What is ULIP?

ULIP is an insurance product that offers the dual benefit of investment and insurance to fulfil your long-term goals. The full form of ULIP is Unit Linked Insurance Plan. The premiums paid towards a ULIP is divided into two parts. A part of your premiums goes towards securing life insurance coverage, while the rest is invested in market-linked funds of your choice to potentially generate returns. ULIP enables you to achieve your long-term financial goals while securing your loved ones in your absence. With a ULIP, you can gain both financial security and the opportunity to grow your savings.

COMP/DOC/Feb/2025/272/8476

How does a ULIP work?

Let’s consider the example of Amit, who purchases a ULIP at the age of 30 with a 30-year tenure.

Amit’s premium payments are allocated towards a life cover/ of ₹ 1 crore. Additionally, he chooses to invest in equity funds through his ULIP.

There are two possible scenarios:

Scenario one

Scenario two

If Amit passes away at the age of 45 due to an accident, his family will receive the higher of two amounts - either the death benefit of ₹ 1 crore or the fund value at the time of his demise. This ensures that his family gets the maximum financial support available under the plan.

30 Years

Amit chooses a

Unit Linked Insurance Plan

of ₹1 crore for 30 years

45 Years On Amit’s

unfortunate demise,

his family will receive

the higher of two

amounts.

Either death benefit of 1 crore or the fund value at the time of his demise

Unit Linked Insurance Plans offered by ICICI Pru Life

The Linked Insurance Products do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender or withdraw the monies invested in Linked Insurance Products completely or partially till the end of the fifth year

IN ULIPS, THE INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDERU

ICICI Pru Signature Assure

IN ULIPS, THE INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDERU

- Create wealth with market-linked returns

- Life cover1 + premium waiver2 + income3 benefit to financially protect your loved ones

- Tax* benefits u/s 80C and 10(10D)

- Loyalty additions4 of 2.5% of fund value

- Access to make withdrawals13 from fund

- Free switching5 with fixed portfolio strategy

IN ULIPS, THE INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDERU

ICICI Pru Signature Online

IN ULIPS, THE INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDERU

ICICI Pru Platinum

What are the benefits of investing in a ULIP Plan?

Below are some benefits of investing in a ULIP:

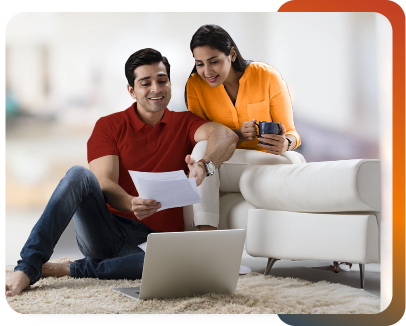

Dual benefits of insurance and investment Unit linked insurance plan offers the dual advantages of insurance and investment within a single plan. You pay a unified premium and gain access to both life insurance coverage and investment opportunities. This streamlines your financial planning as you do not need to juggle separate insurance and investment policies. Instead, you can enjoy the benefits of both under one plan.

Flexibility ULIPs offer significant flexibility. You can tailor the plan to suit your investment goals and risk tolerance and choose from a range of funds, from equity to debt. You also have the option to switch between funds as you choose. Additionally, ULIPs provide flexible premium payment options. You can select a payment plan that best fits your financial situation, such as annually, semi-annually, quarterly, or monthly.

Liquidity With Unit Linked Insurance Policies, you also get an option called partial withdrawal+, which allows you to withdraw a part of the money invested in your policy. This option helps you to take care of immediate expenses such as your child’s education fees, family vacation, in case of emergencies, and more. Partial withdrawals are usually free of cost.

Goal-based planning ULIPs are structured to help you secure your key goals such as wealth creation, retirement planning or saving for your child’s education. ULIPs also give you the added benefit of knowing that your premium is working towards securing your future goals.

Tax* benefits ULIP offers several tax* benefits under the Income Tax Act, 1961. You can save on taxes through deductions on your premium payments under Section 80C. Additionally, you can make tax*-free switches between debt and equity funds within the ULIP. At maturity, the benefit you receive is also tax*-free, subject to the conditions outlined in Section 10(10D).

Why invest in ULIPs?

ULIP is a life insurance plan that offers the dual benefit of investment to fulfil your long-term goals and a life cover to financially secure your loved ones in case of an unfortunate event.

The returns from ULIPs are market-linked. With the right plan and investment strategy, you can earn better returns on your investments.

How to maximise returns from a ULIP?

Here are some steps you can take to maximise the returns from a ULIP

Start early

Invest regularly

Take advantage of various fund options

Review your portfolio regularly

Who should consider investing in a ULIP?

Below are some investor classes that can benefit from investing in ULIPs:

Individuals with a medium to long-term investment horizon

ULIPs are well-suited for investors with medium to long-term financial goals. The investments are market-linked which offer better returns over the long term.

Individuals with varying risk profiles

Investors across all life stages

How to choose the best ULIP?

Evaluate your goals

You may have goals, such as buying a house, starting your own venture, your child’s higher education, and more. Evaluating your goals will help you calculate the amount you will need to achieve them.

Choose an Adequate Life Cover/

The life cover/ should adequately meet the needs of your loved ones, including daily expenses, future goals, debt obligations and more. Make sure to wisely account for these and select a life cover/ accordingly.

Understand the Key Features & Benefits

Understanding the key features of ULIPs is essential for making an informed choice. ULIPs provide life cover/ to protect your loved ones, the flexibility to switch between funds during the policy term and allow for top-ups to invest your surplus money. They also permit partial withdrawals in times of need. It is important to check all the features before selecting a ULIP plan.

Understand the charges under ULIP

There are various charges like policy administration charges, fund management charges, or more that may be included in your plan depending on the fund you select. It is important for you to understand the different charges you may incur in order to select the right plan.

Frequently Asked Questions

What are the different types of ULIP available in India?

ULIPs are available in several types to suit various investment needs. Equity ULIPs focus on investing in stocks and carry high risk with the prospect of higher returns. Debt ULIPs invest in fixed-income securities for stable returns with lower risk. Lastly, balanced ULIPs offer a mix of equity and debt investments to balance growth and risk.

What are the different charges associated with ULIPs?

Below are some types of charges associated with ULIPs:

- Partial withdrawal charge

- Guarantee charge

- Premium redirection charge

- Rider charge

- Switching charge

- Top-up charge

- Premium discontinuance charge

- Premium allocation charge

- Fund management charge

- Mortality charge

- Policy administration charge

- Surrender or discontinuance charge

What is the right time to invest in ULIPs?

There is no right or wrong time to invest in ULIPs. The best time to invest in a ULIP largely depends on your financial goals. However, since ULIPs have a lock-in period of five years, it is advisable to invest at least five years before you anticipate needing the funds.

Investing at a younger age can also be beneficial, as it not only helps create long-term wealth but also helps secure life insurance coverage earlier and typically results in lower premium costs.

How long should I stay invested in a ULIP policy?

ULIPs have a lock-in period of five years and so you must remain invested for at least this duration to maximise the benefits and achieve your financial goals. Having said that, the longer you stay invested in a ULIP policy, the better it can be to enhance your returns.

What are the risks associated with ULIPs?

The risks associated with ULIPs depend on the type of funds you choose. Equity funds carry higher risk, while debt funds have lower risk. Hybrid funds offer a balanced approach with moderate risk.

What is the lock-in period in ULIP?

ULIPS have a lock-in period of five years.

What are the maximum and minimum lock-in periods for ULIPs?

The lock-in period for ULIPs is strictly five years as per the regulations by the Insurance Regulatory and Development Authority of India (IRDAI), with no maximum or minimum duration.

Do ULIPs provide death and maturity benefits?

Yes, ULIPs offer a death benefit that is paid to the nominee in case of an unfortunate event during the policy term. ULIPs also provide maturity benefits at the end of the policy term. The amount is the return on your investment. This can vary based on the type of policy, choice of funds, investment term, market conditions and more such factors.

Do ULIPs allow partial withdrawal of money?

Yes, you can make a partial withdrawal from a ULIP, depending on your plan. Most plans allow you to make unlimited partial withdrawals, but there could be a limit on the total withdrawal amount in a policy year. Further, partial withdrawals can only be made after five years from the purchase of the policy.

Do ULIPs provide guaranteed returns?

ULIP returns depend on the type of policy, the kind of funds you choose, the duration of the investment, market conditions and more. Most ULIPs do not offer a fixed, guaranteed return, however, they provide an opportunity to earn higher returns from market-linked instruments.

What happens to ULIP after maturity?

On maturity, you or your loved ones receive the maturity amount, and the plan expires.

What types of funds do ULIPs offer?

ULIPs offer multiple funds, such as equity, debt, a mix of both, and index funds. Equity funds carry high risk and may offer high returns. Debt funds are low-risk funds with stable returns. You may choose the funds you want to invest your money in basis your risk appetite and requirements.

What is ULIP NAV?

When you invest money in a ULIP, units from the ULIP are allocated to you. The Net Asset Value (NAV) is the value of one unit of the ULIP.

NAV of a ULIP may change every day depending on the market value of the ULIP.

How can ULIP's premium amount be reduced?

ULIPs offer you the flexibility to choose the premium you want to pay towards your plan. You may choose the amount basis your convenience and requirements. You can also choose to pay this amount monthly, half-yearly or yearly.

People like you also read ...