Why is ICICI Pru Assured Savings Insurance Plan special?

At the end of the policy period, you will receive a lump sum pay out called Maturity Benefit, which helps you fulfil your family’s dreams.

How much money will I get at policy maturity?

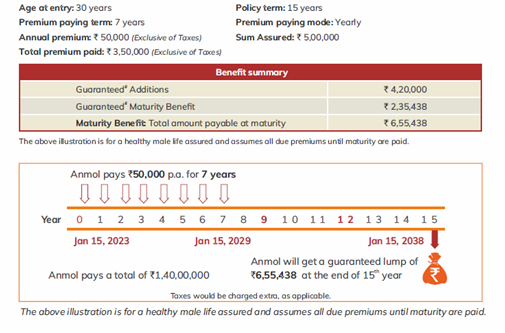

At the end of the policy term, provided all due premiums have been paid, Maturity Benefit would be payable. It will be a sum of Accrued Guaranteed$ Additions# and Guaranteed$ Maturity Benefit1.

The GMB depends on several factors such as policy term, premium payment term, age and gender. Your Guaranteed$ Maturity Benefit (GMB) will be set at policy inception and will depend on age, policy term, premium, premium payment term and gender. Your GMB may be lower than your Sum Assured on death. Please read further for more details on GAs.

#Every year an amount called the Guaranteed Addition is added to the policy. Guaranteed Addition (GA) is equal to the predetermined Guaranteed Addition rate multiplied by the sum of all premiums paid till date (excluding extra mortality premiums and taxes).

$ Terms and conditions apply

Every year, 9%, 10% or 11% Guaranteed$ Additions would be added to your policy depending on your policy term.

How is the Guaranteed$ Addition (GA) calculated?

Guaranteed$ Addition (GA) is equal to a fixed Guaranteed$ Addition Rate multiplied by the sum of all premiums paid.

Example: If you choose a policy term of 12 years the GA rate will be 10% p.a. If your Annual Premium is `50,000, Guaranteed Additions will be as below.

| Policy Year | Premiums Paid For The Year (Exclusive of taxes) |

Total Premiums Paid Till Date (Exclusive of taxes) |

Guaranteed$ Addition For The Year = GA Rate X Sum Of All Premiums Paid |

|---|---|---|---|

| 1 | 50,000 | 50,000 | 10% x 50,000 = `5,000 |

| 2 | 50,000 | 1,00,000 | 10% x 1,00,000 = `10,000 |

| 3 | 50,000 | 1,50,000 | 10% x 1,50,000 = `15,000 |

| 4 | 50,000 | 2,00,000 | 10% x 2,00,000 = `20,000 |

| 5 | 50,000 | 2,50,000 | 10% x 2,50,000 = `25,000 |

| 6 | 50,000 | 3,00,000 | 10% x 3,00,000 = `30,000 |

| 7 | 50,000 | 3,50,000 | 10% x 3,50,000 = `35,000 |

| 8 | 50,000 | 4,00,000 | 10% x 4,00,000 = `40,000 |

| 9 | 50,000 | 4,50,000 | 10% x 4,50,000 = `45,000 |

| 10 | 50,000 | 5,00,000 | 10% x 5,00,000 = `50,000 |

| 11 | 50,000 | 5,50,000 | 10% x 5,50,000= `55,000 |

| 12 | 50,000 | 6,00,000 | 10% x 6,00,000 = `60,000 |

How is the Guaranteed$ Addition (GA) Rate calculated?

The GA rate depends upon the policy term you have chosen, as shown below:

| Policy Term | Guaranteed$ Addition |

|---|---|

| 10 years | 9% |

| 12/15 years | 10% |

| 16/20 years | 11% |

$ Terms and conditions apply

ICICI Pru Assured Savings Insurance Plan provides your loved ones a lump sum pay-out. This amount ensures that even in your absence your family members are able to live the life you planned for them.

How much money will my family receive in my absence?

Your family will receive a lump sum amount, which will be the higher of:

A fixed amount called the Sum Assured^ including Guaranteed$ Additions. Here, Sum assured is 10 times of the annualized premium.

Guaranteed$ Maturity Benefits (GMB)1 including Guaranteed$ Additions

Minimum Life Cover2 that is the higher of the following:

- 105% of the sum of premiums paid till date#

- 10 times the annualized base premium

- Chosen Sum Assured^

#Excluding extra mortality premiums and taxes. The cost of providing a Life Cover under the policy is called Mortality Premium.

^Sum Assured is the fixed minimum amount guaranteed on maturity.

$ Terms and conditions apply

Tax benefits may be applicable as per prevailing tax laws. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for more details.