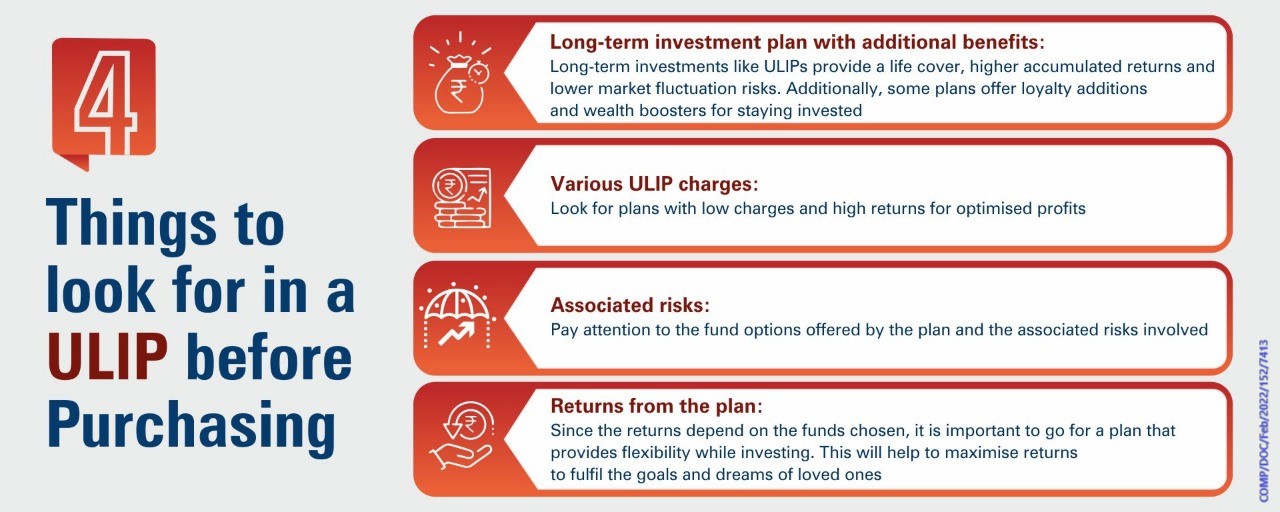

ULIPs help you to achieve your life’s financial goals by creating wealth through market-linked investments. Through these instruments, you can spread your money across debt, equity, or balanced funds based on your risk appetite. This gives you the possibility to earn inflation-beating returns from the market. The in-built life insurance cover helps you safeguard your loved ones against financial challenges in case of a mishap.

There are certain charges levied by the insurance provider in exchange for their services. Some of these ULIP charges are deducted upfront from your premium while the rest are levied through the cancellation of units from your fund.

Before making an investment decision, you must consider these charges to ensure that your investment is cost-effective. Currently, the Insurance Regulatory and Development Authority of India (IRDAI) has put a cap on the amount of ULIP charges that can be levied by insurers. As a result, there is a limit to how much these costs can impact your investments. Also, most of these charges reduce over the policy tenure, levelling out your investment costs in the long term.

When you understand the charges in ULIP, you can plan your investments well and select the policy best suited to your specific financial needs.

Types of ULIP Charges

When investing in ULIPs, it is important to understand the various charges associated with the plan. Since these plans enable you to invest in funds and grow your money, they may charge fees for the management, allocation and administration of your funds. These ULIP charges can affect the overall returns from your plan. Below are some key charges associated with ULIPs:

a. Partial Withdrawal:

ULIPs feature a five-year lock-in period. During this period, you cannot access the money in your investment fund. But after the first five years, you can withdraw a part of the accumulated amount.

The maximum amount you can withdraw from your ULIP fund and the number of times you can withdraw varies from policy to policy. Typically, you can take out the money to fund key life events like child’s wedding or for medical emergencies. However, you may have to pay pre-specified charges for such partial withdrawals.

b. Guarantee Charges:

Returns from ULIPs depend on market conditions. But some policies offer the guarantee of high returns after a specific investment period. For example, some ULIPs may guarantee a 125% profit after 12 years. But you have to incur guarantee charges in ULIP that let you enjoy such high-returns assurance.

c. Premium Redirection Charges:

ULIPs provide various fund options for you to invest in and your premiums go into your selected funds. You can freely redirect your premiums into different funds as per your choice. However, such premium redirection services incur charges levied by your insurer.

For example, you started allocating your premiums in fund A. But later, you find a fund option, say fund B, offering possibilities of higher returns. With ULIPs, you have the option to redirect your future investments into fund B. You can also shift towards a conservative investment approach by directing your upcoming premiums into a more stable debt instrument, fund C.

Such premium redirections can help you align your investment strategy with your financial goals. However, to enjoy this benefit, you may have to pay premium redirection charges as per your insurer.

d. Rider Charges:

Riders provide an additional protection cover over the base life cover1. Rider charges are deducted from your premium. We, at ICICI Prudential Life Insurance offer Unit Linked Accident Death Benefit Rider.

e. Switching Charge:

ULIPs not only allow you to invest your money in fund options with different debt-equity exposures but also give you the option to move your money between different funds. Moving your money from one fund to another is called Switching. For example, you can switch money from a fund invested 100% in equity to a balanced portfolio, which is invested 60% in equity and 40% in debt.

Generally, only a limited number of fund switches are recommended in a year as a ULIP is a long-term investment tool. ULIPs from ICICI Prudential Life offer you four free Switches in a year. For additional Switches, a minimal charge of ₹ 100/- is applied per Switch.

f. Top-up Charge:

Top-up is one of the unique features of a ULIP. This allows you to invest your surplus money either once or multiple times in your policy. This amount is over and above your regular premium payments and can be made at any time while your policy is in force. Top-ups help you grow your wealth further by increasing the amount of investment. Insurance companies may deduct a certain percentage from the top-up amount as charges.

g. Premium Discontinuance Charge:

You may decide to stop paying your premium before the lock-in period of five years. Upon discontinuance of premium payments, your money will be locked in a Discontinuance Fund. A Premium Discontinuance charge may be deducted for this, as mentioned under the policy conditions. This is charged as a percentage of the fund value or as a percentage of the premium. While you can discontinue your policy before the policy term, it is advisable to stay invested for at least 10 years to enjoy the maximum benefits offered by your policy.

h. Premium Allocation Charges in ULIP

Premium allocation charges are deducted from the premium amount paid during the first year of a ULIP. These charges are generally higher in the first year and gradually reduce in subsequent years. Premium allocation charges cover the expenses associated with the life cover provided by ULIPs, such as underwriting, policy issuance, administration and distribution costs.

i. Fund Management Charges in ULIP

Fund management charges in ULIPs cover the cost of allocating your money into the funds of your choice. The Insurance Regulatory and Development Authority (IRDA) has prescribed a limit to the maximum percentage of fund management charges that an insurer can charge.

j. Mortality Charges in ULIP

Mortality charges in ULIPs are charged towards the cost of the life cover offered by your plan. ULIPs offer a life cover that secures your loved ones in case of an unfortunate event. When an insurance company provides this life cover, it undertakes risk. Mortality charges compensate the insurer for their risk in offering the life cover. This mortality charge depends on factors such as your age, gender, sum assured and policy duration.

k. Policy Administration Charges in ULIP

Insurance companies levy policy administration charges for the administrative expenses they bear when issuing a policy. These ULIP charges include policy maintenance, paperwork, monthly/quarterly/annual updates sent to you, record keeping, premium intimation and more.

l. Miscellaneous Charges in ULIP

Miscellaneous ULIP charges cover a range of additional fees charged on activities, such as switching from one fund to another, changing the premium payment method, updating the beneficiary's name and other such instances. Every time you make any changes to your policy, the insurance company may bear some costs to implement those changes. The miscellaneous charge covers these costs in a ULIP.

m. Surrender or Discontinuance Charges in ULIP

It is always advisable to stay invested in ULIPs for the long term. However, due to unforeseen situations, you may want to discontinue or surrender your policy. In such a case, the insurance company may levy surrender or discontinuance charges. These charges are applicable when you decide to surrender or prematurely terminate your ULIP before the completion of the lock-in period.

Understand the charges under your ULIP policy

You can get the details of charges in your ULIP from any of these sources

Sales Benefit Illustration

A sales benefit illustration shows the various charges applicable, for the entire duration of the policy. This helps you understand the amount deducted and the exact amount invested in your choice of funds. You can request the company sales representative to share a sales benefit illustration with you.

Product Brochure

A product brochure informs you about the various charges applicable on your policy, and the reason for which they are charged. You can download the product brochure from our website or ask for it from our sales representatives.

Advisor

You could also enquire with your advisor for a detailed understanding of all the charges applicable on your policy throughout its term.

Conclusion

COMP/DOC/Sep/2023/209/4131

People like you also read ...