s 80D of ₹ 25,000. Tax benefits under the policy are subject to conditions under Section 80C, 80D, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details

^ The premium of ₹3085 p.m. has been approximately calculated for a 28-year-old healthy, non-smoker male who has bought ‘Income Benefit’ plan option with ‘0.3% monthly income’, premium payment term as ‘pay till 60’ years, death benefit payout option as Lump sum, with a policy term of 37 years and life cover of ₹1 Crore. The above mentioned premium is online premium and is inclusive of taxes

5d The above monthly premium of ₹1,416 is for a 22-year-old, healthy non-smoker male life who has purchased ‘Return of Premium’ plan option under ICICI Pru iProtect Return of Premium and is paying premiums regularly for a policy term of 30 years for a life cover of ₹1 crore and death benefit payout option as regular income. The premium is for an online policy and is inclusive of taxes. The life assured will receive 105% return of premium of ₹5,11,812 on survival till the end of the policy term

ICICI Pru iProtect Return of Premium (UIN: ), A Non-Linked, Non-Participating Individual Life insurance Savings product. W/II/4644/2021-22

ICICI Pru iProtect Smart

!aLife cover: Life Cover is the benefit payable on the death of the life assured during the policy term

2aThe premium of ₹ 460 p.m. has been approximately calculated for a 18-year-old healthy male life with monthly mode of payment and premiums paid regularly for the policy term of 31 years with income payout option (income for 20 years) with Life Cover of ₹1 crore. Goods and Services tax and/or applicable cesses (if any) as per applicable rates will be charged extra.

~^The percentage saving computed is purely in terms of premium paid over the term (Difference between 5 years Limited and Regular pay) of the policy and does not account for time & other factors that may happen during this period. It is one of the many features that the product offers and you can opt for it based on your individual needs. The percentage saving is for ICICI Pru iProtect Smart - Life Option for ₹ 1 Crore life cover for a 26-year-old healthy male for a policy term of 58 years with a lump sum payout option. The annual premium for 5 years Limited Pay option will be ₹ 85,762/- & the monthly premium will be ₹ 7,324. The premium amounts are inclusive of taxes

**Our Life insurance policies COVID-19 life claims are subject to applicable terms and conditions of the policy contract and extant regulatory framework

## Accelerated Critical Illness benefit(ACI benefit) is up to ₹1 crore (Subjected to underwriting guidelines). Accelerated Critical Illness Benefit (ACI Benefit) is optional and available under Life & Health and All in One options. This benefit is payable, on first occurrence of any of the 34 illnesses covered. Medical documents confirming diagnosis of critical illness needs to be submitted. The benefit is payable only on the fulfillment of the definition of the diagnosed critical illness. The ACI Benefit, is accelerated and not an additional benefit which means the policy will continue with the Death Benefit reduced by the extent of the ACI Benefit paid. The future premiums payable under the policy will reduce proportionately. If ACI Benefit paid is equal to the Death Benefit, the policy will terminate on payment of the ACI Benefit. To know more in about ACI Benefit, terms & conditions governing it, kindly refer to sales brochure. ACI Benefit term would be equal to policy term or 30 years or (75-Age at entry), whichever is lower.

^^Available only under Life Plus and All in One option. The maximum amount that can be availed is ₹ 2 Crore and will be paid as a lump sum.

++A lump sum is paid out on diagnosis of any of the listed conditions. This payout is based on the level of the condition. In any case, the total payout in the policy cannot exceed 100% of the Sum Assured of the cover selected. Please refer to the sales brochure to know about the payouts at different level of condition

~Subject to realisation of payment and documents. Policy can be purchased in 3 steps: 1. Generating premium quote 2. Filling basic details and answering health related questions 3. Premium payment

2A discount as follows will be offered on first year’s premium of Death Benefit, Terminal Illness and Waiver of Premium on permanent disability (excluding rider premiums, underwriting extra premiums and taxes) to salaried customers opting for sum assured greater than or equal to ₹ 15,000,000:

| Limited Pay |

15% |

| Regular Pay |

10% |

4A Life Assured shall be regarded as Terminally Ill only if that Life Assured is diagnosed as suffering from a condition which, in the opinion of two independent medical practitioner’s specializing in treatment of such illness, is highly likely to lead to death within 6 months. The terminal illness must be diagnosed and confirmed by medical practitioner’s registered with the Indian Medical Association and approved by the Company. The Company reserves the right for independent assessment.

5In case of permanent disability due to an accident, all future premiums are waived off and the life cover continues for the remaining policy duration. This benefit comes in-built in your term insurance policy without any extra cost to you. To know more about definitions, terms & conditions applicable for permanent disability due to accident, kindly refer sales brochure of ICICI Pru iProtect Smart.

65% discount on premium is applicable only for Regular and Limited pay policies. In case of Single Pay, the discount applicable is 2% of Single Premium.

7Only a doctor’s certificate confirming the diagnosis needs to be submitted. The benefit is payable only on the fulfilment of the definition of the diagnosed critical illness.

8Our Life insurance policies cover COVID-19 claims under life insurance claims, subject to applicable terms and conditions of policy contract and extant regulatory framework. COVID-19 is not included in Critical Illness benefit covered under IProtect Smart

9Accidental Death benefit (ADB) is up to ₹2 crores(Subjected to underwriting guidelines). ADB is available in Life Plus and All in One options. In case of death due to an accident Accidental Death Benefit will be paid out in addition to Death Benefit. Accidental Death Benefit will be equal to the policy term or (80-Age at entry), whichever is lower.

ō The policyholder will have an option to cancel the Policy and receive Smart Exit Benefit, equal to Total Premiums Paid under the Policy. The following conditions are applicable for availing Smart Exit benefit:

This option can be exercised in any policy year greater than 25 but not during the last 5 policy years, provided the age of the life assured is 60 years or more at the time of exercise

The Policy is in-force with all due premiums paid at the time of exercising this option

No claim for any of the underlying benefits has been registered and is under evaluation/ or accepted/ or paid/ being paid on the Policy

Where, Total Premiums Paid means the total of all premiums received, excluding any extra premium, any rider premium and taxes. In case the benefit term for additional benefit(s), for which additional premium has been paid, has expired at the time of exercise of Smart Exit Benefit, then Total Premiums Paid shall exclude the premium paid towards such additional benefit(s). Please refer to sales brochure for more details.

S1 Total Premiums Paid means the total of all premiums received, excluding any extra premium, any rider premium and taxes. In case the benefit term for additional benefit(s), for which additional premium has been paid, has expired at the time of exercise of Smart Exit Benefit, then Total Premiums Paid shall exclude the premium paid towards such additional benefit(s)

^ Tax benefit of ₹ 54,600 (₹ 46,800 u/s 80C & ₹ 7,800 u/s 80D) is calculated at highest tax slab rate of 31.2% (including Cess excluding surcharge) on life insurance premium u/s 80C of ₹ 1,50,000 and health premium u/s 80D of ₹ 25,000. Tax benefits under the policy are subject to conditions under Section 80C, 80D, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details

°a The first year premium of ₹677 p.m. (less than ₹23 per day) has been approximately calculated for a 18-year-old healthy male(Occupation: Salaried) life with monthly mode of payment and premiums paid regularly for the policy term of 48 years with income payout option (income for 30 years) with Life Cover of ₹1 crore. The premium amount is inclusive of taxes. For the above selected premium, customer will be able to avail 5% lifetime online discount and 30% lifetime discount on premiums due to monthly income payout

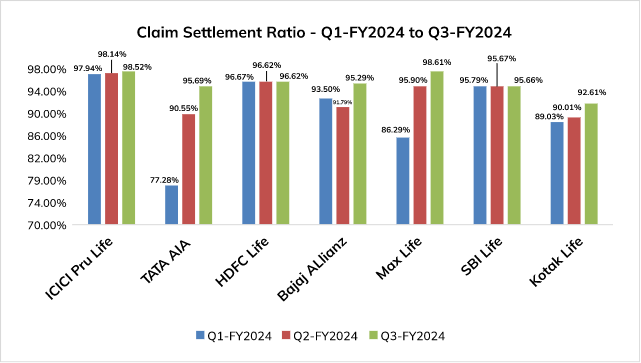

!j Claim settlement ratio is for Financial Year FY2023-24 and is computed on individual basis claims settled over total individual claims for the financial year. For details, refer to Source: https://www.iciciprulife.com/about-us/investor-relations/yearly-public-disclosures.html?ID=about3

F The 15% percentage has been calculated by comparing the premium for a 20-year-old healthy male (occupation: salaried) and 20-year-old healthy female (occupation: salaried), for a life cover of ₹1 crore under life option for a policy term of 26 years for a monthly income payout option (till 30 years) for a regular premium pay mode. The premium (inclusive of taxes) for this case for the male is ₹ 481 per month and for a female is ₹ 410 per month

W/II/1058/2023-24

ICICI Pru iProtect Smart UIN:

~*Additional Maturity Benefit is offered for online sales: For the Lump Sum Plan option, 2.5% of Sum Assured on Maturity is applicable for Limited pay. In the case of Single Pay in Lump Sum Plan option, 1% of Sum Assured on Maturity is applicable. For the Income Plan option, 2.5% of Guaranteed Income is applicable. For the Early Income Plan option, 3.5% of Guaranteed Income is applicable. For the Single Pay Income Plan option, 1% of Guaranteed Early Income is applicable

!’The yearly online premium of ₹960 (less than ₹99 per month) is for a 22-year-old healthy non-smoker male who has bought ICICI Pru Heart / Cancer Protect, with cancer cover of ₹20 lakh, paying premiums regularly for 13 years, inclusive of tax.

3Refer to the product brochures for the definitions, exclusions and other terms and conditions applicable for Permanent Disability due to an accident and Terminal Illness.

+The policyholder can have funds in only one of the Portfolio Strategies.

#Excluding taxes and Top-up Premium Allocation Charges.

UIN details: ICICI Pru iProtect Smart - . ICICI Pru Signature - . ICICI Pru Guaranteed Pension I13 & I14 UIN - . ICICI Pru Guaranteed Pension Plan Flexi - . ICICI Pru Saral Pension Plan - . ICICI Pru Guaranteed Wealth Protector -

ICICI Pru Heart/Cancer Protect: UIN 105N154V03. COMP/DOC/Jan/2022/101/7213

1The company will allocate extra units to your ULIP policy provided all due premiums have been paid. To know more in detail, kindly refer to the sales brochure of the respective products.

8As per currently applicable tax laws, tax benefit of ₹ 54,600/- ( ₹ 46,800/- under Section 80C and ₹ 7,800/- under Section 80D) is calculated at the highest tax slab rate of 31.2% (including Cess excluding surcharge) on life insurance premium under Sections 80C of ₹ 1,50,000/- and health premium under Section 80D of ₹ 25,000/-. Tax benefits under the policy are subject to conditions under Sections 80C, 80D, 80CCC, 10(10A), (10D) and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on the above.

~#Your annuity/income is informed to you when you buy the plan and is guaranteed and unchanged for life.

//Tax benefits under the policy are subject to conditions under Sections 80C, 80CCC, 115BAC and other provisions of the Income Tax Act, 1961. Goods and Service Tax and Cesses, if any, will be charged extra as per prevailing rates. The tax-free return is subject to conditions specified under Section 10(10D) and other applicable provisions of the Income Tax Act, 1961. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on the above.

"Guaranteed Additions (GAs) rate will be 9% for a policy term of 10 years and 10% for a policy term of 15 years. GAs will be added to the policy at the end of every policy year if all due premiums have been paid. Each GA will be calculated as GA rate multiplied by the total premiums paid till date (excluding extra mortality premiums, Goods & Services Tax and Cess (if any)).

`*Wealth Boosters equal to 3.25% of the average of the Fund Values including Top-up Fund Value, if any, on the last business day of the last eight policy quarters will be allocated as extra units to your policy at the end of every 5th policy year starting from the end of the 10th policy year till the end of your policy term.

^*Systematic Withdrawal Plan is allowed only after the first five policy years.

-Guaranteed Maturity Benefit (GMB): Your GMB will be set at policy inception and will depend on the policy term, premium, premium payment term, age and gender.

~~Guaranteed benefits in the form of lump sum will be payable under the Lump Sum Plan option. Guaranteed benefits in the form of regular income will be payable under the Income Plan option and Early Income Plan option.

$How much life insurance do you really need? - https://economictimes.indiatimes.com/wealth/insure/how-much-life-insurance-do-you-really-need/articleshow/22065416.cms?from=mdr

$$Why men often die earlier than women - https://www.health.harvard.edu/blog/why-men-often-die-earlier-than-women-201602199137

ΘGuaranteed benefits are payable subject to all due premiums being paid and the policy being in force on the date of maturity.

°The total amount is calculated for a 30-year-old healthy male with a premium paying term of 10 years paying premiums in monthly mode and income period of 30 years taking income in annual instalments under the Income Plan option. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and the policy is in force till the completion of the entire policy term opted. The total benefit of ₹ 1,01,77,830 is calculated by taking the sum of all guaranteed incomes payable over the entire income duration. COMP/DOC/Dec/2021/3012/7166

ΘGuaranteed benefits are payable subject to all due premiums being paid and the policy being in force on the date of maturity.

ↃGuaranteed Maturity Benefit (GMB) will be set at policy inception and will depend on the policy term, premium, premium payment term, Sum Assured and gender. Your GMB may be lower than your Sum Assured. GMB is the Sum Assured on maturity.

£Bonuses consist of vested reversionary bonuses, interim bonus and terminal bonus, if any. Reversionary bonuses may be declared every financial year and will accrue to the policy if it is premium paying or fully paid. Reversionary bonuses will be allocated through the compounding bonus method. All reversionary bonuses will be declared as a proportion of the sum of the GMB and the vested reversionary bonuses. Reversionary bonus once declared is guaranteed and will be paid out at maturity or on earlier death. A contingent reversionary bonus may be declared every financial year and will accrue only to a policy if it becomes paid-up. Contingent reversionary bonus will be a part of the paid up benefit and will be paid on maturity or earlier death. A terminal bonus may also be payable at maturity or on earlier death.

ŦGuaranteed Additions (GAs) totaling 5% of GMB each year will accrue during the first five policy years if all due premiums are paid. GAs accrue on payment of due premium.

±Tax benefit of ₹ 46,800/- is calculated at the highest tax slab rate of 31.2% (including Cess excluding surcharge) on life insurance premium under Section 80C of ₹ 1,50,000/-. Tax benefits under the policy are subject to conditions under Sections 80C, 80D, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on the above.

≠ΘGuaranteed benefits are payable subject to all due premiums being paid and the policy being in force on the date of maturity.

∞Tax benefits of ₹ 46,800/- under Section 80C is calculated at the highest tax slab rate of 31.20% (including cess excluding surcharge) on life insurance premium under Section 80C of ₹ 1,50,000/-. Tax benefits under the policy are subject to conditions under Sections 80C, 80D, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Service Tax and Cesses, if any, will be charged extra as per prevailing rates. The Tax Free income is subject to conditions specified under Section 10(10D) and other applicable provisions of the Income Tax Act, 1961. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on the above.

ꓘICICI Pru Guaranteed Income For Tomorrow (Long-term) offers 4 options in income period namely 15, 20, 25 and 30 years. The customer can choose any plan option from the four available options. Please refer to the brochure for more details.

ꞂICICI Pru Guaranteed Income For Tomorrow (Long-term) offers two plan options namely, 'Income' and ‘Income with 110% ROP’. The customer can choose any plan option from the two available options. Please refer to the brochure for more details.

+Life Cover is the benefit payable on the death of the life assured during the policy term.

!As per Internal Data of policies sold for all products from April’21-December’21 in the BOL Channel.

ADVT: W/II/5060/2021-22

*Claim statistics are for FY2020 and is computed on the basis of individual claims settled over total individual claims for the financial year. For details, refer to the Public Disclosures on our Website. W/II/3484/2018-19.

&The premium of ₹ 700 p.m. has been approximately calculated for protection plans and will vary case to case depending on different payment and policy term chosen. Goods and Services tax and/or applicable cesses (if any) as per applicable rates will be charged extra.

@Life cover, Critical illness cover, Accidental death cover, Return of premiums' features are available across various protection plans available with ICICI Prudential Life Insurance.

Life cover is the benefit payable on death of the Life Assured during the policy term.

ICICI Pru iProtect Smart UIN: . COMP/DOC/Jun/2023/96/3246

ICICI Pru Savings Suraksha

1 Life Cover is the benefit payable on death of the life assured during the policy term

2 Your GMB will be set at policy inception and will depend on policy term, premium, premium payment term, Sum Assured on death and gender. Your GMB may be lower than your Sum Assured on death

3 Guaranteed Additions (GAs) totaling 5% of GMB each year will accrue during the first five policy years if all due premiums are paid. GAs accrue on payment of due premium

4 Reversionary bonuses may be declared every financial year and will accrue to the policy if it is premium paying or fully paid. Reversionary bonuses will be applied through the compounding bonus method. All reversionary bonuses will be declared as a proportion of the sum of the GMB and the vested reversionary bonuses, if any. Reversionary bonus once declared is guaranteed and will be paid out at maturity or on earlier death. A terminal bonus may also be payable at maturity or on earlier death

5Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details

* Guaranteed benefits is in the form of Guaranteed Maturity Benefit and Guaranteed Additions

ICICI Pru Savings Suraksha: UIN . ADVT: W/II/0901/2023-24

ICICI Pru Guaranteed Pension Plan Flexi

1+ The income/annuity amount chosen at the time of purchasing the policy is guaranteed for life and will be payable in arrears at the end of every month, quarter, half-year or year, after completion of the deferment period

2+ An enhanced benefit will be offered on surrender anytime from date of commencement of policy to the end of the Deferment Period for eligible policies purchased through the online platform. This amount payable will be the surrender value as described under the section “Surrender” in the sales brochure, subject to minimum of 100% of Total Premiums Paid till the date of surrender

ICICI Pru Guaranteed Pension Plan Flexi: UIN

ICICI Pru Gold

1 In plan option ‘Immediate income’ and ‘Immediate income with Booster’, starting from the first policy year, you will receive a regular income at the end of every policy year/month, as chosen by you, provided the policy is in-force.

In ‘deferred Income’ plan option, you will receive regular income at the end of every year/month, starting from end of deferment period as chosen by you, provided the policy is in-force. You can start this income as early as 2nd policy year or as late as Premium Payment Term plus 1 year

Guaranteed Income (GI) and

Income which will be linked to Bonus, if declared; referred to as Cash Bonus (CB)

2 For all plan options, Maturity Benefit will be sum of:

Sum Assured on Maturity, plusBalance in the Savings Wallet (if any), plusTerminal Bonus (if declared)

3 ICICI Pru Gold offers three plan options namely ‘Immediate Income’ and ‘Immediate Income with booster’ and ‘Deferred Income’. The customer can choose any one of the three available options. Please refer to sales brochure for more details

4 Life cover is the benefit payable on death of the life assured during the policy term. For all plan options, Death Benefit is equal to:

Sum Assured on Death, plus

Balance in the Savings Wallet (if any), plus

Interim Survival Benefit (if any), plus

Terminal Bonus (if declared)

Where, the Sum Assured on Death is the highest of:

7 times the Annualized Premium

105% of the Total Premiums Paid as on the Date of Death

Death Benefit multiple times Annualized Premium

5 Tax benefits under the policy are subject to prevailing conditions and provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on above. ICICI Pru Gold A Non-Linked Participating Individual Life Insurance Savings plan. UIN 105N190V02

6Bonuses: Bonuses will be applied through the simple bonus method. Cash Bonuses may be declared annually throughout the policy term for all three variants, and will be expressed as a proportion of the Annualized Premium. For a new policy sold with Date of Commencement of Risk on or after April 1 in any financial year, there may not be any Cash Bonus rate declared for such policies when the Survival Benefit becomes due to be paid. In such circumstances, the Company may pay a fixed cash income benefit in lieu of Cash Bonus. This fixed cash income benefit will be based on a non-participating Cash Income rate (declared by the Company annually in advance) and once declared shall remain guaranteed to be paid as part of Survival Benefit as and when it is due. Such payments in the form of fixed benefit shall continue till a Cash Bonus rate (as applicable for the policy) is declared and the Cash Bonus benefit, if declared, becomes payable at the next benefit due date. A separate Terminal Bonus may be declared under each variant, and will be payable on death, surrender and maturity, respectively, for a premium paying or a fully paid policy. Please refer to the sales brochure for more details.

ICICI Pru Gold UIN: 105N190V02 A Non-Linked, Participating Individual Life Insurance Savings plan. W/II/0941/2023-24

ICICI Pru Protect N Gain

1 Life cover is the benefit payable on death of the life assured during the policy term. Death Benefit will be highest of:

Sum Assured, including Top-up Sum Assured, if any

105% of the total premiums paid

Fund Value including the Top-up Fund Value, if any

2 Starting from the 11th policy year, you will receive 2X/4X of return of mortality and 2X of policy administration charges (excluding taxes), at the beginning of each month, till the end of the policy term. These will be added in the form of units to the Fund Value.

3 At policy maturity, an addition, known as Maturity Booster in the form of extra units (Units mean a specific portion or part of the Unit Linked Fund(s) in which you have saved your money) will be made to boost your Fund Value. This Maturity Booster will be equal to 20% percentage of the average of the Fund Values including Top-up Fund Value, if any, on the last business day of the last eight policy quarters

4 Systematic Withdrawal Plan is allowed only after the first five policy years.

5Available through mandatory rider ‘ICICI Pru Accidental Death and Disability rider’. Please refer to the rider brochure for more details.

6Switches are only applicable for fixed portfolio strategy and not applicable for other portfolio strategies.

7The sum assured multiple in ICICI Pru Protect N Gain is calculated basis the chosen life cover, life assured’s age, premium payment term and policy term. The highest available sum assured multiple is 125 in the product.

^The premium ₹7,694 p.m. is calculated for a 30-year-old healthy male with the monthly mode of payment, premiums paid regularly for the policy term of 40 years and life cover of ₹1 crore. The premium shown is inclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and the policy is in force till the completion of entire policy term opted.

~Maturity benefit is policy fund value, including top up fund value, if any. On payment of maturity benefit, the policy terminates.

% 7.72 crore lives covered across our individual and group customers as per ICICI Prudential Life Council Report

*Tax-free returns/Tax benefits of ₹46,800 under Section 80C is calculated at highest tax slab rate of 31.20%(including cess excluding surcharge) on life insurance premium under Section 80C of ₹1,50,000/-. Tax benefits under the policy are subject to conditions under Sections 80C, 10(10D), 115BAC and other provisions of the Income Tax Act,1961. Goods and Services tax and Cesses, if any will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details

> ClaimForSure: 1 Day Death Claim Settlement is available for the following:

a) All due premiums in the policy have been paid and the policy has been active for 3 consecutive years preceding life assured’s death

b) Mandatory documents to be submitted at Branch Office- Claimant statement form, Original policy certificate, Copy of death certificate issued by local authority, AML KYC documents- Nominee’s recent photograph ,Copy of Nominee’s pan card, Nominee’s current address proof, photo identity proof, Cancelled cheque/ Copy of bank passbook, Copy of medico legal cause of death, Medical records (Admission notes, Discharge / Death summary, Test reports, etc.), For accidental death - Copy of FIR, Panchnama, Inquest report, Postmortem report, Driving license

c) Total claim amount of all the life policies held by the Life Assured <=₹ 1.5 Crore

d) Claim does not require any on-ground investigation

1 Day is a working day, counted from date of receipt of all relevant documents from the claimant, additional information sought by the Company and any clarification received from the claimant. The Company will be calling the claimants for verification of information submitted by the Claimant which will also be considered as part of relevant documents. Working day will be counted as Monday to Friday and excluding National holidays/Bank holidays/Public holidays, Interest shall be at the bank rate that is prevalent at the beginning of the financial year in which death claim has been received. In case of breach in regulatory turnaround time, interest will be paid as per IRDAI regulations. Under ULIP policies, if claim is submitted prior to 3 pm then the claim will be considered under Claim For Sure on the same day. If claim is submitted post 3pm or if the policy is inactive at the time of claim notification then the claim will be considered under Claim For Sure the next day as per availability of NAV

ICICI Pru Protect N Gain (UIN: ). ICICI Pru Linked Accidental Death and Disability Rider (UIN: )

^a The premium ₹8982 p.m. is calculated for a 40-year-old healthy male with the monthly mode of payment, premiums paid for 12 years for the policy term of 40 years and life cover of ₹1 crore. The premium shown is inclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and the policy is in force till the completion of entire policy term opted.

ADVT: W/II/1197/2023-24

ADVT: W/II/0327/2024-25

COMP/DOC/May/2024/305/6251

ICICI Pru Platinum

1 Life cover is the benefit payable on death of the Life Assured during the policy term

2 Systematic Withdrawal Plan is allowed only after completion of five policy years

3 Tax benefits under the policy are subject to conditions under Section 80C, 80D, 10(10D) and other provisions of the Income Tax Act, 1961.

4 Past performance of funds is not indicative of future performance.

ICICI Pru Platinum (UIN: 105L192V01). ADVT: W/II/0043/2024-25

IShield

This advertisement is designed for Combi Product named: iShield, UIN: . The product is jointly offered by “ICICI Lombard General Insurance Company Limited” and “ICICI Prudential Life Insurance Company Limited” which offers the combination of a Life Insurance cover offered by ICICI Prudential Life Insurance Company Limited and a Health Insurance cover offered by ICICI Lombard General Insurance Company Limited. The risks of this ‘Combi Product’ are distinct and are assumed / accepted by respective insurance companies. The liability to settle the claim vests with respective insurers, i.e., for health insurance benefits “ICICI Lombard General Insurance Company Limited” and for life insurance benefits “ICICI Prudential Life Insurance Company Limited.”

1Life cover is the benefit payable on death of the Life Assured during the policy term.

2Permanent Disability: On diagnosis of Permanent Disability (PD) due to an accident, the future premiums under your policy for all benefits are waived. To know more about definitions, terms and conditions applicable for permanent disability due to accident, kindly refer sales brochure of ICICI Pru iProtect Smart.

3The Company hereby agrees subject to the terms, conditions and exclusions herein contained or otherwise expressed, for the period and to the extent of the Sum Insured as specified in the Schedule to this Policy. The Policy covers Reasonable and Customary Charges incurred towards medical treatment taken during the Policy Period for an Illness, Accident or condition described below if this is contracted or sustained by an Insured / Insured Person during the Policy Period and subject always to the Sum Insured, any subsidiary limit specified in the schedule of Benefits, the terms, conditions, limitations and exclusions mentioned in the Policy and eligibility as per the insurance plan opted by insured and stated in as stated in the Schedule

4This benefit covers relevant medical expenses incurred during a period up to the number of days as specified in the Schedule of benefits forming part of this Policy, prior to hospitalisation or day care treatment for treatment of Disease, Illness contracted or Injury sustained for which the Insured / Insured Person was hospitalized, giving rise to an admissible claim under this Policy. This benefit is a part of benefit available under ‘In-patient treatment’ and is limited to the available Sum Insured under ‘In-patient treatment’. Pre-hospitalisation Medical Expenses can be claimed as reimbursement only.

5This benefit covers hospitalisation expenses towards medical treatment, and/or day care procedure/ treatment/ surgery incurred by the Insured / Insured Person which is undertaken under General or Local Anesthesia in a Hospital/day care centre (where 24 hours of hospitalisation is not required due to technologically advanced treatment) which shall be payable. The benefit under this Section is limited to the available Sum Insured under ‘In patient treatment’ of this Policy as mentioned in the Schedule to this Policy

6Tax benefits are subject to conditions under Sections 80C, 80D, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services tax and Cesses, if any will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details.

IShield – UIN: . ADV/17800

ICICI Pru GIFT Pro

1Life Insurance Cover is the benefit payable on death of the Life Assured during the policy term.

2Guaranteed Benefits will be payable subject to all due premiums being paid.

3Level Income and Increasing Income are income options available under GIFT Pro. Under Level Income, the Guaranteed Income will remain constant throughout the income period. If Increasing Income is selected, the Guaranteed Income will increase by 5% p.a of the base income

4You can choose to receive any percentage from 0% to 100% of the sum total of all annualized premiums payable by you as MoneyBack Benefit. This will be paid as a one time Lump sum amount. Additionally you also have the flexibilty to choose any year, on or after the maturity date of the policy up to the last income year, to receive this MoneyBack Benefit. Your Guaranteed Income amount will be adjusted based on the MoneyBack Benefit % and payout year selected by you. You can opt for these flexibilities at the inception of the policy. MoneyBack Benefit % and payout year cannot be changed later.

5Low cover income booster at the inception of the policy, you can choose to opt for “Low Cover Income Booster” wherein you will be able to receive increased income for opting a lower life cover

6You have an option to receive GI every year on a Special Date of your choice preceding the due date of first GI pay-out during the Income Period. The Special date can be chosen to coincide with any date such as, Date of Maturity, birth date or anniversary date etc. Payment of GI will commence from this Special Date and all further GIs will be paid every year on this Special Date chosen. In case You opt for a Special Date, the GI payable each year would be adjusted by multiplying the GI amount with a discount loading factor, varying by the policy month in which the Special Date falls.

7Tax benefits under the policy are subject to conditions under provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details.

~Additional Benefit is offered for online sales: For both Level Income/Increasing Income Plan option, Extra 3% of Guaranteed Income and Moneyback Benefit is applicable.

Ͱ The total amount is calculated for a 30-year-old healthy male with a premium paying term of 12 years, deferment period of 5 years, income period of 30 years taking income in annual instalment along with 100% MoneyBack with the last income under Increasing Income plan option. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and the policy is in force till the completion of entire policy term opted. 6X is calculated by taking the sum of all benefits payable and dividing it by the total premiums paid.

ICICI Pru GIFT Pro UIN:

ICICI Pru Guaranteed Income for Tomorrow

1Guaranteed benefits in the form of lump sum will be payable under Lump Sum Plan option. Guaranteed benefits in the form of regular income will be payable under Income Plan option and Early Income Plan option provided all due premiums have been paid.

2Life Insurance Cover is the benefit payable on death of the Life Assured during the policy term.

3Tax benefits are subject to conditions under Sections 80C, 80D, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on the above.

4Calculated for a 30-year-old healthy male with a premium paying term of 12 years and a policy term of 20 years for Lump Sum plan option. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and the policy is in force till the completion of entire policy term opted.

~Additional Maturity Benefit is offered for online sales: For Lump Sum Plan option, 2.5% of Sum Assured on Maturity is applicable for Limited pay. In case of Single Pay in Lump Sum Plan option, 1% of Sum Assured on Maturity is applicable. For Income Plan option, 2.5% of Guaranteed Income is applicable. For Early Income Plan option, 3.5% of Guaranteed Income is applicable. For Single Pay Income Plan option, 1% of Guaranteed Early Income is applicable.

ICICI Pru Gold Pension Savings

1Guaranteed benefit is the Assured Benefit, i.e., 105% of the total premiums paid

2Bonuses are in the form of regular bonus, loyalty accumulation and terminal bonus

3Minimum 40% of the vesting benefit must be mandatorily used to purchase an annuity plan

4This can be availed after the completion of 3 policy years and allows you to encash up to 25% of the Total Premiums Paid over the lifetime of your policy. Withdrawals are allowed for the conditions of higher education of children; marriage of children; purchase or construction of a residential house or flat; treatment of critical illnesses; to meet medical and incidental expenses arising out of the disability

5Avail periodic complimentary health check-ups during the policy years on attaining 50 years of age and completion of 3 policy years. This service shall be directly provided by third party service provider(s) and the Company will not be liable for any deficiency in service by the service provider. The Company reserves the right to discontinue the service or change the service provider(s) at any time. Please read the policy document to know more

ICICI Pru Gold Pension Savings UIN:. ADVT No:- W/II/1283/2023-24

ICICI Pru Save N Grow

1 Guaranteed benefits will be payable, provided all due premiums have been paid. Guaranteed benefits are payable through ICICI Pru Guaranteed Income For Tomorrow

2 Wealth creation is through maturity benefit of ICICI Pru EzyGrow.

3 Tax benefits under the policy are subject to conditions under Sections 80C, 10(10D),115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details.

4 Life cover is the benefit payable on death of the life assured during the policy term.

5 There is no premium allocation charges in ICICI Pru EzyGrow. Starting from the 6th policy year, at the beginning of each policy month, the mortality charge (excluding taxes and excluding extra mortality charges) and policy administration charge (excluding taxes) deducted from the policy in the 60th month prior to the applicable month, will be added back to the Fund Value in the form of addition of units.

6 Maturity Booster will be allocated as extra units at the end of the policy term provided the policy is in-force. The Maturity Booster will be equal to a percentage of the average of the Fund Values including Top-up Fund Value, if any, on the last business day of the last eight policy quarters, as shown in the table below:

| Less than 10 years |

2.25% |

4.00% |

6.00% |

| Greater than or equal to 10 years |

4.25% |

7.00% |

10.00% |

ICICI Pru EzyGrow UIN:, ADVT : W/II/1483/2023-24

ICICI Pru Signature CG II

1 Wealth Boosters equal to 3.25% of the average of the Fund Values including Top-up Fund Value, if any, on the last business day of the last eight policy quarters will be allocated as extra units to your policy at the end of every 5th policy year starting from the end of 10th policy year till the end of your policy term.

2 Tax benefits under the policy are subject to conditions under Sections 80C, 10(10D),115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details.

4 Life cover is the benefit payable on death of the life assured during the policy term.

9 Guaranteed benefits will be payable, provided all due premiums have been paid. Guaranteed benefits are payable through ICICI Pru Guaranteed Income For Tomorrow.

12 Wealth creation is through maturity benefit of ICICI Pru Signature.

ICICI Pru Signature UIN:, ADVT : W/II/1482/2023-24

Smartkid with ICICI Pru Smart Life

~Reference for rising cost of education: https://www.thehindubusinessline.com/data-stories/data-focus/after-a-massive-dip-in-2021-education-inflation-rises-with-return-to-normalcy/article65513706.ece

https://www.moneycontrol.com/news/business/personal-finance/how-education-inflation-can-hurt-your-childs-future-8682261.html

`Company pays all due premiums in your absence provided all due premiums have been paid. Units will continue to be allocated as if the premiums are being paid – to ensure that your savings for your desired goal continues uninterrupted.

*Tax benefits under the policy are subject to conditions under Section 80C, 80D, 10(10D),115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details

+Partial withdrawals are allowed after the completion of five policy years provided monies are not in Discontinued Policy Fund. You can make unlimited number of partial withdrawals as long as the total amount of partial withdrawals in a year does not exceed 20% of the Fund Value in a policy year. The partial withdrawals are free of cost. For the purpose of partial withdrawals, lock in period for Top-up premiums will be five years from date of payment or any such limit prescribed by IRDAI from time to time. Partial withdrawal will not be allowed if it results in termination of the policy

ΔChild Education Plan -Maturity amount is shown for a Male 20 years old who has invested ₹ 5000 per month for 20 years and policy term is 20 years. Child Investment Plan-Maturity amount is shown for a Male 20 years old who has invested ₹ 5000 per month for 15 years and policy term is 15 years

SmartKid with ICICI Pru Smart Life Plan UIN . Advt. No.: W/II/0607/2023-24

`Tax benefits under the policy are subject to conditions under Sections 80C, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per applicable rates. Tax laws are subject to amendments from time to time. Please consult your tax advisor for more details, before acting on the above.

*Tax benefits under the policy are subject to conditions under Sections 80C, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any will be charged extra as per applicable rates. Tax laws are subject to amendments from time to time. Please consult your tax advisor for more details.

Ωhttps://www.deccanherald.com/business/1-in-3-life-insurance-policies-in-india-sold-to-women-sbi-report-1093571.html

E/II/0643/2023-24

*`Benefits from the 2nd year onwards is available under the Early Income Plan option.

Two policies of ICICI Pru iProtect Smart. UIN:

W/II/0602/2023-24

††The 18% percentage has been calculated by comparing the premium for a 34-year-old healthy male (occupation: non-salaried) and 34 year old healthy female (occupation: non-salaried), for a life cover of ₹1 crore & an accelerated critical illness benefit of ₹10 lakh for a policy term of 26 years for a lumpsum payout option for a regular premium pay mode. The premium (inclusive of taxes) for this case for the male is ₹20,121 per annum and for a female is ₹16,384 per annum.

`=The online discount percentages vary according to age, policy term , premium payment term and sum assured chosen by the customer and can range between 2%-5%. The exact 5% discount appears at the following scenario: ICICI Pru iProtect Smart for ₹1 Crore of life cover for a 35 year old healthy non-smoker male (occupation: non-salaried) for a policy term of 40 years with regular pay and lumpsum payout option. The offline annual premium exclusive of taxes will be ₹20,520 & online annual premium exclusive of taxes will be ₹19,440.