Health Claim FAQS

Health Claim FAQS

Health Claim FAQs

- Cashless Claims: Cashless claims allow you to receive medical treatment at a network hospital without having to pay out of pocket at the time of treatment. You only need to share your policy details with the hospital, and the insurance provider takes care of all other formalities. In this case, you don’t need to arrange for funds upfront, as the insurer covers the expenses directly with the hospital.

- Reimbursement Claims: Reimbursement claims involve paying for medical expenses out of pocket and then claiming the amount back from your insurance company. You need to raise a claim for reimbursement and submit all medical bills to the insurance company. The insurance company will review the bills and repay you for the amount spent up to the extent of your policy coverage. This gives you the flexibility to choose any hospital or healthcare provider, even if they are not part of the insurer's network.

- Critical Illness/Rider Claims: Critical illness or rider claims provide a lump sum payment upon the diagnosis of specific critical illnesses covered by additional riders or add-ons to your main insurance policy. To claim this, you must submit medical records, diagnosis reports, doctor reports, etc., of the medical condition. The lump sum payment can be used for any purpose, such as covering medical expenses, paying off debts, or compensating for lost income during recovery.

A health insurance claim can be submitted by the owner of the policy. If the policy owner passes away during treatment, the beneficiary (nominee) can submit the health claim along with the policy owner's death certificate.

The table below provides an overview of the different types of health claim benefits available under ICICI Pru Life policies, along with their descriptions and applicable policies:

| Type of Claim | Description | Applicable Policies |

|---|---|---|

| Hospitalization Reimbursement Claims | This claim can be submitted in case of hospitalization of the life assured with the complete set of documents as mentioned on the claim form. | ICICI Pru Health Saver, Hospital Care I, Hospital Care II |

| Critical Illness/Disability, Heart and Cancer Claim | This claim becomes applicable when a Critical Illness rider is opted under the policy; a fixed benefit is payable. | Health Critical Illness, Critical Illness Rider added under Health Policy |

| Cashless Claim | Cashless claims can be availed by policyholders by getting treatment at specified network hospital | ICICI Pru Health Saver, Hospital Care I, Hospital Care II |

| Benefit Claims | Health Saving Benefit Claim- The policy holder can claim benefits from the policy fund value for non-medical deductions, rejected claims. | ICICI Pru Health Saver |

| Health Check-up Claim | The policy holder can claim investigation bills (e.g., Blood reports, MRI, CT scan, etc.). This claim can be submitted once in every two policy years; the benefit is payable. | ICICI Pru Health Saver, Hospital Care II |

Please refer the policy document for more details on the exact amount and benefit applicable in your policy

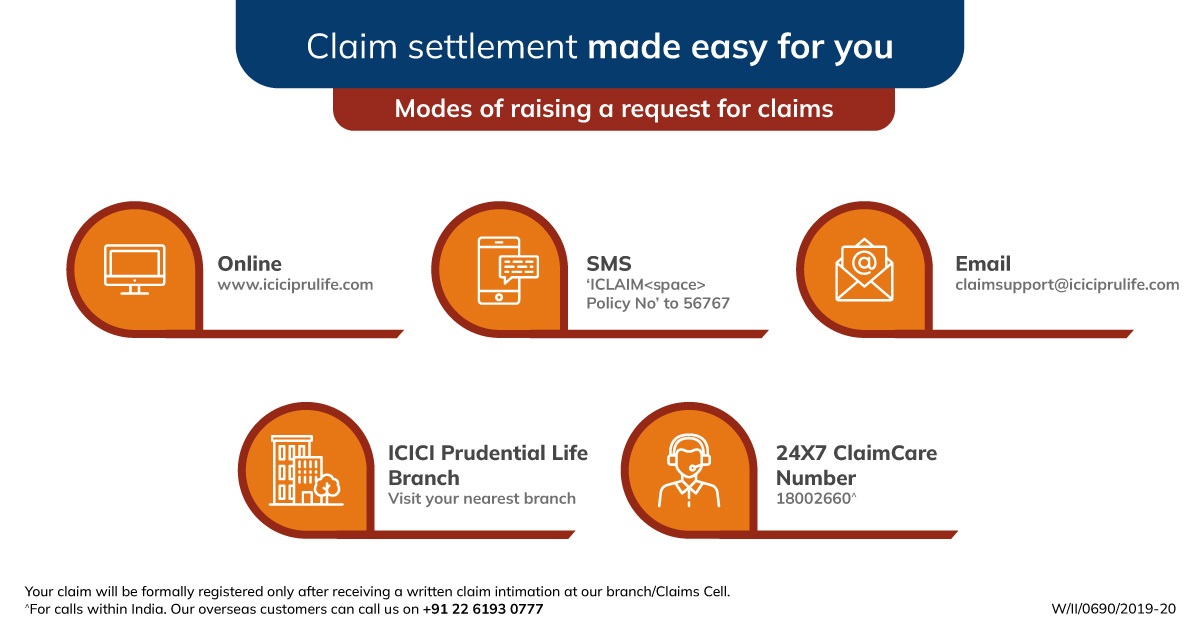

You can initiate a health claim request through any of the following options:

- Request Online: Visit www.iciciprulife.com > File a Claim > follow the instructions.

- Email: Write to claimsupport@iciciprulife.com from your registered email address with your policy details.

- Visit a Branch: Drop by the nearest ICICI Pru Life branch with the required documents (diagnosis report, medical bills, etc.).

For assistance on the required documents, you can refer to the next question or call the claim helpline at

- Visit a Network Hospital and Share Policy Details: Start by visiting a network hospital and provide your ICICI Pru Life policy details to the hospital's insurance desk to verify your coverage.Click here to view the network hospital list.

- Pre-Authorization Request and Approval: The hospital will send a pre-authorization request to ICICI Pru Life detailing your treatment and estimated costs. If the request meets the policy terms, approval will be shared with the hospital, usually within a few hours

- Proceed with Treatment and Final Bill Settlement: You can then proceed with your treatment, and the hospital will handle the billing directly with ICICI Pru Life. After your treatment, the hospital will send the final bill to ICICI Pru Life for settlement.

To know our Network Hospital list - Click here

To know our Blacklisted Hospital list - Click here (Kindly note- cashless facility is not available for Blacklisted Hospitals)

A cashless claim is approved within:

- 1 hour of the request received from the hospital for admission of the patient.

- 3 hours of the request received from the hospital for discharge.

In case of hospitalization at a non-network hospital, you can pay for treatment and submit a reimbursement claim to the company

Mandatory documents required for health claim :-

- Duly filled and signed health claim form

- Owner / Proposer address proof

- Owner / Proposer photo identify proof

- Recent photograph of the owner / proposer

- Pan card / Form 60 of the owner / proposer

- Payout mandate form with bank account details of the owner / proposer

- Copy of cancelled cheque / bank statement / bank passbook of the owner / proposer

“Any one of the officially valid documents such as Aadhar card, Passport, Driver’s License, Vendors ID.

“As per the regulatory requirement, all payout under as insurance policy are required to be processed electronically in the bank account of the policy holder / nominee / assigner / trustee as applicable.

Depending on the type of product or nature of claim, below mentioned mandatory documents will be required for the purpose of claim assessment and decisioning. The health claim will be considered once all mandatory documents started below and health claim form is received.

| Mandatory Documents required based on type of product or nature of claim :- | ||

|---|---|---|

| ICICI Prudential Hospital Care 2 Application for ICICI Pru Hospital Care / Fixed Benefit Hospitalization Claim | Indemnity Hospitalization Claim Applicable for ICICI Pru Medi assure / ICICI Pru Health Saver | Critical illness claim / Terminal illness claim / Major Surgical Assistance Rider / Accidental Disability rider applicable for ICICI Pru Crisis Cover / Rider claim / Heart and Cancer product / ICICI Pru Wish |

All Hospitalization records of the Life Assured such as :

|

All medical records of the Life Assured such as :

|

Medical documents confirming diagnosis like :-

|

Submission Options:

- Branch: Submit the documents at the nearest ICICI Prudential Life Insurance branch. To locate the nearest branch, visit www.iciciprulife.com/branchlocator.

- Website: Upload the documents online in the claims section of the website: www.iciciprulife.com > claims > file a claim.

- Courier: 9th Floor, B Wing, office No. 906, BSEL Tech Park, Opp. Vashi Station, Section 30,Vashi, Navi Mumbai 400706.

- Doorstep Document Pick-Up Service: To schedule a pick-up, simply call 18002660.

Note: Original document submission is mandatory for claims under the ICICI Pru Health Saver policy

After receiving the claim request along with mandatory documents, we review the claim and communicate any requirements (if any) or make a decision within the regulatory timeframe mentioned below:

Average time for health claim decisioning – As per Insurance Regulation and Development Authority of India (IRDAI):

| Stages of Claim | Turn Around Time |

|---|---|

| Decision of Claims (other than cashless) | 15 days from the submission of claim |

| Decision of Health Claims for which investigation is required | Within 45 days from the date of intimation of claim |

The following touchpoints are available for any assistance on the claim process:

- Call us: Call our 24x7 claim helpline on 18002660.

- Call: Contact the 24x7 claim helpline at 18002660. Provide your unique Claim ID when prompted.

- Email: Write to claimsupport@iciciprulife.com.

- Visit a branch: Speak to a claim executive at the nearest branch. Find the nearest branch https://www.iciciprulife.com/branchlocator

Upon submission of your claim, a unique Claim ID will be sent to you via SMS. You can use this Claim ID to track your claim status through the following methods:

- Online: Visit www.iciciprulife.com > Claim section > Track claim and enter your unique Claim ID

- Call: Contact the 24x7 claim helpline at 18002660. Provide your unique Claim ID when prompted.

- Email: Write to claimsupport@iciciprulife.com

- Branch: Speak to a claim executive at the nearest ICICI Pru Life branch.

A health insurance claim is rejected in the following scenarios:

- The condition/claim does not fulfill the policy terms and conditions

- In case of 'non-disclosure' or 'misstatement' of material facts discovered at the claim stage, or any act fitted to deceive or any omission as the law specially declared to be fraudulent

- If your claim was accepted and you are not satisfied with the claim amount processed or require clarification on the claim amount, you may write to claimsupport@iciciprulife.com

- In case your claim was rejected, and you wish to represent the claim (decision review), you may write to:

- Company’s Grievance Redressal Officer (GRO)

- Grievance Redressal Committee (GRC) at the following address: Grievance Redressal Committee – ICICI Prudential Life Insurance Co. Ltd., Unit No. 901A, 901B, 1001A & 1002B Prism Towers, Mindspace, Link Road, Goregaon West, Mumbai – 400063

These documents are collected to verify and authenticate the bank account details provided by the claimant for receiving the insurance claim. This also ensures that the claim amount is quickly transferred via electronic mode to the policyholder’s bank account.

Insurance proceeds can be repatriated in an NRE account in the proportion of the premiums being paid from the NRE source. To receive payment in an NRE account, proof of premiums paid from an NRE account (bank statement of the policyholder) will have to be submitted by the policyholder. If the same is not available, then insurance proceeds can be credited to an NRO or any other Indian savings bank account.

A pre-existing disease is a condition, ailment, or injury that already exists at the time you buy a health insurance policy. These are generally excluded from the policy coverage for an initial waiting period. It could be diabetes, hypertension, thyroid, asthma, etc.

Network hospitals, often referred to as cashless hospitals, are tied up with your insurance company, allowing you to avail cashless hospitalization benefits. However, when you get admitted to a non-network hospital, you have to pay the bills first and later claim for reimbursement.

The No Claim Bonus amount is a reward that a policyholder receives for maintaining good health and not claiming during a policy year. This feature is available in Health Saver Plan . Kindly refer your policy document for more details

Insurance Riders or rider benefits are optional and additional covers that you can add to your life insurance policy to enhance the coverage of your base policy. These riders allow you to customize your policy to better suit your needs by providing benefits for specific situations that the standard policy might not cover. The rider benefit is payable when the specific event covered by the rider occurs, such as a critical illness diagnosis or an accidental death.

| Rider Type | Description | Feature available in |

|---|---|---|

| Critical Illness Rider | Applicable on diagnosis of critical illness conditions listed in policy documents. | iProtect Smart |

| Waiver of Premium Rider | Applicable in case of diagnosis of permanent disability due to accident, as defined in policy documents. | Optional Rider |

| Accidental Disability Rider | Applicable on diagnosis of permanent disability due to accident, with benefits payable as 1/10th of the rider sum assured up to a certain number of years. | Life Insurance Policies |

| Major Surgical Assistance Rider | Applicable when the life assured undergoes a surgical procedure listed under policy documents. | Life Insurance Policies |

| Corona Protect Rider | Hospitalization benefit paid on diagnosis of COVID-19. | Life Insurance Policies |

| Waiver of Premium on Proposer | Applicable when the policyholder/proposer is diagnosed with permanent disability or a critical illness listed under policy documents. | iProtect Smart/Smart Life |

You can refer to your policy document for details of the rider benefit (if any) opted by you in your policy.

Yes, a waiting period is applicable as defined under the policy document.

Complete medical documents, including prior and post-diagnosis of a critical illness event, are required for a holistic evaluation of rider claims.

ICICI Pru Wish is a health insurance plan specifically designed for women, offering comprehensive coverage against women-specific critical illnesses, surgeries, and maternity complications. The plan provides a fixed lump sum payout upon diagnosis of any covered condition.

The ICICI Pru Wish plan covers various benefits, including:

- Vital Care Benefit: For minor and major critical illnesses.

- Surgical Care Benefit: For specific surgeries.

- Maternity Care Benefit: For pregnancy complications and newborn congenital illnesses.

For more details of the benefits covered, refer to the policy brochure or your Policy Document for the benefits opted.

Yes, a waiting period is applicable as defined in the policy document. This period must be completed before certain benefits can be claimed:

- Vital Care & Surgical Care Benefits: 90 days from the date of issue of the policy or date of revival/reinstatement, whichever is later.

- Maternity and Child Care Benefits: 365 days from the date of issue of the policy or date of revival/reinstatement, whichever is later. No benefit will be payable if there is a diagnosis of any critical illness or any signs or symptoms related to any critical illness within the waiting period.

No, cashless benefits are not offered under this plan.

Complete medical records, including prior and post-diagnosis documents, are required for a thorough evaluation of the claim. This ensures that the claim is processed accurately and fairly.

People like you also read ...