With inflation on the rise, increasing financial responsibilities and economic uncertainties, securing your loved ones with adequate insurance is essential. A ₹ 5 crore term insurance plan can be ideal for ensuring your family's financial stability in your absence.

Let’s find out more about ₹ 5 crore term insurance plan and how it can help you.

What is a ₹ 5 crore term insurance plan?

₹ 5 crore term insurance is a term plan that offers a life cover` of ₹ 5 crore. In case of a tragic event with the insured during the policy term, the plan offers the entire sum assured of ₹ 5 crore in a lump sum, as regular income, or as a combination of both these options to the nominee.

This insurance payout can help your loved one in the difficult time of your absence if you are the breadwinner of the family.

Reasons to buy ₹ 5 crore term insurance plan

Below are some reasons to buy ₹ 5 crore term insurance:

Despite the high sum assured, term insurance offers affordable premium options that make it easy for you to purchase the plan and secure your family financially.

A sum assured of ₹ 5 crore ensures the financial protection of your loved ones in your absence. The high payout can help your family tackle inflation and ensures their well-being in the long run. This payout can be used for various financial goals, such as buying a house, covering financial emergencies, ensuring the spouse’s financial security in retirement and much more.

Term insurance plans allow nominees to avail the insurance payout in regular instalments. This feature allows families to replace the lost income if you are the breadwinner for the family and continue their lives with dignity.

Term insurance payouts can be used to repay home loan and other forms of debt that you may have. In the event of your unfortunate absence, the family will bear the responsibility of clearing these debts and can use the insurance payout to clear the dues without much financial stress.

How Does a ₹ 5 Crore Term Insurance Plan Work?

Here’s an example to illustrate how a ₹ 5 crore term insurance plan works:

Arun, a 30-year-old, buys a term insurance plan worth ₹ 5 crore with a policy term of 30 years. He pays regular monthly premiums. However, in the 24th year of the policy, Arun passes away unexpectedly due to an accident.

Since this tragic event occurred during the policy tenure, his designated beneficiary, his wife, is entitled to receive ₹ 5 crore. She selects the lump sum payout option and uses the money to clear Arun’s outstanding home loan due while reserving the rest of the money for her personal needs.

Benefits of ₹ 5 Crore Term Insurance Plan

Below are some benefits of buying a ₹ 5 crore term insurance plan:

Customisation with riders

Apart from the high sum assured, a ₹ 5 crore term insurance plan also lets you enhance your insurance coverage` with additional riders. These riders can be added to your base plan at a nominal extra cost.

Tax benefits under The Income Tax Act, 1961

You can claim tax benefits under Section 80C* and Section 10(10D)* of The Income Tax Act, 1961, on the premium paid and the benefits received from a ₹ 5 crore term insurance plan.

Flexible Premium Payment

The premium can be paid monthly, quarterly, semi-annually or annually depending on your financial situation and preference.

How to Choose the Right ₹ 5 crore Term Insurance Plan

Premiums

Claim Settlement Ratio

Riders

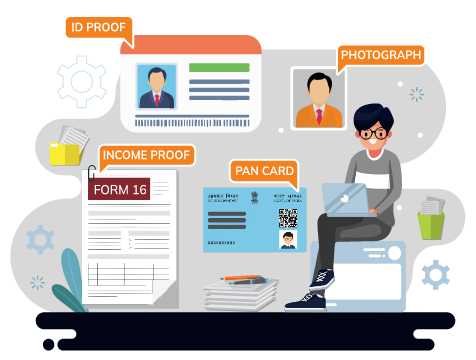

Documents required to purchase a ₹ 5 crore Term Insurance plan

Below is a list of documents required to purchase a ₹ 5 crore term insurance plan:

-

Income proof

This can be any of the following: Last 6 months Bank statement with salary credit, Form 16, Last 3 years ITR with Computation of Income (COI) or Last 3 months salary slip + Last 6 months bank statement showing salary credit.

-

ID and Address Proof

This can be any of the following: Passport, Masked Aadhar, Voters ID or Driver's License.

-

Age Proof

This can be any of the following: Passport, Masked Aadhar, Driver's License, Birth Certificate or Baptism Certificate or PAN card.

-

Additional requirements

Additional requirements include Recent passport-size photograph, Details of other existing life insurance policies and Medical reports or health declaration form.

People like you also read...