Plan your Retirement:

Retire on your terms! Retirement is a significant life milestone, and how you retire can greatly impact the quality of your post-working years. In your golden years you would want a steady stream of income to cover your daily expenses, healthcare cost and any unforeseen emergencies. You would want to live a preferred lifestyle, wish to travel, pursue hobbies, or spend time with family, having the financial means to do so is crucial.

The concept of ‘Retirement on your terms’ embodies the idea that retirement should be a carefully planned and personalized journey towards financial independence and freedom.

ICICI Pru Gold Pension Savings (GPS) is one such financial tool that navigates your journey to a stress-free retirement.

About the Plan

The plan helps you to accumulate and grow your savings over the period of your policy term. At the time of your vesting (maturity) you have the option to commute 60% of the vesting (maturity) corpus completely tax free and mandatorily annuitization 40%, which provides you guaranteed7 lifelong income.

7 T&C Apply

Key Benefits:

Invest early to reach your financial goals

Illustration:

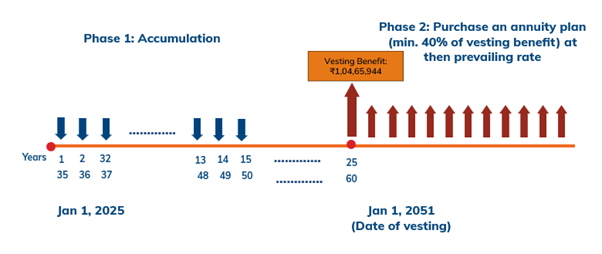

Mr. Prateek, a 35-year-old, wants to save for his retirement. He decides to pay the premium1 of ₹ 2,00,000 every year for 15 years and wants a retirement corpus at the age of 60 years, i.e. a policy term of 25 years

Below are the detail benefits received in the policy:

| Benefits payable2 | Assumed at 4% p.a. | Assumed at 8% p.a. |

|---|---|---|

| Assured Benefit on Vesting (provided all due premiums are paid) (A) | ₹ 31,50,000 | ₹ 31,50,000 |

| Estimated Accumulating Cash Bonus at the end of the Policy Term (B) | ₹ 27,713 | ₹ 15,12,809 |

| Estimated Terminal Bonus at Vesting (C) | ₹ 23,81,649 | ₹ 63,32,728 |

| Estimated Total Vesting Benefit (A + B + C) | ₹ 55,59,362 | ₹ 1,09,95,536 |

1 GST applicable on premium will be charged extra as per prevailing tax laws. 2For variable benefits, the illustrations on this page will show two different rates of assumed future investment returns. These assumed rates of return are not guaranteed, and they are not the upper or lower limits of what you might get back

At Maturity, Prateek will buy an annuity plan with a minimum 40% of Vesting (Maturity) corpus and gets guarantee7 pension (annuity) for life. The remaining 60% will be taken as a tax free lumpsum.

Eligibility Criteria:

| Premium Payment Term (PPT) | Min/ Max Policy Term (PT) | Min/ Max Age at Entry | Min/ Max Age at Vesting | Min/ Max Premium |

|---|---|---|---|---|

| Single pay: One year | 10 years / 40 years | 18 years / 70 years | 40* years / 90 years | Minimum – Single pay: ₹ 50,000 Limited/ Regular pay: ₹ 50,000 p.a.** Maximum – Subject to internal company guidelines (Board Approved Underwriting Policy) |

| Limited pay: 2 years to 15 years | ||||

| Regular pay: 10 years to 40 years |

* 55 years last birthday for policies sourced from overseas pension fund (HMRC, UK).

Premium Payment Frequency: Yearly, Half-Yearly, Monthly, Single pay

** Applicable Goods and Services Tax will be taken separately, as per applicable rates. The tax laws are subject to amendments from time to time

Tips on retirement planning

Retirement planning is an essential and crucial financial goal that requires careful consideration and preparation. Here are some tips to help you plan for a secure and comfortable retirement:

- Start Early: The earlier you begin saving for retirement, the more time your money has to grow. Even small contributions towards your retirement can add up significantly over time

- Set Clear Goals: Determine your retirement goals, including the age at which you want to retire and the lifestyle you wish to maintain. Take inflation into account

- Create Budget: To keep track of your earnings and outlays, create a monthly budget. This will assist you in determining your retirement savings capacity. Reduce wasteful spending and put the money into your retirement accounts

- Diversify Investments: Diversify your investment portfolio to spread risk

- Invest In A Retirement Pension Plan: Select a longer policy term to accumulate more when investing in a pension plan for your retirement needs

- Continuously Increase Contributions: As your income grows, try to increase your retirement contributions. Gradually increasing your savings rate can make a significant difference in the long run

- Emergency Fund: Invest in a plan that also provides you with liquidity in financial needs

- Test Your Retirement Plan: Use our retirement calculators to estimate whether your savings will meet your retirement goals

People like you also read ...