What makes ICICI Prudential Smart Kid Solution special?

You can enjoy the opportunity to get potentially better returns and grow your money by investing it in equity and debt funds for the long term. This combination helps you beat inflation while protecting your investments.

How does a mix of equity and debt beat inflation?

Inflation is the rate at which the price of goods and services increases over a period of time. For example, the price of a particular item has increased from `100 in 2005 to `243 in 2017.

To gain from your investments, your savings should grow at a rate higher than the inflation rate.

In order to get better returns in the long run, it is advisable to have equity exposure. Equity markets are subject to short-term market volatility. However, the effect of market volatility is negligible in the long term.

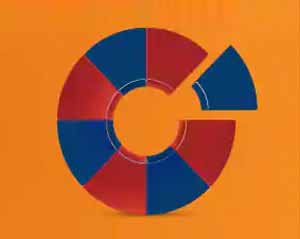

Below is an example of how investing in a mix of equity and debt can help in building your savings,

If 60% of your money was invested in the equity market and 40% in debt market## in the last 12 years, your investment would have grown by around 12% on an annualized basis. This growth would have helped you stay ahead of the inflation rate of about 7.7%# in the same period.

*Source: CEIC, CSO, CPI inflation average of 12 years (from March 2006 to March 2017)

##Equity market: BSE 100; Debt market: CRISIL Composite Bond Index (from March 2005 to March 2017)

You may want to manage your investments yourself, or want an expert to do it for you. This plan brings you the best of both worlds. With the Fixed Portfolio Strategy, you can manage your money by investing it as per your risk appetite in equity and debt funds. Whereas with the Lifecycle-based portfolio strategy, we carefully manage your money to create an ideal balance of equity and debt funds, depending on your age.

Which portfolio strategy suits me the best?

Fixed Portfolio Strategy:With this option, you can invest your money in the equity and debt funds of your choice. You can also move your money from one fund to another to suit your investment needs.

Lifecycle-based Portfolio Strategy: With this option, your money is automatically allocated to equity and debt funds based on your age. As you grow older, your money is systematically transferred from equity to debt to secure it when the policy matures.

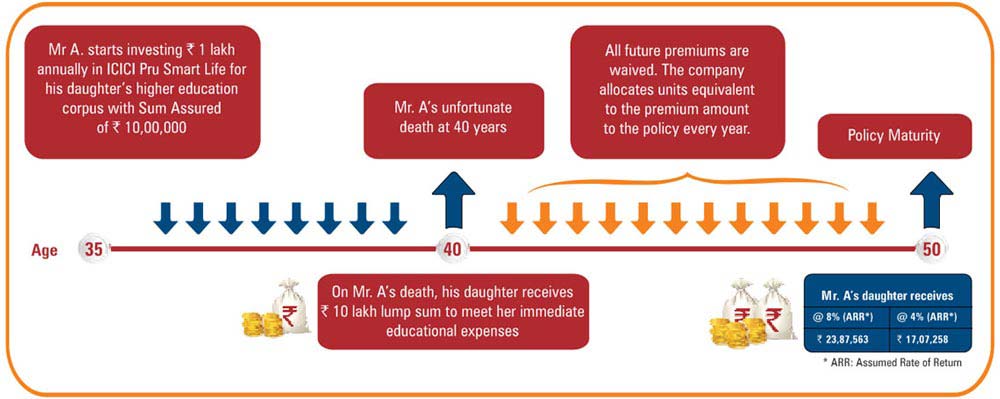

This plan provides your child an all-round protection. In case of an unfortunate event during the policy term, your child receives a lump sum amount. This amount will help cover the cost of regular expenses and help fund your child’s education.

How much lump sum amount will my family receive in my absence?

In case of unfortunate demise of the person insured, the company pays in two ways:

a) Lump Sum Benefit - A lump sum amount is paid out, to take care of any immediate liabilities of the family. The Lump Sum benefit is higher of the two amounts:

A fixed minimum amount called the Sum Assured including top-up** Sum Assured if any

Minimum Life Cover amount that is equal to 105% of the total premiums paid including top-up** premiums, if any.

**Top-up is any extra amount that you can invest and add to your existing Life Cover amount.

b) Smart Benefit -This benefit ensures that your money continues to grow for your children’s higher education. In case of an unfortunate event, the company pays all future premiums on your behalf and the policy continues uninterrupted. In addition, a Maturity benefit is paid at the end of the policy to make sure that your long term goals are fulfilled.

To reward you for being a loyal customer, the company adds to your savings further with Loyalty Additions, which helps your wealth grow.

How much Loyalty Additions do I get and when?

Loyalty Additions will be added as extra units at the end of each policy year, starting from the sixth policy year. Each Loyalty Addition will be equal to 0.25% of the average Fund Value*. It includes Top-up Fund Value**, if any, if all premiums until that year have been paid.

An extra Loyalty Addition of 0.25% will be paid every year after the 6th year if all premiums due until that year have been paid. These Loyalty Additions will be allocated to your fund in the form of units.

*Average of the Fund Values on the last business day of the last eight policy quarters where Fund Value is the total value of your money that is invested in equity and debt fund of your choice.

**Top-up Fund Value is any extra amount that you can invest and add to your Fund Value.

The company also adds Wealth Boosters to your savings. This helps you grow your money without making any additional investments.

What is the value of Wealth Boosters that I will get?

Each Wealth Booster addition will be equal to 3.25% of the average Fund Value* in the Regular Pay option and 1.5% in the One Pay option. This will also include additional Fund Value from Top-up** Fund Value, if any. The additions are made once in 5 years starting from the end of the 10th policy year, which means for a policy term of 25 years, you will receive Wealth Boosters four times.

Loyalty Additions and Wealth Boosters will be equal to the above percentage of the average Fund Values on the last business day of the last eight policy quarters.

Is this a guaranteed feature of the product?

Yes, the allocation of Wealth Booster units is guaranteed subject to regular premium payment to be made by you.

*Average of the Fund Values on the last business day of the last eight policy quarters where Fund Value is the total value of your money that is invested in equity and debt fund of your choice.

**Top-up Fund Value is any extra amount that you can invest and add to your Fund Value.

Starting from the sixth policy year, you can withdraw a part of your money as per your need. This ensures that you have easy access to your money while at the same time allowing the rest of your invested money to grow.

How much can I withdraw?

You can withdraw up to 20% of your Fund Value at any time+ after the fifth policy year.

Am I charged for making partial withdrawals?

No, partial withdrawals are completely free of cost.

Will partial withdrawals reduce the lump sum amount my nominee receives in my absence?

No, partial withdrawals will not reduce the lump sum amount that your nominee receives in your absence.

+Provided monies are not in DP Fund. You can make unlimited number of partial withdrawals as long as the total amount of partial withdrawals in a year does not exceed 20% of the Fund Value in a policy year. DP Funds refer to Discontinued Policy Funds and consist of money from lapsed policy.

With this plan, you can reduce your taxable income by investing up to `1.5 lakh under Section 80C. This will help you save tax. What’s more, even shifting your money from equity to debt or debt to equity is completely tax-free*. The money you get on maturity/death is also completely tax-free*.

*Tax benefits under the policy are subject to conditions under Section 80C, 80D,10(10D) and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on above