India has witnessed remarkable economic growth over the past few decades, creating new opportunities and raising aspirations across generations. As part of this rising India, you are working hard to build a better future for your family- whether it’s securing your child’s education, owning a home, or planning a comfortable retirement. These goals are important and achieving them requires disciplined long-term savings along with the right financial plan. At the same time, it is equally important to ensure that your family’s financial well-being is protected, even in your absence.

ICICI Pru Protect N Gain Whole Life is a unit-linked savings life insurance plan designed to provide your comprehensive life protection while your wealth grows. It offers market-linked returns to support your long-term goals, along with an adequate life cover to safeguard your loved ones against life’s uncertainties. With flexible investment strategies, charge efficiencies, and lifetime coverage up to age 99, the plan helps you protect your goals, build a meaningful corpus, and move towards a more secure and stress-free future.

ICICI Pru Protect N Gain Whole Life: A complete solution for your Insurance and Wealth creation needs

Protect

You and your family with a Life Insurance cover1, Accidental Death cover5 and Accidental Disability cover5

Benefits

- Life Insurance cover: Life Cover1 for the entire policy term so that your family is financially secured even in your absence

- Accidental Death cover: Accidental Death cover5 paid as lump sum in case of death due to an accident

- Accidental Disability cover: Accidental Disability cover5 paid as lump sum in case of permanent disability due to an accident

Gain

By staying longer in the policy with market linked returns

Benefits

The maturity benefit is inclusive of the following additions to your policy:

- 1X return of mortality2 charges from 11th year onwards

- 1X return of premium allocation charges2 charges from 11th year onwards

- LoyaltyL additions: Extra units from policy year (67 less Entry Age) and onwards

- Coverc continuance booster: Protection from adverse market scenarios

- 20% Maturity booster3

GET ADDITIONAL FLEXIBILITIES WITH

SIMPLE STEPS TO BUY PROTECT N GAIN

Choose sum assured

Choose the level of life cover as per your goals, income and life-stage.

Choose the PPT

Choose for how long you would like to pay the premiums (premium payment term).

Select Funds/Strategy

Select how you want to save your money and the funds in which you want to save your money.

Plan Issued

Start paying your premiums and stay covered in the policy to achieve your protection and wealth creation goals.

Boundary Conditions

| Premium Payment option | Premium Payment Term (in years) | Policy term (in years) | Minimum/ Maximum age at entry (in years) | Minimum/ Maximum age at maturity (in years) | Minimum Sum Assured |

|---|---|---|---|---|---|

| Limited Pay | 7 - 12 | Whole life (99-age at entry) | 18/50 | 99 | ₹ 50,00,000 |

Premium Payment Frequency: Annual, Half-yearly, Monthly

Maximum Premium/ Maximum Sum Assured: Subject to internal Company guidelines i.e., Board Approved Underwriting Policy (BAUP)

Illustration

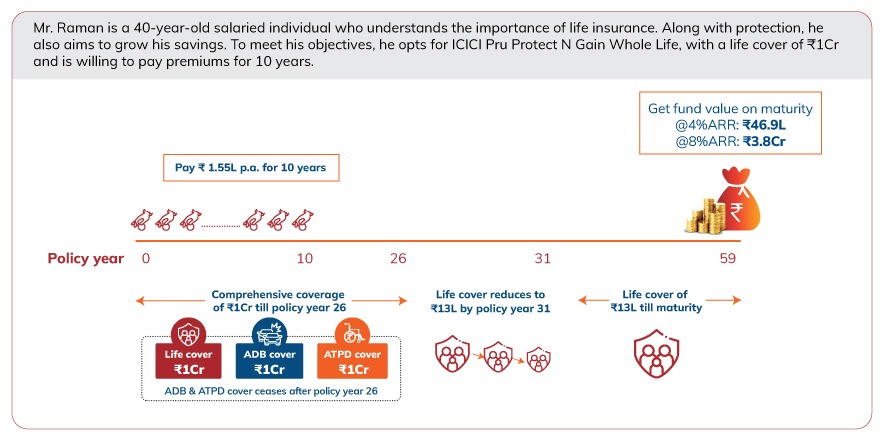

Mr. Raman is a 40-year-old salaried individual who understands the importance of life insurance. Along with protection, he also aims to grow his savings. To meet his objectives, he opts for ICICI Pru Protect N Gain Whole Life, with a life cover of ₹1Cr and is willing to pay premiums for 10 years.

ARR: The Illustrations are based on Assumed Rate of Return of 8% and 4%. The maturity benefits shown are for illustrative purposes only and are subject to the actual fund performance

PERFORMANCE OF FUNDS`

Please note: NA: Fund has not completed the stipulated time period

Past performance is not indicative of future performance.

People like you also read ...