Insurance Plans For All Your Goals

ULIP

Wealth Plans

Tax*-free returns

Trending`~

Term Life

Insurance

99.3% Claim Settlement!j

New

Term Plans

with Return

Multiple Options

Term Plan

for Salaried

on 1st year premiums

Upto 15%S Off

Term Insurance

for Women

Flat 15%F discount

Child Plan

Premium Waiver Benefit

Term Plan for

Self-employed

No Income DocumentsI

Retirement / Pension Plans

Lifelong Income

Guaranteed

Plan

Savings Plan

More Plans

Existing Customer Corner

268912Θ!’†ꞂⱵ`^ō`~ Conditions Apply. W/II/0366/2025-26

DISCOVER THE PERFECT PLAN FOR YOU

Tailored solutions for your needs

Conditions Apply. W/II/1812/2024-25

Find the right plan based on your goals

Find top-selling plans

Browse our top selling plans to suit your needs and fulfil your goals

Browse our top selling plans to suit your needs and fulfil your goals

Meet our Experts

Get the best advisory from our experts directly

Get the best advisory from our experts directly

Call and reach out

Connect with us to find the right plan

Connect with us to find the right plan

ONLINE TOOLS AND CALCULATOR

Explore our Interactive Planning Tools

Term

Insurance

Human Life

Value

House Rent

Allowance

Retirement

Planner

Income Tax

Calculator

Power of

Compounding

Home Loan

Insurance

ICICI PRU PROMISE

Our Proven Track Record

99.3%

Claim Settlement Ratio!j for FY 2025

₹46,182 crores

Benefits paid till March 31, 2025`

₹ 3.09 lakh crore

Assets Under Management as on March 31, 2025^^

9.17 crores

Lives Covered as on March 31, 2025^^

INSURANCE WITH ASSURANCE

Breaking down insurance complexities

Life insurance is a contract between an insurance policyholder and an insurance company, where the insurer promises to pay a sum of money in exchange for a premium after a set period or upon the death of an insured person. Life insurance offers you and your family financial protection. Some policies also offer optional add-ons, such as critical illness benefit, accidental death benefit and more with a Smart Exit Option. The importance of life insurance cannot be ignored in ensuring the financial safety of your loved ones. Read moreWhat are the benefits of buying a life insurance plan?

Financial Security

Wealth Creation

Tax* Savings

Retirement Planning

Death Benefit

Children's Future Planning

Long-term Benefits

Financial Security

Wealth Creation

Some life insurance plans, such as Unit Linked Insurance Plans (ULIPs), offer the opportunity for wealth creation along with a life cover. These plans allow you to invest the premium in different securities like equity, debt, or balanced funds and earn inflation-beating returns. For example, ICICI Pru Signature is a ULIP that offers a yield of ₹ 64.8 Lakh at 4% or ₹ 99.24 lakh at 8% for a 30-year-old male investing ₹ 20,000 per month for 20 years.

(IN ULIPS, THE INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER)

Tax* Savings

Life insurance policies provide tax* benefits that help you maximise your returns and build savings. The premiums paid under the policy are eligible for deduction subject to conditions prescribed under Section 80C of the Income Tax Act, 1961, up to ₹ 1.5 lakhs per annum. Additionally, the proceeds received under the policy are exempt subject to conditions under Section 10(10D) of The Income Tax Act, 1961.

This makes life insurance an attractive investment option if you are looking to save on taxes while securing your financial future.

Retirement Planning

Death Benefit

Children's Future Planning

Long-term Benefits

E/II/0643/2023-24

VOICE OF CUSTOMERS

Their stories, our pride

Dipankar Roy

Network Engineer

Satish

Data Analyst

Sunil Heda

Chartered Accountant

Rohit Bharadwaj

Support executive

Dipankar chose ICICI Prudential iProtect Smart

“…premium is nominal along with extra riders…”

View Full VideoSatish chose ICICI Prudential iProtect Smart

“…was a complete digital process, so it was very simple…”

View Full VideoSunil chose ICICI Prudential iProtect Smart

“…After comparing all the aspects, I could trust ICICI Prudential…”

View Full VideoRohit chose ICICI Prudential iProtect Smart

“…have better claim ratio and good customer support…”

W/II/0816/2024-25

What are the different types of life insurance?

Types of life insurance in India:

- Term life insurance plan: Term insurance plans offer your loved ones a fixed sum assured amount in exchange for regular premiums, in case of an unfortunate incident during the policy term

- Health insurance plan: Health insurance plans reimburse policyholders for their medical expenses, including treatments, surgeries, hospitalisation and the like, which arise from injuries/illnesses, or directly pay out a certain pre-determined sum to the customer

- Unit linked insurance plan (ULIP): A unit-linked insurance plan offers investment and insurance under the same policy. A part of your premium gets invested in equity/debt/balanced funds as per your choice and the other part is used to secure your loved ones with a sum assured

- Endowment plan: An endowment plan allows you to build risk-free savings and protect the financial interests of your family in your absence

- Annuity plan: An annuity plan is a type of retirement plan that offers you a regular payment in return for a lump sum investment. Simply put, you pay the life insurance company a premium in a lump sum and your money is returned to you as regular income immediately or after a certain period of time. The life insurance company invests your money and pays back the returns generated from it to you as payouts

Who needs life insurance the most?

Life insurance can be a must-have financial tool for the following people:

- Newly married couples: Life insurance can offer newly married couples’ peace of mind and financial security. It can help your spouse live their life comfortably and meet all financial liabilities in your absence

- Parents with young children: Parents with young children can purchase life insurance to ensure their children have a financial cushion to fall back on if they are not around. Life insurance plans can also help parents save for their kids' future needs

- People nearing retirement with fewer savings: Life insurance plans allow you to save and invest your money. You can opt for low-risk options and secure your retirement and old age

- Business owners: Life insurance benefits can help your family continue your business in your absence. The payouts can also help them pay off creditors or clear their debts

Why do you need Life Insurance?

- Financial security for your loved ones and peace of mind: Life insurance ensures your loved ones are protected financially in your absence. There is no way to replace a loved one, but life insurance helps provide a safety net that gives financial security and helps build a sizable corpus over time. A life insurance plan ensures that the constant stress of financial planning is reduced considerably, thus providing absolute peace of mind

- Accomplish your financial goals: Life insurance plans help you achieve your financial goals, be it securing your family from life's uncertainties, saving for your child's education or buying your dream house. Life insurance plans can help you accumulate money over time by paying a nominal amount as a premium at a frequency of your choice. Some new-age insurance plans also allow you to withdraw money at key milestones without additional charges

- Save tax*: The premiums paid under the life insurance policy is eligible for deduction subject to conditions prescribed under Section 80C of the Income Tax Act, 1961, up to ₹ 1.5 lakhs per annum. Additionally, the proceeds received under the policy are exempt subject to conditions under Section 10(10D) of The Income Tax Act, 1961

How much life insurance coverage do you need?

The simplest way to calculate the minimum life cover+ amount for a life insurance plan is to multiply your current annual income by 10$ if you are under 55 years of age. For example, if your current annual salary is ₹ 10 lakh, you should buy a life insurance cover worth at least ₹ 1 crore. Another way to calculate life insurance is by analysing your current and future expenses.

Here are some of the most important factors that you must consider before choosing a life cover+ amount for life insurance:

- Debt: Financial liabilities like loans can burden your family in your absence. Take cognisance of your debt and pick a life insurance coverage that can be used to repay it

- Dependents: Consider the expenses of dependent family members like minor children and ageing parents. Different circumstances may necessitate different life insurance coverage needs. So, pick an appropriate amount of life insurance as per their lifestyle and requirements

- Financial goals: Financial goals like retirement planning, children's higher education, marriage, medical expenses, and others must also be considered while selecting the life cover+ amount

- Age: Different stages of life present different financial needs. Hence, keep the age of your dependents in mind while calculating your life insurance coverage

How can you choose the best life insurance plan?

Here is a guide to help you select the right life insurance policy that suits all your needs:

- Identify your life insurance goals: You must plan for your life insurance goals with the help of a suitable life insurance policy. Term insurance plans offer high coverage at affordable rates and help safeguard your family's financial security. A Unit Linked Insurance Plan (ULIP) can help you when it comes to your child’s education or buying that dream house. You can also buy a retirement plan to ensure regular income for your everyday expenses post retirement

- Right life insurance cover, policy premium and policy term: Your life insurance cover should be at least ten to fifteen times your annual income$. You must consider other factors such as any loans, your child's higher education, marriage, ageing parents, and more. This will help when you narrow down on estimating the ideal life insurance cover.

- Choose a trustworthy life insurance provider: The reputation of an insurance company, the number of years it has been active, the Claim settlement ratio, and the solvency ratio are a few factors you need to keep in mind.

- Buy life insurance early: Insurance premiums for health insurance and term insurance plans are lower when you are younger. So, it is suggested that you buy a life insurance policy as soon as you start earning. You can begin with lower coverage and add more riders as your income increases

- Choose a comprehensive all-in-one plan: Medical emergencies might affect your income adversely. Hence, choosing a comprehensive life insurance plan, with appropriate riders available in the market is advisable. Riders that various insurers usually offer include Critical Illness rider, Accidental Death Benefit, Permanent Disability rider and Terminal Illness rider among others

What is a whole life insurance policy?

Whole Life Insurance is a term insurance policy that covers you up to 99 years of age. They differ from other insurance policies with a defined term of say 10, 20 or 30 years.

How to choose the right sum assured under life insurance?

The right sum assured amount for you will depend on factors such as your age, number of dependents, income, lifestyle, liabilities like debt, and future financial goals. You must also consider other factors like an ongoing home loan, child's education or marriage. It can also help to consult with a financial advisor or speak to an insurance agent to decide the appropriate sum assured for your needs and budget.

Why is it important for women to have a life insurance plan?

According to a research study conducted by the State Bank of India's Economic Research Department, in 2021, women purchased only 33% of the life insurance policies in the countryΩ. While there is still a disparity in numbers between male and female life insurance policyholders, the number of women buying life insurance has gradually increased due to increased awareness and exposure.

Buying life insurance is extremely important for you to protect the financial future of your loved ones and to save for your life goals systematically. Moreover, science has proven that women have a longer life expectancy than men$$. This means you will have to stay financially prepared for a longer period. And what better way to do that than with a life insurance plan?

Factors that affect life insurance premium

The premium amount for your life insurance plans like health insurance and term insurance, can depend on a number of factors. Some of these have been mentioned below:

Age: Age is a chief factor impacting your life insurance premiums. As you age, the possibility of the insurer paying the claim also increases. This is why the life insurance premium rises with age

Gender: Women have higher life expectancy than men$$. This results in a comparatively lower life insurance premium

Present health and medical history: You may have to undergo a medical test before purchasing a life insurance policy so that the insurer can assess your health status. Having a history of medical issues can increase the premium for life insurance. Family health history and hereditary diseases can also impact the life insurance premium

Lifestyle: Lifestyle choices like smoking and drinking alcohol can increase the risk of certain ailments. This impacts the premium amount for a life insurance plan

Hence it is very important to disclose any lifestyle choices or medical history at the time of purchase; incomplete or lack of disclosures might impact your claims

What will happen if the life insurance premium is not paid on time?

If you fail to pay the life insurance premium on time, your policy may lapse, and you will not be protected by it financially. However, the insurance company will provide you with a grace period. During this time, you can pay the premium along with a penalty fee or interest for late payments. If you do not pay the premium during the grace period, the policy may be terminated permanently, and you may lose all benefits.

What happens if I stop paying life insurance premiums?

If you stop paying the life insurance premium, your policy will be terminated, and you will lose all your benefits. Your life insurance policy will no longer offer coverage and the protection associated with it. In the case of an unfortunate event during the policy term, your loved ones will not receive the plan's benefits. Therefore, it is recommended to pay the premium on time. If you must surrender your policy, make sure you first understand the terms and conditions and then proceed.

Will I receive tax benefits upon the maturity of my life insurance policy?

Yes, life insurance plans do offer tax* benefits under the Income Tax Act, 1961. The proceeds received under the policy are exempt subject to conditions under Section 10(10D) of The Income Tax Act, 1961.

Will I be able to claim tax benefits if I stop paying premiums in the middle of my policy term?

If you stop paying the premium for your life insurance plan, your policy will lapse, and you will lose all benefits.

What is the average life insurance payout?

The average life insurance payout in India can depend on various factors, such as the type of policy, the sum assured, and the life insured's age, health, and occupation. The payout can range from a few lakhs to several crores of rupees. It is important to evaluate your insurance needs and select a sum assured amount that adequately covers your family's future needs. When deciding the sum assured, you can consider factors like your ongoing debts, children's higher education, lifestyle needs, and others.

Do I need Term insurance if I already have Life insurance?

Life insurance plans can be categorised into multiple types: whole life insurance, endowment plans, Unit-Linked Insurance Plans (ULIPs), and more. These plans provide a life cover and have a savings or investment component. They can help you provide a safety net for your family, create wealth, and plan for future financial goals like a home, children's higher education, retirement, and other similar needs.

Term insurance plans only provide coverage for a specified period. In the case of an unfortunate event, these plans offer a guaranteed sum assured to the nominee as long as the policy is active and all premium payments have been paid in full.

Having a term insurance and another life insurance policy for other needs secures your family and ensures their well-being in case one plan does not suffice. However, decide after thoroughly evaluating your needs, as the premium payments may interfere with your monthly budget.

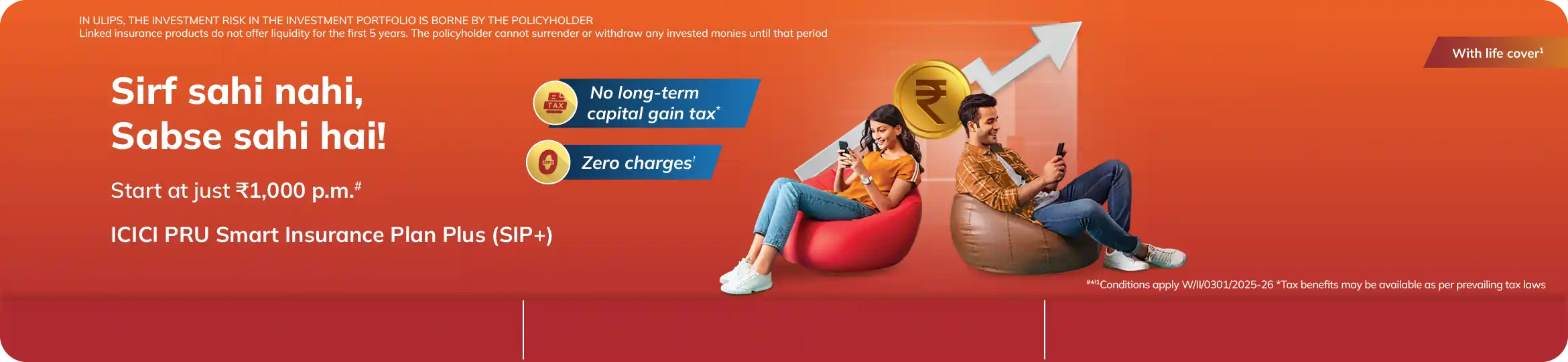

How do you file a life insurance claim?

You can file a life insurance claim in the following steps:

- You can file a life insurance claim online, at a physical branch central office, or on our central

- ClaimCare helpline through SMS or e-mail

- You can visit the Claims section of the ICICI Prudential Life Insurance website to submit an online claim

- You can call us at our 24x7 ClaimCare helpline number at 18002660

- You can e-mail us at claimsupport@iciciprulife.com

Please submit the following information along with the claim:

- Claimant statement form

- Death certificate in case of death claims

- Medical papers, diagnosis reports, and other necessary documents

- Your identity proof, address proof, and a cancelled cheque or copy of your bank passbook

The team will assess your claim and get back to you if they need any more information.

Important documents to buy a life insurance policy

You may require the following documents when buying a life insurance policy:

- Identity proof, such as Aadhaar Card, PAN Card, Passport, or Voter ID

- Address proof, such as Aadhaar Card, Passport, Voter ID

- Age proof, such as a birth certificate, Passport, or PAN Card

- Income proof, such as salary slips, bank statements, or Income Tax Returns (ITRs)

- Medical history records if requested for

When to get life insurance?

While you can buy life insurance at varying stages of your life, getting it as soon as possible is recommended. Buying life insurance at a young age can help you get a lower premium that can aid in savings over time. Delaying the purchase of life insurance can result in higher premiums due to increased risk of health concerns. Ideally, buying life insurance in your 20s is recommended to get the best life insurance premium and a longer financial cover.

What factors shape my life insurance cost?

The premium you pay for your life insurance can depend on a number of factors, such as your age, health, gender, lifestyle habits such as smoking or drinking, occupation, and other similar things. The cost is determined based on the risk associated with each of these factors. For instance, advanced age and health conditions can result in higher premiums, while individuals with healthy lifestyles and no history of illnesses may get lower premiums. Even though these factors affect your insurance cost, you must always disclose honest and relevant information to the insurance company.

What does life insurance exclude?

All life insurance plans are different, and it is recommended to go through the policy document carefully. Having said that, life insurance typically excludes death caused by suicide or self-inflicted injuries, death caused by participation in illegal activities, or death caused by engaging in hazardous activities such as skydiving, paragliding, and other adventure sports.

What is the life insurance term that I should choose?

The right life insurance term depends on your specific needs and goals. It is recommended to assess your financial situation and financial responsibilities. For instance, if you have dependent parents, a spouse, and children who rely on your income, you can opt for a longer term that provides financial coverage until your dependents are financially independent. If you have a loan, you can choose a policy term that provides coverage for the loan's repayment period. It is essential to carefully evaluate your insurance needs and choose a policy term that provides adequate coverage for your specific concerns and situation.

Which type of life insurance plan is the most affordable?

Term life insurance is typically the most affordable type of life insurance plan as it does not offer any cash value or investment component. Term policies provide coverage for a specific term, such as 10, 20, or 30 years, and only offer death benefits to the beneficiary in the case of the policyholder's unexpected demise during the policy term.

Can whole life insurance help you create a legacy?

Yes, whole life insurance can help you leave behind a legacy/inheritance for your family. This is because whole life policies cover you till the age of 99. In case of the insured person's death before this age, the life insurance policy's beneficiaries will get the sum assured. Insurance payouts are exempt from tax subject to conditions prescribed under Section 10(10D) of the Income Tax Act, 1961.

How does the Limited Pay option work in term life insurance?

The Limited Pay option in term life insurance allows you to pay the premium for a specific period, such as 10, 15, or 20 years. While the policy stays active for the chosen policy term, you only pay the premium for a limited time and not the entire term. The Limited Pay option can be a good choice if you do not want to pay premiums for the entire policy duration.

Do term insurance premiums increase every year?

No, term insurance premiums do not increase every year. The premium amount remains the same throughout the policy's term. This is why it is advised to purchase term insurance early in life. The younger you are, the lower the premium, and you get to save a lot of money throughout the policy term.

However, some term insurance policies may have increasing premiums. It is important to go through the terms and conditions of the plan before purchasing it to understand how its premium can be paid.

Should you opt for Limited Pay or Regular Pay term life insurance?

The decision to choose between Limited Pay or Regular Pay term life insurance depends on your income, financial goals, and needs. If you do not want the hassle of paying the premium for the entire duration of the policy, you may consider the Limited Pay option in term insurance. On the other hand, if you are comfortable paying the premium for the entire duration of the policy, you may consider the Regular Pay option in term insurance. It is important to understand the effect of the premium on your monthly budget and carefully opt for a policy that aligns with your financial goals and needs in the long run.

Are proceeds from life insurance taxable?

The death benefit received from a life insurance plan is entirely tax-free. The proceeds received under the policy are exempt subject to conditions under Section 10(10D) of The Income Tax Act, 1961. It is advisable to consult a tax advisor to better understand the tax implications associated with life insurance policies, as tax laws can change over time.

What are the tax* benefits applicable on a term life insurance?

Term life insurance policies offer tax* benefits on the premiums paid and the benefits received. The premiums paid under the policy are eligible for deductions subject to conditions prescribed under Section 80C of The Income Tax Act, 1961. The proceeds received under the policy are exempt subject to conditions under Section 10(10D) of The Income Tax Act, 1961.

What is the difference between term life insurance and traditional life insurance plans?

The primary difference between term life insurance and traditional life insurance plans is that the former does not have a savings feature. Term life insurance is a pure protection policy that only provides coverage for a specified period. There are generally no benefits on surviving the term. It is also generally more affordable as no savings or investment component exists. In contrast, traditional life insurance plans provide coverage for the policy term and have a savings or investment component that helps you build cash value over time.

Important documents to get your life insurance claim amount easily

Here is the list of documents required for a death claim:

- Claimant's statement form

- For Lender Borrower Group (only for Credit Life policies) - claimant's statement/claim intimation form

- For Affinity/Employer-Employee Group - claimant's statement/claim intimation form

- Original Policy Document

- Copy of death certificate issued by the local municipal authority

- Copy of claimant's photo identification proof and current address proof

- Cancelled cheque/Copy of bank passbook

- Copy of medico-legal cause of death certificate

- Medical records include admission notes, discharge/death summary, indoor case papers, test reports, etc.)

- Prior medical records of insured

- Medical attendant's/hospital certificate issued by a doctor

- Certificate from employer (for salaried individuals)

In addition to the above, the following documents are required for filing an accidental/suicidal death claim:

- Post-mortem report and chemical viscera report

- FIR/Panchnama/inquest report and final investigation report

- Copy of driving license if the life assured was driving the vehicle at the time of the accident and if the policy has the accident and disability benefit rider

Disclaimer

`~Source for Popular, Bestseller, Trending, Most Selling, Top Selling, High Demand: Company BuyOnline Data-Nov 2024 till date

`^Source: Company Buy Online Data-December 2015 till date

!aLife cover: Life Cover is the benefit payable on the death of the life assured during the policy term

ICICI Pru iProtect Smart

1 Life cover is the benefit payable on the death of the Life Assured during the policy term

2 Critical Illness benefit under ICICI Pru Non-Linked Health Protect Rider: Critical Illness rider(CI benefit) is up to life cover value capped at 1.5 crore (Subjected to underwriting guidelines). Critical Illness Benefit (CI Benefit) is optional and is payable, on first occurrence of any of the 20 or 60 illnesses covered (Classic variant covers 20 illnesses and Comprehensive variant covers 60 illnesses). Medical documents confirming diagnosis of critical illness needs to be submitted. The benefit is payable only on the fulfillment of the definition of the diagnosed critical illness. The CI Benefit, is an additional benefit which means the policy will continue with the life cover and other riders covers even after CI Benefit is paid. The future premiums payable under the policy will reduce proportionately. To know more in about CI Benefit, terms & conditions governing it, kindly refer to rider sales brochure. CI Benefit term would be equal to policy term or 20 years or (75-Age at entry), whichever is lower

3 Accidental Death benefit (ADB) is up to ₹3 crores (Subject to underwriting guidelines). ADB is available in Life Plus option. In case of death due to an accident Accidental Death Benefit will be paid out in addition to Death Benefit. Accidental Death Benefit policy term will be equal to the policy term of death benefit or (85-Age at entry), whichever is lower

4 Premium Break: You can get Premium Break under the product for a period extending by 12 months from the due date of first unpaid premium. During this Premium Break Period, the premium (including the rider(s) premium, additional premium (if any) for the other inbuilt benefits, any underwriting extra premium, loadings for modal premiums, applicable taxes, cesses and levies, etc. if any) due and payable for the said period will be deferred (“Deferred Amount”) but the risk cover under the policy and rider(s) will continue as per the terms and conditions of the policy and rider(s), respectively. In case of any claim under the Policy on the happening of any insured event during this period, the policyholder will receive the eligible claim amount under the policy after deducting all the deferred amount. This benefit option can be availed multiple times with at least 5 policy years between two Premium Break periods. The Premium Break will not be available during the last 3 policy years of the premium payment term. The Deferred Amount along with the next due Premium is to be paid within the Grace period applicable for the premium due at the next Policy Anniversary after the commencement of the Premium Break Period to ensure continuance of the risk cover under the policy

5 In the event of the death of the Life Assured and upon subsequent receipt of intimation of the death claim (with required supporting documents) by the Company, the Company shall pay an accelerated Death Benefit of Rs. 3,00,000/- (Rupees Three Lakhs only). Thiswill only be applicable where sum assured is greater than or equal to ₹1 crore and is not payable in case of death of the Life Assured during the first three Policy Years from the Date of Commencement of Risk or that from the Date of Revival of the policy whichever is later.. The immediate payout will be done within 1 working day from the Claim Registration Date, subject to submission of required documents. In case, after the evaluation or investigation of the claim records, it is found that the Death Benefit (including the applicable accelerated death benefit) is not payable to the Claimant owning to any reason whatsoever, the Claimant shall refund the entire amount paid towards accelerated Death Benefit within 7 days of receipt of communication. In case the policyholder has opted for a Death Benefit Payout Option whereby a part or the whole of the death benefit is payable in monthly instalments, this accelerated death benefit amount will be the lowest of:

6 A Life Assured shall be regarded as Terminally Ill only if that Life Assured is diagnosed as suffering from a condition which, in the opinion of two independent medical practitioner’s specializing in treatment of such illness, is highly likely to lead to death within 6 months. The terminal illness must be diagnosed and confirmed by medical practitioner’s registered with the Indian Medical Association and approved by the Company. The Company reserves the right for independent assessment. Terminal Illness benefit will not be applicable in case the policy is sourced through POS personnel

° The policyholder will have an option to cancel the Policy and receive Smart Exit Benefit i.e. 100% of Total Premiums Paid under the Policy

The following conditions are applicable for availing 100% Premium Refund:

Where, Total Premiums Paid means the total of all premiums received, excluding any extra premium, any rider premium and taxes. In case the benefit term for additional benefit(s), for which additional premium has been paid, has expired at the time of exercise of Smart Exit Benefit, then Total Premiums Paid shall exclude the premium paid towards such additional benefit(s). Please refer to sales brochure for more details

S A discount as follows will be offered on first year’s premium of Death Benefit (excluding rider premiums, underwriting extra premiums and taxes) to salaried customers:

| Premium Payment Option | Discount |

|---|---|

| Limited Pay | 15% |

| Regular Pay | 12.5% |

F Flat 15% lifetime discount is applicable for females as compared to male lives for across all sum-assured, Policy Term, Premium Payment Term and age combinations. The discount is only available on the base premium

‘ The online discount percentages vary according to age, policy term , premium payment term and sum assured chosen by the customer and can range between 1%-5%. The exact 5% discount appears at the following scenario: ₹ 50 lakh of life cover for a 30-year-old healthy non-smoker male (occupation: non-salaried) for a policy term of 35 years with regular pay and lumpsum payout option. The offline monthly premium inclusive of taxes will be ₹876 & online annual premium inclusive of taxes will be ₹832

!j Claim settlement ratio is computed basis individual claims settled over total individual claims for the financial year. For details, refer to ICICI Prudential Financial Information- Business Presentation (FY2025)

1° The 1st year online premium of ₹399 p.m. (less than ₹14/day) has been calculated for a 21-year-old healthy male (Occupation: Salaried) life with monthly mode of payment and premiums paid regularly for the policy term of 45 years with income payout option of 10 years with Life Cover of ₹50 lakh. The premium amount is exclusive of taxes. Premium back value is ₹2,12,724

2a The 1st year online premium is ₹440 p.m. and has been approximately calculated for a 19-year-old healthy male life (occupation: salaried) with monthly mode of payment and premiums paid regularly for the policy term of 28 years with income payout with Life Cover of ₹1 crore. The premium amounts are exclusive of taxes

*D1 15% is the discount factor available if the policyholder opts for ICICI Pru iProtect Smart Plus with death benefit payout option of ‘income’ with income duration of 10 years, as compared to the premium in death benefit payout option of lump sum

* Tax benefit of ₹ 54,600 (₹ 46,800 u/s 80C & ₹ 7,800 u/s 80D) is calculated at highest tax slab rate of 31.2% (including Cess excluding surcharge) on life insurance premium u/s 80C of ₹ 1,50,000 and health premium u/s 80D of ₹ 25,000. Tax benefits under the policy are subject to conditions under Section 80C, 80D, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details

** Tax benefits/Tax-free returns are subject to conditions under Sections 80C, 80D, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services tax and Cesses, if any will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details

D4 Lumpsum Payout: This is one of the four available death benefit payout options. Under 'Lumpsum' option, 100% of the benefit amount is payable i.e in a single instalment

D1 Monthly income: This is one of the four available death benefit payout options. Under ‘Income’ option, a percentage of the benefit amount is payable every year throughout the income term of 10 years as chosen at policy inception. This will be paid in equal monthly instalments in advance at for income term of 10 years i.e. 0.83333% of death benefit will be payable as monthly in advance. At the time of death claim approval and at any time after the start of monthly income, the beneficiary will have the option to convert the outstanding monthly income into lump sum pay out and the Policy will terminate after the lump sum payout. The lump sum amount will be the present value of future payouts calculated at a discount rate

ICICI Pru iProtect Super

1 Life cover is the death benefit payable on death of the Life Assured during the policy term.

I Income Documents waiver is subject to your financial eligibility based on income estimated using on third party data base & underwriting criteria.

P Premium Break: You can get Premium Break under the product for a period extending by 12 months from the due date of first unpaid premium. During this Premium Break Period, the premium (including the rider(s) premium, additional premium (if any) for the other inbuilt benefits, any underwriting extra premium, loadings for modal premiums, applicable taxes, cesses and levies, etc. if any) due and payable for the said period will be deferred (“Deferred Amount”) but the risk cover under the policy and rider(s) will continue as per the terms and conditions of the policy and rider(s), respectively. In case of any claim under the Policy on the happening of any insured event during this period, the policyholder will receive the eligible claim amount under the policy after deducting all the deferred amount.

6 A Life Assured shall be regarded as Terminally Ill only if that Life Assured is diagnosed as suffering from a condition which, in the opinion of two independent medical practitioner’s specializing in treatment of such illness, is highly likely to lead to death within 6 months. The terminal illness must be diagnosed and confirmed by medical practitioner’s registered with the Indian Medical Association and approved by the Company. The Company reserves the right for independent assessment.

3 The policyholder will have an option to cancel the Policy and receive Smart Exit Benefit, equal to Total Premiums Paid under the Policy. The following conditions are applicable for availing Smart Exit benefit:

Where, Total Premiums Paid means the total of all premiums received including Rider Surrender Value if applicable, excluding any extra premium, and taxes. In case the benefit term for additional benefit(s), for which additional premium has been paid, has expired at the time of exercise of Smart Exit Benefit, then Total Premiums Paid shall exclude the premium paid towards such additional benefit(s). Please refer to sales brochure for more details.

4 Accidental death benefit option available through ICICI Pru Non-Linked Accidental Death and Disability Rider: Under this option, if the person whose life is covered by this benefit option (known as the Life Assured) passes away, due to an accidental death which happens within the Coverage term such that death happens 180 days from the date of accident, the sum assured for ADB will be paid out as a lump sum to the person specified (known as the Claimant) in the policy, provided the benefit option is in-force at the time of the accident. Maximum Sum Assured available under Accidental Death Benefit option will be equal the Sum Assured on Death at inception for the base policy (capped at ₹ 1Crore)

5 Accidental total and permanent disability benefit option available through ICICI Pru Non-Linked Accidental Death and Disability Rider: If the life assured covered by this benefit option become totally, continuously and permanently disabled as a result of accident i.e., Accidental Total Permanent Disability and meets any of 3 clauses as defined in the policy document, the Accidental Total and Permanent Disability Sum Assured will be paid out as a lump sum to the nominee. On payment of the Accidental total and permanent disability Sum Assured to the Claimant, the benefit option will terminate and all rights, benefits and interests under the option will stand extinguished. Maximum Sum Assured available under Accidental Total and Permanent Disability Benefit option will be up to the Sum Assured on Death at inception for the base policy (capped at ₹ 1 Crore). For more details, kindly refer to the Rider policy document.

! The 5% discount on 1st year premiums is applicable only on ICICI Pru iProtect Super policies purchased online.

F The 15% percentage has been calculated by comparing the premium for a 20-year-old healthy male and 20-year-old healthy female, for a life cover of ₹1 crore for a policy term of 40 years for a regular premium pay mode. The premium (inclusive of taxes) for this case for the male is ₹ 958 per month and for a female is ₹ 814 per month. Flat 15% discount is applicable for females for across all sum-assured, Policy Term, Premium Payment Term and age combinations. The discount is only available on the base premium.

L Loyalty discount of 7% on the first years premium is available only on ICICI Pru iProtect Super for our ICICI Prudential Life Insurance existing customers.

6a The first year monthly premium of ₹505 for a 19-year-old healthy non-smoker male have been calculated for Regular Pay premium payment option with a policy term of 24 years with a life cover of ₹ 50 lakh. The above premiums are online and are inclusive of taxes.

W/II/1439/2024-25

ICICI Pru iProtect Super UIN:

ICICI Pru Non-Linked Accidental Death and Disability Rider. UIN: 105B042V02

ICICI Pru iProtect Smart Return of Premium

1Life cover is the benefit payable on death of the Life Assured during the policy term

3Return of premium is available on survival of life assured till the completion of the policy term, for a fully paid policy. This will be 100% of Total premiums paid i.e. the total of all the premium paid under the base product, excluding any extra premium, rider premium and taxes, if collected explicitly. On completion of the policy term and payment of maturity benefit, the policy will terminate and all rights, benefits and interests under the policy will stand extinguished.

4Accidental death benefit option available through ICICI Pru Non-Linked Accidental Death and Disability Rider: Under this option, if the person whose life is covered by this benefit option (known as the Life Assured) passes away, due to an accidental death which happens within the Coverage term such that death happens 180 days from the date of accident, the sum assured for ADB will be paid out as a lump sum to the person specified (known as the Claimant) in the policy, provided the benefit option is in-force at the time of the accident. Maximum Sum Assured available under Accidental Death Benefit option will be up to three times the Sum Assured on Death at inception for the base policy (capped at Rs. 3 Crore).

5Accidental total and permanent disability benefit option available through ICICI Pru Non-Linked Accidental Death and Disability Rider : If the life assured covered by this benefit option become totally, continuously and permanently disabled as a result of accident i.e., Accidental Total Permanent Disability and meets any of 3 clauses as defined in the policy document, the Accidental Total and Permanent Disability Sum Assured will be paid out as a lump sum to the nominee. On payment of the Accidental total and permanent disability Sum Assured to the Claimant, the benefit option will terminate and all rights, benefits and interests under the option will stand extinguished. Maximum Sum Assured available under Accidental Total and Permanent Disability Benefit option will be up to the Sum Assured on Death at inception for the base policy (capped at Rs. 3 Crore). For more details, kindly refer to the Rider policy document.

F The 15% percentage has been calculated by comparing the premium for a 20-year-old healthy male and 20-year-old healthy female, for a life cover of ₹1 crore for a policy term of 40 years for a regular premium pay mode. The premium (inclusive of taxes) for this case for the male is ₹ 1,441 per month and for a female is ₹ 1,225 per month. Flat 15% discount is applicable for females for across all sum-assured, Policy Term, Premium Payment Term and age combinations. The discount is only available on the base premium.

*Tax benefits under the policy are subject to conditions under Section 80C, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details.

W/II/1208/2024-25

ICICI Pru iProtect Smart Return of Premium. UIN. 105N195V01.

ICICI Pru Non-Linked Accidental Death and Disability Rider. UIN: 105B042V02

~*Additional Maturity Benefit is offered for online sales: For the Lump Sum Plan option, 2.5% of Sum Assured on Maturity is applicable for Limited pay. In the case of Single Pay in Lump Sum Plan option, 1% of Sum Assured on Maturity is applicable. For the Income Plan option, 2.5% of Guaranteed Income is applicable. For the Early Income Plan option, 3.5% of Guaranteed Income is applicable. For the Single Pay Income Plan option, 1% of Guaranteed Early Income is applicable

!’The yearly online premium of ₹960 (less than ₹99 per month) is for a 22-year-old healthy non-smoker male who has bought ICICI Pru Heart / Cancer Protect, with cancer cover of ₹20 lakh, paying premiums regularly for 13 years, inclusive of tax.

3Refer to the product brochures for the definitions, exclusions and other terms and conditions applicable for Permanent Disability due to an accident and Terminal Illness.

+The policyholder can have funds in only one of the Portfolio Strategies.

#Excluding taxes and Top-up Premium Allocation Charges.

UIN details: ICICI Pru iProtect Smart - . ICICI Pru Signature - . ICICI Pru Guaranteed Pension I13 & I14 UIN - . ICICI Pru Guaranteed Pension Plan Flexi - . ICICI Pru Saral Pension Plan - . ICICI Pru Guaranteed Wealth Protector -

COMP/DOC/Jan/2022/101/7213

1The company will allocate extra units to your ULIP policy provided all due premiums have been paid. To know more in detail, kindly refer to the sales brochure of the respective products.

8As per currently applicable tax laws, tax benefit of ₹ 54,600/- ( ₹ 46,800/- under Section 80C and ₹ 7,800/- under Section 80D) is calculated at the highest tax slab rate of 31.2% (including Cess excluding surcharge) on life insurance premium under Sections 80C of ₹ 1,50,000/- and health premium under Section 80D of ₹ 25,000/-. Tax benefits under the policy are subject to conditions under Sections 80C, 80D, 80CCC, 10(10A), (10D) and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on the above.

~#Your annuity/income is informed to you when you buy the plan and is guaranteed and unchanged for life.

//Tax benefits under the policy are subject to conditions under Sections 80C, 80CCC, 115BAC and other provisions of the Income Tax Act, 1961. Goods and Service Tax and Cesses, if any, will be charged extra as per prevailing rates. The tax-free return is subject to conditions specified under Section 10(10D) and other applicable provisions of the Income Tax Act, 1961. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on the above.

"Guaranteed Additions (GAs) rate will be 9% for a policy term of 10 years and 10% for a policy term of 15 years. GAs will be added to the policy at the end of every policy year if all due premiums have been paid. Each GA will be calculated as GA rate multiplied by the total premiums paid till date (excluding extra mortality premiums, Goods & Services Tax and Cess (if any)).

`*Wealth Boosters equal to 3.25% of the average of the Fund Values including Top-up Fund Value, if any, on the last business day of the last eight policy quarters will be allocated as extra units to your policy at the end of every 5th policy year starting from the end of the 10th policy year till the end of your policy term.

^*Systematic Withdrawal Plan is allowed only after the first five policy years.

-Guaranteed Maturity Benefit (GMB): Your GMB will be set at policy inception and will depend on the policy term, premium, premium payment term, age and gender.

~~Guaranteed benefits in the form of lump sum will be payable under the Lump Sum Plan option. Guaranteed benefits in the form of regular income will be payable under the Income Plan option and Early Income Plan option.

$How much life insurance do you really need? - https://economictimes.indiatimes.com/wealth/insure/how-much-life-insurance-do-you-really-need/articleshow/22065416.cms?from=mdr

$$Why men often die earlier than women - https://www.health.harvard.edu/blog/why-men-often-die-earlier-than-women-201602199137

ΘGuaranteed benefits are payable subject to all due premiums being paid and the policy being in force on the date of maturity.

°The total amount is calculated for a 30-year-old healthy male with a premium paying term of 10 years paying premiums in monthly mode and income period of 30 years taking income in annual instalments under the Income Plan option. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and the policy is in force till the completion of the entire policy term opted. The total benefit of ₹ 1,01,77,830 is calculated by taking the sum of all guaranteed incomes payable over the entire income duration. COMP/DOC/Dec/2021/3012/7166

ΘGuaranteed benefits are payable subject to all due premiums being paid and the policy being in force on the date of maturity.

ↃGuaranteed Maturity Benefit (GMB) will be set at policy inception and will depend on the policy term, premium, premium payment term, Sum Assured and gender. Your GMB may be lower than your Sum Assured. GMB is the Sum Assured on maturity.

£Bonuses consist of vested reversionary bonuses, interim bonus and terminal bonus, if any. Reversionary bonuses may be declared every financial year and will accrue to the policy if it is premium paying or fully paid. Reversionary bonuses will be allocated through the compounding bonus method. All reversionary bonuses will be declared as a proportion of the sum of the GMB and the vested reversionary bonuses. Reversionary bonus once declared is guaranteed and will be paid out at maturity or on earlier death. A contingent reversionary bonus may be declared every financial year and will accrue only to a policy if it becomes paid-up. Contingent reversionary bonus will be a part of the paid up benefit and will be paid on maturity or earlier death. A terminal bonus may also be payable at maturity or on earlier death.

ŦGuaranteed Additions (GAs) totaling 5% of GMB each year will accrue during the first five policy years if all due premiums are paid. GAs accrue on payment of due premium.

±Tax benefit of ₹ 46,800/- is calculated at the highest tax slab rate of 31.2% (including Cess excluding surcharge) on life insurance premium under Section 80C of ₹ 1,50,000/-. Tax benefits under the policy are subject to conditions under Sections 80C, 80D, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on the above.

≠ΘGuaranteed benefits are payable subject to all due premiums being paid and the policy being in force on the date of maturity.

∞Tax benefits of ₹ 46,800/- under Section 80C is calculated at the highest tax slab rate of 31.20% (including cess excluding surcharge) on life insurance premium under Section 80C of ₹ 1,50,000/-. Tax benefits under the policy are subject to conditions under Sections 80C, 80D, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Service Tax and Cesses, if any, will be charged extra as per prevailing rates. The Tax Free income is subject to conditions specified under Section 10(10D) and other applicable provisions of the Income Tax Act, 1961. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on the above.

ꓘICICI Pru Guaranteed Income For Tomorrow (Long-term) offers 4 options in income period namely 15, 20, 25 and 30 years. The customer can choose any plan option from the four available options. Please refer to the brochure for more details.

ꞂICICI Pru Guaranteed Income For Tomorrow (Long-term) offers two plan options namely, 'Income' and ‘Income with 110% ROP’. The customer can choose any plan option from the two available options. Please refer to the brochure for more details.

+Life Cover is the benefit payable on the death of the life assured during the policy term.

!As per Internal Data of policies sold for all products from April’21-December’21 in the BOL Channel.

ADVT: W/II/5060/2021-22

&The premium of ₹ 700 p.m. has been approximately calculated for protection plans and will vary case to case depending on different payment and policy term chosen. Goods and Services tax and/or applicable cesses (if any) as per applicable rates will be charged extra.

@Life cover, Critical illness cover, Accidental death cover, Return of premiums' features are available across various protection plans available with ICICI Prudential Life Insurance.

Life cover is the benefit payable on death of the Life Assured during the policy term.

ICICI Pru iProtect Smart UIN: . COMP/DOC/Jun/2023/96/3246

ICICI Pru Savings Suraksha

1 Life Cover is the benefit payable on death of the life assured during the policy term

2 Your GMB will be set at policy inception and will depend on policy term, premium, premium payment term, Sum Assured on death and gender. Your GMB may be lower than your Sum Assured on death

3 Guaranteed Additions (GAs) totaling 5% of GMB each year will accrue during the first five policy years if all due premiums are paid. GAs accrue on payment of due premium

4 Reversionary bonuses may be declared every financial year and will accrue to the policy if it is premium paying or fully paid. Reversionary bonuses will be applied through the compounding bonus method. All reversionary bonuses will be declared as a proportion of the sum of the GMB and the vested reversionary bonuses, if any. Reversionary bonus once declared is guaranteed and will be paid out at maturity or on earlier death. A terminal bonus may also be payable at maturity or on earlier death

5Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details

* Guaranteed benefits is in the form of Guaranteed Maturity Benefit and Guaranteed Additions

ICICI Pru Savings Suraksha: UIN . ADVT: W/II/0901/2023-24

ICICI Pru Guaranteed Pension Plan Flexi

2 Joint life can be either the spouse/child/parent or sibling of the primary annuitant

3 Applicable for Joint Life options only. The policyholder can choose the waiver of premium benefit option with joint life options. On death of the primary annuitant during the premium payment term, the future premiums will be waived off and the applicable benefits will continue to be paid to the secondary annuitant. If the waiver of the premium benefit option is selected, separate annuity rates for Joint life options will be applicable. This benefit is applicable only in case of death of primary annuitant while the policy is inforce and premium paying

ICICI Pru Guaranteed Pension Plan Flexi: UIN. W/II/1054/2024-25

ICICI Pru Gold

1 In plan option ‘Immediate income’ and ‘Immediate income with Booster’, starting from the first policy year, you will receive a regular income at the end of every policy year, as chosen by you, provided the policy is in-force.

In ‘deferred Income’ plan option, you will receive regular income at the end of every year, starting from end of deferment period as chosen by you, provided the policy is in-force. You can start this income as early as 2nd policy year or as late as Premium Payment Term plus 1 year

2 For all plan options, Maturity Benefit will be sum of:

The Sum Assured on Maturity shall be the sum of Annualised Premium payable under the policy

3 ICICI Pru Gold offers three plan options namely ‘Immediate Income’ and ‘Immediate Income with booster’ and ‘Deferred Income’. The customer can choose any one of the three available options. Please refer to sales brochure for more details

4 Life cover is the benefit payable on death of the life assured during the policy term. For all plan options, Death Benefit is equal to:

Where, the Sum Assured on Death is the highest of:

5 Tax benefits under the policy are subject to prevailing conditions and provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on above.

6Bonuses: Bonuses will be applied through the simple bonus method. Cash Bonuses may be declared annually throughout the policy term for all three variants, and will be expressed as a proportion of the Annualized Premium. For a new policy sold with Date of Commencement of Risk on or after April 1 in any financial year, there may not be any Cash Bonus rate declared for such policies when the Survival Benefit becomes due to be paid. In such circumstances, the Company may pay a fixed cash income benefit in lieu of Cash Bonus. This fixed cash income benefit will be based on a non-participating Cash Income rate (declared by the Company annually in advance) and once declared shall remain guaranteed to be paid as part of Survival Benefit as and when it is due. Such payments in the form of fixed benefit shall continue till a Cash Bonus rate (as applicable for the policy) is declared and the Cash Bonus benefit, if declared, becomes payable at the next benefit due date. A separate Terminal Bonus may be declared under each variant, and will be payable on death, surrender and maturity, respectively, for a premium paying or a fully paid policy. Please refer to the sales brochure for more details.

ICICI Pru Gold UIN: 105N190V04 A Participating Non linked Life Individual Savings Product. W/II/1986/2024-25

ICICI Pru Protect N Gain

1 Life cover is the benefit payable on death of the life assured during the policy term. Death Benefit will be highest of:

3 At policy maturity, an addition, known as Maturity Booster in the form of extra units (Units mean a specific portion or part of the Unit Linked Fund(s) in which you have saved your money) will be made to boost your Fund Value. This Maturity Booster will be equal to 20% percentage of the average of the Fund Values including Top-up Fund Value, if any, on the last business day of the last eight policy quarters

4 Systematic Withdrawal Plan is allowed only after the first five policy years.

5Available through mandatory rider ‘ICICI Pru Accidental Death and Disability rider’. Please refer to the rider brochure for more details.

6Switches are only applicable for fixed portfolio strategy and not applicable for other portfolio strategies.

7The sum assured multiple in ICICI Pru Protect N Gain is calculated basis the chosen life cover, life assured’s age, premium payment term and policy term. The highest available sum assured multiple is 125 in the product.

^The premium ₹7,694 p.m. is calculated for a 30-year-old healthy male with the monthly mode of payment, premiums paid regularly for the policy term of 40 years and life cover of ₹1 crore. The premium shown is inclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and the policy is in force till the completion of entire policy term opted.

~Maturity benefit is policy fund value, including top up fund value, if any. On payment of maturity benefit, the policy terminates.

% 7.72 crore lives covered across our individual and group customers as per ICICI Prudential Life Council Report

*Tax-free returns/Tax benefits of ₹46,800 under Section 80C is calculated at highest tax slab rate of 31.20%(including cess excluding surcharge) on life insurance premium under Section 80C of ₹1,50,000/-. Tax benefits under the policy are subject to conditions under Sections 80C, 10(10D), 115BAC and other provisions of the Income Tax Act,1961. Goods and Services tax and Cesses, if any will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details

> ClaimForSure: 1 Day Death Claim Settlement is available for the following:

a) All due premiums in the policy have been paid and the policy has been active for 3 consecutive years preceding life assured’s death

b) Mandatory documents to be submitted at Branch Office- Claimant statement form, Original policy certificate, Copy of death certificate issued by local authority, AML KYC documents- Nominee’s recent photograph ,Copy of Nominee’s pan card, Nominee’s current address proof, photo identity proof, Cancelled cheque/ Copy of bank passbook, Copy of medico legal cause of death, Medical records (Admission notes, Discharge / Death summary, Test reports, etc.), For accidental death - Copy of FIR, Panchnama, Inquest report, Postmortem report, Driving license

c) Total claim amount of all the life policies held by the Life Assured <=₹ 1.5 Crore

d) Claim does not require any on-ground investigation

1 Day is a working day, counted from date of receipt of all relevant documents from the claimant, additional information sought by the Company and any clarification received from the claimant. The Company will be calling the claimants for verification of information submitted by the Claimant which will also be considered as part of relevant documents. Working day will be counted as Monday to Friday and excluding National holidays/Bank holidays/Public holidays, Interest shall be at the bank rate that is prevalent at the beginning of the financial year in which death claim has been received. In case of breach in regulatory turnaround time, interest will be paid as per IRDAI regulations. Under ULIP policies, if claim is submitted prior to 3 pm then the claim will be considered under Claim For Sure on the same day. If claim is submitted post 3pm or if the policy is inactive at the time of claim notification then the claim will be considered under Claim For Sure the next day as per availability of NAV

ICICI Pru Protect N Gain (UIN: ). ICICI Pru Linked Accidental Death and Disability Rider (UIN: )

^a The premium ₹8982 p.m. is calculated for a 40-year-old healthy male with the monthly mode of payment, premiums paid for 12 years for the policy term of 40 years and life cover of ₹1 crore. The premium shown is inclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and the policy is in force till the completion of entire policy term opted.

ADVT: W/II/1197/2023-24

ADVT: W/II/0327/2024-25

ADVT: W/II/0722/2024-25

COMP/DOC/May/2024/305/6251

ICICI Pru Platinum

1 Life cover is the benefit payable on death of the Life Assured during the policy term

2 Systematic Withdrawal Plan is allowed only after completion of five policy years

3 Tax benefits under the policy are subject to conditions under Section 80C, 80D, 10(10D) and other provisions of the Income Tax Act, 1961.

∆Maturity amount is shown for a Male 20 years old who has invested Rs 5000 per month for 20 years and policy term is 20 years. Maturity amount is shown for a Male 20 years old who has invested Rs 5000 per month for 15 years and policy term is 15 years.

4 Past performance of funds is not indicative of future performance.

ICICI Pru Platinum (UIN: 105L192V01). ADVT: W/II/0043/2024-25

IShield

This advertisement is designed for Combi Product named: iShield, UIN: . The product is jointly offered by “ICICI Lombard General Insurance Company Limited” and “ICICI Prudential Life Insurance Company Limited” which offers the combination of a Life Insurance cover offered by ICICI Prudential Life Insurance Company Limited and a Health Insurance cover offered by ICICI Lombard General Insurance Company Limited. The risks of this ‘Combi Product’ are distinct and are assumed / accepted by respective insurance companies. The liability to settle the claim vests with respective insurers, i.e., for health insurance benefits “ICICI Lombard General Insurance Company Limited” and for life insurance benefits “ICICI Prudential Life Insurance Company Limited.”

1Life cover is the benefit payable on death of the Life Assured during the policy term.

2Permanent Disability: On diagnosis of Permanent Disability (PD) due to an accident, the future premiums under your policy for all benefits are waived. To know more about definitions, terms and conditions applicable for permanent disability due to accident, kindly refer sales brochure of ICICI Pru iProtect Smart.

3The Company hereby agrees subject to the terms, conditions and exclusions herein contained or otherwise expressed, for the period and to the extent of the Sum Insured as specified in the Schedule to this Policy. The Policy covers Reasonable and Customary Charges incurred towards medical treatment taken during the Policy Period for an Illness, Accident or condition described below if this is contracted or sustained by an Insured / Insured Person during the Policy Period and subject always to the Sum Insured, any subsidiary limit specified in the schedule of Benefits, the terms, conditions, limitations and exclusions mentioned in the Policy and eligibility as per the insurance plan opted by insured and stated in as stated in the Schedule

4This benefit covers relevant medical expenses incurred during a period up to the number of days as specified in the Schedule of benefits forming part of this Policy, prior to hospitalisation or day care treatment for treatment of Disease, Illness contracted or Injury sustained for which the Insured / Insured Person was hospitalized, giving rise to an admissible claim under this Policy. This benefit is a part of benefit available under ‘In-patient treatment’ and is limited to the available Sum Insured under ‘In-patient treatment’. Pre-hospitalisation Medical Expenses can be claimed as reimbursement only.

5This benefit covers hospitalisation expenses towards medical treatment, and/or day care procedure/ treatment/ surgery incurred by the Insured / Insured Person which is undertaken under General or Local Anesthesia in a Hospital/day care centre (where 24 hours of hospitalisation is not required due to technologically advanced treatment) which shall be payable. The benefit under this Section is limited to the available Sum Insured under ‘In patient treatment’ of this Policy as mentioned in the Schedule to this Policy

6Tax benefits are subject to conditions under Sections 80C, 80D, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services tax and Cesses, if any will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details.

IShield – UIN: . ADV/17800

ICICI Pru GIFT Pro

1Life Insurance Cover is the benefit payable on death of the Life Assured during the policy term.

2Guaranteed Benefits will be payable subject to all due premiums being paid.

3Level Income and Increasing Income are income options available under GIFT Pro. Under Level Income, the Guaranteed Income will remain constant throughout the income period. If Increasing Income is selected, the Guaranteed Income will increase by 5% p.a of the base income

4You can choose to receive any percentage from 0% to 100% of the sum total of all annualized premiums payable by you as MoneyBack Benefit. This will be paid as a one time Lump sum amount. Additionally you also have the flexibilty to choose any year, on or after the maturity date of the policy up to the last income year, to receive this MoneyBack Benefit. Your Guaranteed Income amount will be adjusted based on the MoneyBack Benefit % and payout year selected by you. You can opt for these flexibilities at the inception of the policy. MoneyBack Benefit % and payout year cannot be changed later.

5Low cover income booster at the inception of the policy, you can choose to opt for “Low Cover Income Booster” wherein you will be able to receive increased income for opting a lower life cover

6You have an option to receive GI every year on a Special Date of your choice preceding the due date of first GI pay-out during the Income Period. The Special date can be chosen to coincide with any date such as, Date of Maturity, birth date or anniversary date etc. Payment of GI will commence from this Special Date and all further GIs will be paid every year on this Special Date chosen. In case You opt for a Special Date, the GI payable each year would be adjusted by multiplying the GI amount with a discount loading factor, varying by the policy month in which the Special Date falls.

7Tax benefits under the policy are subject to conditions under provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details.

~Additional Benefit is offered for online sales: For both Level Income/Increasing Income Plan option, Extra 3% of Guaranteed Income and Moneyback Benefit is applicable.

Ͱ The total amount is calculated for a 30-year-old healthy male with a premium paying term of 12 years, deferment period of 5 years, income period of 30 years taking income in annual instalment along with 100% MoneyBack with the last income under Increasing Income plan option. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and the policy is in force till the completion of entire policy term opted. 6X is calculated by taking the sum of all benefits payable and dividing it by the total premiums paid.

ICICI Pru GIFT Pro UIN:

ICICI Pru Guaranteed Income for Tomorrow

1Guaranteed benefits in the form of lump sum will be payable under Lump Sum Plan option. Guaranteed benefits in the form of regular income will be payable under Income Plan option and Early Income Plan option provided all due premiums have been paid.

2Life Insurance Cover is the benefit payable on death of the Life Assured during the policy term.

3Tax benefits are subject to conditions under Sections 80C, 80D, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on the above.

4Calculated for a 30-year-old healthy male with a premium paying term of 12 years and a policy term of 20 years for Lump Sum plan option. The premium shown is exclusive of taxes and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and the policy is in force till the completion of entire policy term opted.

~Additional Maturity Benefit is offered for online sales: For Lump Sum Plan option, 2.5% of Sum Assured on Maturity is applicable for Limited pay. In case of Single Pay in Lump Sum Plan option, 1% of Sum Assured on Maturity is applicable. For Income Plan option, 2.5% of Guaranteed Income is applicable. For Early Income Plan option, 3.5% of Guaranteed Income is applicable. For Single Pay Income Plan option, 1% of Guaranteed Early Income is applicable.

ICICI Pru Gold Pension Savings

1Guaranteed benefit is the Assured Benefit, i.e., 105% of the total premiums paid

2Bonuses are in the form of regular bonus, loyalty accumulation and terminal bonus

3Minimum 40% of the vesting benefit must be mandatorily used to purchase an annuity plan

4This can be availed after the completion of 3 policy years and allows you to encash up to 25% of the Total Premiums Paid over the lifetime of your policy. Withdrawals are allowed for the conditions of higher education of children; marriage of children; purchase or construction of a residential house or flat; treatment of critical illnesses; to meet medical and incidental expenses arising out of the disability

5Avail periodic complimentary health check-ups during the policy years on attaining 50 years of age and completion of 3 policy years. This service shall be directly provided by third party service provider(s) and the Company will not be liable for any deficiency in service by the service provider. The Company reserves the right to discontinue the service or change the service provider(s) at any time. Please read the policy document to know more

ICICI Pru Gold Pension Savings UIN:. ADVT No:- W/II/1283/2023-24

ICICI Pru Save N Grow

1 Guaranteed benefits will be payable, provided all due premiums have been paid. Guaranteed benefits are payable through ICICI Pru Guaranteed Income For Tomorrow

2 Wealth creation is through maturity benefit of ICICI Pru EzyGrow.

3 Tax benefits under the policy are subject to conditions under Sections 80C, 10(10D),115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details.

4 Life cover is the benefit payable on death of the life assured during the policy term.

5 There is no premium allocation charges in ICICI Pru EzyGrow. Starting from the 6th policy year, at the beginning of each policy month, the mortality charge (excluding taxes and excluding extra mortality charges) and policy administration charge (excluding taxes) deducted from the policy in the 60th month prior to the applicable month, will be added back to the Fund Value in the form of addition of units.

6 Maturity Booster will be allocated as extra units at the end of the policy term provided the policy is in-force. The Maturity Booster will be equal to a percentage of the average of the Fund Values including Top-up Fund Value, if any, on the last business day of the last eight policy quarters, as shown in the table below:

| Premium payment Term | Policy Term | ||

|---|---|---|---|

| 15-19 years | 20-24 years | >24 years | |

| Less than 10 years | 0.50% | 0.50% | 0.50% |

| Greater than or equal to 10 years | 0.50% | 0.50% | 0.50% |

ICICI Pru EzyGrow UIN:, ADVT : W/II/1483/2023-24

ICICI Pru Signature CG II

1 Wealth Boosters equal to 3.25% of the average of the Fund Values including Top-up Fund Value, if any, on the last business day of the last eight policy quarters will be allocated as extra units to your policy at the end of every 5th policy year starting from the end of 10th policy year till the end of your policy term.

2 Tax benefits under the policy are subject to conditions under Sections 80C, 10(10D),115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details.

4 Life cover is the benefit payable on death of the life assured during the policy term.

9 Guaranteed benefits will be payable, provided all due premiums have been paid. Guaranteed benefits are payable through ICICI Pru Guaranteed Income For Tomorrow.

12 Wealth creation is through maturity benefit of ICICI Pru Signature.

ICICI Pru Signature UIN:, ADVT : W/II/1482/2023-24

Smartkid with ICICI Pru Smart Life

~Reference for rising cost of education: https://www.thehindubusinessline.com/data-stories/data-focus/after-a-massive-dip-in-2021-education-inflation-rises-with-return-to-normalcy/article65513706.ece https://www.moneycontrol.com/news/business/personal-finance/how-education-inflation-can-hurt-your-childs-future-8682261.html

`Company pays all due premiums in your absence provided all due premiums have been paid. Units will continue to be allocated as if the premiums are being paid – to ensure that your savings for your desired goal continues uninterrupted.

*Tax benefits under the policy are subject to conditions under Section 80C, 80D, 10(10D),115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details

+Partial withdrawals are allowed after the completion of five policy years provided monies are not in Discontinued Policy Fund. You can make unlimited number of partial withdrawals as long as the total amount of partial withdrawals in a year does not exceed 20% of the Fund Value in a policy year. The partial withdrawals are free of cost. For the purpose of partial withdrawals, lock in period for Top-up premiums will be five years from date of payment or any such limit prescribed by IRDAI from time to time. Partial withdrawal will not be allowed if it results in termination of the policy

ΔChild Education Plan -Maturity amount is shown for a Male 20 years old who has invested ₹ 5000 per month for 20 years and policy term is 20 years. Child Investment Plan-Maturity amount is shown for a Male 20 years old who has invested ₹ 5000 per month for 15 years and policy term is 15 years

Advt. No.: W/II/0607/2023-24

`Tax benefits under the policy are subject to conditions under Sections 80C, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per applicable rates. Tax laws are subject to amendments from time to time. Please consult your tax advisor for more details, before acting on the above.

*Tax benefits under the policy are subject to conditions under Sections 80C, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any will be charged extra as per applicable rates. Tax laws are subject to amendments from time to time. Please consult your tax advisor for more details.

Ωhttps://www.deccanherald.com/business/1-in-3-life-insurance-policies-in-india-sold-to-women-sbi-report-1093571.html

E/II/0643/2023-24

*`Benefits from the 2nd year onwards is available under the Early Income Plan option.

Two policies of ICICI Pru iProtect Smart. UIN:

W/II/0602/2023-24