What is an Endowment plan?

Endowment plans are life insurance plans that offer life cover along with a fixed lump sum or income benefit, to the policyholder. An endowment policy can be used to build a risk-free savings corpus, while providing financial protection for family in case of an unfortunate event. This simplicity of an endowment plan has over the years made it an attractive savings plan for all.

A good endowment policy provides you with the confidence to meet any financial emergency in the future. It provides you with returns that can help you meet your non-negotiable life goals, such as your child’s education or marriage, fulfilling the needs and aspirations of your loved ones and yourself, and more.

COMP/DOC/Jan/2022/41/7184

How Do Endowment Plans Work?

An endowment plan offers fixed returns at the end of the policy term. At the same time, the plan also offers a life cover that gives financial coverage to your loved ones in case of an unfortunate event.

In an endowment plan, you can choose the amount you want to pay as premiums, basis your requirements. The life cover offered by the plan is generally 10 times your annual premium. The returns offered by the plan are fixed at the time of the purchase of the plan. Depending on the plan you choose, you may get the flexibility to pay your premiums monthly, half-yearly, yearly, or all at once. Similarly, you may choose to get the returns from the plan as a lump sum or as regular income.

Below is an example that can help you understand this better.

Mr. Mehta is 35 years old. He is planning for his daughter's future education expenses. He invests in an endowment plan for 15 years. He chooses to pay ₹ 5 lakh every year as premium towards the plan. He gets a life cover of ₹ 50 lakh. Additionally, he will get returns on his premiums towards the end of the policy term.

COMP/DOC/Mar/2023/223/2563

Why should you buy an Endowment Policy?

There are a lot of reasons to purchase an endowment policy. It can help you build your financial pool with regular savings. The money received at maturity can be used for various short and long term financial goals, such as a child’s education, buying a car, post-retirement goals, and more. It also helps you protect your family financially, in case of an unfortunate event, through the in-built life cover.

Types of endowment life insurance plans

Unit-linked endowment plans - In these plans, a part of your premium goes into a life cover and the remaining is invested in equity funds, debt funds or a mix of both. You can choose to invest in the fund of your choice basis your risk appetite and financial goals

Full/with profit endowment plans - Under these plans, the basic sum assured is pre-decided at the start of the policy term. However, the final payout is higher than the sum assured since bonuses&8 get added to this amount basis the performance of the insurer

Non-profit endowment plans - These are similar to full endowment plans. The sum assured is pre-fixed. However, there are no bonuses. Instead, guaranteed policy additions are given at the time of maturity along with the maturity benefits

Low-cost endowment plans - These plans allow you to save and collect the funds for financial needs that might occur after a specified period of time, such as re-payment of mortgages, loans, and more

Benefits of an Endowment Policy

There are broadly four benefits of an endowment policy.

Life insurance benefit - Your loved ones are always taken care of. The life insurance benefit gives a lump sum pay-out, ensuring that even in your unfortunate absence your family members are able to continue the life you so carefully planned for them. This is a fixed amount and is given to your nominee/legal heir. Do remember some policies also give guaranteed additions and Reversionary Bonus which are considered in the calculation of death benefit

For instance, a 35-year-old person buying ICICI Pru Savings Suraksha pays ₹ 30,000 annual premium for a sum assured on death# of ₹ 3 lakh. So, they are getting 10 times sum assured for the premium

Maturity benefit - As long as you pay timely premiums and keep the endowment policy active, the maturity benefit is intact. This is a guaranteed maturity benefit~6 amount that will enable you to meet your financial goals. This maturity benefit depends on the policy term, policy premium, premium payment term, age, and gender. You may get guaranteed additions7 on maturity in some policies. Apart from this, in participatory policies, you may also get Accrued Reversionary bonuses and Terminal bonuses

Tax benefit1 - Endowment insurance plans also offer tax benefits1. The premiums you will pay can help you reduce your taxable income under Section 80C of Income Tax Act1. There are tax benefits available on maturity of endowment policies as well. This helps you save tax at the time of inception of the policy and accumulation stage, and also the maturity stage

Loan benefit - Endowment policies can help you use them to get a loan. After a policy acquires a surrender value you can take a policy loan. The interest charged on such loans is quite competitive. For instance, some ICICI Prudential traditional plans offer a loan amount of up to 80% of the surrender value. The loan benefit helps you arrange funds in emergency and when all other routes of collecting funds are blocked

Option to add riders - Endowment plans offer additional riders to enhance the coverage of the plan. You can add a critical illness rider, an accidental death rider, or a permanent disability rider and enjoy increased protection

Low risk - An endowment policy is usually a low-risk investment. Your money grows over time with most endowment products and your returns are guaranteed

Dual purpose - You get to enjoy the dual benefit of insurance as well as investment. Your savings continue to build over time and your family stays secure in the case of an unfortunate event

Explore protection and savings plans in different categories

Salient features of an Endowment Policy

Endowment policies offer a whole range of features. Let us go through them, one by one.

Guaranteed savings no matter what - An endowment policy gives fixed returns. So, your financial goals and family's future are always in safe hands

Dual Benefits - Endowment policies provide dual benefits of savings and life cover. Plus, the returns are tax-free so real returns are higher

Premium flexibility - Premium payment can be done on monthly, half-yearly, and on yearly basis

Zero risk - Endowment plans come with zero risks for you. As long as you pay premiums on time, all your benefits are safe. There is zero risk

Earn bonus - Endowment plans offer additional bonuses. The bonuses&8 is the extra amount of money which a policyholder can get

No market risk - Endowment policies are non-linked. In these policies will not be dependent on

Who should buy an Endowment Policy?

An endowment policy is suitable for anyone from a young professional to a senior citizen. Most of us have family responsibilities that we need to take care of. Also, most of us have long term non-negotiable goals that need to be achieved no matter what.

If you are looking for a low-risk plan with the two-in-one benefit of insurance and investment, go for an endowment policy.

If you are looking for lump sum maturity for long-term goals, an endowment plan is suitable for you.

If you want to save small amounts of money over the long-term and get tax benefits, an endowment policy is best for you.

If you want zero risks in an investment, endowment plan is the one you should consider.

Things to consider before buying an Endowment Policy

The market is flooded with different endowment policies. How do you find the best one? The answer is easy if you know what the things you need to look at are.

Affordable premium - The cost of the premium is probably the first thing insurance customers look. Since endowment policies are a long-term financial commitment, an affordable premium is a must. A very big premium amount may lead to a situation when you are forced to stop due to exigencies

Guaranteed addition/bonus - Some Endowment policies offer guaranteed additions (GAs)7. Guaranteed Additions (GAs) are added to the policy at the end of every policy year if all due premiums have been paid. This addition is paid as a rate of all premiums paid so far. This means you will get continuous rewards for continuing with a policy

Claim settlement ratio and process - You must choose an endowment policy from an insurer who has a high and consistent claim settlement ratio. Additionally, a simple and fast claim process should be preferred. Buy policies from an insurer where claims can be reported online, at branches, central office, SMS or email etc

Financial status of the insurer - Storms can't uproot trees with deep roots. The financial strength of an insurer is vital. Buy endowment policies from an insurer who has an independent certification of financial strength. For instance, ICICI Prudential Life Insurance has been rated iAAA since 2009 by rating agency ICRA. This Claims Paying Ability rating measures an insurance company’s ability to meet policyholder obligations

Flexible premium payment options - Invest in a plan that allows you to pay premium monthly, quarterly, or annually, so that it suits your income pattern

Option to add riders - Riders can provide you with increased benefits. Make sure to look for an insurer that lets you add riders to your policy to enhance the scope of the coverage

Plan early - If you buy an endowment life insurance plan early, not only do you get lower premiums with a high sum assured, you can also choose a long policy term and generate a large savings fund over time

COMP/DOC/Sep/2021/309/6669

| Lets Connect! |

|---|

If you have any queries regarding the online purchase of our Savings Plan, please give us a call on

180030069777 |

Power of Compounding Calculator

See how your investments grow exponentially over time, to give you significant returns

People like you also read ...

ICICI Pru Cash Advantage (UIN: 105N132V02), ICICI Pru Savings Suraksha (UIN:105N135V02), ICICI Pru Assured Savings Insurance Plan (UIN: )

# Death benefit

On death of the life assured during the policy term, for a premium paying or fully paid policy , the following will be payable:

Death Benefit = Highest of,

Sum Assured plus accrued Guaranteed Additions and Bonuses*

GMB plus accrued Guaranteed Additions and Bonuses*

Minimum Death Benefit

*Bonuses consist of vested reversionary bonuses, interim bonus and terminal bonus, if any

Minimum Death Benefit is equal to 105% of sum of premiums paid till date (excluding extra mortality premiums, Goods and Services Tax and Cess (if any). All policy benefits cease on payment of the death benefit.

** Mentioned guaranteed addition is for 25 years male, 10 year premium payment term, 30 year policy term, ₹ 10, 00,000 sum assured and ₹ 1,00,000 annual premium exclusive of taxes.

1Tax benefits are subject to conditions under Sections 80C, 80D, 10(10D), 115BAC and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on the above.

2. If the policy offers guaranteed returns, then these will be clearly marked “guaranteed” in the Benefit Illustration. Since the policy offers variable returns, the given illustration shows two different rates of assumed future investment returns. The returns shown above are not guaranteed and they are not the upper or lower limits of what you might get back, as the maturity value of policy depends on a number of factors including future investment performance

ICICI Pru GIFT Long-term:

<Guaranteed income is payable subject to all due premiums being paid and the policy being in force on the date of maturity.

^ICICI Pru Guaranteed Income For Tomorrow (Long-term) offers 4 options in income period namely 15, 20, 25 and 30 years. The customer can choose any plan option from the four available options. Please refer to the brochure for more details

2 ICICI Pru Guaranteed Income For Tomorrow (Long-term) offers two plan options namely, 'Income' and ‘Income with 110% ROP’. The customer can choose any plan option from the two available options. Please refer to the brochure for more details

3 Save the Date: The policyholder has the option to receive GIs on any one date, succeeding the due date of first GI pay-out, to coincide with any special date such as birth date or anniversary date. This option needs to be selected at policy inception or before the completion of the premium payment term and is only available with annual mode of income. The GIs payable from the special date will be increased for the deferment period i.e. the period between the due date of first GI pay-out and the special date, at an interest rate of 3.00% p.a. compounded monthly. Any change in interest rate will be subject to prior approval from IRDAI. The last GI will be paid on the date of maturity of the policy and not on the special date. Therefore, the interest rate mentioned above shall not be applicable for the last GI

*Tax benefits of ₹46,800 u/s 80C is calculated at highest tax slab rate of 31.20%(including cess excluding surcharge) on life insurance premium u/s 80C of ₹1,50,000. Tax benefits under the policy are subject to conditions under Section 80C, 80D,10(10D), 115BAC and other provisions of the Income Tax Act,1961. Good and Service tax and Cesses, if any will be charged extra as per prevailing rates. The Tax Free income is subject to conditions specified under section 10(10D) and other applicable provisions of the Income Tax Act,1961. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on above.

4Life Cover is the benefit payable on death of the life assured during the policy term

ICICI Pru Guaranteed Income For Tomorrow (Long-term) UIN: 105N185V11

ICICI Pru GIFT :

^^Guaranteed benefits in the form of lump sum will be payable under Lump Sum Plan option. Guaranteed^^ benefits in the form of regular income will be payable under Income Plan option and Early Income Plan option.

** Benefits from 2nd year onwards is available under the Early Income plan option.

## Save the Date: You can choose to receive income on any one date succeeding the due date of first income to coincide with any special date. This option is available only for Income and Early Income options.

*Tax benefits of ₹46,800 u/s 80C is calculated at highest tax slab rate of 31.20%(including cess excluding surcharge) on life insurance premium u/s 80C of ₹1,50,000. Tax benefits under the policy are subject to conditions under Section 80C, 80D,10(10D), 115BAC and other provisions of the Income Tax Act,1961. Good and Service tax and Cesses, if any will be charged extra as per prevailing rates. The Tax Free income is subject to conditions specified under section 10(10D) and other applicable provisions of the Income Tax Act,1961. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on above.

+ Life Cover is the benefit payable on death of the life assured during the policy term

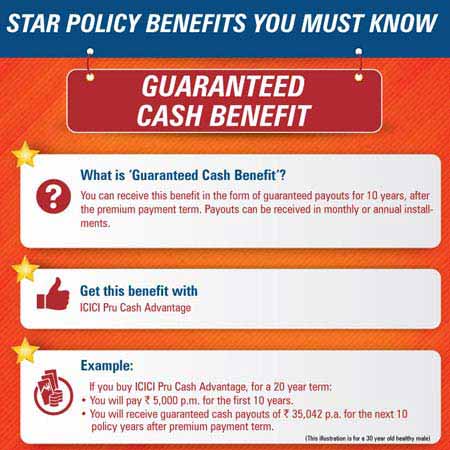

ICICI Pru Cash Advantage :

~GMB: GMB is the Sum Assured on Maturity and will be calculated, at inception, based on your premium, premium payment option, premium payment mode, Sum Assured on Death, cash benefit mode, age and gender.

5GCB: Guaranteed Cash Benefit (GCB) is payable in advance during the payout term provided the life assured is alive and the policy is fully paid, payout term begins as soon as the premium payment term is over and terminates at the end of the policy term. GCB can be received in monthly or annual installments. GCB is a percentage of the Guaranteed Maturity Benefit (GMB) and depends on cash benefit mode opted. It is equal to 1% of GMB every month throughout the payout term of 10 years for monthly mode and 11.5% of GMB every year for annual payout mode.

$Guaranteed Benefits: Guaranteed benefits are payable only if all premiums are paid as per the premium paying term and the policy is in-force till the completion of entire policy term opted.

&Bonus: Reversionary bonuses may be declared every financial year and will accrue to the policy if it is premium paying or fully paid. Reversionary bonus once declared is guaranteed and will be paid out at maturity or on earlier death. A terminal bonus may also be payable at maturity or on earlier death.

ICICI Pru Savings Suraksha:

6GMB: Your GMB will be set at policy inception and will depend on policy term, premium, premium payment term, Sum Assured on death and gender. Your GMB may be lower than your Sum Assured on death.

7GA: Guaranteed Additions (GAs) totaling 5% of GMB each year will accrue during the first five policy years if all due premiums are paid. GAs accrue on payment of due premium

8Bonus: Reversionary bonuses may be declared every financial year and will accrue to the policy if it is premium paying or fully paid. Reversionary bonuses will be applied through the compounding bonus method. All reversionary bonuses will be declared as a proportion of the sum of the GMB and the vested reversionary bonuses, if any. Reversionary bonus once declared is guaranteed and will be paid out at maturity or on earlier death. A terminal bonus may also be payable at maturity or on earlier death

9Guaranteed Benefits: Guaranteed benefits is in the form of Guaranteed Maturity Benefit and Guaranteed Additions.

ICICI Pru Guaranteed Income For Tomorrow UIN 105N182V06.

W/II/0938/2019-20