You strive to provide comfort, happiness, and security to your family and want your and your family’s health and future to be secured at all times.

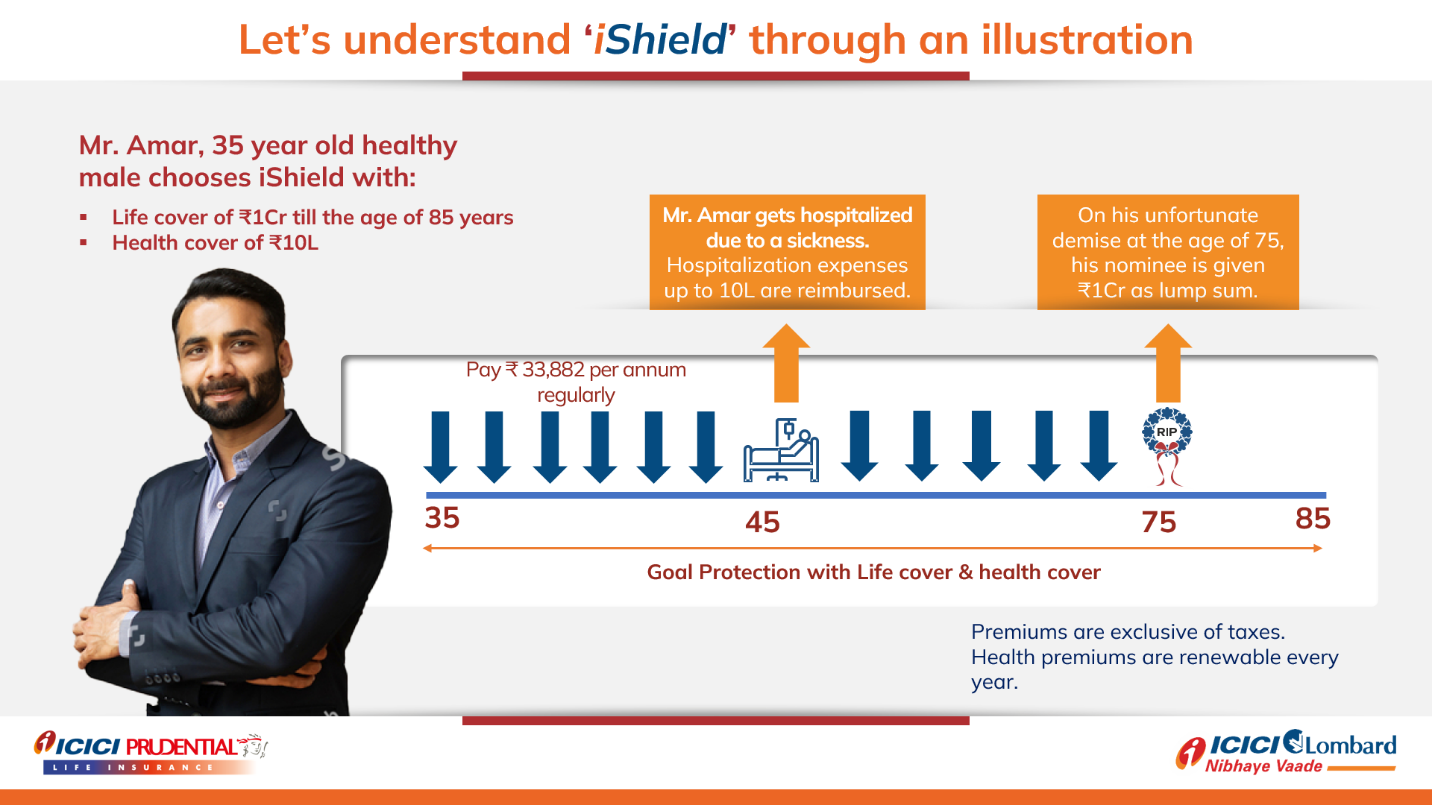

To assist you, ICICI Lombard General Insurance Co. Ltd. and ICICI Prudential Life Insurance Co. Ltd. have come together to bring you iShield, a comprehensive and affordable combi policy with dual benefit of health and life insurance which helps provide a safety net for you and your family so that you can lead a comfortable life without any worries.

Key Features of iShield:

1. Get dual benefit of Health and Life Insurance:

Health Insurance:

- Cashless hospitalisation3: Get reimbursement for medical expenses incurred during hospitalisation for more than 24 hours, including room charges, doctor/surgeon’s fee, medicine bills, and more

- Pre and Post hospitalisation4 expenses: Get reimbursement for medical expenses incurred pre and post hospitalisation

- Day care treatment5: Get reimbursement for medical expenses for advanced, technological medical surgeries and procedures requiring less than 24 hours of hospitalisation(including dialysis, radiotherapy and chemotherapy)

- Restore benefit7: Get facility to restore your balance sum insured up to 100% of the base sum insured once in a policy year in case the sum insured, including accrued additional sum insured (if any), is insufficient as a result of previous claims in that policy year

- Get multiple add-on benefits like sum insured protector, claim protector and value-added services like 24x7 online and telephonic consultations, wellness programs, and much more

Life Insurance:

- Longer cover1: Get life cover till the age of 85

- Get Waiver of future premiums2 in case of permanent disability due to an accident: In case of permanent disability due to an accident, the company waives all future premiums and your policy continues uninterrupted

- Get Terminal illness cover8: Get a lumpsum payout if you are diagnosed with terminal illness

- Payout options: It gives you 3 flexible life cover payout options to choose from

| Options | Details |

|---|---|

| Income | In your absence, your nominee will receive a regular monthly income for 10, 20 or 30 years, as chosen by you at policy inception. This ensures that your loved ones have a steady source of income for a long period of time. |

| Lump Sum | In your absence, your nominee will receive the life cover as a lump sum payout. This ensures that your loves ones have an adequate amount to take care of all major liabilities. |

| Increasing Income | This payout option gives you extra life cover than originally selected. In your absence, your nominee will receive a regular increasing monthly income payable for 10 years. Each year, the income will increase by 10% p.a. simple interest every year. This ensures that your loves ones have a steady source of income, which is increasing year on year. |

Your premiums will vary as per the life cover (death benefit) payout option chosen by you.

2. Multiple combinations to choose from:

Choose from 4 combinations to get a following coverage:

| Combination | Life Cover1 (in ₹) | Health Cover (in ₹) |

|---|---|---|

| 1 | 50lakh | 5lakh |

| 2 | 50lakh | 10lakh |

| 3 | 1crore | 10lakh |

| 4 | 1crore | 20lakh |

Health cover

1.What does health cover include?

iShield offers varying degrees of health coverage. Please refer to the Key information sheet in the booklet to learn more about your policy coverage.

2. What is annual sum insured?

Sum Insured" or Annual Sum Insured means the sum as specified in the Schedule to this Policy against the name of Insured / each Insured Person at the inception of a Policy Year and in the event of Policy is upgraded or downgraded on any continuous Renewal, then exclusive of Cumulative Bonus, if any, the Sum Insured for which premium is paid at the commencement of the Policy Year for which the prevalent upgrade or downgrade is sought.

3. How soon can I file a hospitalisation claim on my policy?

There is a waiting period of 30 days from the start of the first time you buy the policy before which a claim cannot be made for any illness, except for hospitalisation due to injury or accident. For OPD related claims, the waiting period works differently and is explained in the next question.

Apart from this, there are some illnesses for which you cannot make a claim for the first 2 years (refer to e. exclusions of the policy wordings for this list).

4. What is the difference between a cashless and a reimbursement claim?

Cashless3 and reimbursement are two different ways to settle a claim: Cashless claim is a claim where the agreed claim amount is paid by the insurer directly to the hospital. You need not pay the claim amount to the hospital. You are required to inform your insurer about the procedure or treatment and send all the related documents.

Reimbursement claim is a claim where you settle the bill with the hospital and then send the relevant documents to your insurer. The insurer will then reimburse you for the agreed claim amount.

5. Can I file multiple claims in the year?

Yes, you may file multiple claims in the year, subject to the total amount of the claims not exceeding the sum insured on your policy.

6. Will my policy cover medical treatment at any hospital I choose?

ICICI Lombard has an extensive network of hospitals with which it works to offer cashless3 and reimbursement facilities for your treatment. However, there are some hospitals that are delisted and ICICI Lombard will not cover any medical expenses for treatment taken in these hospitals. The list of these delisted hospitals is available with your policy document. The updated list of delisted hospitals is also available on our website www.icicilombard.com. Please call us at our toll free number 1800 2666 should you need more information on this.

7. When do I have to renew my policy?

You get a grace period of 30 days after the expiry date of the policy, within which you can renew the policy without making a fresh application. During this period, you will not be covered for any ailments or accidents but the same policy can be continued. However, it is in best of your interest to pay your renewal premium while your policy is still in force so that you can enjoy uninterrupted coverage.

8. How can I renew my policy?

You can renew your policy either by paying the renewal premium online or by calling us at our toll free number 1800 2666. Alternatively, you may also visit your closest ICICI Lombard branch.

9. Will the premium be the same when I renew my policy?

Your premium depends on your age and the extent of coverage you have opted for in your policy.

If you move to a higher age band at the time of renewal, the premium will change as per new age band. In case of an individual policy, the age of individual is checked. For floater policies, age of the senior most member is considered.

If, at the time of renewal, you upgrade your policy to a higher sum insured, add on covers or make changes to the number of people covered, your premium will change.

10. If I have made a claim, does that affect the renewal of my policy?

In case you have made a claim in the current year, you will not be eligible for guaranteed cumulative bonus - 20% additional sum insured. However, the accrued guaranteed cumulative bonus shall not be impacted.

11. How can I create my online account with ICICI Lombard to avail these services?

You can avail of these services through your personal login on our website. Log on to www.icicilombard.com and click on the IL Healthcare option which you will find under 'Claims and Wellness'.

Go to the customer log in section and sign up to fill in and submit the form.

You will get a reference number and message informing you that your ID will be activated in 24 hours.

After you receive an email with your log in credentials, log into the system to avail the value added services available for you.

With this online account you can also access your policy certificate, policy information, claim forms, list of empaneled hospitals and more. If you have any other question(s) or cannot access your account then please call us at our toll free number 1800 2666 or e-mail to us at customersupport@icicilombard.com.

Life cover

12. Does this policy have waiver of premium2?

In case of permanent disability due to an accident, the company waives all future premiums pertaining to life insurance and your policy continues uninterrupted.

13. Is death due to suicide included in this policy?

Yes, death due to suicide is covered. If the Life Assured, whether sane or insane, commits suicide within 12 months from the date of commencement of risk of this Policy, the Company will refund higher of 80% of the total premiums paid including extra premiums, if any till the date of death or unexpired risk premium value as available on date of death, provided the policy is in force. In the case of a revived Policy, if the Life Assured, whether sane or insane, commits suicide within 12 months of the date of revival of the Policy, higher of 80% of the total premiums paid including extra premiums, if any till date of death or unexpired risk premium value as available on date of death will be payable by the Company. The Policy will terminate on making such a payment and all rights, benefits and interests under the Policy will stand extinguished.

14. At what age can I start this policy ?

You can start this plan from the age of 18. But, the maximum age should not exceed 60 years.

15. What are the premium payment options available under this policy?

Only Regular pay is available.

16. How much premium do I have to pay?

The premium will depend on the Life Cover amount and other Benefit Options you choose.

17. What are the protection benefits available in this plan?

1. Death and Terminal Illness8: Your nominee receives the Life Cover1 amount in case of your death. You get 100% cash payout of the total life cover amount if you are diagnosed with terminal illness. The policy will close on payment of either the death benefit or the terminal illness benefit. Terminal Illness refers to the high likeliness of death within the next six months as diagnosed by medical practitioners that specialise in the same. To know more about the details of Terminal Illness, refer to the information provided in the product brochure.

2. Permanent Disability2: The company pays all due premiums on your behalf in case of permanent disability caused due to an accident. Permanent Disability~ will be triggered if you are unable to perform 3 out of the 6 following activities permanently and consistently for 6 consecutive months:

- Mobility: The ability to walk a distance of 200 meters on flat ground

- Bending: The ability to bend or kneel to touch the floor and straighten up again and the ability to get into a standard car, and out again

- Climbing: The ability to climb up a flight of 12 stairs and down again, using a handrail if needed

- Lifting: The ability to pick up an object weighing 2 kg at table height and hold it for 60 seconds before replacing the object on the table

- Writing: The ability to write using a pen or pencil, or type using a computer's keyboard

- inability or ability (permanent and irreversible): Permanent and irreversible loss of sight to the extent that even when tested with the use of visual aids, vision is measured at 3/60 or worse, using a Snellen eye chart

Common FAQs for Health and Life Insurance

18. In iShield, can one policy (health/life) get issued and the other declined? How will the policy issuance work?

No, both policy (health and life) will either get issued together or get declined together. Also, iShield will get issued post acceptance of both life and health policies.

| Eligibility criteria | Health insurance | Life Insurance | ||||

|---|---|---|---|---|---|---|

| Minimum age at entry | Individual: 6 years Floater: 91 days | 18 years | ||||

| Maximum age at entry | Individual: 65 years for adult and 25 years (for dependent children) | 60 years | ||||

| Policy term | 1 |

|

||||

| Mode of premium payment | Single (on a renewable basis) | Yearly | ||||

| Min. age at maturity | Lifelong renewable plan | 23 years | ||||

| Max. age at maturity | 85 years | |||||

| No. of lives covered | Maximum 5 members can be covered in a single policy | 1 |