Everybody hopes for the best, but it is always better to prepare for scenarios that might not be ideal. This is why a backup in any situation always helps. This is especially true for life. A life insurance plan can offer financial support to your loved ones in your absence. Keep reading to find out how.

What is Life Insurance?

Meaning & Definition

A life insurance policy is a contract between a policyholder and an insurance company. In a life insurance policy, the insurance company promises to pay a sum of money to the loved ones of the policyholder in case of death of the policyholder during a certain period. In return, the policyholder pays a small amount as premium to the insurance company.

In certain types of policies, the policyholder can also opt for critical illness benefits or choose additional protection to cover against an unfortunate event due to an accident. Read more about these features and types of life insurance policies below.

COMP/DOC/Feb/2022/212/7457

Types of Life Insurance Policies

| Types of Life Insurance Policies | Coverage |

|---|---|

| Term life insurance policy | Pure Risk Cover |

| Endowment life insurance policy | Insurance Cover + Saving |

| Non-Linked Participating Endowment Plan | Insurance cover |

| Unit Linked Insurance Plans (ULIP) | Insurance Cover + Market-linked Investment Benefits |

| Non-participating Non-linked endowment plan | Fixed Insurance Cover |

| Retirement Plan | Insurance Cover + Saving |

| Child Plan | Insurance Cover + Investment Benefits |

Step 1

Term Insurance Policy

This is the simplest type of life insurance policy. It pays your family a sum of money in case of your death, during the policy term. It does not pay anything if you survive the policy term. However the premiums on this type of policy tend to be low.

Read More...Step 1

Endowment Policies

Policies other than term life insurance, are called endowment policies. These can in turn be divided into participating, non-participating and unit-linked.

Read More...Step 2

Non-Linked Participating Endowment Plan

This type of policy lets you ‘participate’ in the profits of the life insurance company and get a share of them. It pays your family a sum of money on your death but it also pays you an accumulated sum, if you survive the policy term. The survival payment or benefit is linked to the profits of the life insurance company.

Read More...Step 3

Unit Linked Life Insurance Policy (ULIP)

This policy pays an amount on your death and a maturity amount if you survive the term. However unlike a traditional participating policy, the maturity amount is more dependent on your investment choices rather than the profits of the life insurance company. Your policy is invested in funds and divided into ‘units’ similar to those of a mutual fund. You typically get a lot of freedom to choose the type of fund your money will be invested in.

Read More...Step 4

Non-participating Non-linked endowment plan

A non-participating policy defines exactly how much your family will get on your death and how much you will get on the maturity of the policy. There is no variable or investment linked component. You know before-hand exactly how much you will get, in each scenario.

Read More...

Benefits of Life Insurance Plans

Life insurance in India can play a critical role in your life. It can help you in diverse financial situations and offer the following advantages:

Act as loan collateral

A lot of loan providers ask for collateral when sanctioning a loan. A life insurance plan can be used as collateral for secured loans. This can help you get a loan with a favourable rate of interest in your hour of need.

Online payment discount

Life insurance plans offer online discounts from time to time. If you purchase a plan online, you can enjoy a discount on the premium. Some plans may offer a discount if you make the payment through a specific bank.

Maturity Benefits

Life insurance provides more than just a life cover+. It also offers maturity benefits. Return of premium plans refunds all premiums paid at maturity. Endowment, guaranteedΩ and money-back plans help you save over the years while providing a lump sum payout at maturity. It is advised to read the product brochure carefully before making the purchase to understand the details of the plan.

Tax benefits

A life insurance policy can help you save a lot of money otherwise spent on tax. You can claim a deduction^ of up to ₹ 1.5 lakh in a financial year under Section 80C of the Income Tax Act, 1961 on the premium paid towards a life insurance plan. In addition to this, the payout received for your life insurance policy is tax-free^ subject to conditions prescribed under Section 10(10D).

Discount based on payment periodicity

Life insurance plans let you choose the premium payment method. Typically, the premium can be paid in half-yearly, yearly, or monthly instalments. Each of these methods can provide you with unique discounts. You can find out more about them from the insurance company and pick an option that lets you save the most.

Retirement Planning

Life insurance can be a valuable tool in retirement planning. Some life insurance plans may offer a cash accumulation feature that allows you to save for your future needs, such as retirement.

Financial Security

Life Insurance provides financial security for your loved ones by offering a payout in the event of your absence. It safeguards their future and ensures they have the necessary financial support they need during difficult times.

How Does Life Insurance Works?

Life insurance is a legally binding contract between the insurer and the policyholder that offers financial security to the policyholder’s loved ones. The policyholder purchases the life insurance by paying a premium. In the event of the policyholder's demise during the policy term, the insurer provides a predetermined death benefit to the nominee, often a loved one.

Why is it important to buy a life insurance plan?

Critical Illness Protection

As you head towards retirement, life insurance policy that cover critical illnesses become important. Some life insurance policies offer you features that cover you from severe ailments like heart attacks and cancer. Buying these types of policies can protect you from some of the world’s most deadly diseases.

Family Support

If you have a spouse and kids, building a safety net for them becomes important. You would want to protect them from financial hardship in case of your untimely demise. You can also get good returns with life insurance by investing in some policies.

Savings Growth

In your early years of working, some life insurance plans can be a useful way to save and invest your money. ULIPs or Unit Linked Life Insurance Policies allow you to invest in equity and debt markets. Under current tax laws (which are subject to future amendment), you also get tax^ benefits for investing in a life insurance plan and on the maturity amounts of such policies.

Debt

You often take large loans in your working life, especially when it comes to buying a house. An untimely death while the loan is still due can have grave economic consequences for our families. In such a scenario, money from a life insurance plan in India can be used to pay off the loan. Policies taken under the Married Women’s Property Act^+, 1874 are also immune from attachment by creditors.

Financial Security

Life insurance plans can offer financial security for your loved ones in case something unfortunate happens to you. If your family depends on you for their day-to-day needs, buying a life insurance plan will ensure that they have a financial cushion to fall back on in your absence.

Peace of mind

A life insurance policy can prove to be a saviour when an uncertainty strikes. They are safe savings tools that can help your family in need. Investing in them can offer you peace of mind and reduce your financial stress.

Opportunities to create wealth

There are different types of life insurance plans available and some of them, like endowment plans, pension plans, and unit-linked insurance plans can also be used as an investment option to build wealth for your future financial goals. These plans also provide a life cover+.

Financial planning for life

You can choose from the different types of life insurance policies and select a plan for every life-stage. Whether you are saving for a specific goal like retirement or investing for your child’s future, you can plan for all your goals with life insurance plans.

Assured income for retirement

Insurance plans like pension plans or annuity plans can be great for retirement planning. They offer low risk and assured returns that can secure your post-retirement life.

Who can purchase a Life Insurance Policy?

Life insurance in India is a vital financial tool to have for all age groups. A life insurance policy can provide your loved ones with financial support as well as offer you adequate returns that can be used to plan for various individual goals.

Here is how you can benefit from buying a life insurance policy:

Importance of buying life insurance for different age groups

| Age group | Importance of buying life insurance |

|---|---|

| 20 to 30 years | People between the ages of 20 and 30 years can use life insurance plans to secure their future financial goals, such as saving for a house purchase, retirement, and more. |

| 30 to 40 years | People between the ages of 30 and 40 years can use life insurance plans to secure their family members in their absence with adequate financial protection. Life insurance plans can also be used to plan for your child’s higher education and marriage expenses, and more. |

| 40 to 50 years | Individuals between the age of 40 and 50 years can buy a life insurance policy to plan for their retirement savings. |

| 50 years and above | Individuals aged 50 or above can purchase a life insurance policy to invest and ensure financial security for self and family. Life insurance can also offer them tax benefits and help them save more money. |

Apart from the age groups mentioned above, there are several other types of people who can benefit from a life insurance plan. These include the following:

Smokers:

Smokers can be prone to health issues. Buying a buy life insurance policy can ensure sufficient financial protection for their loved ones. However, smokers must inform the insurer of their lifestyle habits before purchasing a plan.

Disabled individuals:

Disabled individuals can also benefit from a life insurance plan. However, they need to undergo some medical tests before buying a suitable insurance plan.

People with pre-existing medical conditions:

Individuals with pre-existing medical concerns can enjoy financial security with life insurance. However, it is vital to share the details of such medical conditions with the insurer.

Important life insurance terms you should know

Life assured:

Life Cover:

Nominee or Beneficiary:

Premium:

Insurer:

Policy tenure:

Death benefit:

Lapsed policy:

Maturity benefit:

Grace period:

Insurer:

Revival period:

Riders:

Policy:

Claim process:

Sum Assured:

Exclusions:

Life Insurance Coverage Period:

Life insurance Policies offered by ICICI Prudential

IN ULIPS, THE INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER

ICICI Pru Signature Online

Unit Linked Insurance Plan (ULIP)

A savings plan that can give you better returns while it shields your loved ones with life cover

- Financial protection for your loved ones with life insurance cover

- Return of mortality and policy administration charges1

- Enjoy policy benefits till 99 years of age with Whole Life policy term option

- Withdraw money regularly from your policy with SWP2

ICICI Pru Guaranteed Income For Tomorrow

Non participating non linked endowment plan

A protection + savings life insurance plan with guaranteed benefits to help you achieve your goals

- 100% Guaranteed^^ Tax free^3 income/lump sum

- Life cover+ for entire policy term

- Option to get income from 2nd year*`

- Upto 3.5% Additional Maturity Benefit online~

^^Terms & conditions apply

View All Online Life Insurance Plans

Our experts are happy to answer any questions you may have.

Call us at 1800-267-9777

Call centre hours - 9.00 a.m. - 9.00 p.m. all days

Comparison of different types of life insurance plans

| Term life insurance policy | Endowment life insurance policy | Non-linked participating endowment plan | Unit linked insurance plans (ULIP) | Non-participating Non-linked endowment plan | |

|---|---|---|---|---|---|

| Overview | Used to financially protect your dependents in your absence | Used to financially secure your loved ones & build low risk savings | Used to financially secure your loved ones and build low risk savings | Used to financially secure your loved ones and create wealth as per your preferred risk type | Used to financially secure your loved ones and yourself. The death & maturity benefits are fixed |

| Maturity benefits | No maturity benefits | Offers maturity benefits | Offers maturity benefits | Offers maturity benefits | Offers maturity benefits |

| Death benefits | Offers death benefits | Offers death benefits | Offers death benefits | Offers death benefits | Offers death benefits |

| Purpose | Provides pure risk cover | Provides insurance cover plus low risk savings | Provides insurance cover plus low risk savings | Provides insurance cover plus investments | Provides a fixed insurance cover |

How to choose the right Life Insurance Policy?

Assess your financial needs

Everyone’s financial needs are unique. A life insurance plan that is suitable for your peers may not be ideal for you. So, make sure to assess your individual needs and understand your investment purpose before you pick a life insurance plan. Do not pick a plan just because it is popular amongst your peers.

Learn about the various types of life insurance policies

It is important to understand the various types of life insurance policies available in the market, so you can make the right choice. Go through the different varieties and see how they align with your needs and budget.

Reputation of the provider

Life insurance plans are a long-term commitment. They are meant to secure your family at a time when you may not be around anymore. Hence, it is important to pick an insurance company that has a good reputation and is financially reliable.

Claim settlement ratio

This is the number of claims that an insurance company receives in a year versus the number of claims it settles in the same year. The higher the claim settlement ratio, the more reliable is the insurer, thus there is a lower chance of your claim getting rejected

Solvency ratio

The solvency ratio indicates the insurance company’s ability to meet its debt obligations. It gives you an insight into the insurer’s cash flow and financial health. Pick an insurer with a high solvency ratio to ensure financial security

Premium

Affordable premiums can help you save money. Look for a life insurance plan that offers cost-effective insurance premiums

Customer feedback

Positive customer feedback can help you gauge the insurance company’s performance and willingness to assist its customers. You can look for customer reviews online or refer to friends and colleagues for recommendations when purchasing a life insurance policy

Do’s and Don'ts of life insurance policies

Below are some essential do’s and don'ts to keep in mind:

Do’s of life insurance policies

- Buy early: When you buy life insurance early in life, you can get a bigger cover at comparatively lower premiums. This also ensures financial protection for your loved ones from an early stage

- Read the policy document carefully: It is important to take the time to read and understand the policy document thoroughly. This helps you make informed decisions and know exactly what you are covered for

- Consider adding riders: You can enhance your coverage by adding riders to your policy. Riders can provide additional protection in times of need

- Compare policies: Comparing different policies and insurance companies helps you find the one that offers the best coverage, premium and customer service. You can compare claim settlement ratio, assets under management and number of lives covered for different insurance companies

Don’ts of life insurance policies

- Don’t provide false information: Avoid providing false or inaccurate information during the application process. This could lead to claim rejections and policy cancellations

- Don’t miss premium payments: Missing or delaying premium payments can lead to lapses in your coverage

- Don’t delay purchasing insurance: Don't procrastinate on purchasing life insurance. Delaying this crucial decision can leave your loved ones financially vulnerable in case of an unfortunate event

Why is life insurance a safe investment?

Life insurance can offer a safe investment avenue. The sum assured of your policy remains unaffected by market fluctuations, certifying your family’s financial stability in uncertain times. The inclusion of riders can provide you with additional coverage during challenging times. These riders offer extra financial protection against specific risks, ensuring overall financial security.

Life insurance is a transparent financial product. It clearly outlines inclusions and exclusions to ensure you know exactly what you are covered for. This offers peace of mind, making life insurance a safe choice to protect your loved ones' financial future.

Life Insurance Plan Riders

Well, different types of policies suit different types of people. Someone who is willing to take some risk and knows a little about investments may go in for a ULIP. Someone who only wants the protection aspect of life insurance may prefer a term insurance policy.

Critical Illness Benefit*^

This feature pays you a certain sum of money on the diagnosis of a critical illness like heart attacks and cancer. With providers such as ICICI Prudential, a defined amount is paid regardless of your actual medical expenses. This saves you the hassle of showing bills and getting reimbursed, as with medical insurance. If your life cover exceeds the critical illness amount, the balance cover will remain intact.

Accidental Death Benefit+*

Accidents are all too common in India with our unruly traffic and tough driving conditions. This feature pays your family an additional amount if your death is due to an accident.

Steady Income After Death

Many families have a tough time managing monthly expenses after death. Hence, companies like ICICI Prudential Life Insurance give you the option of giving your family a steady income after your death rather than a lump sum which they may have difficulty managing.

You can choose all or any of these options depending on what is offered to you by the life insurance company.

Factors that affect life insurance premium

Below are some factors that affect the life insurance premium:

Sum Assured

The sum assured directly impacts the premium. A higher sum assured leads to higher premiums and vice versa.

Age

Gender

Medical History

Lifestyle

Occupation

Should you buy more than one life insurance policy?

The decision to purchase multiple life insurance policies depends on your circumstances, objectives and financial situation. Having multiple policies can provide broader coverage and potentially cover more risks. Moreover, if one plan’s claim is rejected or the coverage is insufficient, another policy can act as a safety net for your family.

While multiple policies can offer enhanced coverage and serve as a backup, they also come with increased premiums that might interfere with your current financial goals. Managing several policies can be complex and increases the risk of missing premium payments. This may lead to lapses in coverage.

It is important to consider the benefits against the drawbacks to determine if the added protection from multiple policies is worth the increased expenses.

What are the payout options available for ICICI Pru Life Insurance Plans?

ICICI Pru Life Insurance Plans offer flexible payout options that cater to every type of policyholder. You can choose from 4 payout options. These are:

LUMP-SUM

INCOME

INCREASING INCOME

LUMP-SUM PLUS INCOME

Steps to buying a Life Insurance Policy Online

Step 1

Life insurance plans come with various options. It is important to pick a plan that is the most suitable to your unique needs, budget, and family’s future requirements

Step 2

Select an insurance company that has a positive reputation and offers good customer service, timely and quick claim settlements, and a simplified claim process

Step 3

Select the policy term, type of cover, sum assured, and riders for your life insurance policy judiciously. Check the premium and go ahead if it fits your budget

Step 4

Submit all the relevant information like your identity, age, income, and address proofs. You may also be asked to submit photographs and take a medical test

Step 5

Pay the premium online using your debit card, credit card, net banking, payment wallets or UPI

Important documents to buy a life insurance policy

Identify proof

Address proof

Age proof

Medical history/ diagnosis reports

Passport sized photographs

Bank statements

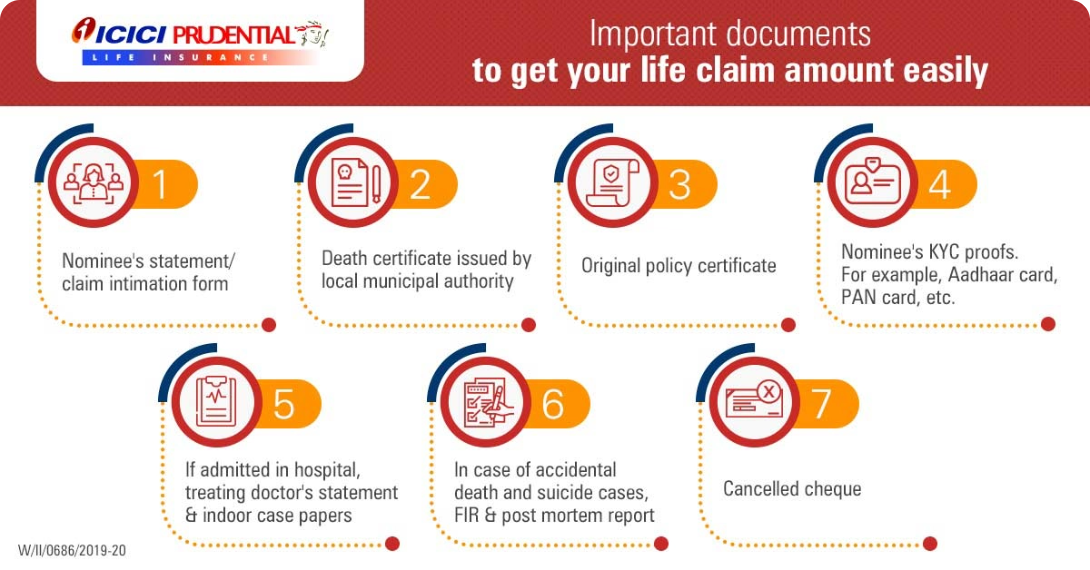

Important documents to get your Life Insurance claim amount easily

How to file a life insurance claim?

You can file a life insurance policy claim online, at a physical branch central office, or on our central ClaimCare helpline through SMS or e-mail by following the steps given below:

- To submit an online claim, please visit the Claims section on the ICICI Prudential website

- To submit a claim via phone, please call us at our 24x7 ClaimCare helpline number at 1800 2660

- To submit a claim via email, please e-mail us at claimsupport@iciciprulife.com

- To submit a claim in person, you can visit a branch near you

Claim in case of death

In case of an untimely death of the insured, the nominee can follow the steps given below to raise a life insurance policy claim:

- Inform the insurer of the unfortunate event using any one of the methods mentioned above – website, call, email, or in person

- Submit all necessary documents like the death certificate, hospitalisation documents, and others. KYC proofs of the nominee, like Aadhaar card, PAN card, or any other required document. FIR papers in case of suicide or accidental death, and a cancelled cheque

- The insurance company will review the documents and issue the settlement

What are the Types of Death Not Covered in Life Insurance?

The following types of death are not covered in a life insurance policy:

Suicide

Deaths due to self-inflicted harm or suicide within a specified duration from policy inception or revival are not covered

Homicide involving the nominee

Deaths resulting from homicides where the nominee is involved may not be covered

Death due to Self-Inflicted Injuries

If death occurs due to a self-inflicted injury, the death claim is not accepted

Death while Driving under the Influence of Drugs/Alcohol

Life insurance does not cover death caused by an accident while intoxicated by drugs or alcohol.

Death due to Participation in Adventure Sports/Activities

Life insurance does not cover death caused by an accident while intoxicated by drugs or alcohol.

Read the product brochure carefully to understand the detailed list of exclusions under the plan.

COMP/DOC/Jul/2025/157/0741

What happens when there is no nomination or in case of a pre-deceased nominee at the time of death claim?

In such circumstances, we would require the proof of title or succession certificate issued by a competent court. The claim would then be paid to the person specified in the said proof. Such a condition is called ‘Open Title’ situation.

If we have accepted the claim but are waiting for the issued certificate of proof, we hold the money till the proof is submitted and pay interest as directed by the Insurance Regulatory and Development Authority of India.

Claim in case of maturity

You can follow the steps given below to raise a maturity claim for your life insurance plan:

Contact the insurer using any one of the methods mentioned above – website, call, email, or in person

Submit your life insurance policy certificate, KYC proofs like Aadhar card, pan card, or any other required document, and a cancelled cheque

The insurance company will review the documents and issue the settlement

Frequently Asked Questions

What are the benefits of Life Insurance?

There is a wide range of benefits of owning life insurance.

- Financial safety for family and loved ones

- High life cover at affordable premiums

- Tax^ benefits under section 80C and section 10(10D) of Income tax act, 1961

- Assured income through Annuity plans

What is the Life Insurance term that I should choose?

Selecting the tenure of your term insurance plan is as important as the amount of cover. A life insurance policy is usually taken for covering financial risks until the end of your working age. People usually work till 58-60 years. However, in today's times, many work till 65-70 years of age if health condition permits. So, it is better to choose a life insurance term that lasts till you have cleared all your financial liabilities like various loans, education, and marriage of children.

Which type of life insurance plan is the most affordable?

A term insurance plan is one of the most affordable life insurance plans in the market. A term insurance plan is a pure protection plan that offers a life cover in case of an unfortunate event during the policy term. There are no survival benefits or the option of saving or investing your money for other financial goals. As a result, its premium is the most affordable. However, the premium can still differ for different people and may be higher for people who smoke or consume alcohol, those who have health issues, people working in dangerous working environments and older people.

What Life Insurance plan should I buy?

There is a life insurance plan for every possible financial goal. If you are looking for a simple cover to shield your loved ones against financial risks, choose a term plan. Whole life Insurance plan offers life insurance coverage to the life assured for the whole life. Those looking for a combination of insurance and investment opportunity, a Unit linked insurance plan (ULIP) is the ideal choice. If you want insurance and comfort of savings, select an endowment plan. Periodic returns with an insurance cover can be realized from a money-back plan. A child plan is a right choice to fulfill your child’s life goals like education, marriage, etc. Plan your retirement and retire gracefully with a retirement plan.

How much life insurance coverage do I need?

It’s important to get adequate life insurance coverage to ensure optimum financial security for your loved ones. However, the right amount of life insurance coverage that you must buy depends upon several factors, such as your age, annual income, lifestyle, monthly expenses, and the number of people financially dependent on you. As a general rule, you can buy life insurance coverage of almost 10 times3 your current annual income.

Are proceeds from Life Insurance taxable?

Proceeds from Life insurance policy is exempt under section 10(10D) of the Income Tax Act, 1961 if: i. Sum paid on Death except in case of a keyman policy

ii. Sum paid other than in case of Death (i.e., surrender/partial withdrawal/maturity), if

- For policy issued between April 1, 2003 to March 31, 2012: if Premium does not exceed 20% of Sum Assured (SA to premium is 5 times or more)

- For policy issued post March 31, 2012: if Premium does not exceed 10% of Sum Assured (SA to premium is 10 times or more)

Can life insurance premiums be tax deductible?

Yes, a policyholder can claim deduction for the premiums paid by him or her towards a life insurance policy subject to conditions under Section 80C^ of The Income Tax Act, 1961. The maximum deduction allowed under this section is ₹ 1.5 lakh per financial year. This deduction is available if the policy is purchased by the taxpayer for self, spouse, or children.

Should I buy Life Insurance?

Life insurance is a great financial tool. From offering protection against financial risks, over the years life insurance has evolved to provide options for building wealth and generate tax-free^^ maturity.

You should buy life insurance if you meet any of the following:

- Have financial dependents

- Are beginning a family

- Have a mortgage or other significant debt/loan

- Are part of a non-child working couple family structure

- Have children

- Have specific long-term financial goals

Are life insurance benefits paid in a lump sum?

As a policyholder, you can choose how you want your nominee to receive your life insurance benefits. In the case of your unfortunate death during the policy term, your nominee will receive policy benefits as a one-time lump sum payout. Or else, he or she can also receive a portion of the sum assured as a lump sum and the rest of the amount would be paid to them in instalments.

What is the “Sabse Pehle Life Insurance” campaign?

“Sabse Pehle Life Insurance” is the first joint mass media campaign launched by the Life Insurance Council of India. This campaign aims to create awareness about the importance of Life Insurance for Indian households.

Why would a life insurance claim be denied?

Some common reasons for life insurance claim rejection are providing false information in the application, lapse of the policy due to premiums not paid on time, type of death not covered in the plan etc.

Can I withdraw money from my insurance policy?

Yes, some life insurance plans like unit-linked investment plans, savings plans, and others offer the option to withdraw money.

Is life insurance necessary for senior citizens?

Buying life insurance is not necessary for senior citizens unless their children or spouse are dependent on them or they have existing loan or debt, which is yet to be settled.

Can a minor be appointed as Nominee in life insurance?

A minor can be appointed Nominee, but it is recommended that an appointee be a person who has completed the age of majority.

How to file a life insurance claim?

In case of the untimely death of the policyholder, the nominee can file a claim on the life insurance policy. Below are the steps to file a life insurance claim:

- Step 1 – Intimate the insurance company about the death of the policyholder

- Step 2 – Fill out a life insurance claim form and attach the required documents. The insurer may ask for the original policy copy, the death certificate of the policyholder, and other relevant documents

- Step 3 – The insurer will appoint a surveyor to assess the claim

- Step 4 – Once the surveyor approves the claim, the insurer will transfer the claim amount to the nominee’s bank account within a few working days. In some cases, the insurer may also send the claim amount through a cheque or Demand Draft (DD)

When can I start to pay the life insurance premiums?

When you buy a life insurance plan, you also get an option to choose the premium payment method, which can be in the form of monthly, quarterly, semi-annual, or annual payments. You can start paying your life insurance premiums as per the chosen method as soon as your policy is active.

What if I do not pay my premium on time?

If you do not pay your premium on time, you will get a grace period of 15 – 30 days, during which you can pay the premium and keep your life insurance policy active. If you pay the premium, your policy will be reinstated. However, if you do not pay the premium, your policy will be deactivated and you will lose all the benefits of the life insurance plan.

If your plan has a paid-up value and you have paid premiums for a certain period as specified in the policy document, your policy will not be discontinued. In this case, your nominee will receive the paid-up value at the time of death and not the entire sum assured.

What happens if I stop paying life insurance premiums?

If you stop paying the life insurance premium, your life insurance policy will be deactivated. You will be given a grace period to complete the payment. If you are unable to do so during the grace period, the plan will lapse permanently.

Will I have to pay tax on my life insurance policy's maturity benefit?

The benefits of life insurance plans that are received at the time of maturity are tax-free^, subject to the conditions of Section 10(10D) of the Income Tax Act of 1961. However, keep in mind that these conditions may change with a change in the law.

What is the average life insurance payout?

There is no fixed average life insurance payout and you can pick a sum assured of your choice as per your family’s future needs. The payout for a life insurance plan generally differs as per the policy term, age and gender of the policyholder, premiums, occupation of the policyholder, terms and conditions of the policy, and many other similar factors.

Can life insurance policy payouts be claimed before death?

Yes, depending upon the kind of life insurance policy you invest in, you can claim some part of the payout before death. For instance, a life insurance plan, such as the unit-linked insurance plan, has a lock-in period of 5 years. Post the lock-in period, you can withdraw funds partially for short term needs. Endowment plans also offer a loan facility after your policy acquires a surrender value. A term insurance plan, on the other hand, may not offer such a facility.

Hence, claims before death would depend on the type of life insurance product you choose.

What happens if I outlive my life insurance policy term?

There will be no survival benefits if you outlive your life insurance policy. However, if you have a return of premium life insurance plan, you will receive the total of all your premiums. If you want to continue the protection, you will either have to buy a new plan or extend your coverage to your whole life.

What are the documents required for buying a life insurance policy?

The documents required for buying a life insurance policy may vary from one insurance provider to another. Usually, an insurer asks for the following documents for issuing life insurance policies:

- A duly filled proposal form

- Age proof of the proposer or life assured (PAN card, Aadhaar card, Birth Certificate, or others)

- Photo identity proof (PAN card, masked Aadhaar card, Driving License, Passport, or others)

- Address proof (Driving license, masked Aadhaar card, Voters ID card, Passport, or others)

- Income proof (Bank statements, Salary slips, ITR receipts, or others)

- Medical examination reports of the life assured in case of any previous health history

- Recent passport-sized photograph

What do you mean by paid-up value in life insurance?

If the policyholder fails to pay the premiums after a certain period, such as 3 or 5 years, the insurance company pays a reduced sum assured amount instead of the one chosen at the time of purchase. This reduced amount is known as the paid-up value in a life insurance plan. In the event of death, if no premiums were paid beyond a certain year, the insurance company pays the paid-up value to the nominee and not the original sum assured.

People like you also read ...