What is

retirement planning?

Retirement planning means preparing today for your future life so

that you continue to meet all your goals and dreams independently.

This includes setting your retirement goals, estimating the amount

of money you will need, and investing to grow your retirement

savings.

Every retirement plan is unique. After all, you may have very

specific ideas on how you want to spend your retired life. This is

why it’s important to have a plan that is designed specifically to

suit your individual needs.

Why

plan for retirement?

You retire from work, not life. You may have a new set of dreams

for your post-retirement life. At the same time, you may also want to

maintain your day-to-day lifestyle without worrying about

expenses.

By planning in advance, you can define the path to achieve these life goals without any financial dependence.

Here is how retirement planning can help you:

How much do you need to retire?

Figuring out how much do you need for retirement is one of the most important steps in retirement planning.

While it seems complex, you may arrive at a strong estimate by following a structured approach. This may help you understand the corpus you need to build for a financially

independent and stress-free retired life.

Here’s how you can calculate your estimated retirement needs:

Step 1: Start with your current monthly expenses

Step 2: Calculate your years to retirement. Based on your current age and your target retirement age, determine how many working years you have left to build your corpus. For example, if you are 40 and plan to retire at 60, you have 20 years to save and invest.

Step 3: Estimate the length of your retirement. Consider how long your retirement might last. With advancements in healthcare, life expectancy in India is on the rise. It's prudent to plan for a long retirement.

Step 4: Project your future expenses by adjusting for inflation. This is the most critical step. The ₹50,000 that covers your monthly expenses today will not be enough in the future due to inflation, which is the rate at which the cost-of-living increases. By factoring in inflation, you can find out the future value of your current expenses. By following these steps, you can estimate the total funds you will require throughout your retired years. From this, you can calculate the savings you need to start today to build a corpus that covers those expenses.

To make this process simpler, you can use our Online Retirement Calculator. It helps you determine exactly how much you should invest every month, starting today, to achieve your goal and live your post-retirement life without financial dependency.

What are retirement plans?

Retirement plans are fundamentally structured around two distinct stages: the accumulation phase and the distribution, or annuity, phase. The accumulation phase encompasses an individual's working years, during which a financial corpus is systematically built through consistent contributions and the compounding growth of investments.

Following this period, upon retirement, the individual transitions into the annuity phase. In this stage, the accumulated capital is converted into a regular stream of income, often through the purchase of an annuity product or the establishment of a systematic withdrawal plan, to provide sustained financial support throughout the post-employment years.

Where to invest for retirement?

Many investment options can help you save for retirement. Some options

may attract higher risks; others may help you protect your wealth.

We understand that growing your money safely is important. This is why we have designed retirement plans that suit your needs. Some of these plans offer you the potential to grow your money. There are also plans designed to ensure a guaranteed1

regular income for life.

1 T&C Apply

Retirement plans offered by ICICI Prudential Life

Advantages of retirement plans?

Below are the advantages of a retirement plan:

Returns for life

Retirement plans such as annuity plans provide you returns for life. You may choose to invest regularly or as a lump sum and stay financially independent for your entire life.

Regular income after retirement

A retirement plan helps you create a regular flow of income after retirement. Retirement plans offer a fixed income which substitutes for your pre-retirement salary. You can use this money to cover your daily expenses, such as groceries, fuel, electricity, and more. You can also meet your post-retirement goals, such as traveling, pursuing a hobby, starting a new venture, and more.

Tax2 benefits

A retirement plan provides you with tax2 benefits. You can claim a deduction of up to ₹ 1.5 lakh for the premiums paid towards the plan under Section 80C2 of the Income Tax Act, 1961. So, you can save for your future needs as well as lower your taxes.

Importance of a retirement plan

Stay financially prepared for medical emergencies

As you grow old, you may need healthcare facilities. A retirement plan can help you cover these expenses without affecting your savings.

Stay financially independent

A retirement plan can help you continue your current lifestyle even after retirement. The income from the plan can help you meet your day-to-day expenses and meet your financial goals post retirement.

Help your family as well

Retirement plans not only help you but also those around you. Income from the plan can enable you to help your loved ones, including child and your spouse, whenever they are in need of money.

Meet your financial goals

Apart from life’s necessities, retirement plans can also help you fulfil your goals post retirement. You may have retirement goals, such as traveling, pursuing a hobby, starting a new venture, and more. Retirement plans can help you fulfil these goals without any worry.

A step-by-step guide to planning your retirement

We have created a step-by-step guide that can help you plan your retirement.

Step 1: Set your retirement date

The first step of retirement planning is to answer the question: At what age would you like to retire?

You may want to retire at the age of 60, or you may want to plan for an early retirement. The time you have until retirement can affect a lot of your decisions.

For example, if you are 15 years away from retirement, you can choose to invest smaller amounts every month. You can also afford to take a more aggressive approach towards investing. In contrast, if you are 1-2 years away from retirement, you may need to invest a large amount in safer options.

You may also want to consider factors like pending loans, current savings, ability to take workload or stress, among others.

Step 2: Decide what you would like to do after retirement

You may want to live a simple life, or you may have large dreams like starting a new venture or taking up new hobbies. Your post-retirement lifestyle can dictate how much you may spend on a daily or monthly basis.

Here are some questions you can answer to find out your ideal retirement:

· Would you like to relax and spend time with family?

· Would you like to start a new business?

· Do you have any specific goals to fulfil after retirement?

· Does volunteering and helping your community excite you?

· Do you have responsibilities like your children’s education or marriage to fulfil?

These are just some of the factors you can consider to understand your ideal retirement lifestyle.

Step 3: Find out what expenses would continue after retirement

Your monthly expenses today may or may not continue post-retirement. For example, you may be paying for your child’s education currently. But if they are likely to graduate before you retire, those expenses may not continue.

You may also have lifestyle-related expenses - some of which may continue even after retirement. For example, utility bills like electricity and the internet are likely to continue.

This is why you may want to go through your current expenses and identify which ones are likely to continue post-retirement.

Step 4: Estimate the cost of your retirement goals

You may want to buy a vacation home to enjoy your post-retirement years. You may also want to take your spouse on a cruise or explore a new country every year. You need to estimate the cost of these goals that you plan to fulfil during retirement.

Step 5: Plan for an emergency fund

There can be unexpected circumstances like medical emergencies or accidents. Such situations can create a financial strain after retirement. By building your retirement savings, you can build a cushion that can minimise the impact of such unfortunate events.

Step 6: Tally the amount and add inflation

By now, you may have a clear picture of your retirement lifestyle and goals. The next step involves listing these down and assigning an amount for each goal or expense. For example, you can make a list like below:

| Expense | Cost |

| Living expenses | ₹ 50,000 per month |

| Travel | ₹ 5 lakh per year |

| Child’s education abroad | ₹ 2 crore |

| Emergency fund | ₹ 50 lakh |

Note: These numbers are just indicative in nature.

In the above example, traveling once every year for 10 years will need a budget of ₹ 50 lakh. Similarly, for 20 years after retirement, the living expenses could cost another ₹ 1.2 crore. Add to this, child’s education of ₹ 2 crore and an emergency fund of ₹ 50 lakh.

When you add up all these expenses, it amounts to an estimate of ₹ 4.2 crore.

You will also need to factor in the impact of inflation on this amount.

Step 7: Calculate how much you have saved already

You may have saved regularly over the years. Your workplace may have also contributed regularly to an Employee Pension Fund. You should take stock of all your investments to date.

Next, estimate how much these investments may grow until your retirement. This can give you a good idea about how much you may need to invest further.

For example, let’s assume you are 45 years old and you have already saved ₹ 60 lakh over the years. You may expect to earn 8% returns per annum over the next 15 years. You can then expect your investments to be valued at ₹ 1.9 crore at the time of your retirement.

Step 8: Decide your monthly investment amount

You may want to invest a certain amount every month towards your retirement savings. The amount of money you invest can have a big impact. For example, if you can invest ₹ 50,000/- every month without fail for 10 years, you can set aside ₹ 60 lakh. This money can grow over the years and add a lot more value to your retirement savings.

Once you decide how much you plan to invest, you can find out the estimated value of your retirement savings. You can compare this amount with your estimated cost of retirement. This can help you identify any gaps and make necessary changes to your plan.

Step 9: Choose your investment option

Every investment option has a different way of earning returns. Some options, like equity, have a higher potential of earning returns, but they come at the cost of higher risks. Other options, like debt or fixed-income investments, offer a safer approach but may earn lower returns.

You can also choose a mix of equity and debt to grow your money.

Step 10: Choose if you want regular income or lump sum payout

The last step of retirement planning is about deciding your income after retirement.

You may plan your investments such that they mature on the day you retire and give you a lump sum amount. You can also plan in such a way that when you retire, your investments give you a lifelong regular income.

You can also invest your lump sum in an annuity plan and get lifelong regular income every month, quarter, six months or year.

Retirement Planning Stages

Your approach for retirement financial planning may differ at different stages of your life. Below is a breakdown of how you can plan your retirement through various life stages:

Young Adult (Ages 21–35)

This is the time to establish a solid financial foundation. Starting your retirement planning early allows you to save more and earn higher returns. Your must focus on selecting suitable financial instruments that can help you get the benefit of compounding over time.

Early Midlife (Ages 36–50)

During this life stage, your responsibilities towards your family may increase. However, it is also important to balance your current financial goals and your retirement needs. You may want to adjust your investment approach based on your evolving needs.

Later Midlife (Ages 50–65)

As you approach retirement, it becomes essential to assess your financial readiness. You may want to fine-tune your investment portfolio to ensure that your retirement funds are adequate for your investment. It is also important to explore healthcare plans, as your medical expenses will likely increase as you age.

COMP/DOC/Feb/2024/212/5515

How retirement plans work

Before choosing a plan, you must, first, identify your needs and goals. If you have some years until retirement and want to build a corpus, you can go for a retirement savings plan. If you are nearing retirement and have some funds you invest in, you can choose a retirement annuity plan.

If you invest in a retirement savings plan, you get a lump sum amount as your retirement fund on maturity. You can invest the entire lump sum amount or a part of it in an annuity plan to get lifelong regular income.

When you invest in retirement annuity plans, you will start getting regular income every month, quarter, six months or year starting either immediately or at a later period as per your need.

Depending on the Retirement plan you choose, you have the power to control5:

- How you want to grow your retirement fund

- If you want lump sum or regular payouts

- When your regular income starts

- Whether you get your regular income every month, quarter, six months or

year

Tips for retirement planning

Below are some tips for your retirement planning:

Save for retirement now

Instead of delaying matters for a later stage in life, consider planning for retirement immediately. Saving early gives more time for your money to grow, hence, providing a greater income during your retirement. Investing in a retirement plan during your earning years can also help you save tax2.

Be prepared for future financial emergencies

It is important to have an emergency fund to rely on. This can help you in your hour of need and cover the costs of unplanned expenses. So, when investing your money, make sure that you save adequately for any unexpected financial requirements.

Explore various life insurance options

Life insurance can safeguard your loved ones with a protective financial security in your absence. Therefore, add some life insurance options to your list when exploring and comparing investment plans.

Diversify your investments

When preparing for the future, try to choose different types of investment options that put your money in varying asset classes, industries, and sectors. This way, if you suffer a loss in one investment or if one option does not perform per your expectations, you can rely on the others.

Think about your retirement wants

Keep your retirement wants in mind when choosing an investment option. For instance, if you wish to settle in a new city, your monthly expenses could be higher, depending on the city. Likewise, if you like to travel, you may spend more on travel expenses in retirement than someone who prefers being at home. Your wants can help you choose a suitable plan that can generate sufficient returns.

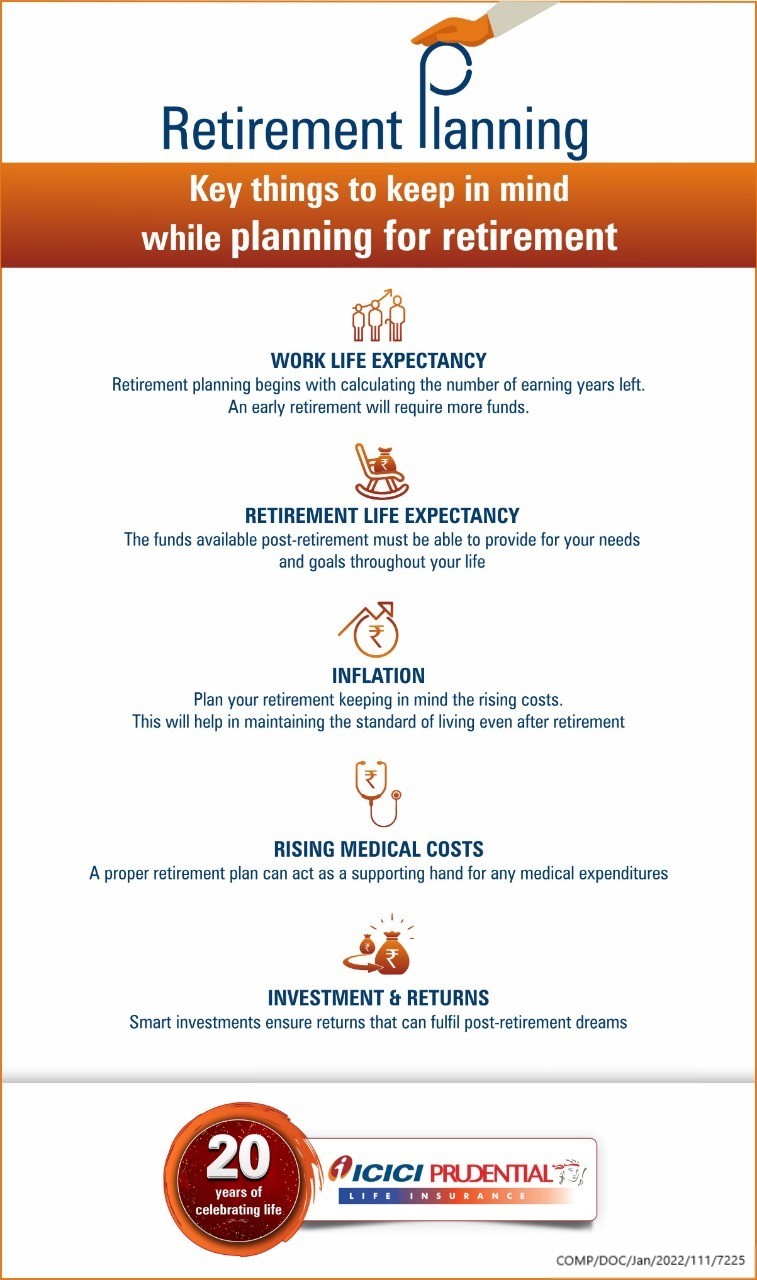

Factors to keep in mind while

planning for retirement

Frequently asked questions

1. Why do you need retirement planning?

You may have several dreams for your post-retirement life. With a little retirement planning in advance, you can fulfil your post-retirement goals while maintaining the same lifestyle.

With rising inflation, the cost of all products and services is increasing. With a sound retirement plan, you can ensure that your retirement funds are protected against inflation as well. It can also help you be ready for any unforeseen financial emergencies.

2. Why choose a retirement plan?

A retirement plan is designed to take care of your post-retirement days and help you lead a stress-free life. One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life. Such plans help you set aside some amount towards your retirement while you are still working. The other type is a retirement annuity plan where you invest a one-time amount and receive a guaranteed1 regular income either immediately or at a later period from the purchase date.

3. What is the ideal income I need during retirement?

Every retirement is unique. This is why, the money you need for your retirement depends on various factors like:

- Your retirement age

- Your health and lifestyle

- Any loans or liabilities

- The retirement goals you may have

- Any commitments you may have to fulfil

We can help you find out the amount you would require in a matter of seconds with our pension calculator. Just answer a few basic questions on your income, age, the number of years till you want to retire, and the premium amount you want to invest.

You can use our pension calculator to understand the ideal income you would require as per your needs.

4. What are some effective ways to plan for retirement and achieve my financial goals?

You may consider the below steps to plan for your retirement and achieve your financial goals:

- Set a target retirement age

- Identify your retirement goals

- Calculate the amount you will need to meet these goals. Factor inflation into the calculation

- Save/invest in the right retirement plan that can help you stay financially prepared to meet your post-retirement goals

5. When should I start planning for retirement and how much do I need to save to prepare?

You should start planning for your retirement as early as possible. Investing early offers more time for your money to grow and give higher returns. This helps you stay financially prepared for your post-retirement needs.

The amount you need to save for retirement depends on your post-retirement goals. You may want to travel, buy a house, start a new venture and more. You would also want to continue your current lifestyle after retirement and meet medical expenses. Basis these, you can calculate the amount you will need during your retirement. Do not forget to factor inflation into this calculation. Once you have calculated the amount you will need for your retirement, you will be able to calculate the amount you need to save now to stay financially independent during retirement.

6. How can I make sure my retirement savings will last throughout my lifetime, even if I live longer than expected?

You may consider buying a retirement annuity plan that provides you with a fixed income for life. Plans like ICICI Pru Guaranteed Pension Plan Flexi provide you with guaranteed~ income that is fixed at the time of the purchase of the plan. This income is paid to you throughout your life

~ T&C Apply

7. What steps can I take to adjust my retirement plan if my circumstances change, such as needing to retire earlier or later than expected?

It is important to regularly review and update your retirement plan to cater to your changing requirements. You may plan to retire earlier or later than what you planned earlier. Your post-retirement goals may also change. Reviewing your retirement plan regularly can enable you to adjust it to meet your needs.

8. What is deferment?

When you buy an annuity plan, you can choose to get your regular income from the very next month onwards. These plans are called immediate annuity plans.

However, you can also choose to start getting your regular income at a later date, provided it is within the time frame specified in the terms and conditions of the plan you choose. This is called ‘deferment’. For example, in the Deferred Annuity options of ICICI Pru Guaranteed Pension Plan, you can choose to get your regular income at any time between 1 and 10 years from the date of purchase.

W/II/0153/2023-24

People like you also read...

Disclaimers:

fcCalculated for a 30-year-old healthy male with a premium payment term of 10 years for limited pay option. The premium shown is exclusive of any additional charges and the mentioned benefit is payable only if all premiums are paid as per the premium paying term and the policy is in force till the completion of entire policy term opted. The annuity amount is an estimated annuity payable on policy vesting (assuming 40% vesting benefit is annuitized). The annuity amount is assumed at an annuity rate of 7% & is for illustration purpose only. The actual annuity amount receivable depends on the prevailing annuity rates at the time of vesting. With vesting age assumed as 60 years, the total corpus is calculated basis the past 5 years returns of the Pension Opportunities Fund (16.17%).

exYou can get an additional pension of 1% on the purchase price when you buy online. Loyalty Booster and Online Booster cannot be taken together. This benefit is not available for NPS reinvestments.

>An enhanced benefit will be offered on surrender anytime from date of commencement of policy to the end of the Deferment Period for eligible policies purchased through the online platform. This amount payable will be the surrender value as described under the section “Surrender” in the sales brochure, subject to minimum of 100% of Total Premiums Paid till the date of surrender.

~Your annuity/income is informed to you when you buy the plan and is guaranteed~ and unchanged for life. Conditions Apply.

2 Payment received in commutation of pension is tax-free u/s 10(10A) of Income Tax Act, 1961. Tax benefits are subject to conditions under Sections 80CCC, 10(10A), 115BAC and other provisions of the Income Tax Act, 1961. Taxes, if any will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details.

1Annuity will be payable in arrears. The frequency of annuity payments can be monthly, half-yearly, quarterly or annually as chosen by the annuitant at the time of purchasing the annuity. The annuity amount chosen at policy inception is guaranteed for life

2Tax benefits under the policy are subject to sections 80C, 80CCC, 80CCD, 115BAC & other provisions of the Income Tax Act, 1961. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on the above

4Unit Linked products are different from traditional insurance products and are subject to the risk factors

The premium paid in ULIPs are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/ her decisions. ICICI Prudential Life Insurance is only the name of the Life Insurance Company and ICICI Pru Signature is only the name of the unit linked insurance product and does not in any way indicate the quality of the product, its future prospects and returns

Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document issued by the Insurance company

The various funds offered under this product are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns

You get the option to get regular money from your fund value with Systematic Withdrawal Plan. Systematic Withdrawal Plan is allowed only after the first five policy years

5The benefits mentioned might not be available with all products. Please refer to the product brochures for details

10Source: State, area and gender key to life expectancy, shows data

11Life cover is the benefit payable on death of the life assured

12Explained: Why inflation risk is growing in India

13A guaranteed lump sum or regular income will be payable based on the plan option selected

ICICI Pru Signature Pension

In this policy, the investment risk in investment portfolio is borne by the policyholder. The Linked Insurance Products do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender or withdraw the monies invested in Linked Insurance Products completely or partially till the end of the fifth year

@Payment received in commutation of pension is tax-free u/s 10(10A) of Income Tax Act, 1961. Tax benefits are subject to conditions under Sections 80CCC, 10(10A), 115BAC and other provisions of the Income Tax Act, 1961. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details.

#This is called “Partial Withdrawal” and can be availed after the completion of the lock-in period of 5 policy years. The partial withdrawal amount shall not exceed 25% of the fund value as on date of request. Withdrawal is subject to conditions as prescribed in the sales brochure.

!Return of charges is in the form of Pension Booster, which will be paid on vesting. The Pension Booster shall be sum of all premium allocation charges, policy administration charges, and mortality charges deducted (excluding taxes) till the time of vesting.

ICICI Pru Signature Pension: .

+Your annuity/income is informed to you when you buy the plan and is guaranteed+ and unchanged for life. Conditions Apply.

%Joint life can be either the spouse/child/parent or sibling of the primary annuitant

&This option is available only with Joint-life & under this option, on death of the Primary Annuitant during the premium payment term, the future premiums will be waived off and the applicable benefits will continue to be paid to the Secondary Annuitant. This benefit will be applicable only in case of death of Primary Annuitant while the policy is in-force and premium paying or a fully paid policy.

3Under this option, the investment in this plan will be returned to the nominee after the annuitant’s demise

ICICI Pru Guaranteed Pension I13 & I14 UIN:

ICICI Pru Guaranteed Pension Plan Flexi -

W/II/1842/2025-26

W/II/3741/2021-22

COMP/DOC/Sep/2025/129/1136

COMP/DOC/Aug/2022/238/1005

W/II/0998/2025-26

ICICI Pru Signature

Pension

Pay ₹10,000 p.m for 10 years

Get ₹2.31fc crore on retirement

Get ₹89,833 monthly income for life