Life Insurance Claims FAQ

Life Insurance Claims FAQ

Life Insurance Claims FAQ

Life Insurance

Claims FAQ

Death Claim FAQs

Health claims FAQs: Click here

Depending on the type of the policy, the process to file a claim will vary

- Life Insurance claim - If the insurance policy is purchased by an individual, the nominee can directly file a death claim. Click here to know the process of raising a claim and documents required. Claims under Pension/Annuity policies to follow the same process

- Group Insurance claim - Insurance policies which provide coverage to a group of individuals e.g. employees of an organization, customers of a certain financial institutions are called as group policies. For claims under these policies the customer can approach the master policy holder who is owner of the policy i.e. the organization /company or can contact any of our touch points. Click here to know the process of raising a claim and documents required

- Health Insurance claim - These are claims raised under health policies for medical related expenses incurred by the life assured. Rider claims also are considered as health claims. Click here to know the process of raising a claim and documents required

For all other policies the nominee can inform about a claim by submitting the following documents

Mandatory documents required for claim registration:

- Duly filled and signed Claimant Statement Form

- Recent photograph of the claimant

- Copy of Death Certificate of the Life Assured, issued by government authority

- Claimant photo identity proof

- Claimant address proof(Any one of the following: Aadhaar Card, Valid Passport or Driver's License, Voters ID are considered as proofs)

- Pan card/Form 60 of the claimant

- Copy of cancelled cheque/bank statement/bank passbook with printed account number and name of the claimant**

- Duly filled and signed Payout mandate form with bank account details of the claimant

**As per the regulatory requirement, all payouts under an insurance policy are required to be processed electronically in the bank account of the policyholder/nominee/assignee as applicable.

| MANDATORY DOCUMENTS REQIURED BASED ON CAUSE OF DEATH | ||

|---|---|---|

| Death at Home or hospital (Death due to natural/medical reasons) |

In case of death due to Unnatural causes such as Accidents (Road/Rail/Air etc), Murder, Suicide, etc.,) | |

|

|

|

In the event of death of the Nominee/Proposer under the policy, Legal Heir of the Nominee/Proposer/Life Assured as the case maybe, shall submit a claim by providing any one of the following additional mandatory documents:

|

||

Scenarios (In case nominee is different/minor)

a. In case the Nominee under the policy is minor, Guardian/ Appointee may fill the Form and Guardianship Certificate to be submitted along with valid age proof of Claimant in addition to the documents mentioned on claim form

b. If Life Assured holds more than one policy

- Claimant is under all policies is same, one Claim Form is sufficient for claim registration. All the policy numbers should be mentioned in the same claim form.

- Claimant is different under multiple policies, then separate Claim Forms along with KYC and other mandatory documents as mentioned on claim form, will be required from each claimant.

c. If multiple nominees are nominated under a single policy and multiple Claimants register a claim under the same policy, each Claimant shall be required to submit a separate claim form along with KYC and other mandatory documents as mentioned on claim form.

Important points to be followed for faster processing of claim:

- Claimant name to be as per the proof submitted

- Contact number of the claimant is mandatory to ensure periodic update on claim status. Email address if available, will help us sent claim related communication

- Share clear copies of the supporting documents

- Provide all documents as mentioned in the claim form (Mandatory documents) at the time of claim submission

- Bank details of claimant is important to process claim amount electronically

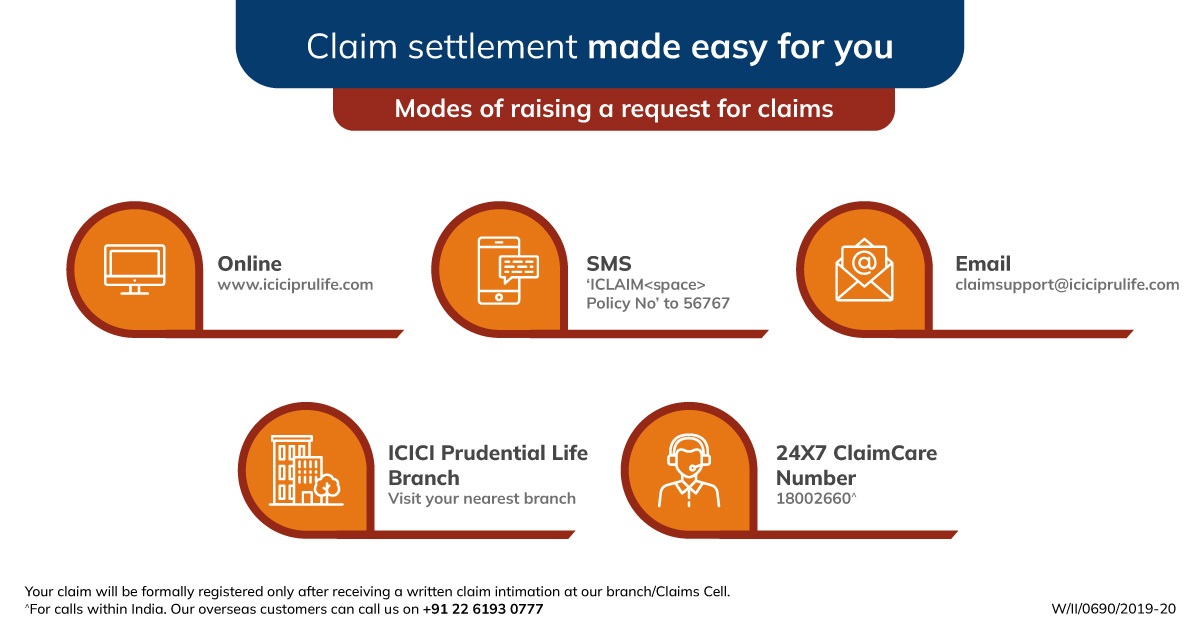

Where can I submit a claim?

The documents can be submitted through any of the following option:

- Branch: Submit the documents at the nearest ICICI Prudential Life Insurance branch. To locate the nearest branch, visit www.iciciprulife.com/branchlocator

- Website: Upload the documents online in claims section of the website www.iciciprulife.c om > claims > file a claim

- WhatsApp: Type ‘Claim' on WhatsApp number 9920667766 and get an option to check the claim status

- Mail us: Claim Care, ICICI Prudential Life Insurance Company Limited, 2nd Floor, Apeejay Express, Beside Saraswat Bhawan, Sector 17, Vashi, Navi Mumbai- 400703

- Doorstep Document pick-up service: To schedule a pick-up simply call

- In the event of death of the Nominee/Proposer under the policy, Legal Heir of the Nominee/Proposer/Life Assured as the case maybe, shall submit a claim by providing any one of the following additional mandatory documents:

- Nominee’s Death Certificate along with Succession Certificate, OR

- “Will” of the Life Assured or the Nominee, OR

- Notarised Indemnity along with Affidavit of ₹ 600/- (other than state of Maharashtra. For Maharashtra, affidavit of ₹ 1,000/- shall be required) and Family Tree Certificate/Legal Heirship Certificate from the current claimant along with No Objection Certificate from the remaining Legal Heirs, OR

- Final Court order, if any

The following touchpoints are available for any assistance on the claim process:

- Call us : Call our 24X7 claim helpline on

- Email : Write to claimsupport@iciciprulife.com

- Visit a branch : Speak to claim executive at the nearest branch

- Get a callback : SMS 'ICLAIMPolicy No' to 56767 and we will call you back in 48 hours

On submission of a claim along with mandatory documents, a unique Claim ID is sent on email / SMS to the claimant.

- To track the claim status: Visit www.iciciprulife.com < Claim section < Track claim and enter the unique Claim ID

- You may also contact any of our touchpoints mentioned below for assistance

- Call us - Call our 24X7 claim helpline on

- Email : Write to claimsupport@iciciprulife.com

- WhatsApp : Type ‘Claim' on WhatsApp number 9920667766 and get an option to check the claim status

- Visit a branch : Speak to claim executive at the nearest branch

- Get a callback : SMS 'ICLAIMPolicy No' to 56767 and we will call you back in 48 hours

- At ICICI Pru Life, the Average Turn Around time for Claim Decisioning for a claim where field verification was not required was 1.2* days in FY2024*.

*From last document received date.

| Turn Around Time for death claim* | |

|---|---|

| Stages of claim | Turn around time |

| Settlement or Rejection or repudiation of claims where field verification is not required | Within 15 days from intimation |

| Settlement / Rejection / Repudiation of claims where field verification is required | Within 45 days from intimation |

*Turnaround time for claim processing and settlement will start only after receipt of all mandatory documents.

A death claim is rejected in case of 'non-disclosure' or 'misstatement' of material facts discovered at claim stage or any act fitted to deceive or any omission as the law specially declares to be fraudulent.

- When a fact that affects the policy issuance decision is not disclosed in the proposal, it is termed as, 'non-disclosure'. For example, when an applicant suffering from kidney failure does not inform the insurer about the same in the proposal form, it is termed as non-disclosure

- Similarly, withholding information or providing incorrect information while answering questions in the insurance proposal form is termed as, 'misstatement'. For example, when an applicant overstates his or her income or discloses incorrect occupation, nationality, hobbies & habits then it is called a misstatement

- If your claim was accepted and you are not satisfied with the claim amount processed or require clarification on the claim amount, you may write to claimsupport@iciciprulife.com

- In case your claim was rejected, and you wish to represent the claim (decision review), you may write to Company’s Grievance Redressal Committee (GRC) on below mentioned address:

Grievance Redressal Committee – ICICI Prudential Life Insurance Company Limited, Unit No. 901A, 901B, 1001A & 1002B Prism Towers, Mindspace, Link Road, Goregaon West, Mumbai – 400104

- If death due to suicide is within one year of policy issuance or within one year of policy re-instatement, then either a percentage of the premium amount or fund value as may be applicable in the policy is paid

- If death due to suicide is after one year of policy issuance or one year of policy being revived, death benefit as per the policy terms and conditions is payable

Life insurance claim

Life insurance is an agreement between you and an insurance company where the insurer agrees to provide you with financial protection against life risks. In exchange for this protection, you pay a fee, which is known as a premium.

A Life insurance claim is a formal request made by the beneficiaries of the policy holder to the insurance provider to provide them with the money or benefits promised in the policy after the insured person has passed away.

There are mainly 3 types of life insurance claims:

- Life insurance (death) claim: If the person insured by the policy (life assured) passes away during the term of the policy, the person mentioned as the nominee in the policy will need to file a life insurance claim to receive sum assured/death benefit.

- Rider claim: These are additional benefits, added to the original life insurance policy on payment of extra premium. There are different types of riders attached to a life insurance plan,

- Maturity claim: Few life insurance policies also have a maturity benefit which is payable at the end of the policy term. This means when the policy tenure ends and the policyholder survives the whole policy tenure a certain amount is paid to the policyholder itself. This is a payment made to policy holder’s bank account if no insurance claim was made on the policy. To receive this benefit, the policy holder needs to pay all premiums regularly and stay invested till the end of the policy term and keep bank account details updated in case of any changes.

a. Accidental death rider: This is paid along with the life insurance benefit; in case the person passes away due to an accident

b. Critical illness rider/ Permanent Disability rider: For any of these riders the policy holder can file claim if he/she is diagnosed with any of the conditions listed in the policy document.

4 things you must do to ensure a smooth claim settlement experience for your nominee:

- Keep your nominee details updated in the policy: It is important to ensure that your nominee details are correctly updated in your Policy document. You also have the option of splitting the nominee % share as per your choice. You can update your nominee details by logging on to your ICICI Pru Life Online account or the ICICI Prudential Life Insurance mobile app.

- Disclose all health information: Always check if all your health habits and conditions are correctly declared by you at the time of the purchase. If any details are not captured, you can always write to claimsupport@iciciprulife.com to update this. This becomes extremely critical because at the time of claim settlement if it is found that details were not declared, the claim would go into further investigation for which additional documents and requirements may have to be submitted by nominee.

- Inform your nominee about your policy: Always keep your nominee informed about your policy benefits and details, so that they can have easy access to your policy document in case required.

- Keep your policy active: Pay all your premiums regularly and on time to keep your policy active and stay invested in your policy till the end of the policy term. Claims are not accepted for lapsed policies.

* 1 Day is a working day, counted from the date of receipt of all relevant documents from the claimant, additional information sought by the Company and any clarification received from the claimant. The Company will be calling the claimants for verification of information submitted by the Claimant which will also be considered as part of relevant documents..

## Working day will be counted as Monday to Friday and excluding National holidays /Bank holidays/Public holidays.

# Interest shall be at the bank rate that is prevalent at the beginning of the financial year in which death claim has been received. In case of breach in regulatory turnaround time, interest will be paid as per IRDAI regulations.

** Mandatory documents to be submitted at Branch Office- Claimant statement form, Copy of death certificate issued by local authority, AML KYC documents- Nominee’s recent photograph ,Copy of Nominee’s pan card, Nominee’s current address proof, photo identity proof, Cancelled cheque/ Copy of bank passbook, Copy of medico legal cause of death, Medical records (Admission notes, Discharge / Death summary, Test reports, etc.), For accidental death - Copy of FIR, Panchnama, Inquest report, Postmortem report, Driving license.

^ All due premiums in the policy have been paid and the policy has been active for 3 consecutive years preceding life assured’s death.

Under ULIP policies, if claim is submitted prior to 3 pm then the claim will be considered under Claim For Sure on the same day. If claim is submitted post 3pm or if the policy is inactive at the time of claim notification then the claim will be considered under Claim For Sure the next day as per availability of NAV.

People like you also read ...