Even the healthiest of individuals can fall sick without warning and require expensive medical treatments. In such a scenario, being financially unprepared to tackle the costs of the necessary medical procedures is not an option. This is where comprehensive health insurance plans come into play, to ensure the financial comfort of your family and you. Here is an in-depth look at this handy financial tool that has helped many individuals heave a sigh of relief in their hour of need.

What are health insurance plans?

Health insurance plans reimburse insured customers for their medical expenses, including treatments, surgeries, hospitalisation and the like which arise from injuries/illnesses, or directly pay out a certain pre-determined sum to the customer. A health insurance policy offers coverage for any future medical expenses of the customer.

This is an agreement between the insurance company and the customer where the former agrees to guarantee payment/compensation~ for medical costs if the latter is injured/ill in the future, leading to hospitalisation. In most cases, insurance companies have tie-ups with a network of hospitals, thereby ensuring cashless treatment for patients there.

Types of health insurance plans

- Cancer insurance plans - A cancer insurance plan is a health policy specifically designed to offer financial protection against the costs of several types and stages of cancer. The plan can offer high lump sum payouts on the diagnosis of cancer

- Critical illness plans - Critical illness plans are a type of health insurance plans which provides money for the treatment of major critical illnesses like kidney ailments, liver disorders, heart attacks, cancer, paralysis, and more. Critical illness plans offer a high sum assured that can be adequate to cover the costs of such illnesses. They also provide lump sum payouts on the first diagnosis of a critical illness without the claimant having to submit any hospital bills

- Individual health insurance plans - This is a basic health insurance plan that covers an individual. The coverage and sum assured can depend on the age, gender, and health status of the person

- Family floater insurance plans - These health insurance plans offer umbrella coverage that covers the entire family under a single policy. These plans have a unified premium and sum assured for all the members of the family. They can be used to cover costs like hospitalisation, surgeries, room rent, and more

- Personal accident insurance plans - A personal accident insurance is a health policy that covers the cost of treatment due to an accident. These plans cover the life assured and offer a payout to cover expenses like ambulance costs, emergency surgery expenses, doctor’s consultation, and more

- Unit-linked health insurance plans - A Unit Linked Health Insurance Plan (ULHP) combines health insurance and an investment component under one policy. A part of your premium is used to secure health coverage that can be claimed to cover your health-related expenses. The other part is invested in market-linked assets to create wealth for your future goals

KEY BENEFITS OF HEALTH INSURANCE PLANS

There are several benefits offered by health insurance plans, including the following:

Coverage for pre and post hospitalisation expenses

Room rent coverage

Cashless facility

Medical check-ups

Ambulance and transportation costs

Tax benefits

No-claim bonuses

Maternity Benefit

Day Care Procedures

Pre-existing Diseases

Why do you need a health insurance plan?

Here is why you need health insurance:

- Health insurance covers future illnesses/medical treatments without depleting your savings or negatively impacting your family’s financial future

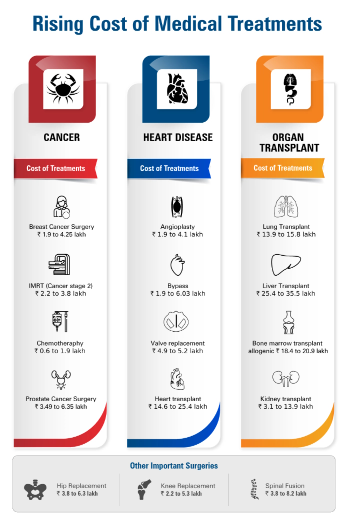

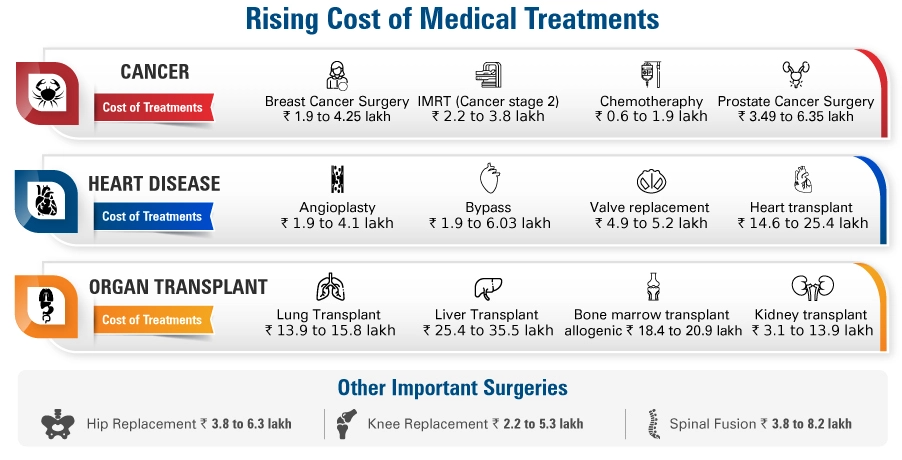

- Medical costs are increasing rapidly and for those with insufficient savings, affording medical care becomes a problem during emergencies

- Cashless treatment is possible within network hospitals, while reimbursements are given by insurance companies in other cases

- Health insurance plans offer coverage against several types of ailments and surgeries, along with other aspects of medical treatment

- Health insurance keeps you and your family worry free; you only have to pay an affordable premium for the same

- In many cases, you also get coverage against hospitalisation costs, ambulance costs, consultations, medicines, tests and post-hospitalisation expenditure

Who should buy a health insurance plan?

Below are some people who can benefit from buying health insurance plans:

Parents

It is important for parents to prioritise the financial needs of their children and buy the right health insurance plan for their medical needs. Health insurance covers the costs of preventative health, planned and unplanned medical treatments and more. It ensures your children get access to the best healthcare facilities and helps you stay stress-free.

Young adults

Buying health insurance at a young age ensures optimum financial protection for healthcare needs and allows you to focus on other essential financial goals in your life. Health insurance plans are also a lot more affordable for younger applicants than for older applicants. People are free from pre-existing illnesses and usually have no history of any ailments, which contributes to getting a lower premium.

Self-employed

Self-employed individuals may not always have a steady income source, making it challenging to tackle health expenses. Buying health insurance becomes essential for self-employed people to ensure they have the necessary financial backup in their hour of need.

Individuals with pre-existing health conditions

Health insurance is essential for people with pre-existing health conditions, such as diabetes, asthma, thyroid or hypertension, among others. Buying adequate insurance ensures you can cover the costs of such illnesses and live a long and healthy life. Moreover, health insurance can also be ideal for those seeking coverage against cancer and critical illnesses as these plans cover the high costs associated with treatments for such illnesses. It is recommended that you refer to the conditions specified under the policy where the issuance would be subjected to underwriting policies of the insurer.

Senior citizens

Older people are more prone to falling sick and requiring constant medical care, which makes health insurance a must for them. Senior citizen health insurance plans in India are designed to cover the health expenses of older people. These plans can help senior citizens cover the expenses arising out of age-related illnesses, such as arthritis, diabetes and others.

Individuals seeking tax benefits

You can purchase health insurance to reduce your taxable income, as these plans offer tax benefits under Section 80D^ of The Income Tax Act, 1961. You can claim a deduction of up to ₹ 25,000 per financial year on premiums paid for a health plan for non-senior citizens and up to ₹ 50,000 for a health plan for senior citizens. These deductions apply to plans bought for yourself, your spouse, children and parents.

How to choose the best health insurance plan?

Make sure your health plan covers a wide range of medical problems and can help you avail of various pre and post-hospitalisation benefits. If the health insurance you have bought is for your family, it is necessary to make sure that it covers the needs of all the family members

As much as it is important that the health plan meets your needs, it is equally important that it also suits your budget. As your income increases, and the size of your family as well as requirements change over time, the plan can further be reviewed accordingly

According to your status, select an individual or family health plan. If you have a family who needs your support, opt for a family health plan so as to reap maximum benefits at a comparatively low cost

It is important to know the term for which the policy would cover you. After all, one is more likely to require medical facilities at a later stage in life, as we approach old age. Therefore, a plan which offers lifetime renewability would be more beneficial

It is always better to choose an insurance provider that has a wide network of hospitals included in its list. One should also check if the hospitals one prefers are included in the list or not

It is advisable to choose an insurance provider with a higher claim settlement ratio. The claim settlement ratio is the number of claims settled by the insurance provider over the total number of claims received

How to choose the best health insurance plan?

- Right

Coverage

Make sure your health plan covers a wide range of medical problems and can help you avail of various pre and post-hospitalisation benefits. If the health insurance you have bought is for your family, it is necessary to make sure that it covers the needs of all the family members - Suits your budget

As much as it is important that the health plan meets your needs, it is equally important that it also suits your budget. As your income increases, and the size of your family as well as requirements change over time, the plan can further be reviewed accordingly - Individual plans or family plans

According to your status, select an individual or family health plan. If you have a family who needs your support, opt for a family health plan so as to reap maximum benefits at a comparatively low cost - Lifetime renewability

It is important to know the term for which the policy would cover you. After all, one is more likely to require medical facilities at a later stage in life, as we approach old age. Therefore, a plan which offers lifetime renewability would be more beneficial - Preferred hospital coverage

It is always better to choose an insurance provider that has a wide network of hospitals included in its list. One should also check if the hospitals one prefers are included in the list or not - High claim settlement ratio

It is advisable to choose an insurance provider with a higher claim settlement ratio. The claim settlement ratio is the number of claims settled by the insurance provider over the total number of claims received

Factors affecting your health insurance premium

Below are some factors that can impact the premium for health insurance plans:

- Smoking and drinking habits

Lifestyle habits, such as smoking and drinking, can affect the premium of health insurance plans. These habits can increase the likelihood of suffering from various illnesses, such as liver and heart problems. If you drink or smoke, you will likely be charged a higher premium by the health insurance provider. - Past medical history

A history of medical conditions can also lead to higher health insurance premiums. If you have a history of certain illnesses, there is a greater likelihood that these conditions may recur or affect your overall health in the future. Consequently, insurance companies may charge you a higher premium to account for the elevated risk of future claims. - Family medical history

Your premium can be affected by your family's medical history. If your family has a history of hereditary diseases, you may be considered at higher risk of contracting them. This can result in a higher premium. - Age and gender

Your age and gender can impact the premium for your health insurance plan. Health insurance premium tends to increase as you get older, as your health is more likely to suffer. Gender may also affect the premium, as healthcare needs differ for men and women. - Policy term

Longer-term policies may have a higher premium compared to short-term policies. However, long-term policies offer better protection by ensuring financial protection for an extended period. Short-term policies may seem more affordable but can come with additional costs for renewal, which can be more expensive in the long run. - Lifestyle

Lifestyle habits like smoking, alcohol consumption and others may result in a higher premium as they enhance the chance of falling sick. On the other hand, a healthy lifestyle may lead to a lower premium.

Why buy a health insurance plan at an early age?

- One can avail lower premiums as the premium amount is usually determined on the basis of the current age and health status of the policyholder, by insurance providers

- One can enjoy tax^ benefits for a longer duration. One can claim the premium deducted from the income under Section 80D of the Income Tax Act, 1961

- Insurance providers exclude pre-existing conditions. As you grow older, you are more likely to have such conditions and if you buy a policy then, it won't cover them

- As a young person, there are lesser health problems at the onset. This reduces the chances of the health insurance policy getting rejected

- Along with better coverage, buying insurance at a young age helps in better financial planning. If the health aspect is taken care of, one can think of making other financial investments as well

- We are trapped into sedentary lifestyles from a very young age, which lay the foundation of many critical illnesses. In such times, it becomes more important than ever to have a health insurance policy to keep one covered

How to calculate health insurance premium?

Health insurance plans offer financial protection against medical expenses. However, in order to keep the plan active, you must pay a premium. The premium for a health insurance policy is calculated based on a number of factors. These include the age and gender of the policyholder, the occupation of the policyholder, lifestyle habits like smoking and drinking alcohol, health history, family history of illnesses and more. In addition to this, factors like sum assured, policy term and benefits can also affect the premium. Companies offering health insurance plans in India take all of these factors into consideration and calculate the premium.

You can use an online health insurance premium calculator to get an estimated quote for medical insurance plans. You can enter your details on this free tool, and the calculator will give you an estimate of the premium within a few minutes.

Optional add-ons in health insurance

1. Maternity cover add-on

This optional add-on will cover expenses during childbirth. It is mostly for pre and post-delivery expenses

2. Critical illness add-on

This optional add-on covers the cost of selected critical illnesses with the sum assured paid by the insurance company

3. Accidental disability add-on

This optional add-on helps the policyholder in case of an accident and the amount paid depends on the sum assured (totally or partially) for the optional add-on. However, the amount that would be paid would depend on the severity of the injury

4. Room rent waiver

The room rent waiver helps the policyholder select the room of their own choice without paying the payment of extra money

5. Hospital cash add-on

If the policyholder has been hospitalized, this optional add-on provides them with the cash amount for all the days of hospitalisation

Important documents for health insurance

Below is a list of documents required to buy a health insurance policy:

- Age proof, such as Passport, Class 10th Mark Sheet, Aadhaar Card and others

- Identity proof, such as Driver’s Licence, Passport, Aadhaar Card and others

- You may be required to submit a medical check-up report

- Passport size photos

Below is a list of documents required for claiming a health insurance payout:

- Claim intimation form

- Medical records like admission and discharge documents

- Attending doctor’s certificate

- Policy certificate

- Canceled cheque

Health insurance plans FAQs

How much does health insurance cost for an individual?

Health insurance costs are a function of your age, coverage amount and health status. For instance, if your age is 20 years, the health insurance cost in the form of a premium will be lower than that of somebody who is 50 years of age.

What are the things to look for while choosing a health insurance plan?

- i) Payout mechanism - Whether payout happens on diagnosis, or on actual hospitalisation

- ii) Claim Process - Claim process should be simple, fast and efficient involving minimum discomfort to policyholder/family

- iii) Waiting Period - The best plans will have minimal waiting period before you can claim for a pre-existing cover

- iv) Adequate cover - With health costs on the rise, the best health plans will give maximum cover at an affordable cost

- v) Pre/post hospitalisation benefit - Some health plans have limits related for pre and post hospitalisation expenses and so you must be aware of them before buying.

Does health insurance provide tax benefits?

Yes, paying a health insurance premium every year can lower your annual tax liability. Health insurance premium paid can be used to claim deduction under Section 80D^. An individual can claim a deduction of up to ₹ 25,000 for the insurance of self, spouse, and dependent children. An additional deduction for the insurance of parents is available. This is to the extent of ₹ 25,000, if the parents are less than 60 years of age. The additional deduction can be up to ₹ 50,000 if the parents are aged above 60.

What is the sum insured in medical insurance?

The sum insured in medical insurance refers to the maximum amount that the insurance provider is liable to pay in the event of the policyholder’s hospitalisation. If the hospitalisation expenses exceed the sum insured on the policy, it won’t be borne by the insurer. Instead, it has to be paid by the policyholder. For example, if the sum insured of a health insurance policy is ₹ 10 lakh and the hospitalisation expenses turn out to be ₹ 12 lakh, then ₹ 10 lakh will be paid by insurer and the policyholder will have to pay ₹ 2 lakh out of their pocket.

Do health insurance plans cover diagnostic charges like X-ray, MRI or ultrasound?

Yes, the health insurance cover usually pays for them as long as the patient is hospitalized for at least 24 hours and such tests have been prescribed. Such tests done out-patients are not always covered, unless specified in the policy#1 . Please read your health insurance policy document to find out.

What is a freelook period in health insurance?

As per the Insurance Regulatory and Development Authority of India (IRDAI), all insurers are mandated to offer a freelook period of at least 15 days on health insurance plans. A freelook period refers to the tenure during which a policyholder can review a health insurance plan bought by him/her and even cancel the policy if he or she is not satisfied with its benefits. The health insurance provider, in such a case, will have to return the premium amount paid by the policyholder.

What are the documents required for buying a health insurance plan?

Generally, the following documents are required to buy health insurance

- i) Age proof

- ii) Identity proof

- iii) Address proof

- iv) Some plans may require medical check-up reports, usually for people above the age of 45

- v) Passport size photo

What is the right age to get health insurance?

The earlier you get health insurance, the lower is your premium amount. If you wait to buy a health insurance policy at later stages of life, you might be deprived of immediate coverage due to the waiting period$. So, it is better to buy health insurance as soon as you meet the minimum entry age requirements for the policy.

What are pre-existing diseases or conditions in medical insurance?

As per the IRDAI, if a policyholder is diagnosed with a disease at least 48 months before buying a health policy, it is termed a pre-existing disease. Usually, health insurance companies provide coverage for these pre-existing diseases after a waiting period.

Can a person have more than one health policy?

Of course, you can have more than one health policy. Many people have a separate health insurance policy apart from the health cover provided by their employer. You may use the second policy if you exhaust the health cover in the first one.

Is medical test mandatory to purchase a health insurance policy?

Many health insurance plans issue policies without medical tests, depending on the age and medical history of the applicant. However, if your age is above the minimum age limit set by the insurer, then you will have to go through a medical test.

Is there any difference between health insurance and a mediclaim policy?

Mediclaim is a type of health insurance plan that takes care of the policy-holder’s healthcare expenses in case he/she gets hospitalized due to an illness or an accident. These policies cover the policyholder for a defined time period and up to a predetermined limit known as the ‘sum assured’. These policies need to be renewed regularly to continue enjoying the benefits.

Can I add my family members to a health insurance policy cover?

Yes, you can add different family members to a health insurance plan. Usually, health insurance plans let you add the following family members to the same plan:

- i) Spouse

- ii) Dependent children (biological and legally adopted children)

- iii) Dependent parents

- iv) Dependent parents-in-law

- v) Brothers and sisters

You can opt for a family floater health insurance plan if you wish to insure your loved ones. All insured members of a family floater plan can avail up to the maximum limit of the sum insured of the policy. Moreover, such plans extend the coverage to the entire family under a single premium. This saves a lot of time and money in the long run.

Do I need to purchase additional health insurance plans to increase the sum assured amount?

There can be two ways to increase the sum assured amount of your health insurance plan. These are:

- 1) You could buy a new health plan with a higher sum assured

- 2) You could simply increase the sum assured of your plan at the time of policy renewal

Will my health insurance plan work in non-network hospitals?

Yes, your health insurance plan will work in both network and non-network hospitals. However, you can claim the cashless facility at a network hospital only. If you were to seek treatment at a non-network hospital, you would not be able to use the cashless facility and might have to submit the bills of hospitalisation/treatment to request a claim.It may be advised to read and understand such details before signing the policy document. And remember that it helps to pick a health insurance policy that offers a vast network of hospitals

What happens if I am hospitalised and on the same day my health insurance plan has lapsed?

Typically, all insurance companies give customers a grace period of 15 – 30 days after the date of expiry. The customer can use this time to renew the plan and keep the policy running. However, it is important to understand that health insurance is given in return for the premiums paid. In the absence of a premium, the insurer is not obligated to offer you financial protection. Hence, till you renew your plan again, you will not receive any protection or benefits from your health plan. Therefore, it is advised to renew your plan in time and ensure that your plan is always active

What does cashless hospitalisation mean in a health insurance plan?

Cashless hospitalisation is a health insurance feature that allows you to avail of medical services at a hospital without making any upfront payments. Under this feature, the insurance company directly deals with the hospital and clears all hospital bills. However, this facility can only be availed at a network hospital specified in the health insurance plan

What if I already have a health insurance policy but I just want to increase my sum insured?

Almost all insurance companies in India allow you to increase your health insurance sum insured at the time of policy renewal. All you need to do is intimate your medical insurance provider that you want to increase the sum insured on your policy. However, this can result in an increase in your health insurance premium amount. You can also take a top-up plan on your health insurance policy to increase its sum insured

At what age can you include your children in the health insurance plan?

Family floater health insurance plans can be used to cover children between the ages of 90 days and 25 years. You can include your children in your plan anytime during this period

Can the nominee be changed in the mid-term of the health insurance policy?

Yes, health insurance plans allow you to change the nominee anytime during the policy term

Can a person have more than one health insurance policy?

Yes, you can have more than one health insurance policy from several insurers. Multiple health insurance policies can offer several benefits like wider coverage, safety from claim rejection, better features and more peace of mind

COMP/DOC/Apr/2025/84/0026