Goals. Objectives. Life Dreams. Words and themes around which you spend most of your lives. You want to provide the best to your loved ones. In order to ensure that you are able to live a carefree life, a financial plan that provides protection of life cover4 becomes extremely important. This would become even more special if it comes combined with the benefits of a savings plan that can help you plan for various goals in life.

Presenting ICICI Pru Gold, a protection and savings oriented participating life insurance plan that provides the protection of life cover4 along with a regular income for whole of life that can be used to meet your long-term recurring financial needs through participation in bonus.

What makes ICICI Pru Gold a suitable plan for you?

- Choice of 3 plan options customised as per your savings needs:

- Immediate Income: Start receiving a regular income1 at the end of every policy year, starting from the first policy year till the end of the policy term followed by a lump sum2 on maturity

- Immediate Income with booster: Start receiving a regular income1 at the end of every policy year, starting from the first policy year till the end of the policy term. Along with the regular income, you will also receive a benefit (known as Guaranteed7 Booster) every 5th policy year followed by a lump sum2 on maturity

- Deferred Income: Start receiving a regular income1 after a few years (known as the deferment period) instead of starting immediately, as per your income requirements. You can start this income as early as 2nd policy year or as late as Premium Payment Term plus 1 year. Also, get a lump sum2 on maturity of the policy

- Survival benefits (Income, booster) are paid at the end of the policy year by default. Also, you can choose Monthly income option where income will be Payable at the end of every policy month. If you have opted for annual payment frequency, you also have the choice of receiving income in following ways:

- Instant income: Payable at the beginning of each policy year starting within 7 working days of realisation of first year’s premium by the company post issuance of the policy

- Get additional flexibilities in the form of :

- Savings Wallet8:

- Income accumulation: You have an option to accumulate Survival benefits, instead of taking as payment during the policy term

- Income withdrawal: You can choose to withdraw, completely or partially, the balance in the wallet anytime during the Income Term

- Savings Wallet8:

Premium Offset9: You also have the option to utilise the balance in the Savings Wallet8 to offset any premiums due to be paid during the premium payment term. If the amount available for offset is not sufficient to adjust the due premium, the balance due premium shall remain payable as on the premium due date

In case the balance in the wallet is not withdrawn completely during the income term, such balance will be paid along with the benefit to the claimant at the time of termination of the Policy on of death, surrender or maturity, whichever happens first. On payment of this benefit, the policy will terminate.

- Save the Date10: You can choose to receive the Survival Benefits annually on any one "Special Date", during the policy year prior to the policy anniversary, as per your choice and the benefit will be paid within 7 working days of realization of the respective Policy Year’s premium (if due) by Us or on this chosen date every year, whichever is later through the income term till policy termination

- Tax Benefits5: Tax benefits5 may be applicable on premiums paid and benefits received as per the prevailing tax laws

Plan Options in detail:

Plan Option 1: Immediate Income

- Regular income: The life assured will receive a regular income1 at the end of every policy year, starting from the first policy year till the end of the policy term. This income will comprise of:

- Guaranteed7 Income (GI) and

- Income which will be linked to Bonus, if declared; referred to as Cash Bonus6 (CB)

You will receive this income till the date of maturity, death, surrender or lapse of the policy, whichever happens first - Lump sum2 on maturity: On survival of the life assured till the end of the policy term for a fully paid policy, a Maturity Benefit will be payable which will be equal to the sum of:

- Sum Assured on Maturity (i.e. equal to sum of all Annualised Premiums payable), plus

- Terminal Bonus6 (if declared)

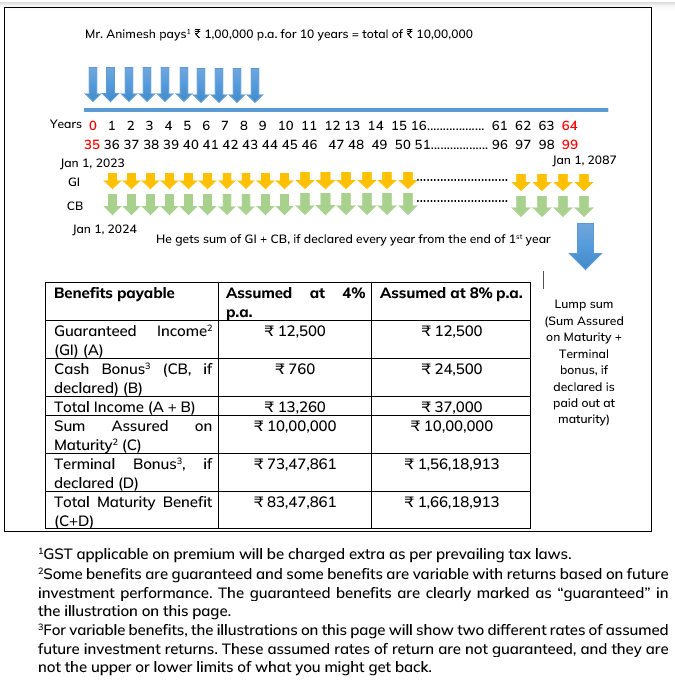

Illustration:

Mr. Animesh, a 35 year old, wants to save for his son’s regular expenses. He decides to pay the premium of ₹ 1,00,000 every year for 10 years and chooses to take life insurance cover till the age of 99 years

His goals will also be secured with a life insurance cover till the age of 99 years

Plan Option 2: Immediate Income with Booster

- Regular income and Guaranteed7 Booster: The life assured will receive a regular income1 at the end of every policy year, starting from the first policy year till the end of the policy term. Along with the regular income, you will also receive a benefit (known as Guaranteed7 Booster) every 5th policy year, provided the policy is in-force. This Guaranteed Booster will be equal to 100% of the Guaranteed Income, as applicable for the year of payment

To sum it up, you will receive the sum of:- Guaranteed7 Income (GI)

- Guaranteed7 Booster (GB), and

- Cash Bonus6, if declared (CB)

You will receive this income till the date of maturity, death, surrender or lapse of the policy, whichever happens first - Lump sum2 on maturity: On survival of the life assured till the end of the policy term for a fully paid policy, a Maturity Benefit will be payable which will be equal to the sum of:

- Sum Assured on Maturity (i.e. equal to sum of all Annualised Premiums payable), plus

- Terminal Bonus6 (if declared)

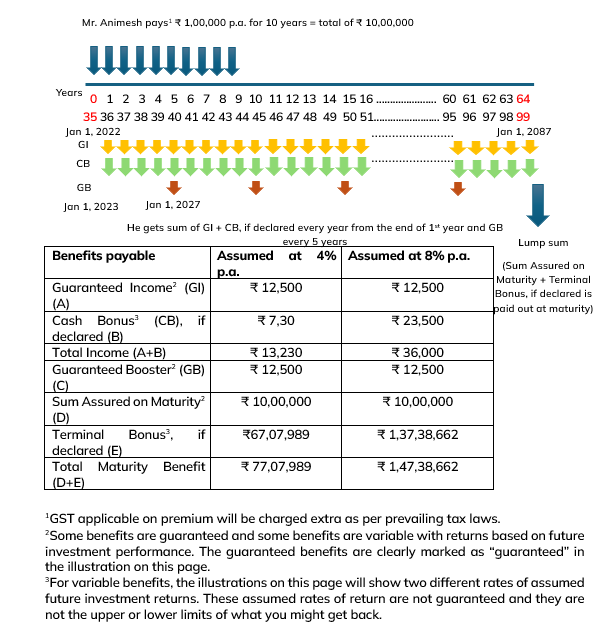

Illustration:

Let’s say Mr. Animesh from the previous example now pays the premium of ₹ 1,00,000 every year for 10 years and takes life insurance cover till age 99 years with Immediate Income with Booster plan variant.

His goals will also be secured with a life insurance cover till the age of 99 years.

Plan Option 3: Deferred Income

- Regular income: The life assured will receive a regular income1 at the end of every policy year. You can choose to start receiving the income after a few years (known as the deferment period) instead of starting immediately, as per your income requirements. You can start this income as early as 2nd policy year or as late as Premium Payment Term plus 1 year

To sum it up, you will receive the sum of:- Guaranteed7 Income (GI) and

- Income which will be linked to Bonus, if declared; referred to as Cash Bonus6 (CB)

You will receive this income till the date of maturity, death, surrender or lapse of the policy, whichever happens first - Lump sum2 on maturity: On survival of the life assured till the end of the policy term for a fully paid policy, a Maturity Benefit will be payable which will be equal to the sum of:

- Sum Assured on Maturity (i.e. equal to sum of all Annualised Premiums payable), plus

- Terminal Bonus6 (if declared)

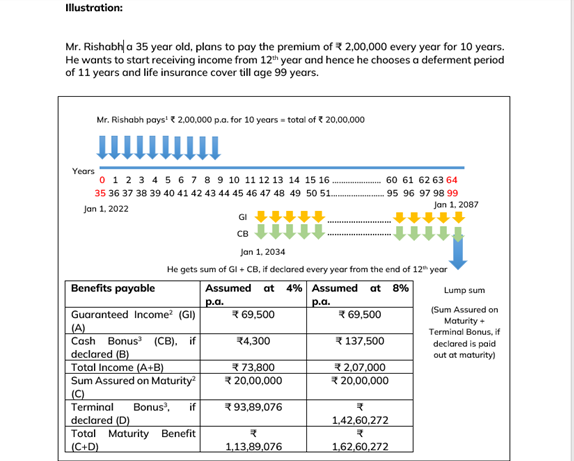

Illustration:

Mr. Rishabh a 35 year old, plans to pay the premium of ₹ 2,00,000 every year for 10 years. He wants to start receiving income from 12th year and hence he chooses a deferment period of 11 years and life insurance cover till age 99 years.

Note: In all the illustrations shown above, the Bonuses are not guaranteed in nature and the Company may declare these at its discretion. For the purpose of each illustration, we have assumed two different rates of returns, 4% p.a. and 8% p.a. and these are not the upper or lower limits that you may receive as benefits

For all the above plan options, the Life Insurance Benefit (Death Benefit) will be as follows:

On the death of the life assured during the policy term (for a premium paying or fully paid policy) the following will be payable:

Death Benefit is equal to:

- Sum Assured on Death, plus

- Interim Survival Benefit (if any), plus

- Terminal Bonus6 (if declared)

Where, the Sum Assured on Death is the highest of:

- 7 times the Annualised Premium,

- 105% of the Total Premiums Paid as on the Date of Death

- Death Benefit multiple times Annualised Premium

Annualised Premium is the premium amount payable in a year, excluding the taxes, rider premiums, underwriting extra premium and loadings for modal premium, if any.

Total Premiums Paid means the total of all the premium received, excluding any extra premium, any rider premium and taxes.

Death Benefit multiples are as follows:

| Age | Multiple | Age | Multiple | Age | Multiple | Age | Multiple |

|---|---|---|---|---|---|---|---|

| ≤ 5 | 15.0 | 17 | 13.8 | 29 | 12.6 | 41 | 11.4 |

| 6 | 14.9 | 18 | 13.7 | 30 | 12.5 | 42 | 11.3 |

| 7 | 14.8 | 19 | 13.6 | 31 | 12.4 | 43 | 11.2 |

| 8 | 14.7 | 20 | 13.5 | 32 | 12.3 | 44 | 11.1 |

| 9 | 14.6 | 21 | 13.4 | 33 | 12.2 | 45 | 11.0 |

| 10 | 14.5 | 22 | 13.3 | 34 | 12.1 | 46 | 10.9 |

| 11 | 14.4 | 23 | 13.2 | 35 | 12.0 | 47 | 10.8 |

| 12 | 14.3 | 24 | 13.1 | 36 | 11.9 | 48 | 10.7 |

| 13 | 14.2 | 25 | 13.0 | 37 | 11.8 | 49 | 10.6 |

| 14 | 14.1 | 26 | 12.9 | 38 | 11.7 | ≥ 50 | 10.5 |

| 15 | 14.0 | 27 | 12.8 | 39 | 11.6 | ||

| 16 | 13.9 | 28 | 12.7 | 40 | 11.5 |