IN ULIPS, THE INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDERU

Linked Insurance Products do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender or withdraw the monies invested in Linked Insurance Products completely or partially till the end of the fifth year

What is NFO?

Meaning & Types of New Fund Offer

A New Fund Offer (NFO) is a new mutual fund launched by an Asset Management Company (AMC). An NFO can be an attractive option if you are exploring new and upcoming investment opportunities. Let’s find out what NFOs are, and why they should be part of your investment strategy.

Read More

What is NFO? (New Fund Offer)

An NFO is a new mutual fund scheme launched by an AMC that allows investors to subscribe to its units for the first time. It is not an existing fund but the initial offering of a mutual fund that is created by fund houses to raise capital and attract new investors.

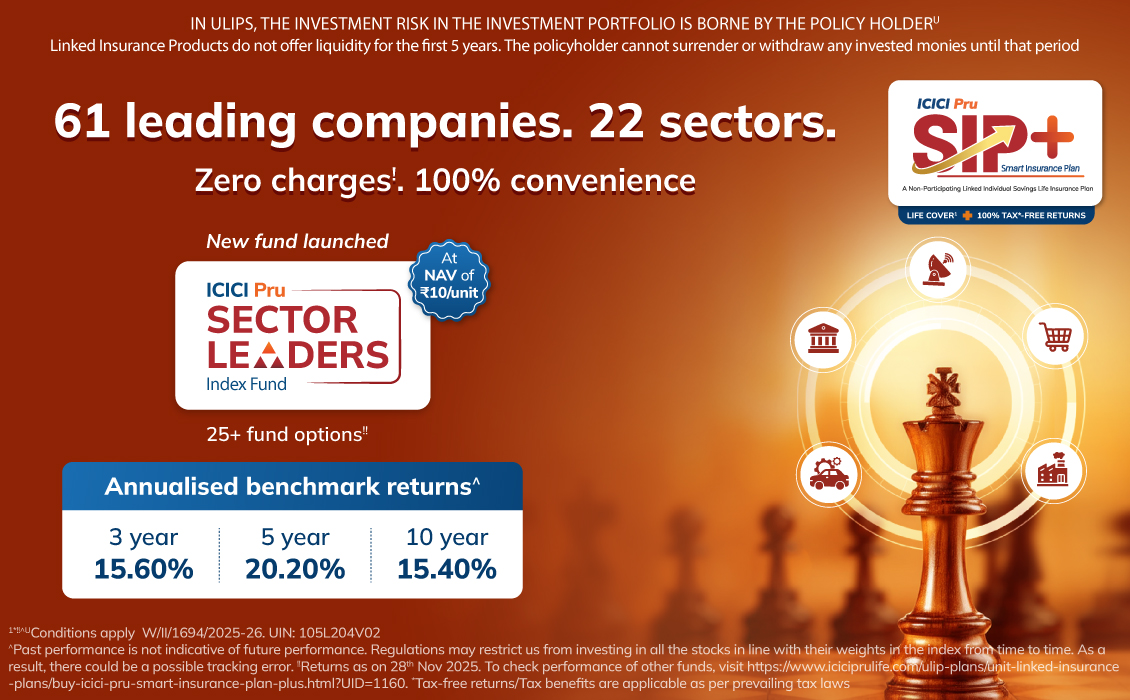

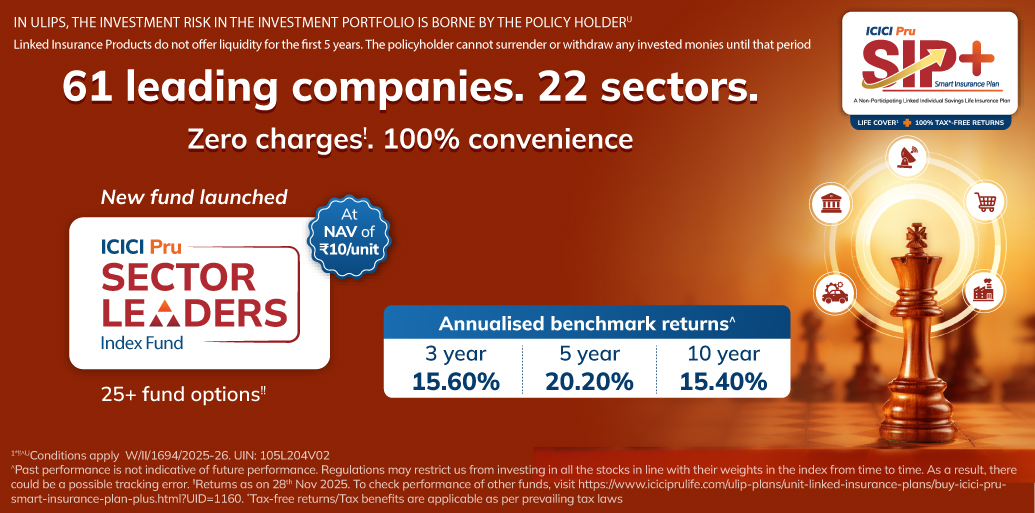

New fund launch by ICICI Prudential Life Insurance

Sector Leaders Index Fund

ICICI Prudential Life Insurance is introducing the Sector Leaders Index Fund under its ULIP offerings, launching on 15th December 2025, which also marks ICICI Prudential Life Insurance’s 25th Foundation Day. The fund will start with an initial NAV of ₹10 per unit.

The ICICI Pru Sector Leaders Index Fund lets you invest in India’s leading companies across major sectors through your ULIP. It follows an index that picks the top three listed companies in each sector from the BSE 500. Instead of you choosing individual stocks, you can simply select this fund while investing in a new policy or when moving money between funds in your existing ICICI Pru Life policy.

Key benefits of the ICICI Pru Sector Leaders Index Fund

Here’s how the ICICI Pru Sector Leaders Index Fund can add value to your ULIP portfolio.

Own sector leaders in one fund

Invest in three largest listed companies from each sector, ensuring your money goes into industry-leading businesses in the Indian market.

Diversified across 22 sectors

Rule-based, transparent approach

Potential for long-term wealth creation

To explore whether the ICICI Pru Sector Leaders Index Fund fits your goals, you can select it among the 28 diverse fund options while investing in a new ICICI Pru ULIP, or switch to it within your existing policy, as per your risk profile and time horizon.

W/II/1584/2025-26

How does an NFO work?

NFO launched by AMCs is available for a limited time, typically for around 15 days after its launch. During this period, the mutual fund house offers the units of the new scheme at a fixed price, usually set at ₹ 10 per unit. The AMC announces the details of the new mutual fund at the time of launch, such as the fund’s objectives, so investors can decide whether or not it makes for a good investment for their goals.

After the offer period ends and the units are allotted to investors, the price of the units may fluctuate based on the fund's performance in the market.

Types of NFO

Below are the different types of NFOs:

Open-ended NFOs

Open-ended NFOs do not have a fixed maturity date. You can buy or redeem their units at any time. These funds are ideal for investors who want flexibility.

Close-ended NFOs

Close-ended NFOs are available for a fixed tenure and can only be bought or sold during the initial offer period. These funds are open for subscription only for a specified period when the scheme is launched.

Interval plans

Interval plans combine features of both open-ended and close-ended schemes. These NFOs allow investors to transact within a specific timeframe where you can buy and sell their units anytime you want.

Benefits of Investing in NFOs

Below are some benefits of investing in an NFO:

Affordable

NFOs are usually aimed to be affordable, with units typically priced at ₹ 10 per unit. This makes them an inexpensive investment for most investors. The minimum subscription amount for investing in an NFO can start from ₹ 500, so you can easily participate in a fund of your choice.

Experienced fund managers

NFOs are mutual funds that are managed by experienced fund managers who are experts in their fields. These professionals handle the fund’s investments and make all crucial decisions about asset allocation, entry and exit strategies, ensuring that your money is in safe hands.

Portfolio diversification

Mutual funds, including NFOs, invest in a wide range of securities, such as equities, bonds and cash. They also provide diversification within the same asset class. For instance, an equity mutual fund invests in stocks of several companies. Investing in NFOs can be a great way to diversify your portfolio and reduce risk.

Early-Stage Growth

Investing in an NFO allows you to participate in the early-stage growth of a fund. You can potentially benefit from its appreciation over time as the fund matures.

Things to consider before investing in an NFO

Below are a few things to consider before investing in an NFO:

Fund investment approach

Every mutual fund has a specific objective. The fund’s asset allocation, risk level and more are decided based on the fund's objective. Understanding the fund’s objective can help you assess whether investing in the NFO aligns with your financial goals and risk tolerance.

Investment horizon

You must ensure that the investment horizon of the NFO matches your own. Based on the fund’s objective and asset allocation, you can evaluate whether the fund is suitable for your short-term or long-term goals.

Fund Manager’s performance history

It is important to check the fund manager's track record managing the NFO, including the funds they have previously managed. This can give you an idea of their expertise and ability to meet the fund’s investment objectives.

Fees Structure

Mutual funds come with various fees, such as expense ratios, exit loads and taxes. Make sure to understand the fee structure of the NFO before investing, as these costs can impact your overall returns. You must also understand that while low associated costs can help you keep more of your rewards, it should not be the only criteria to select a fund.

Market Environment

Different types of funds react differently to market conditions. For example, equity funds invest in stocks primarily and can be more volatile. Before investing, you must assess the current market environment and determine how the fund may perform under prevailing economic conditions.

Liquidity

The liquidity of the NFO depends on whether it is open-ended or close-ended. Open-ended funds offer more flexibility for buying and selling units, while closed-ended funds have limited liquidity during the offer period. Assess your liquidity needs before making an investment.

New Fund Offers in Life Insurance Plans

Life insurance plans also allow you to invest in NFOs. Unit-Linked Insurance Plans (ULIPs) offer a combination of life coverage` and investment opportunities. These plans invest in various types of market-linked funds such as equity, debt and hybrid funds^, and they also provide the option to invest in NFOs. Therefore, you not only gain exposure to market-linked investments but also ensure that your loved ones' financial interests are protected through life coverage`.

People like you also read ...