What are Riders in Insurance?

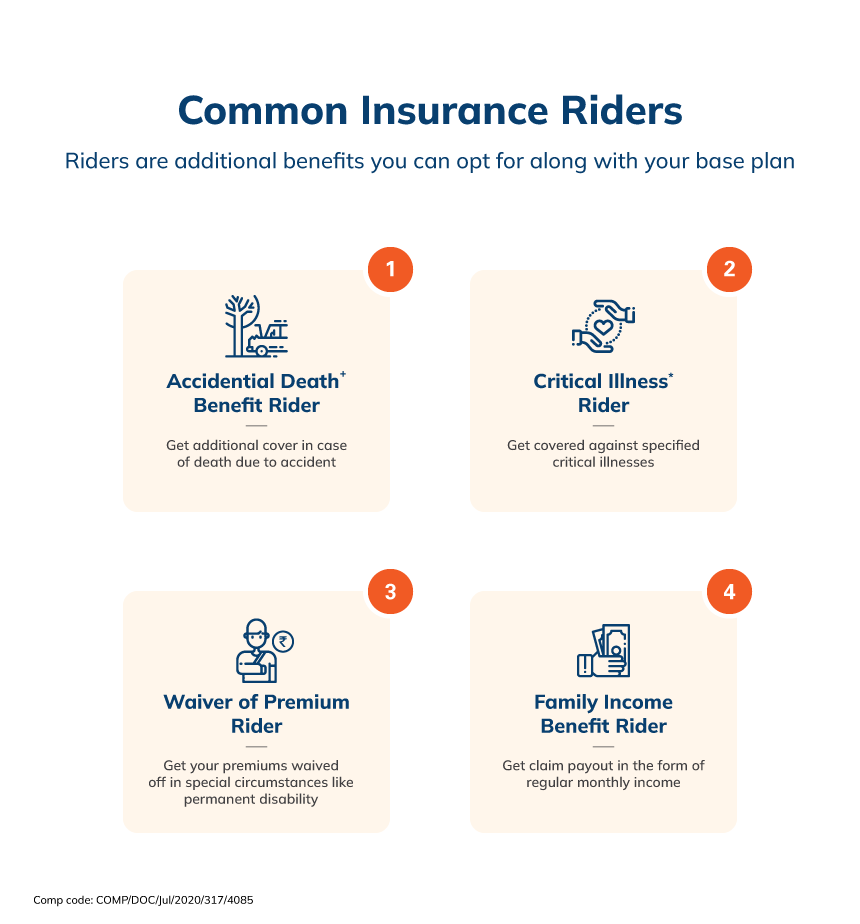

Riders are add-ons or additional benefits which you can opt for along with your current life insurance policy at affordable rates. Riders are valuable tools that help you expand your life insurance coverage.

What are the different life insurance riders?

- Waiver of premium: It ensures that your life insurance policy stays active even if you are unable to pay your premiums. The effect of this policy would be waiving off all future premiums but the continuation of the policy benefits.

- Critical illness*: Under this rider, you pay an extra amount to get yourself covered in case you are diagnosed with any of the critical ailments mentioned in the policy document. Acting like an income replacement plan, the amount received under the rider can be used to meet both medical and household expenses. Though the critical illnesses* covered under the policy may vary from one insurer to another, some ailments like cancer, heart attack, brain tumour, etc.; are covered under the rider.

- Accidental death rider+: All life insurance policies cover accidental death. However, when you buy an accidental death rider, the insurer pays up to double the sum assured to your nominee in case you die in an accident.

- Permanent & partial disability++: It is helpful in case you become temporarily or permanently disabled due to an accident. In most cases, the insurer pays a certain sum assured for the next five or ten years. Also, all future premiums on the main insurance policy are waived off by the insurance company.

- Income benefit rider: It offers a regular source of income to the family in case of the demise or disability of the policyholder.

Benefits of riders

Riders are an excellent solution to increase your insurance coverage without buying a new policy. Here are some of the key benefits of riders:

- Extra coverage: By attaching a rider to the main insurance policy, you can enjoy comprehensive coverage. For instance, a critical illness* rider pays a lump sum amount which can be used to deal with household expenses, loan EMIs and other financial liabilities apart from medical expenses.

- Affordability: Buying a rider is much more affordable than buying a separate insurance policy. Further, there are various types of riders which one can choose from as per their needs. In this way, it becomes easy to cover oneself at an affordable cost.

- Flexibility: You can add a rider to any of your insurance policies— term, ULIP, endowment, whole life— and customise your policy as per your needs.

- Tax# benefits: Riders are additions to the life insurance policies. Therefore, payments toward riders also enjoy tax# benefits as per the prevailing tax rules.

People like you also read ...