India is undergoing a transformative economic growth in the past couple of decades. You, as a part of India’s rising new generation, want to participate in India’s growth story and aspire to realise the dreams you have for your loved ones. For the non-negotiable goals you have in mind for your family, you need the right plan. The plan should also be able to take care of your family’s financial wellbeing even in your absence.

Presenting ICICI Protect N Gain- a unit linked savings life insurance plan with comprehensive protection designed to grow your wealth to fulfil your long-term goals and safeguard your family with an adequate life cover1. With ICICI Pru Protect N Gain, protect your life goals, and gain a stress-free life!

ICICI Pru Protect N Gain: A one stop solution for your Insurance and Investment needs

Protect

You and your family with a Life Insurance cover1, Accidental Death cover5 and Accidental Disability cover5

Benefits

- Life Insurance cover: Life Cover1 for the entire policy term so that your family is financially secured even in your absence

- Accidental Death cover: Accidental Death cover5 paid as lump sum in case of death due to an accident

- Accidental Disability cover: Accidental Disability cover5 paid as lump sum in case of permanent disability due to an accident

Gain

By staying longer in the policy with market linked returns

Benefits

Maturity Benefit*: Lump sum will be paid to you at the maturity of the policy equal to your policy fund value

The above maturity benefit* is inclusive of the following additions to your policy:

Growth option

- Return of 1X premium allocation charges2 and mortality charges2 from 11th policy year

- Return of 2.5X mortality charges2 from 26th policy year

- Maturity booster3 to boost your fund value at maturity

Life option

- Return of 1.5X premium allocation charges2 and mortality charges2 from 11th policy year

- Return of 3.5X mortality charges2 from 26th policy year

- Maturity booster3 to boost your fund value at maturity

GET ADDITIONAL FLEXIBILITIES WITH

SIMPLE STEPS TO BUY PROTECT N GAIN

Growth option or Life option

Choose between the two options as per your goals

Choose sum assured/ premium

In Life option ,choose the level of life cover as per your goals, income and life-stage. In Growth option, choose the premium you want to pay.

Choose the PPT & PT

Choose for how long you would like to pay the premiums (premium payment term) and for how long you would like to stay covered under the policy (policy term).

Select Funds/Strategy

Select how you want to save your money and the funds in which you want to save your money.

Plan Issued

Start paying your premiums and stay covered in the policy to achieve your protection and wealth creation goals.

Boundary Conditions

| Plan Option | Premium Payment option | Premium Payment Term (in years) | Policy term (in years) | Minimum/ Maximum age at entry (in years) | Minimum/ Maximum age at maturity (in years) | Minimum Premium | Minimum Sum Assured |

|---|---|---|---|---|---|---|---|

| Life | Limited Pay | 5 - 12 | 30 – 40 | Life: 18/55 Growth: 18/50 |

48/85 | ₹ 40,000 | ₹ 4,00,000 |

| Growth | ₹ 1,00,000 | ₹10,00,000 |

Premium Payment Frequency: Annual, Half-yearly, Monthly

Maximum Premium/ Maximum Sum Assured: Subject to internal Company guidelines i.e., Board Approved Underwriting Policy (BAUP)

Illustration

Life Option :-

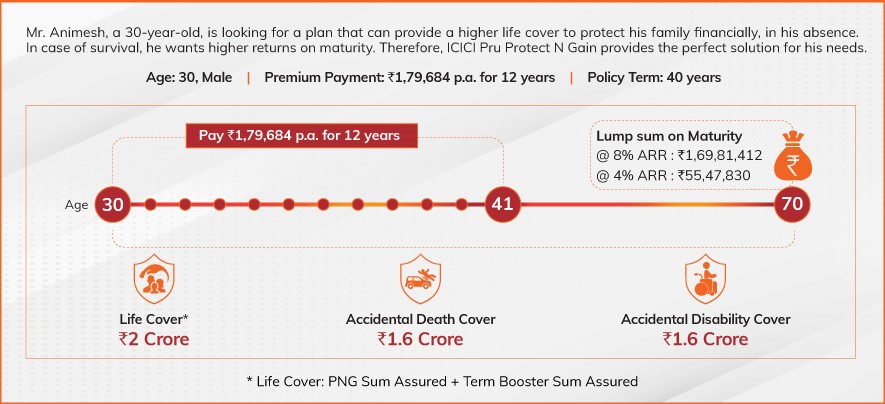

Animesh, a 30-year-old purchased ICICI Pru Protect N Gain-Life to secure family’s future and grow wealth to achieve cherished goals. He selected a sum assured of 2cr with a premium payment term of 12 years and policy term of 40 years.

Growth Option :-

Siddhant, a 30 year old, purchased ICICI Pru Protect N Gain (Growth) plan option to become part of India’s growth story and create wealth to achieve cherished goals. He decided to invest ₹1.5L every year with premium payment term of 12 Years.

ARR: The Illustrations are based on Assumed Rate of Return of 8% and 4%. The maturity benefits shown are for illustrative purposes only and are subject to the actual fund performance

PERFORMANCE OF FUNDS`

People like you also read ...