| January 31, 2026 | 1 Month |

1 Year |

|

| Rupees per Dollar | 91.99 | 89.88 | 86.63 |

| Oil (dollars per barrel) | 70.69 | 60.85 | 76.87 |

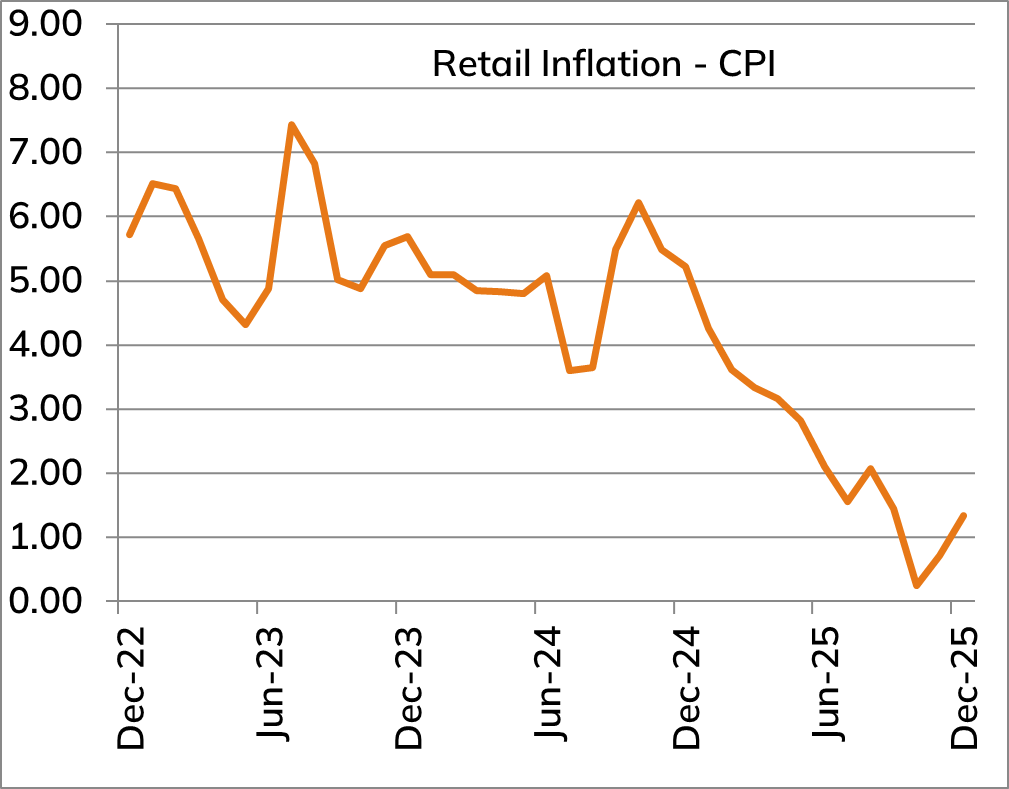

| Retail inflation (CPI) | 1.33% (December) | 0.71% | 5.22% |

- The US Federal Reserve (Fed) kept the policy rate unchanged to 3.50–3.75% in its January 2026 policy meeting. The FOMC is likely to hold policy rate in the next policy as well, with the majority of the FOMC supporting the current policy stance

- On the domestic front, RBI has announced additional liquidity measures, including Open Market Operations (OMOs) and Dollar FX swaps to support the market

- In the annual budget, the government announced a fiscal deficit target of 4.3% of GDP for FY 2027, against 4.4% of GDP for FY 2026. Gross market borrowing came at ₹17.20 lakh crores (~16% increase over the ₹14.82 lakh crore budgeted in FY26). Net market borrowing is pegged at ₹11.70 lakh crores for FY 2027. The borrowing figures were broadly in line with market expectations

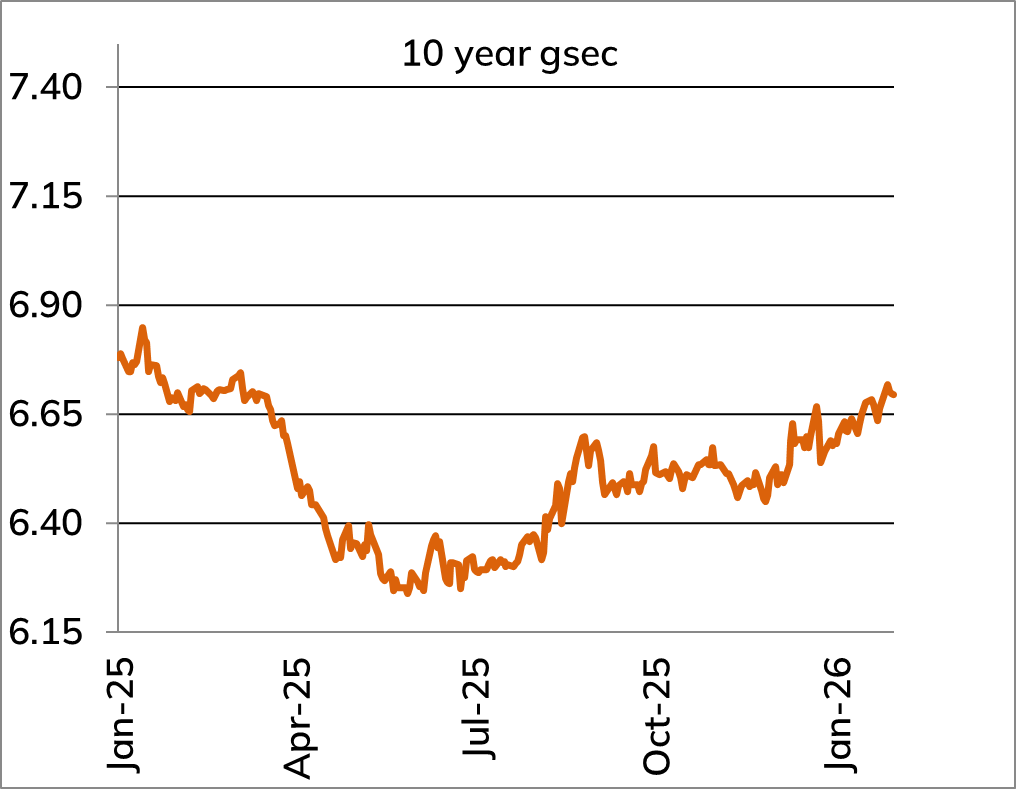

- While we await for RBI’s monetary policy due on 6th February 2026 (which can lead to change in our view going forward), we expect the 10-year yield to trade broadly in 6.65%-6.85% range

| Index | 1 month (%) | 1 year (%) | 3 years (%) |

|---|---|---|---|

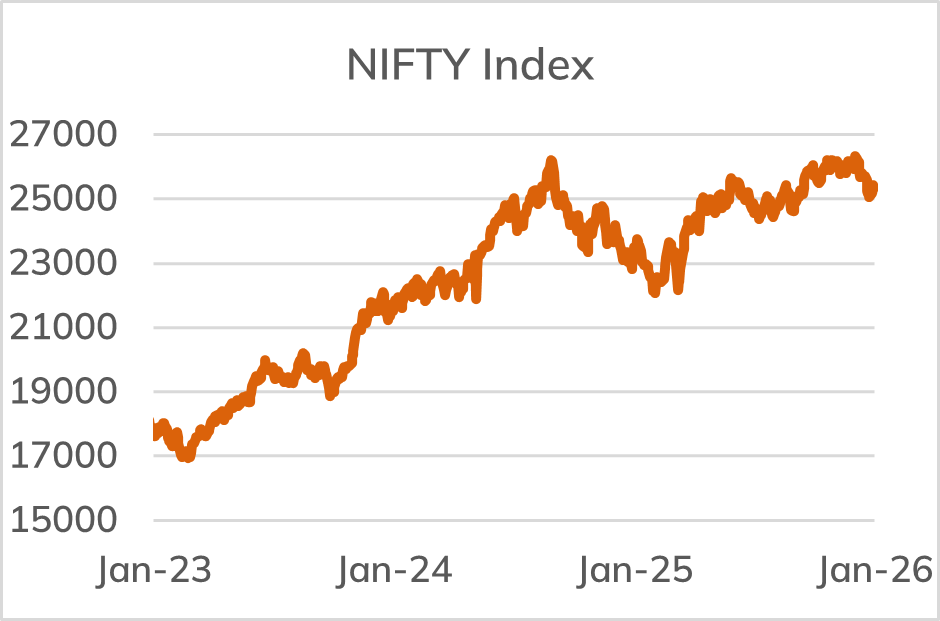

| NIFTY50 | -3.1 | 7.7 | 12.8 |

| BSE100 | -3.0 | 7.8 | 13.9 |

| NIFTY500 | -3.3 | 6.9 | 15.6 |

| NIFTY Midcap100 | -3.4 | 8.8 | 24.0 |

At January 31, 2026

Nifty was down 3.1 % for the month of January 2026

- Nifty fell amidst heavy FII outflow, heightened global geopolitical uncertainty

- Within BSE 100 index, amongst sectors Metal & Minerals / Cement outperformed while Oil & Gas / Consumer underperformed the broader market

We continue to maintain our neutral stance on the market in the short term and positive stance in the medium term

- Overall earnings growth remains muted though there has been prominent divergence across sectors

- India’s trade deal with EU & USA will be taken positively however implementation to take time

- Union budget focused on continuity with steady capex growth, restrained populism and fiscal consolidation

- The Nifty’s one year forward FY27E P/E at 20x, is above its 5-year average

In the medium term, we expect certain important drivers for growth:

- India’s growth outlook is supported by twin policy easing to support domestic demand

- Government’s focus on regulatory reforms with a view to simplify compliance, improve ease of doing business, attract foreign investment, boost innovation and create a more efficient & resilient economy

Market consensus for Nifty earnings CAGR over FY2025-FY2027 at 9% while FY2026-FY2028 at 15%