1. What is a claim settlement ratio?

Claim settlement ratio (CSR) is the % of claims that an insurance provider settles in a year out of the total claims. It acts as an indicator of their credibility. As a general rule, the higher the ratio, the more reliable the insurer is.

You can easily find the CSR of different companies on the official website of the Insurance Regulatory and Development Authority of India (IRDAI).

2. Why is a claim settlement ratio important?

It helps assure the financial security of your family

The entire objective of buying life insurance is ensuring financial protection against unforeseen circumstances. However, the purpose will be defeated if the insurer does not honor your claim. On the other hand, if the insurer honors most of the claims, your family is more likely to have a simple, transparent and hassle-free claim process. You can, thus, be rest assured that your loved ones don’t have to go through a tough for time getting the sum assured.Indicates the insurer’s reliability

The claim settlement ratio indicates their ability to pay the sum assured to you or your nominee. If your provider has been maintaining a consistently high CSR over a considerable amount of time, they are unlikely to default on their compensation commitment.

3. How is a claim settlement ratio calculated?

A CSR is calculated with the following formula:

Claim Settlement Ratio (CSR) = (Total number of claims settled in a year/ Total number of claims in a year) X 100

For example, Company A settled 9,500 claims out of the 10,000 claims for 2019-2020. Its CSR will, thus, be 95% (9,500/10,000*100).

4. Types of Insurance Claims

Life insurance claims can be broadly classified into the below types:

Maturity claims

Maturity claims are paid at the end of the policy tenure. On surviving the policy term, you will receive an amount either as a lump sum or regular income depending on the policy feature and request provided by you. Also, the amount paid on maturity can be fixed or market-linked, basis the type of your policy.Death claims

Death claims are paid in case of the policyholder’s death during the policy term. The life insurance company pays the amount to the policyholder’s nominee. Death claims are usually paid as a lump sum amount or as regular income as chosen at the time of purchasing the policy

5. Why is disclosure important for better claim settlement ratio?

A claim is rejected if 'non-disclosure' or 'misstatement' of facts is discovered during an investigation. When a fact that affects the policy issuance decision is not disclosed in the proposal, it is termed as, 'non-disclosure'. Similarly, withholding information or providing incorrect information while answering questions in the proposal form^^ is termed as a 'misstatement'. Hence, correct disclosure will have a positive impact on claim settlement ratio.

For example, when an applicant suffering from kidney failure does not inform the insurer about the same in the proposal form, it is termed as non-disclosure. Similarly, when an applicant overstates his or her income, then it is called a misstatement.

6. Claim settlement ratio is published every year

7. Claim settlement ratio must be consistent

| Financial Year | 2023-24* | 2022-23 | 2021-22 | 2020-21 | 2019-20 | 2018-19 | 2017-18 | 2016-17 | 2015-16 | 2014-15 | 2013-14 | 2012-13 | 2011-12 | 2010-11 | 2009-10 |

| Claims Settlement Ratio | 99.17% | 95.28% | 97.8% | 97.9% | 97.8% | 98.6% | 97.88% | 96.68% | 96.2% | 93.8% | 94.10% | 96.29% | 96.53% | 94.61% | 90.17% |

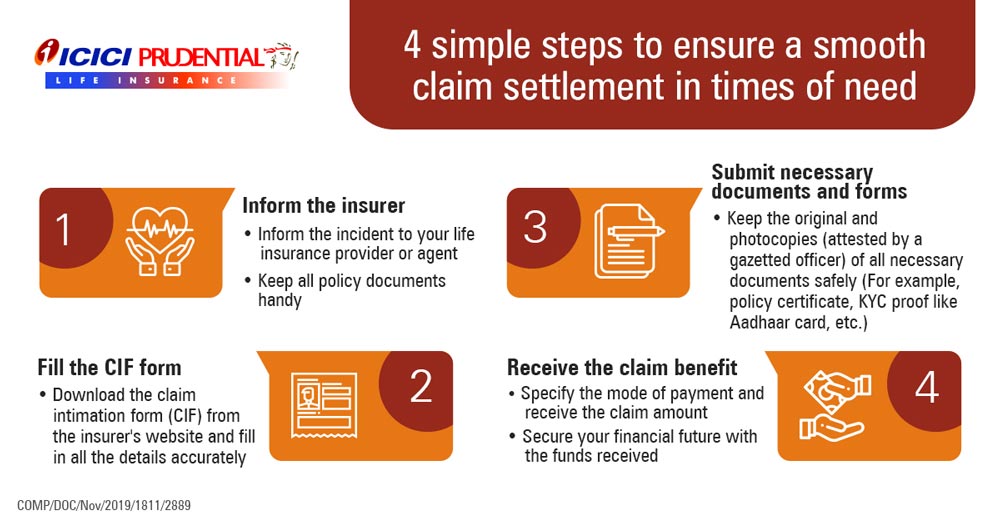

8. Claims process must be simple

For the first time ever, an insurance company has been able to impress me enough & not find a single reason to complain - No repeat visits, no running around, no this/that mismatch, no useless delays, no wastage of time, no useless questions etc. - Just NOTHING except true professionalism!

Well done! - Keep up the brilliant work!!

I think it is the fastest Claim Settlement seen ever and I dont have any words to say except THANK YOU.

My experience through the claim settlement process has been the ultimate service one can get.

Delivered with highest priority care and sensitivity.

I express my gratitude and sincere thanks for the quick settlement of Death Claim under ICICI Pru policy - of my daughter Ms. Latha Ganesan. The entire process was handled quite smoothly by ICICI Pru staff at CMH Road, Indira Nagar, Bangalore, first by explaining the papers required which were duly submitted. Thereupon, further processing was also handled in a professional manner by seeking necessary clarifications and finally accepting the claim. This has helped in settling the account with ICICI Bank for the Housing Loan taken by my daughter.

Thanks to the entire ICICI Pru team.

9. Claims paying ability rating should be good

As a measure of good governance as well as independent certification of financial strength, our Company has subscribed to ICRA Limited’s surveillance on Claims Paying Ability rating. This rating measures an insurance company’s ability to meet policyholder obligations. Our Company has been rated iAAA since 2009 when it initiated the surveillance with ICRA Limited.

| Rating Agency | Instrument | Rating | Rating Date |

|---|---|---|---|

| ICRA | Claims paying ability | iAAA | MAR-19 |

| ICRA | Claims paying ability | iAAA | MAR-18 |

| ICRA | Claims paying ability | iAAA | MAR-17 |

| ICRA | Claims paying ability | iAAA | MAR-16 |

| ICRA | Claims paying ability | iAAA | MAR-15 |

| ICRA | Claims paying ability | iAAA | MAR-14 |

| ICRA | Claims paying ability | iAAA | MAR-13 |

| ICRA | Claims paying ability | iAAA | MAR-12 |

| ICRA | Claims paying ability | iAAA | MAR-11 |

| Note: Ratings for ICICI Prudential Life insurance are subject to regular revisions. Kindly refer to the respective agencies for rating methodology. | |||

Claim Settlement Ratio FAQs

1. What is the claim settlement ratio?

Claim settlement ratio is the percentage of settled claims over the total volume of claim for a financial year.

2. How is claim settlement ratio calculated?

Claim settlement ratio is calculated by dividing the total number of claims settled by the total number of death claims volume.

3. What is the time frame within which the claim has to be reported?

You should report a claim as soon as possible to help us process it faster. There is no specific time frame for death claims. Disability claims need to be reported within 120 days from the date of the disability. For critical illness or major surgery, you have to report the claim within 60 days from the date of diagnosis or surgery.

4. What are the documents required for claim settlement?

To get a list of the documents required while reporting a Hospitalisation Claim, please Click Here

5. Under what circumstances does the company decline the claim?

A claim is rejected if 'non-disclosure' or 'misstatement' of facts is discovered during an investigation. When a fact that affects the policy issuance decision is not disclosed in the proposal, it is termed as 'non-disclosure'. Similarly, withholding information or providing incorrect information while answering questions in the proposal form^^ is termed as 'misstatement'.

For example, when an applicant suffering from kidney failure does not inform the insurer about the same in the proposal form, it is termed as non-disclosure. Similarly, when an applicant overstates his or her income, then it is called a misstatement.

^^Proposal form is the document in which you provide all the relevant details while applying for an insurance policy.

6. Who is entitled to receive the claim benefit?

The claim benefit can be received by:

- The nominee* or their guardian (in case of a minor nominee), if you are the Life Assured

- The proposer, in case you are not the Life Assured^

- Assignee, in case the policy is assigned

- Life Assured, in case of living benefit claims such as claims under disability, critical illness and major surgery rider.

* Nominee is the person you appoint at the time of purchase for receiving the benefits of your insurance policy in your absence.

^Life Assured is the person for whom the life/health insurance policy has been issued.

1. What is the claim settlement ratio?

Claim settlement ratio is the percentage of settled claims over the total volume of claim for a financial year.

2. How is claim settlement ratio calculated?

Claim settlement ratio is calculated by dividing the total number of claims settled by the total number of death claims volume.

3. What is the time frame within which the claim has to be reported?

You should report a claim as soon as possible to help us process it faster. There is no specific time frame for death claims. Disability claims need to be reported within 120 days from the date of the disability. For critical illness or major surgery, you have to report the claim within 60 days from the date of diagnosis or surgery.

4. What are the documents required for claim settlement?

To get a list of the documents required while reporting a Hospitalisation Claim, please Click Here

5. Under what circumstances does the company decline the claim?

A claim is rejected if 'non-disclosure' or 'misstatement' of facts is discovered during an investigation. When a fact that affects the policy issuance decision is not disclosed in the proposal, it is termed as 'non-disclosure'. Similarly, withholding information or providing incorrect information while answering questions in the proposal form^^ is termed as 'misstatement'.

For example, when an applicant suffering from kidney failure does not inform the insurer about the same in the proposal form, it is termed as non-disclosure. Similarly, when an applicant overstates his or her income, then it is called a misstatement.

^^Proposal form is the document in which you provide all the relevant details while applying for an insurance policy.

6. Who is entitled to receive the claim benefit?

The claim benefit can be received by:

- The nominee* or their guardian (in case of a minor nominee), if you are the Life Assured

- The proposer, in case you are not the Life Assured^

- Assignee, in case the policy is assigned

- Life Assured, in case of living benefit claims such as claims under disability, critical illness and major surgery rider.

* Nominee is the person you appoint at the time of purchase for receiving the benefits of your insurance policy in your absence.

^Life Assured is the person for whom the life/health insurance policy has been issued.

People like you also read ...

ICICI Pru claim Settlement Ratio!j is 99.6% (Q1-FY2026)

Published: The Hindu

ICICI Prudential Life Insurance achieved a claim settlement ratio of 99.04% for the second quarter of FY25, making it the leader in the industry. Competitors included HDFC Life at 96.85%, TATA AIA at 96.86% and SBI Life at 96.08% claim settlement ratio.

This high ratio also reflects the company’s commitment to fulfilling claims efficiently and promptly. Average reported turnaround time for death claim settlement was 1.2 days.