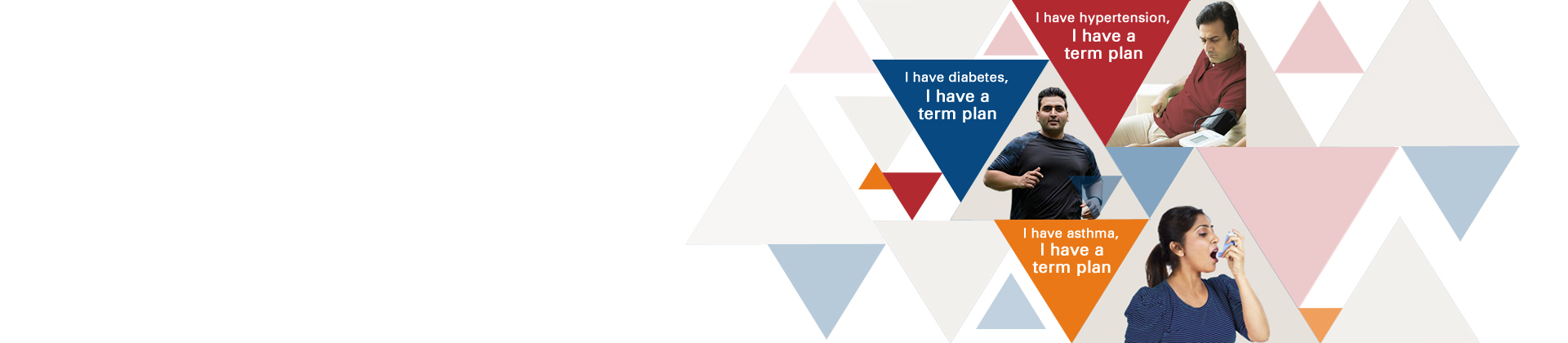

Why should you buy ICICI Pru Precious Life?

The term plans available today are more focused on providing life cover to healthy people. Individuals with health problems – be it lifestyle diseases or other medical conditions - may experience long and difficult processes to get life cover, if they get it at all.

Having a special product greatly reduces these instances as it factors in the nuances of various health problems and thus, offers life cover at an affordable premium with a hassle free process.

Does this plan provide tax benefits?

Yes, it gives three types of tax benefits.

- Premiums paid are eligible for tax benefits under section 80C

- Claim amount received by you or your nominee is tax-free under section 10(10D)

Tax benefits under the policy are subject to conditions under Sec. 80C,10(10D) and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on the above.

At what age can I start this plan?

You can start the plan at 18 years but the maximum age shouldn’t exceed 65 years.

How much money will my family receive in case of death due to accident?

Your family will receive a total of Sum Assured and Accidental Death cover if chosen by you.

Is death due to suicide included in this plan?

In case of death due to suicide within 12 months from the risk commencement date of the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the Life Assured shall be entitled to an amount which is higher of 80% of the total premiums paid till the date of death or the unexpired risk premium value available as on the date of death, provided the policy is in force.

What if my nominee wants to change the death payout option?

At the time of claim or thereafter, your nominee/ legal heir will have the option to convert all or some of his monthly income into a lump sum. The lump sum amount will be the present value calculated at a discount rate of 5% p.a.

Why should you buy ICICI Pru Precious Life?

The term plans available today are more focused on providing life cover to healthy people. Individuals with health problems – be it lifestyle diseases or other medical conditions - may experience long and difficult processes to get life cover, if they get it at all.

Having a special product greatly reduces these instances as it factors in the nuances of various health problems and thus, offers life cover at an affordable premium with a hassle free process.

Does this plan provide tax benefits?

Yes, it gives three types of tax benefits.

- Premiums paid are eligible for tax benefits under section 80C

- Claim amount received by you or your nominee is tax-free under section 10(10D)

Tax benefits under the policy are subject to conditions under Sec. 80C,10(10D) and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on the above.

At what age can I start this plan?

You can start the plan at 18 years but the maximum age shouldn’t exceed 65 years.

How much money will my family receive in case of death due to accident?

Your family will receive a total of Sum Assured and Accidental Death cover if chosen by you.

Is death due to suicide included in this plan?

In case of death due to suicide within 12 months from the risk commencement date of the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the Life Assured shall be entitled to an amount which is higher of 80% of the total premiums paid till the date of death or the unexpired risk premium value available as on the date of death, provided the policy is in force.

What if my nominee wants to change the death payout option?

At the time of claim or thereafter, your nominee/ legal heir will have the option to convert all or some of his monthly income into a lump sum. The lump sum amount will be the present value calculated at a discount rate of 5% p.a.