In ULIPs, the investment risk in the investment portfolio is borne by the policyholder (U)

The Linked Insurance Products do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender or withdraw the monies invested in Linked Insurance Products completely or partially till the end of the fifth year.

Understanding how ULIPs work along with the various features of ULIPs will help you make an informed decision for your future financial needs.

Introduction to ULIPs+

A Unit Linked Insurance Plan (ULIP) is a unique investment instrument with the added protection of life insurance. Through systematic investments and market-linked returns, ULIPs allow you to create wealth for your long-term goals like your dream house, your child's education, your retirement and more. At the same time, it also ensures that your goals are achieved even in case of an unforeseen event, through a life cover^.

ULIPs enable you to place your money in various equity or debt funds, as per your risk appetite. While the premiums you pay are deductible from your taxable income under Section 80C#, the returns are also tax-free subject to Section 10(10D)# of the Income Tax Act, 1961. Thus, ULIPs are a triple bonanza of monetary security for your family, capital appreciation, and tax savings.

Here’s a clear understanding of how ULIPs work to help you get more value and the above mentioned benefits.

How ULIPs Work

- To venture into the capital market with ULIPs, you have to decide the level of life cover^, premium amount, premium payment option and policy term to match your financial protection and savings needs

- You can select the premium payment frequency as monthly, half-yearly, or yearly basis at your convenience and opt between an upfront, lump sum payment, and recurring payments on an annual, half-yearly, or monthly basis

- One part of your premium goes towards providing you with a life cover^

- The other larger part of your premium is invested in the stock market via equity, debt, or hybrid funds based on your preferences

- Equities place your money into stocks. Debt funds channel your capital into bonds, government securities, and other low-risk investment tools. Hybrid funds balance the risky yet high return potential of equities with the stability of debt funds

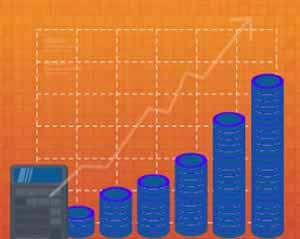

- The money invested in these funds defines the value of your policy. The longer you stay invested, the better your chances of getting higher returns

- In case of an unfortunate incident during the policy tenure, your nominee will receive the sum assured to fulfil their dreams

Features of Unit Linked Insurance Plans

Investment allocation

One of the features of ULIPs is that you can choose the type of funds~ you want to invest in as per your risk appetite. You can choose to be aggressive with equity funds, decide to stay conservative with debt funds, or enjoy the best of both with balanced funds. Even after investing, you can direct your future premiums towards the funds of your choice by making use of this feature of ULIP.

Fund switch

If you foresee a change in market conditions or your requirements from your investment change, you can switch from one fund type to another. The ability to switch between funds is a feature of ULIPs that gives you the flexibility to modify your investment as per your requirements. You can safeguard your investments from market fluctuations by diverting your investments into debt funds during market slowdowns and change back to equities during upswings. All this is available within the same plan, at any time, without any additional costs or charges.

Partial withdrawal##

The option to withdraw money from your plan is one of the key features of ULIP. In case of an emergency, you can withdraw money from your funds after the five-year lock-in period. The number of withdrawals permitted and the cap on withdrawal amounts depend on the plan you choose.

Top-ups

With a change in your life stage and needs, you may want to increase your investment from time to time. One of the features of ULIP is that you can invest an additional amount over and above your regular investment in the plan. This additional investment can provide you with a larger amount at the end of the tenure of the plan.

Tax-saving Instrument

Premiums paid towards ULIPs are tax-free# up to ₹ 1.5 lakh per annum under Section 80C of the Income Tax Act, 1961. The amount received at the end of the tenure of the policy is also tax-free# under Section 10(10D). Tax saving benefits are one of the best features of ULIPs as they add to the returns from the plan.

Multiple premium payment options

This feature of ULIPs offers you to pay your premiums as per your convenience. You can choose to pay monthly, half-yearly or annually. You can also opt for the single premium payment option if you do not want to pay regularly.

Conclusion

With a clear idea of how ULIPs work, you can now make a more informed decision about this investment avenue. It is beneficial to stay invested for a longer duration. The effect of market volatilities are compensated in the long term. With time, higher percentages of your premiums go into the investment funds, empowering you to achieve all your future goals.