What is an insurance claim?

An insurance claim is a formal request to your insurance provider for reimbursement against losses covered under your insurance policy.

Insurance is a financial agreement between you and your insurer. You have to pay a fixed premium. And in exchange, the insurance provider offers financial cover for losses based on the policy terms.

When the event covered under your policy occurs, a claim must be filed. The purpose is to notify the insurer that the event for which you have opted for an insurance has occurred and the insurer should pay the claim amount.

Types of Insurance Claims

An insurance claim can be categorised into various types.

- Health insurance claims

- Life insurance claims

- Group life insurance claims

A health insurance claim is raised to cover the costs of medical expenses. In most cases, these claims are handled by the hospital or doctor, and the insured does not have to do anything. However, if the claim is denied, the policy owner may have to intervene.

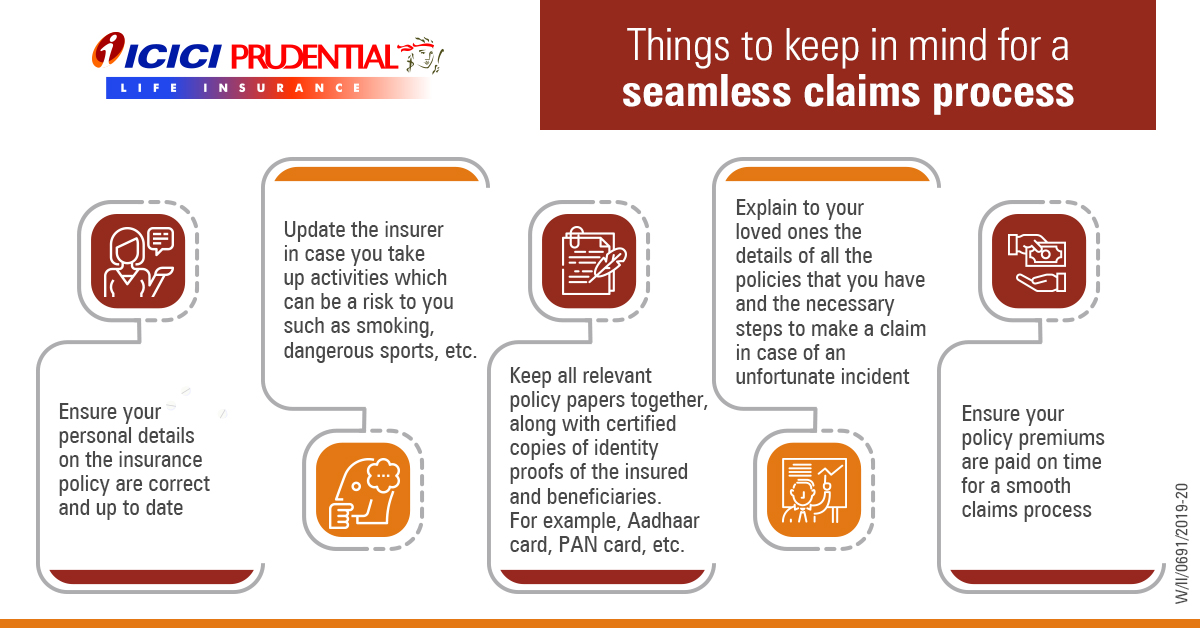

A life insurance claim is raised by the nominee in the unfortunate event of the policyholder's demise. It may require the beneficiary to submit documents like a copy of the death certificate, FIR, PAN, and other documents along with a claim form. Once the insurance company has verified all information, a payout is made to the beneficiary's account.

A group life insurance plan is used by an employer to offer life insurance benefits for their employees. In the unfortunate event of the demise of an employee, the plan's nominee can file a claim and get the sum assured.

How does an insurance claim work?

An insurance claim acts as a safety net against financial losses.

Unforeseen expenses like medical emergencies, accidents, and life’s uncertainties can cause immense economic distress. Insurance claims can provide relief in such unfortunate events.

The funds can cover medical bills, act as income replacements, and help your family meet their living costs. If you have financial dependents, claim payouts can serve as a lifeline if your family loses the support of your income.

How to report or submit a claim request?

Claim can be reported through any of our below mentioned touchpoints:

- Visit the claims section of our website for online claim intimation

- Call us at our 24 x 7 ClaimCare number – 1860 266 7766

- E-mail us at claimsupport@iciciprulife.com

- SMS 'ICLAIM

Policy No' to 56767 - Visit your nearest ICICI Prudential Life Insurance branch.

However, your claim will only be considered for registeration upon submission of dully filled claim intimation form along with other requisite documents.

Once all the requisite documents are received, the claim will be classified as intimated and the Turnaround time (TAT) for claim decisioning as mandated by the Insurance Regulation and Development Authority of India under Policyholders’ Interests (PPHI) Regulations 2017 will be calculated.

What documents are required to intimate a claim?

Reporting a death claim

Report a claim in case of the unfortunate demise of your loved one. Please click the link below to view the documents required.

view documents for death claims

Reporting a health claim

Report a claim in case of a medical emergency such as hospitalisation. Please click the link below to view the documents required.

view documents for health claimsStep 1 – Claim Reporting

Step 2 – Claim Processing

Step 3 – Claim Settlement

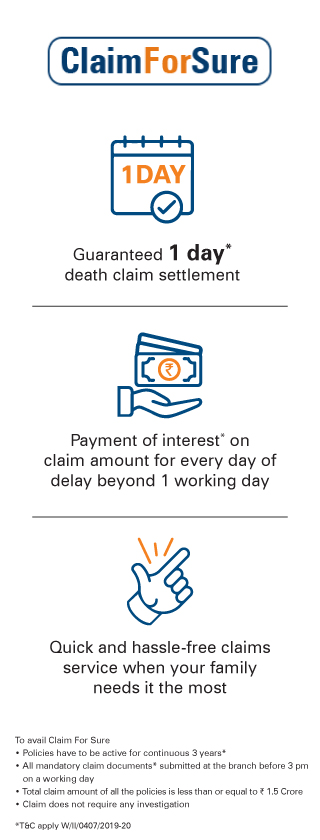

* 1 Day is a working day, counted from the date of receipt of all relevant documents from the claimant, additional information sought by the Company and any clarification received from the claimant. The Company will be calling the claimants for verification of information submitted by the Claimant which will also be considered as part of relevant documents. Working day will be counted as Monday to Friday and excluding National holidays /Bank holidays/Public holidays

# Interest shall be at the bank rate that is prevalent at the beginning of the financial year in which death claim has been received. In case of breach in regulatory turnaround time, interest will be paid as per IRDAI regulations

** Mandatory documents to be submitted at Branch Office- Claimant statement form, Copy of death certificate issued by local authority, AML KYC documents- Nominee’s recent photograph ,Copy of Nominee’s pan card, Nominee’s current address proof, photo identity proof, Cancelled cheque/ Copy of bank passbook, Copy of medico legal cause of death, Medical records (Admission notes, Discharge / Death summary, Test reports, etc.), For accidental death - Copy of FIR, Panchnama, Inquest report, Postmortem report, Driving license

^ All due premiums in the policy have been paid and the policy has been active for 3 consecutive years preceding life assured’s death

Under ULIP policies, if claim is submitted prior to 3 pm then the claim will be considered under Claim For Sure on the same day. If claim is submitted post 3pm or if the policy is inactive at the time of claim notification then the claim will be considered under Claim For Sure the next day as per availability of NAV

COMP/DOC/Jan/2023/271/2140

You can depend on us

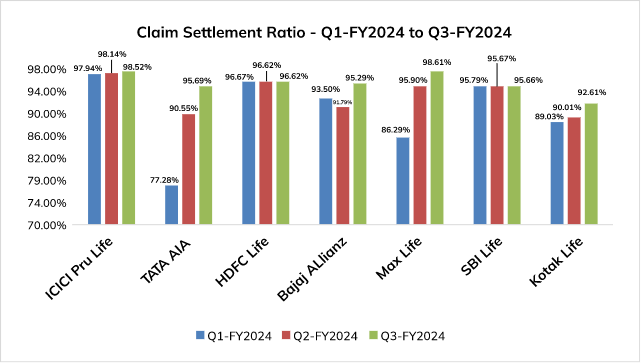

We are committed towards the fulfilment of our promise to you and your family. We are happy to share that our claim settlement ratio is one of the highest in the industry.

At ICICI Prudential Life, we believe that every claim represents fulfilment of a promise made to our policyholders. We are committed to securing the future of your loved ones, in a manner that’s quick and efficient. Accessibility, sensitivity and efficiency are the values that drive our claims philosophy.

People like you also read ...

Talk to us on 24x7

Talk to us on 24x7  Email us on:

Email us on: