India’s Best Term Insurance Provider!^

India’s Best Term Insurance Provider!^

The security of your family is always your top priority. When it comes to securing their future, you want only the best. We understand this and hence offer you a complete solution. Our term life cover plan - iProtect Smart - provides you with a life cover that ensures the financial security of your family, even in your absence and an option to cover yourself against 34 critical illnesses.

Our plan also comes with a host of benefits that you will find very useful, making us the Best Term Insurance Provider. Do have a look:

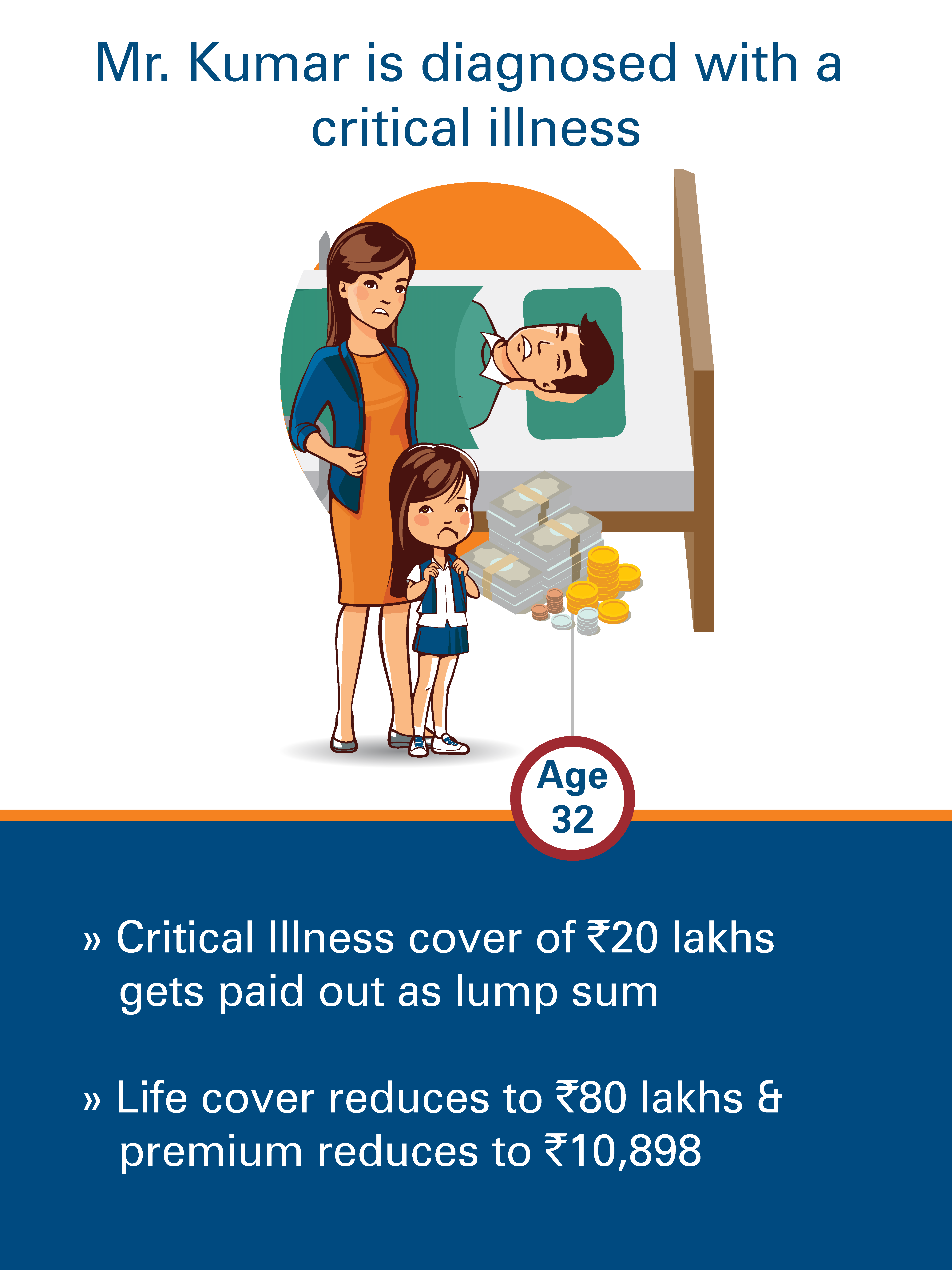

Option to get money in hand to fight critical illnesses

Get the claim amount immediately on detection of any of the 34 critical illnesses*, without any medical bills or hospitalisation

Option to get money in hand to fight critical illnesses

Get the claim amount immediately on detection of any of the 34 critical illnesses*, without any medical bills or hospitalisation

Personalize to cover the best moments in your life

You have the option to increase the security cover for your loved ones at important moments like childbirth and marriage

Personalize to cover the best moments in your life

You have the option to increase the security cover for your loved ones at important moments like childbirth and marriage

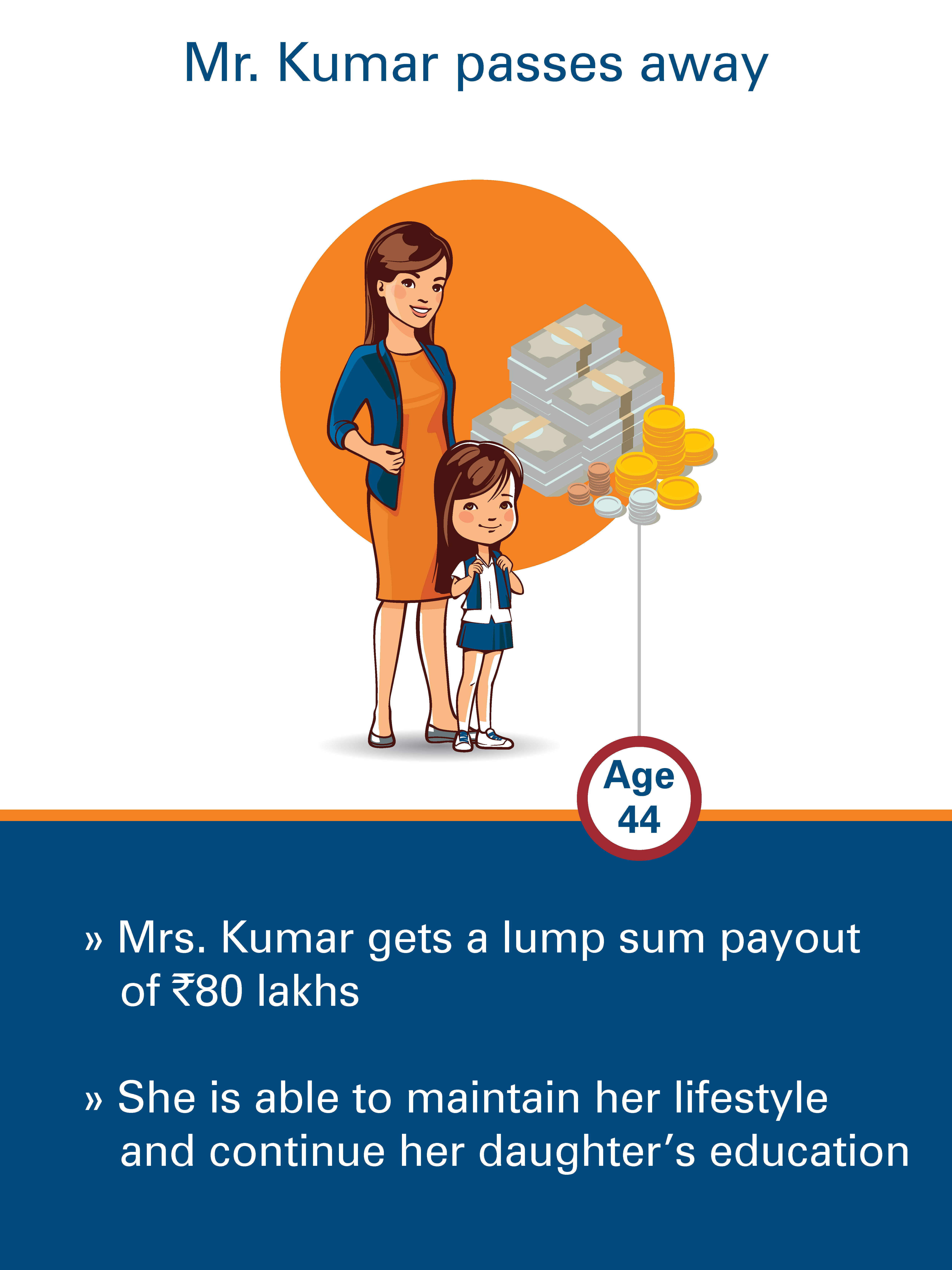

You decide what is the best way for your family to receive the claim money

As a lump sum or as a monthly payout for 10 years or both, as per their needs.

You decide what is the best way for your family to receive the claim money

As a lump sum or as a monthly payout for 10 years or both, as per their needs.

Here is something new for both your family and you

Watch our film to Know More

Here's how we protected the Kumar's

*The critical illness benefit is an accelerated benefit and the death benefit will be reduced by the critical illness cover paid to the policyholder. The future premiums payable for the residual CI Benefit will reduce proportionately. In case the CI Benefit equal to the Death Benefit, the policy will terminate on payment of the CI Benefit. Only doctor’s certificate confirming diagnosis needs to be submitted. On payment of Angioplasty, if the CI Benefit is more than `5,00,000, the policy will continue for other CIs with CI Benefit reduced by Angioplasty payout. To know more about the illnesses covered, please refer to the Sales brochure. Available under Life and Health and All in One options

1Claim statistics are for FY 2017-18 and is computed basis individual claims settled over total individual claims for the financial year. For details, refer to Public Disclosures in our Website.

2Per month premium for ICICI Pru iProtect Smart for a 20 year old healthy, non-tobacco consuming male with life and health option. Life cover- `1 Crore; Policy term- 20 years; Critical illness cover- `10 lakhs; Payment term- Regular pay; Payment option- Income option. The annual premium exclusive of applicable taxes is `5784/-.

3Tax benefit of `54,600 (`46,800 u/s 80C and `7,800 u/s 80D) is calculated at highest tax slab rate of 31.2% (including Cess excluding surcharge) on insurance premium u/s 80C of `1,50,000 and health premium u/s 80D of `25,000. Tax benefits under the policy are subject to conditions under Sec. 80C, 80D and Sec 10(10D) of the Income Tax Act, 1961. Applicable taxes will be charged extra as per prevailing rates. Tax laws are subject to amendments from time to time. Policy issuance is subject to realization of required payment and documents. ICICI Prudential Life Insurance Company Limited. Registered Address: - ICICI PruLife Towers, 1089 Appasaheb Marathe Marg, Prabhadevi, Mumbai-400025. IRDAI Regn No. 105. CIN: L66010MH2000PLC127837. For more details on the risk factors, term & conditions please read sales brochure carefully before concluding the sale. Call us on 1-860-266-7766 (10am-7pm, Monday to Saturday, except national holidays and valid only for calls made from India). Trade Logo displayed above belongs to ICICI Bank Ltd & Prudential IP services Ltd and used by ICICI Prudential Life Insurance Company Ltd under license. Tax benefits under the policy are subject to conditions under the provisions of the Income Tax Act, 1961. Goods & Services Tax and Cess (if any) will be charged extra, as per prevailing rates.The tax laws are subject to amendments from time to time. ICICI Pru iProtect Smart (UIN: 105N151V04) Advt No. W/II/2861/2018-19.

BEWARE OF SUSPICIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS

- IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.