Your family’s priorities are always of utmost importance to you. You want to ensure that they remain financially secure amidst changing needs and scenarios. A life insurance plan secures the financial future of your family against unforeseen circumstances with the protection of a life cover1. At the same time, you also want to give your family the best that life has to offer and be able to fulfil your family’s aspirations.

Presenting ICICI Pru Sukh Samruddhi, a participating savings oriented life insurance plan that gives you the confidence to keep pace with these goals. It helps to grow your savings through participation in bonus and provides you with the flexibility to decide how you want the benefits – as a one-time lump sum, or as regular Income, so that you’re able to achieve milestones across all stages of life.

What makes ICICI Pru Sukh Samruddhi a suitable plan for you?

Choice of 2 plan options customised as per your savings needs

- Lump sum: Get a lump sum on maturity at the end of the policy term

- Income: Get a regular Guaranteed* Income (GI) after completion of premium payment term along with a lump sum on maturity at the end of the policy term

Get additional flexibilities in the form of

- Save the date2: You can choose to receive the Guaranteed* Income (GI) on any special date like birthday, anniversary, etc. This feature is only available under Income Plan option and with annual Income mode

- Savings Wallet3: You have an option to accumulate Guaranteed* Incomes (GIs) and let them grow, instead of taking as payment during the policy term. You also have an option to withdraw, completely or partially, the accumulated GIs anytime during the Income Term. This option is only available under Income Plan option

Tax Benefits4

Tax benefits4 may be applicable on premiums paid and benefits received as per the prevailing tax laws

Plan Options in detail

Lump sum:

- Death benefit: On the death of the life assured during the policy term(for a premium paying or fully paid policy) the following will be payable:

- Sum Assured on Death + Accrued Reversionary Bonuses, if declared + Interim Reversionary Bonus, if declared + Terminal Bonus, if declared; or

- 105% of total premiums paid up to the date of death

Death Benefit will be higher of:

- Maturity benefit: On survival of life assured till the end of the policy term for a policy on which all due premiums are paid, a Maturity Benefit will be payable:

Where, Sum Assured on Death is defined as 10 times the Annualized Premium

Maturity Benefit= Sum assured on maturity + accrued reversionary bonus, if declared + terminal bonus, if declared where, Sum Assured on Maturity is based on your policy term, premium payment term, premium, age and gender and expressed as a multiple of Annualised Premium .

Illustration:

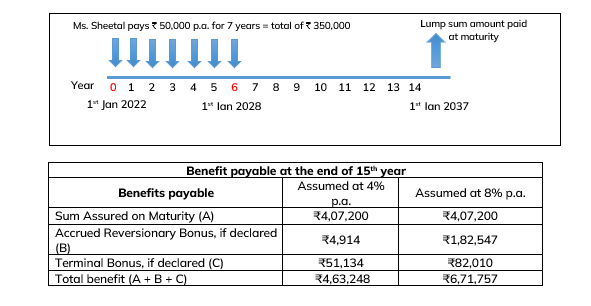

Ms. Sheetal, a 40 year old, wants to build a corpus to save for her daughter’s grand wedding. She decides to save ₹ 50,000 every year for 7 years under Lump sum plan and selects a policy term of 15 years.

Income:

- Death benefit: On the death of the life assured during the policy term (for a premium paying or fully paid policy) the following will be payable:

- Sum Assured on Death + Accrued Reversionary Bonus, if declared + Interim Reversionary Bonus, if declared + Terminal Bonus, if declared; or

- 105% of total premiums paid up to the date of death

Death Benefit will be higher of:

Where, Sum Assured on Death is to Where, Sum Assured on Death is defined as 10 times the Annualized Premium

Illustration:

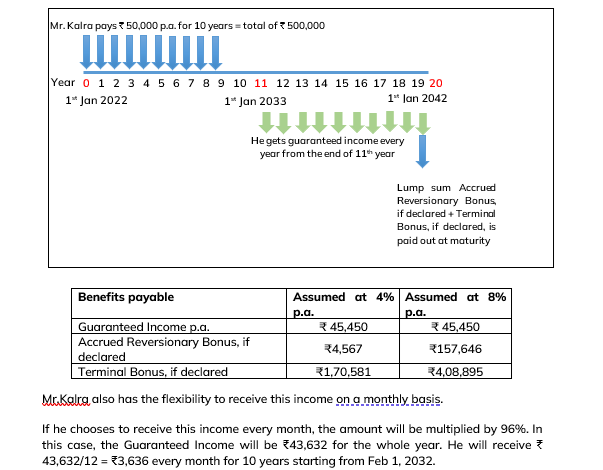

Mr. Kalra, a 35 year old, wants to ensure that he gives his son best-in-class education. He decides to save ₹ 50,000 every year for 10 years under Income plan and chooses to receive income for 10 years.

People like you also read...