Why is ICICI Pru Anmol Bachat special?

Planning for the life events of your loved ones just got easier. With Anmol Bachat, you receive a guaranteed pay-out along with accrued bonuses when the policy matures. This corpus can be utilised at important milestones like your child’s education, their marriage or that much-awaited vacation.

How much Maturity Benefit do I get?

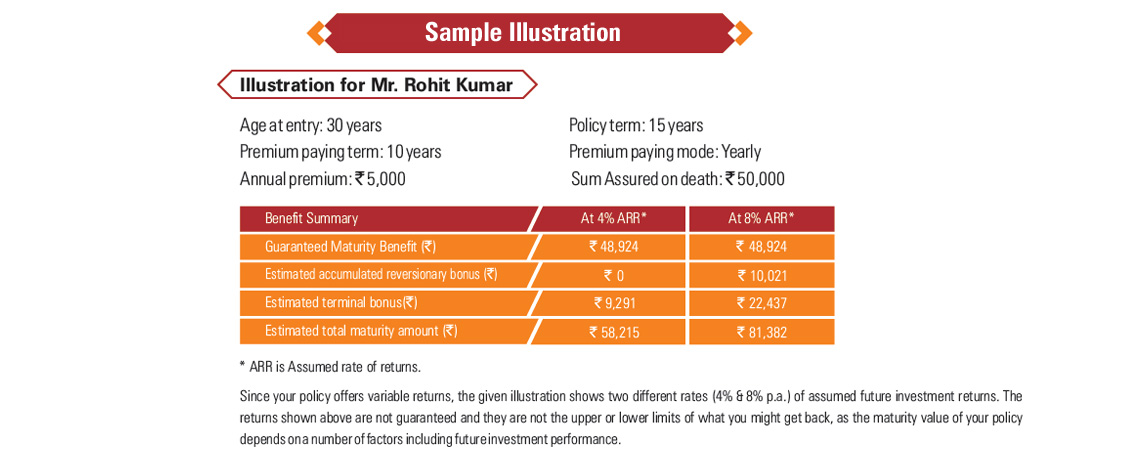

If you have paid regular premiums and survived the end of the policy term, you will receive:

Maturity Benefit, which is higher of A or B, where:

A = Guaranteed Maturity Benefit (plus vested Reversionary Bonuses and Terminal Bonuses, if any)

B = 100.1% of total premiums paid (excluding any extra Mortality Premium and taxes)

Your Guaranteed Maturity Benefit will be set at policy inception and will depend on age at entry, policy term, premium payment term and gender and maybe lower than your Sum Assured on death. All policy benefits cease on payment of the maturity benefit. Reversionary bonus, if any, will be declared each year during the term of the policy starting from the first policy year.

In case of an unfortunate event of your death, ICICI Pru Anmol Bachat supports your family. Your loved ones will receive a pay-out called the Death Benefit that helps them to fulfil their financial needs

How is the Death Benefit calculated?

Death Benefit = Higher of

Sum Assured on Death, plus subsisting bonuses* already accrued

105% of all the premiums paid as on date of death

Sum Assured on Death for Single Pay policy is defined as, highest of

Sum assured multiple X Single Premium

Minimum guaranteed sum assured on maturity

Absolute amount assured to be paid on death

Sum Assured on Death for Limited / Regular Pay policy is defined as, highest of

Sum assured multiple X Annualized Premium

Minimum guaranteed sum assured on maturity

Absolute amount assured to be paid on death

Where, Sum Assured Multiple is as per the table below.

| Sum Assured Multiple | |

|---|---|

| Single Premium and age at entry < 45 years | 1.25 |

| Single Premium and age at entry >= 45 years | 1.1 |

| RP and LP and age at entry < 45 years | 10 |

| RP and LP and age at entry ≥45 years | 7 |

In case of death due to an accident, additional lump sum equal to the absolute amount assured to be paid on death as chosen by the policyholder will be payable.

*Bonuses consist of subsisting reversionary bonuses, interim bonus and terminal bonus, if any.

Enjoy Tax benefits avail exemptions of up to ![]() 1.5 Lakhs on the premium paid. Also, on maturity you get tax-free lump sum pay-out in the form of maturity amount.

1.5 Lakhs on the premium paid. Also, on maturity you get tax-free lump sum pay-out in the form of maturity amount.

How do I avail tax benefit on the premium paid

You can claim deduction of life insurance premium paid from your taxable income as per the provisions under section 80C. The overall limit of exemption under section 80C is ![]() 1, 50,000/-.

1, 50,000/-.

How will the money I get on maturity be tax free?

Payout received on maturity may be taxable as per prevailing tax laws.

Enjoy the safety of a life cover based on your desired level of protection.